The Ethereum network saw a record influx of new users in late April, despite a bear market in crypto. This new dynamic is renewing hopes, but the influence of "whales" raises questions.

Cryptoactif

RippleX, the development branch of Ripple, has just launched a new feature that promises to simplify transactions and boost widespread adoption of XRP. This major advancement aims to democratize the use of Ripple's flagship cryptocurrency.

As the price of Ethereum continues to fall, dropping below the $3,000 mark, investor interest in the second-largest cryptocurrency remains strong. What are the factors that attract investors to ETH despite the price drop?

If you looked at the bitcoin charts on May 1st, you certainly noticed that the price of the cryptocurrency dropped to less than $57,000. Even though the crypto is currently trading at just over $57,000, its continued decline continues to surprise many. How can we understand that its price collapsed after the halving when we expected a contrary trend? The explanations in this piece.

The member states of the European Union are preparing to implement MiCA. This historic law requires national regulators to authorize and supervise service providers. MiCA is an EU-level regulation. However, countries may implement different technical standards, which requires special attention.

A study conducted by a Canadian firm reveals that the interest of Canadian institutional investors in cryptocurrencies has seen a significant surge over the past two years. Estimated at 29% in 2021, the proportion of institutional investors exposed to cryptocurrencies in Canada has increased to 75% in 2023. The executives of the firm present the factors that justify this trend.

Exposed to geopolitical, economic, and fiscal pressures throughout the month of April, Bitcoin once again proves its resilience as an asset. While one could have expected a more rapid decline in its price, the cryptocurrency closes the month of April with only a 10% decrease. Details in the following.

Ripple's XRP crypto corrected to $0.50 on Monday morning, losing all its gains from the past seven days. This drop comes as the XRP community questions the impact of the ETHgate controversy on the ongoing lawsuit between Ripple and the SEC.

Between revolutionary announcements, technological advancements, and regulatory tumult, the crypto ecosystem continues to prove that it is both a territory of boundless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

For the past few months, the Bitcoin blockchain has been expanding its functionalities and attracting interest through a clear evolution of its utility. Elevated to the status of a digital store of value by the ecosystem, it had recently faced significant constraints related to script language. The development of tokens, NFTs, and smart contracts was absolutely impracticable. In fact, it was on this major weakness that competitors such as Ethereum, Solana, Cardano, Polkadot, etc., had built their business models and reputation. But things have changed. The Bitcoin network now supports BRC-20 tokens, competitors to Ethereum's ERC-20 tokens, NFTs, and even houses a Bitcoin DeFi ecosystem. Witness the evolution of a network undergoing a complete overhaul.

Mark Yusko, CEO of Morgan Creek Capital, the $1.5 billion hedge fund, is adamant. A flood of fiat is expected to pour into the crypto markets in the coming months. The expert predicts a growing interest in Bitcoin ETFs from American baby boomers, the generation born between 1946 and 1964. These individuals are expected to transfer their funds currently held in retirement accounts to the crypto markets soon. He expects at least $300 billion to flow into the crypto markets in the coming months. This was during an interview with the podcast The Wolf of All Streets. Clarifications.

The meme token Shiba Inu (SHIB) struggles to maintain its upward momentum. After failing to break through a major resistance zone, SHIB seems to be entering a correction phase, raising concerns among holders.

From $125 million in 2022, the total crypto donations collected by major American charities reached $2 billion in 2024. This surge was triggered when 2 out of the 3 largest charities started accepting crypto donations. Embracing crypto allowed them to expand their donor base, making them significant players in adoption. More details to follow.

Are you looking to enter the crypto market and take advantage of the earning potential of cryptocurrencies? Not willing to take on too much risk? The Altseason is already announcing itself. It's time to get started. There's no need for a large budget. With altcoins available for less than 0.1 dollar, you could potentially see your investment multiply several times with a bit of luck. Here are 10 gems priced at less than 0.1 dollar that might interest you.

Hong Kong is about to launch Crypto ETFs. Will they be successful? What are the implications for the crypto market? Answers.

The U.S. Securities and Exchange Commission (SEC) has once again delayed its decision on the Grayscale Investments and Franklin Templeton's applications for Ethereum spot ETFs. The two asset management companies will have to wait longer before they can launch their crypto investment vehicles on the U.S. stock markets.

The New York Stock Exchange (NYSE) is currently exploring the possibility of moving to a 24/7 trading model, a potentially revolutionary decision largely influenced by the success of crypto markets that operate continuously.

Among revolutionary announcements, technological developments, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of boundless innovations and a battlefield of regulatory and economic battles. Here is a summary of the most significant news from the past week around Bitcoin, Ethereum, Binance, Solana, etc.

Despite a bearish crypto market, Cardano (ADA), the 11th cryptocurrency by market capitalization, is experiencing significant growth in its Plutus V2 smart contracts. This advancement strengthens Cardano's position as a major player among competing blockchain platforms.

Between revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovation and a battlefield of regulatory and economic struggles. Here is a summary of the most significant news from the past week around Bitcoin, Ethereum, Binance, Solana, etc.

Ripple, the company behind the XRP token, sold 100 million tokens on Sunday, as cryptocurrency markets are under pressure following the escalation of the Iran-Israel conflict. This unusual sale raises concerns about its potential impact on its price.

Chainlink has just launched Transporter, a secure crypto transfer application between different blockchains. Based on Chainlink's Cross-Chain Interoperability Protocol (CCIP), this solution promises to simplify and secure transactions across multiple networks.

Receiving a legal notice from the Securities and Exchange Commission (SEC) plunges Uniswap, a flagship of decentralized finance, into the heart of a regulatory storm. This news, occurring in a context of increasing cryptocurrency regulation, raises crucial questions about the future of DeFi and highlights the compliance challenges that these platforms must now confront.

Like Binance or Coinbase, Uniswap Labs could face legal action initiated by the Securities and Exchange Commission (SEC). This is at least the warning sent by the regulator to the crypto company without much information on the reason. The Uniswap community has not remained indifferent to this somewhat concerning development.

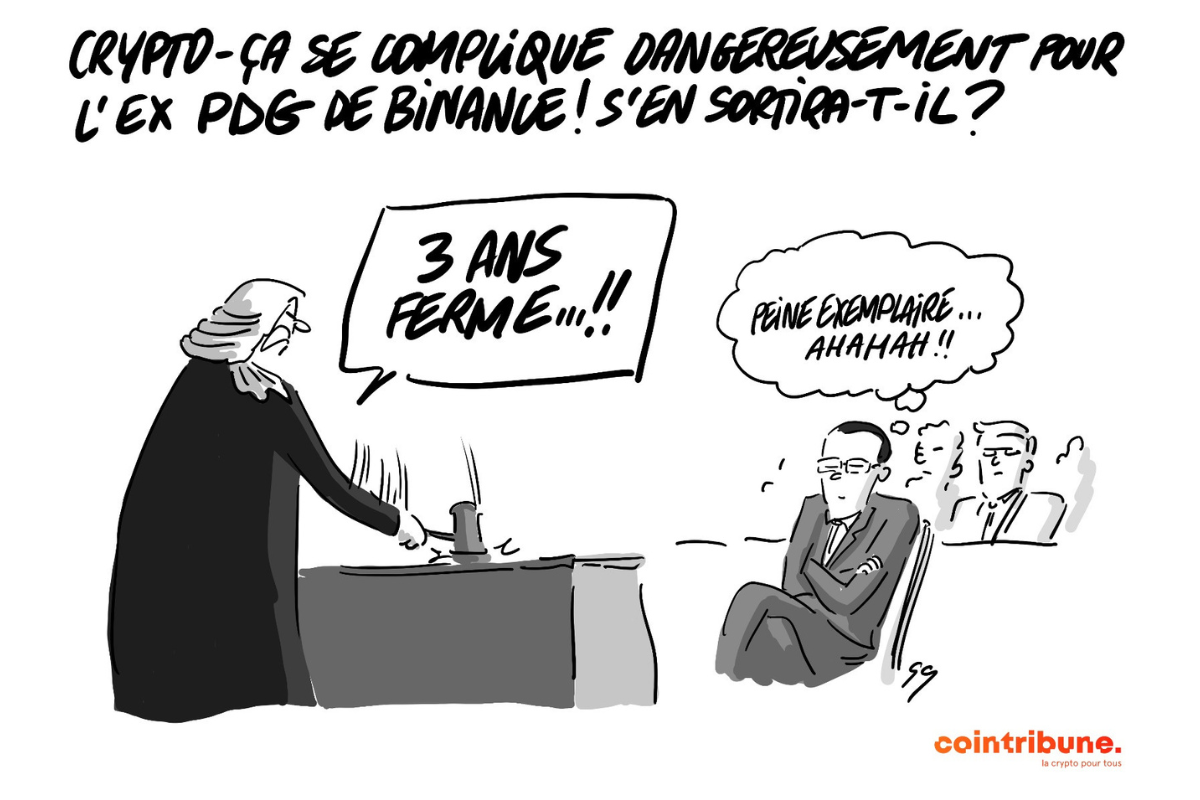

Richard Teng, the current CEO of Binance, has spoken about the evolution of the exchange since he took over. Under his leadership, the company seems to have moved away from the illegal practices that prevailed under the reign of Changpeng Zhao, resolutely committed to continuing on this path to maintain its leadership in the market.

Influx of record and diversification of crypto assets since the beginning of the year: cryptocurrencies attract investors.

For the past seven weeks, Bitcoin ETFs have seen a massive influx of capital. While many experts and investors were expecting this trend to continue, it is fading. Here is what explains this trend, which also affects several other crypto funds, including Ethereum, Solana, and Cardano.

On Sunday, April 7, Bitcoin (BTC) saw a new increase in its value. Its price, which had significantly dropped in the previous days to a level close to $65,000, rose to just over $70,000. Just days before the halving, this rise in the price of the flagship crypto is sparking speculation.

It was known that with the dynamism that has been theirs for several months, cryptocurrencies have lifted many people out of financial misery. The magazine Fort, in a recent study, documented these perceptions. Its report shows how in the space of a year, these assets, both beloved by some and feared by others, have created new billionaires. As for the old ones, they have seen their financial assets linked to crypto grow in line with their faith in these assets. In this article, we present to you those who, through risks, have become wealthy thanks to crypto.

In a bold move that combines the efficiency of traditional finance with the innovation of blockchain technology, PayPal is opening new horizons in the field of cross-border money transfers. Its American users can now use the PayPal USD stablecoin (PYUSD), its dollar-backed crypto, to fund international transfers without incurring transaction fees through the Xoom service.