La SEC veut nous "protéger" en poursuivant Uniswap… alors que le protocole existe depuis 4 ans. Avant ce n'était pas grave, mais maintenant ce l'est 🤣🤡

— Paul Cryptoformation (@Paul_Theway) April 10, 2024

Le porno de la peur continue pendant la période de réaccumulation.https://t.co/OfbZDnmLMT

A

A

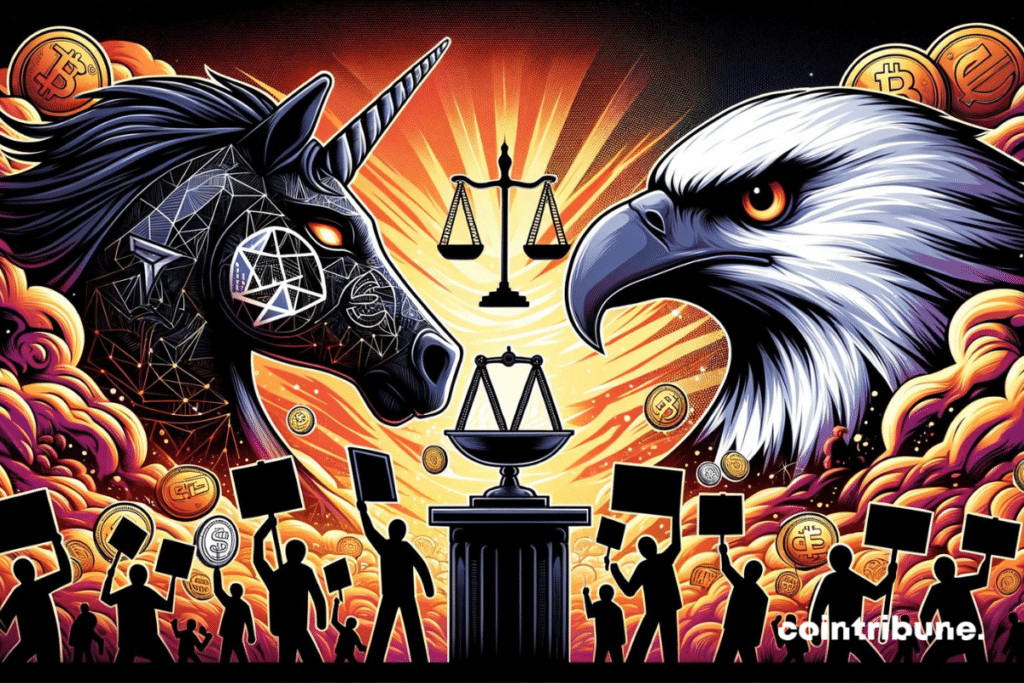

The crypto community is revolted by the SEC's attack on Uniswap

Thu 11 Apr 2024 ▪

4

min of reading ▪ by

Getting informed

▪

Regulation Crypto

Like Binance or Coinbase, Uniswap Labs could be facing legal action at the initiative of the Securities and Exchange Commission (SEC). At least, that’s the takeaway from a warning the regulator issued to the crypto company, though the exact reason remains unclear. The Uniswap community has not been indifferent to these somewhat concerning developments.

An unmotivated warning from the SEC against the crypto firm

Recent information suggests that the SEC has issued a warning to Uniswap Labs, one of the most significant crypto firms in the market. The company has been cautioned about a potential enforcement action against it.

The specific reasons for the SEC’s warning against Uniswap are not yet clear. However, analysts suspect this move is related to the SEC’s notoriously known plan to enforce its regulations on cryptocurrencies.

As a reminder, the regulator has been undertaking an initiative for several months to extend securities regulation to crypto companies. Coinbase, one of the market’s most significant exchanges, has suffered as a result.

At the heart of these lawsuits is the underlying question of whether cryptocurrencies should be treated as investment contracts like traditional stocks and bonds. According to the SEC, the answer is yes. Therefore, it considers itself legitimate in imposing regulation while crypto firms demand more regulatory clarity.

The crypto community’s frustration over regulation

In its blog post, Uniswap expressed frustration over the SEC’s lack of clarity regarding the regulatory framework for crypto-related activities. And the company’s opinion is merely an echo of the position that crypto firms have been making for months. Indeed, there is somewhat panic among certain users who now fear a lawsuit that could last for years. The crypto firm Ripple is an example of what an SEC attack could cost in terms of duration, in particular.

While Uniswap has announced that it will fight against the SEC, users are ready to support the platform in this battle initiated by the SEC. Their weapon, “wait for it [the valuation, Ed.] to drop even more to gobble up UNI at a low price,” explained user @Snkmt_Hdl on X.

On this platform, opinions are divided between fear, anger, and disgust of a persecution that they find ridiculous. Beyond the emotions that this latest attack targeting a crypto firm evokes, an interesting idea has emerged.

User @Thomas__Loyer sees in this SEC onslaught against crypto firms, the execution of a plan aimed at favoring Coinbase by eliminating the competition. “I actually think the SEC is clearing the way for Coinbase. They purged the US of all centralized competitors; now they’re targeting decentralized competition,” he declared. In this case, is the SEC’s attack on Coinbase just a diversion?

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.