When crypto bites its own tail: at Coinbase, shareholders scream betrayal, and executives swear they only sold reluctantly. It smells like asset freezing...

Coinbase

U.S. regulators have taken a clearer position on how securities laws apply to blockchain-based financial products. New guidance from the Securities and Exchange Commission (SEC) addresses growing interest in tokenized securities and how they fit within existing legal frameworks. Market participants have pushed for clarity as tokenization expands beyond experimental use into real-world applications. The latest statement aims to reduce uncertainty without altering core regulatory expectations.

Crypto: Coinbase opens the doors to legal betting in 50 US states. We provide you with all the details in this article!

Gold has just crossed 5,311 dollars an ounce, sparking a race to the safe haven. Facing this historic high, two crypto giants adopt opposite strategies. Tether bets on physical gold, Coinbase on derivatives. This divergence is no coincidence. It reveals two visions of the financial future: grounded in the tangible for one, focused on markets for the other. Such a strategic turning point could redefine the balance of power in the crypto ecosystem.

Global markets are entering a concentrated period of macroeconomic risk that could shape sentiment into early February. Five key U.S. economic releases are scheduled for January 27, increasing pressure on already cautious investors. Crypto markets remain highly sensitive in this environment, with Bitcoin still absorbing the majority of capital flows.

The crypto market is going through a brutal digestion phase since the October shock. However, a message comes up from the professional desks. Indeed, many institutions believe that bitcoin is worth more than its current price. The idea is not new, but the timing is intriguing.

GameStop moved all its treasury in bitcoin, that is 4,710 BTC valued at over 422 million dollars, to Coinbase Prime. This massive transfer, spotted by CryptoQuant, could signal an imminent sale. For a company that became a symbol of finance for individuals since the Reddit saga, this strategic shift is surprising. Indeed, GameStop had until now displayed a firm position on bitcoin, inherited from its dealings with Michael Saylor. Should this be seen as a discreet disavowal of the crypto bet?

Coinbase is forming an expert panel to tackle future quantum threats and strengthen blockchain security before the technology becomes a real risk.

The boundary between traditional banks and crypto could soon disappear. In Davos, David Sacks, White House crypto advisor, stated that these two worlds will soon form just one. Indeed, the CLARITY Act, a decisive bill for the future of the sector in the United States, is at stake. Behind the debates on stablecoin yields, a complete reconfiguration of the financial industry is emerging amid political tensions, power struggles, and strategic ambitions.

The so-called Ethereum Killer blockchains are stirring to nibble away market shares and gain media spotlight. But deep down, in reality as in collective perception, there is only one master. Its name comes up in every conference, every strategic plan, every institutional tweet. Ethereum is no longer just a technology…

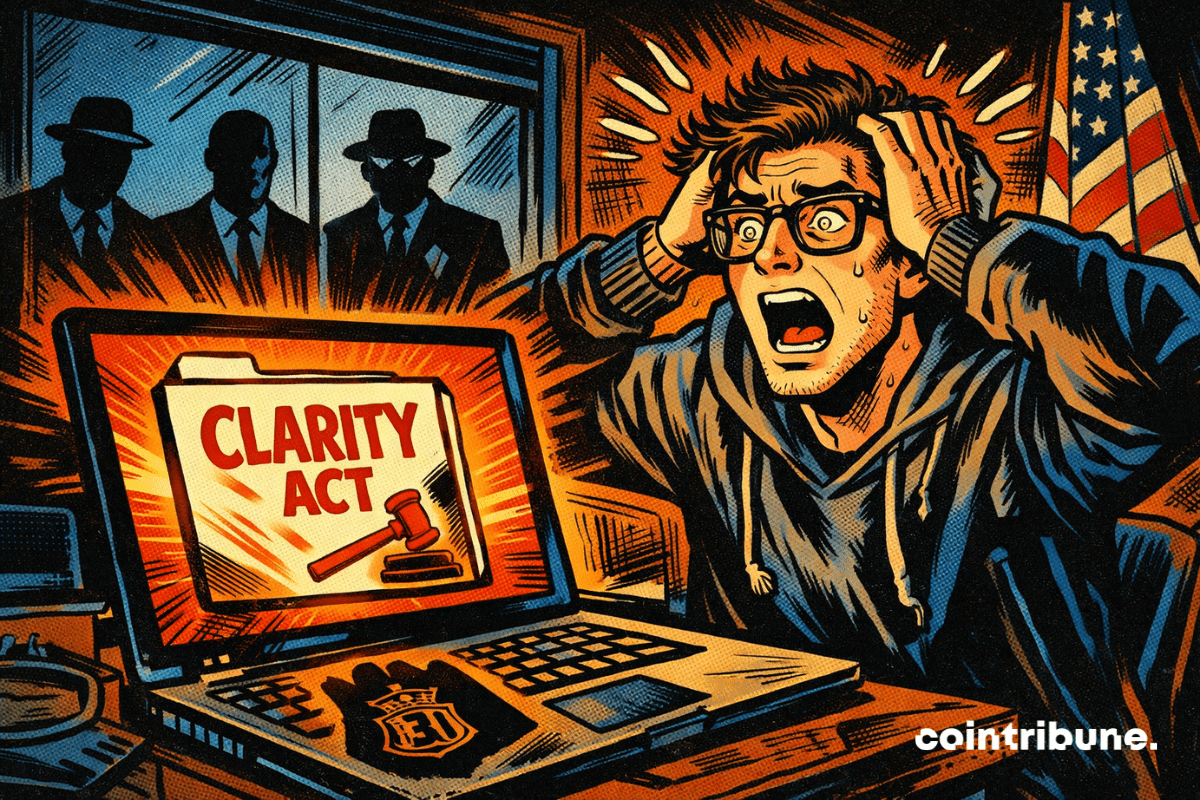

Under regulatory pressure, the American crypto sector closely watched the CLARITY Act, intended to establish a clear legal framework for these assets. However, the bill was abruptly paused in Congress after Coinbase dramatically withdrew its support. Presented as a structural reform, the latest version of the project triggered sharp criticism, accused of threatening innovation. A political setback that reignites tensions between legislators and actors of an ecosystem still seeking recognition.

Brian Armstrong clarified that Coinbase’s talks with the White House remain constructive as the CLARITY Act faces delays over regulation issues.

In Washington, crypto puts the Senate in a tailspin: Coinbase says no, the law collapses, and banks fear that open code will become uncontrollable.

Polygon sacrifices 30% of its team to dominate crypto payments. We give you all the details in this article.

U.S. lawmakers have put a major crypto market structure bill on hold after strong pushback from Coinbase. Fresh criticism from the exchange’s chief executive raised doubts about whether the proposal could move forward without changes. As a result, Senate Banking Committee members delayed a planned markup while reassessing industry and regulatory concerns tied to the draft.

What if the next threat to traditional banks did not come from an economic crisis, but from a simple innovation in stablecoins? Brian Moynihan, CEO of Bank of America, warns that the rise of yield-bearing stablecoins could trigger a massive outflow of bank deposits, thus disrupting the balance of the American financial system. This worrying scenario for traditional institutions could see their role as lenders severely affected by this new form of digital competition.

In Washington, senators want to "clarify" crypto, but Coinbase slams the door. Clarity or control? The CLARITY Act turns regulation into a political battleground.

While Beijing is making its e-yuan grow, Washington debates whether cryptos can offer rewards. What if the real danger is not what we think?

Crypto markets are entering 2026 with stronger structural support than in earlier cycles. Clearer regulation, expanding financial products, and closer links to traditional finance are reshaping how digital assets are adopted and perceived. Coinbase’s research leadership expects this momentum to persist rather than weaken.

Bitcoin and Ether are showing early signs of a shift in investor behavior, even as broader market conditions remain weak. Long-term Bitcoin holders are easing selling pressure, while large Ether holders are adding to their positions. Prices, however, remain under pressure amid caution, macro risks, and year-end positioning.

Coinbase CEO Brian Armstrong has warned US lawmakers against reopening the recently passed GENIUS Act, arguing that changes could reduce competition in the stablecoin market. He accused major banks of pushing Congress to weaken the law to protect their own interests. The comments come as debate grows over how stablecoins should be regulated in the United States.

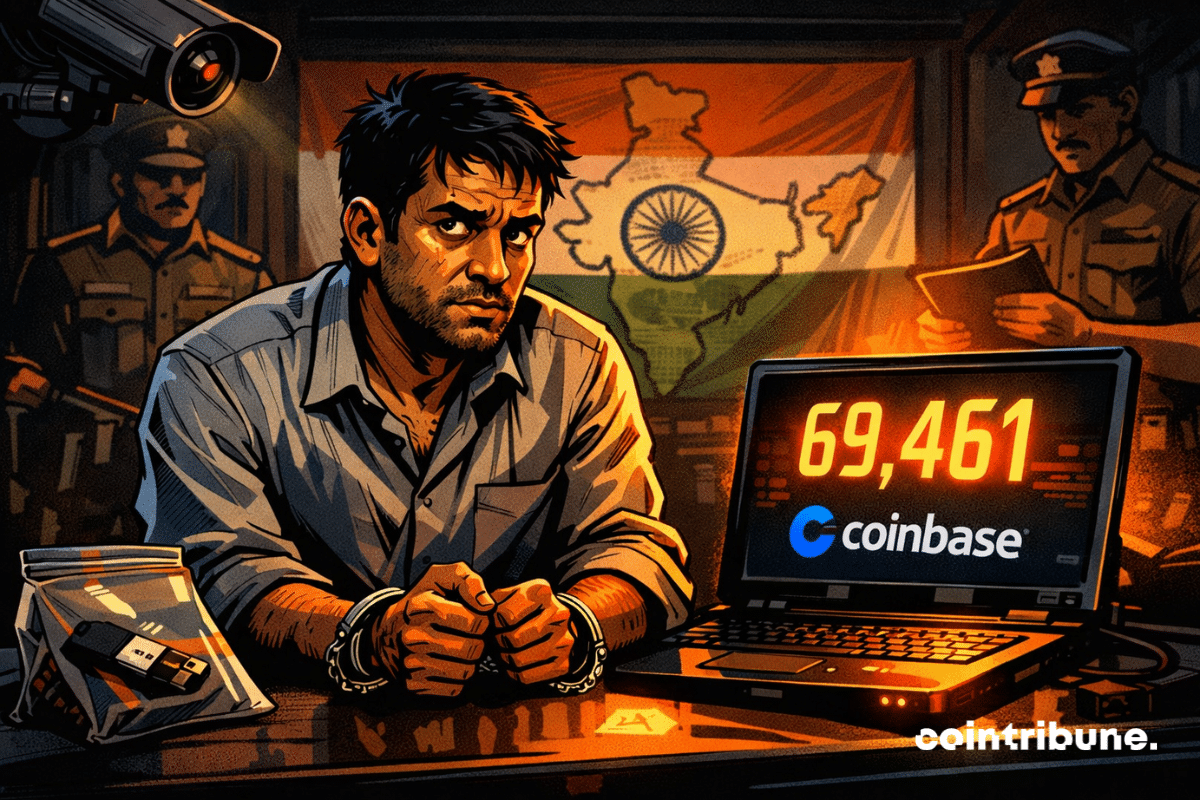

Coinbase pays for justice, not ransom. Data leak, arrest in India, bounty for whistleblowing... courtroom crypto-comedy in several acts.

The Christmas season often raises the same question each year: what gift will have lasting value? For people involved in crypto, interests extend far beyond standard tech gadgets. Crypto users form a global community focused on digital ownership, financial independence, and long-term participation in blockchain networks. And as such, selecting a crypto-related gift shows awareness of these priorities. This article presents practical, beginner-friendly crypto gift ideas suited to different interests while remaining useful long after the holidays.

Coinbase Institutional sees in 2026 much more than a simple market rebound: a strategic shift. In a 70-page report published in mid-December, the platform anticipates a deep integration of cryptos at the heart of global finance. While this year has been marked by volatility and persistent regulatory uncertainties, Coinbase is betting on a new emerging phase where regulation, institutional adoption, and new uses will sustainably reshape the crypto landscape.

Tokenization of real-world assets (RWAs) is moving closer to mainstream finance, though its short-term impact on crypto markets may remain limited. NYDIG says longer-term value will depend on how open, connected, and regulated these assets become across blockchain networks.

BlackRock transfers 2,196 BTC to Coinbase Prime. A decision that could shake the Bitcoin market. Details here!

While Wall Street digests its ETFs, Paul Atkins unwraps an unexpected gift: crypto becomes emancipated, ICOs resurrect. A cooler SEC than ever?

Shiba Inu is moving through a quiet but steady phase as the broader crypto market works toward a gradual recovery. Price action stays compressed between $0.0000085 and $0.000009, creating a stable zone while traders wait for a clearer shift in sentiment. Even with the calm movement on charts, several ecosystem updates show the project continues to focus on long-term progress.

Could bitcoin make a notable comeback by the end of the year? As markets scrutinize Federal Reserve decisions, the flagship crypto benefits from a more favorable macroeconomic environment. The improvement in global liquidity and the prospect of monetary easing fuel hopes for a rebound in December. Behind this emerging optimism, investors remain on alert: a single misstep by the Fed could question everything.

Crypto mergers and acquisitions reached $8.6 billion in 2025, with Coinbase, Ripple, and Kraken among the major firms expanding their operations.