ByteDance forced to sell TikTok US? Is Elon Musk positioning himself for a $50 billion buyout? Analysis.

Coin Stats RSS

The crypto sector continues to amaze, even after years of astonishing progress. Bitcoin has already paved the way for many innovative projects. Today, it is XRP's turn to attract attention, with JPMorgan's bold forecasts anticipating up to 8 billion dollars for an XRP Spot ETF by 2025.

The Federal Deposit Insurance Corporation (FDIC) is at a decisive crossroads, facing challenges related to the "debanking" of crypto businesses and calls for regulatory reform. Debanking refers to the practice by which banks refuse or restrict access to financial services for certain sectors, including the cryptocurrency sector. What position will the FDIC take regarding crypto businesses in the United States?

The movements of Bitcoin rhythm the markets, between phases of euphoria and brutal corrections. After a record of 108,268 dollars in December 2024, the crypto is undergoing a period of consolidation. However, a major technical indicator, the 52-week Simple Moving Average (SMA), fuels speculation. According to analyst Dave the Wave, Bitcoin could reach a new peak by July 2025, a pattern already observed during previous bullish cycles. Thus, if this prediction is validated, it would mark a key milestone in the current cycle. Nevertheless, the market's evolution remains uncertain, between technical signals and external factors likely to influence price trajectories.

Less than a week after proclaiming a commitment to freedom of expression, Meta, the parent company of Facebook and Instagram, is accused of censoring links to competing decentralized platforms. According to a report by 404 Media, Facebook removed links leading to Pixelfed, a decentralized competitor to Instagram, labeling them as "spam." What is really going on?

Bitcoin, this cryptocurrency with growing popularity, intrigues as much as it divides. For Jamie Dimon, CEO of JPMorgan, this digital currency has no place. His criticisms have echoed for years in the financial sector. Yet, his viewpoint raises questions: why is he so harsh, and what does his argument really rest upon?

This week is set to be eventful in the crypto market with a historic token unlock estimated at $3 billion, the largest since November 2023. At the heart of this event, Ondo Finance is preparing to release 1.94 billion ONDO tokens on January 18, representing over 130% of its current circulating supply.

The beginning of 2025 marks a historic turning point for Bitcoin. Technical indicators are looking positive, institutional investors are flocking in massively via ETFs, and macroeconomic prospects are improving. Now, the scenario of $500,000 is highly probable in 2025.

MicroStrategy, under the leadership of Michael Saylor, continues to strengthen its position as the largest holder of bitcoin. Currently, the company has purchased 2,530 BTC for a total of $243 million! This demonstrates its confidence in the long-term potential of BTC, despite the current macroeconomic challenges.

The global economic landscape, long dominated by Western powers and supported by the preeminence of the dollar, seems on the brink of change. In the face of a financial system centralized around the United States and Europe, many nations are expressing a growing desire to turn to alternatives. This trend is accelerating with the recent announcement: more than twenty countries from several continents have officially submitted their candidacy to join BRICS in 2025. If this project comes to fruition, the expansion of the formed bloc could enhance its economic weight but also redefine the balance of power on a global scale.

The crypto beacon is slowly dimming below $92,000. The overheating of platforms fuels fears, investors tremble.

XRP and Solana: Rally or Downturn? The crypto market is facing new instability. Detailed analysis in this article!

This week, the cryptocurrency market is marked by the strength of the US dollar, reaching its highest level since the bear market of 2022. This situation creates challenges for Bitcoin (BTC) traders, who must navigate an environment of increased volatility as the US presidential inauguration approaches.

On the crypto market, AI tokens are stumbling: billions evaporate, and artificial intelligence reveals a very human limit, that of rampant speculation.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic conflicts. Here is a summary of the most significant news from the past week concerning Bitcoin, Ethereum, Binance, Solana, and Ripple.

The crypto market continues to show signs of volatility at the beginning of 2025. According to the latest analyses, Bitcoin (BTC) and Ethereum (ETH) are displaying downward trends, while Ripple (XRP) seems poised for a new rise. What direction will these cryptocurrencies take this week?

Technical innovations, the rise of new protocols, and the growing interest of institutions have laid the foundations for a booming decentralized finance (DeFi) landscape. At the heart of this whirlwind, Bitcoin stands out owing to its status as a "safe haven" in the sector. However, its potential remains underutilized in the DeFi space. By 2025, this dynamic could change. Experts are unanimous: Bitcoin's native decentralized finance has everything to become a major phenomenon.

Investor appetite for altcoins continues to grow, as evidenced by the spectacular increase in their trading volume on Binance, which now accounts for 78% of the platform's activity. This record level raises questions: is the market on the verge of a new bull run for altcoins? According to Burakkesmeci, an analyst at CryptoQuant, this development is a strong signal that reinforces the hypothesis of a bullish market in 2025. However, despite this enthusiasm, some indicators remain mixed. Bitcoin still dominates the market with 57.74% of the total market capitalization, and the Altcoin Season Index, down to 46 out of 100, does not yet confirm a significant shift towards altcoins. In the face of these contradictory signals, the current dynamics reflect more of a gradual rise in power than a real immediate cycle change.

Under the darkened skies of the budget, the Medef proposes a sharp reform: to withdraw retirees' valuable tax allowance. An idea where the economy dialogues with injustice.

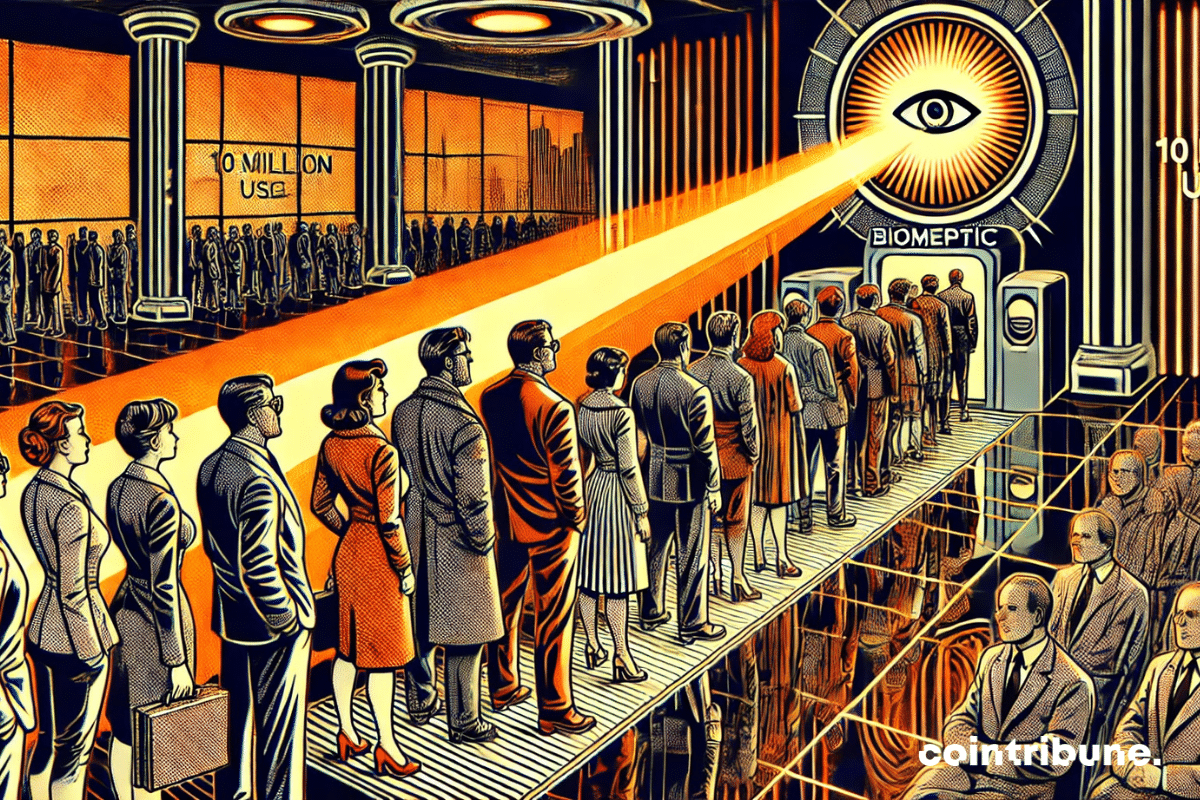

Artificial intelligence is progressing at a rapid pace, making the distinction between humans and machines increasingly difficult. In response to this evolution, Worldcoin, now rebranded as World, aims to establish a universal proof of humanity through a biometric identification system based on iris recognition. The company has just announced that it has surpassed the milestone of 10 million verified users, a benchmark that signifies its massive adoption and fuels growing controversy. Indeed, the project relies on a network of orbs tasked with scanning the users' ocular data to assign them an unforgeable digital identity. According to its creators, this technology would secure digital interactions and ensure that only genuine humans access online services. Nevertheless, several governments and data protection authorities are concerned about the potential pitfalls of this model. Between technological promise and regulatory resistance, Worldcoin is part of a debate on digital identity and personal data governance. Its success or failure could shape the future of online authentication in a world where AI challenges the foundations of digital trust.

Bitcoin has risen by 120% in 2024, significantly outperforming other major asset classes. 2025 is shaping up to be another exceptional year.

While Los Angeles suffocates under a blaze, The Giving Block kindles the flame of hope: quick, generous, and tax-efficient crypto donations. A modern miracle with a digital taste.

The crypto market evolves with the fluctuations, swinging between bursts of enthusiasm and periods of doubt. However, some assets manage to maintain their appeal despite the prevailing volatility. XRP perfectly illustrates this resilience, showing a clear resurgence in activity following a phase of uncertainty. Over 2 million transactions were recorded in a single day, a level rarely reached in recent months. This explosion in transaction volume goes beyond a mere usage indicator. It reflects a strengthening of the network, confirming renewed interest from investors and market players. At the same time, the price of XRP has stabilized above the key supports of $2.30 and $2.20, indicating bullish potential. If this momentum continues, XRP could regain a central place in the crypto transaction landscape and strengthen its long-term adoption.

In an absurd ballet, Bitcoin slips below $95,000, mirroring the S&P 500, with $88,000 in sight. Bounce or imminent shipwreck?

A few days before Donald Trump's inauguration, the outgoing American administration is tightening its sanctions against Russian oil, pushing Brent prices above $80. This new offensive directly targets two Russian giants in the sector and a fleet of nearly 200 ships.

The Bank of Russia has recently introduced new regulations aimed at enhancing the oversight of currency exchange operations involving digital rights. These rights, as defined by Russian law, include electronic records such as cryptocurrencies, tokenized securities, and digital tokens. This initiative aims to integrate digital assets into the traditional financial system while ensuring financial stability.

Dogecoin is going through a decisive phase. For several days, its price has been fluctuating around $0.33, a key level that attracts the attention of analysts and investors. This threshold relies on a major support line, seen as a bulwark against a possible more pronounced correction. So far, DOGE is holding steady, but for how much longer? According to Trader Tardigrade, a closely followed analyst, the crypto may be finalizing a "selling climax bottom," a technical structure that often precedes a bullish reversal. However, if this scenario is confirmed, it would mark the end of the correction and pave the way for a significant rebound. Meanwhile, whales are heavily accumulating tokens, which strengthens the hypothesis of an imminent recovery. For DOGE, the stakes are high: maintaining its support and initiating a bullish trend before the market changes direction.

Bitcoin (BTC) recently fell below its 20-day exponential moving average (EMA) after reaching a peak of $94,000 a few days ago. This decline signals a strong period of correction as investors prepare for Donald Trump's inauguration.

Financial markets hate uncertainty, yet the global economy is entering a period of instability. As we approach 2025, fears of economic slowdown, inflationary pressures, and political uncertainties are multiplying. Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), warns of "headwinds" and "divergences" that threaten global economic balance. Europe is struggling, the United States is surprising with its resilience, China is facing deflationary pressure, and Brazil is battling inflation. Behind these disparities, another concerning factor is the erosion of investments in education, which hampers innovation and long-term growth. As the IMF prepares to release its updated report, one question remains: do these economic fractures create an irreversible divide, or do they foreshadow a new world order?

A shareholder of Meta is proposing to Mark Zuckerberg's company to convert part of its 72 billion dollars in cash into bitcoin to protect against inflation. This initiative is part of a broader movement aimed at urging tech giants to diversify their reserves into cryptocurrency.