The billionaire Jeff Bezos, founder of Amazon, is once again making headlines. In recent days, he has been selling off a significant amount of shares in the company he founded. In light of doubts about the motives behind these transactions, some are wondering if the plan to acquire Bitcoin (BTC) is not behind all this.

Cryptoactif

The Total Value Locked (TVL) in the context of decentralized finance (DeFi) defines the total value of assets locked in DeFi protocols and smart contracts. In other words, it measures the total amount of locked and utilized cryptocurrencies in various decentralized financial services, including liquidity pools, borrowing and lending protocols, decentralized exchange (DEX) platforms, among others. TVL is often seen as an indicator of the popularity and adoption of different DeFi protocols. It acts as a barometer of this crypto ecosystem. Indeed, according to recent data, the TVL of DeFi is in its best shape thanks to the dynamism of Ethereum. This article explains the ins and outs of this trend.

Bitcoin (BTC) is experiencing a remarkable resurgence. An opportunity that is always seized upon by Michael Saylor, the co-founder of MicroStrategy, to share his thoughts on what he believes will happen to the flagship cryptocurrency in the future. His projections regarding Bitcoin (BTC) are rarely pessimistic.

In the particularly thriving context of the crypto market lately, choosing wisely to position oneself on Bitcoin or Ethereum can be quite a dilemma. These two crypto ecosystems are market leaders. But they are distinct from each other in terms of functionalities and advantages. Understanding this divergence can be crucial for crypto investment choices.

Exactly one year ago, the price of bitcoin (BTC) was around $20,000. Throughout the year 2023, the flagship cryptocurrency made headlines for its remarkable dynamism despite the ups and downs. Today, the asset is valued at over $50,000. A level it had not reached since December 2021. The surge of BTC to reach this level is from this point of view a major event for the crypto industry, whose resurgence in 2024 has been announced by a panel of experts. But how can we reasonably explain that in the space of a week, BTC has increased its valuation by 19% to currently trade around $51,600? This article will provide you with some answers.

Despite the legal challenges it is involved in, the crypto firm Ripple wants to expand its operational scope. Latest news has it that the company wants to venture into the crypto custody segment. The company still needs to obtain regulatory approval.

The ERC-404 represents a key evolution in terms of Ethereum tokens. It offers developers and investors the opportunity to create and market tokens that combine both the fungibility of ERC-20 and the uniqueness of ERC-721. This potential of the Ethereum crypto platform has been exploited by a trader who managed to generate $59,000 using this method.

From the spectacular rise of Bitcoin, reaching almost $50,000, to innovative collaborations breaking the boundaries between the traditional web and the decentralized web, the cryptocurrency ecosystem continues to demonstrate its ability to evolve and adapt to regulatory, technical, and economic challenges. Here is a summary of the most significant crypto news of the week!

According to recent figures, five countries excel due to the financial problems they encounter. These countries attract the attention of analysts for their debts reaching record levels. The case of the United States is well known. France is also part of this select group of developed countries heavily in debt.

Geth, acronym for Go Ethereum, is an open-source software client for the Ethereum network. It is a crucial tool for Ethereum developers, miners, validators, and users. It is in high demand due to the many crypto advantages it offers. However, excessive reliance on this tool can be harmful, according to warnings from several analysts.

Two years ago, the crypto platform Polygon (MATIC), created to solve Ethereum's scalability issues, unveiled zkEVM. A solution that helps address the scalability challenges of Blockchain. The improvements in this regard have not stopped, as stakeholders have gone even further by developing a type 1 zkEVM prover. Here's what it's all about.

The future of bitcoin (BTC) is currently attracting great interest. Recently, some crypto analysts have expressed their prediction of a profound disruption in the flagship crypto market. As the bitcoin (BTC) halving approaches, they anticipate an exceptional supply "shock". These projections hint at significant implications regarding the price dynamics of the flagship crypto and its ecosystem. In this article, we will attempt to explain the implications of an explosion in the supply of bitcoin (BTC). This will be done through the lens of the current context of the flagship crypto in the crypto market.

In a world where crypto is synonymous with innovation and transformation, the launch of Dymension (DYM) stands out as a significant event. Captivating the attention of crypto enthusiasts from its very beginning, Dymension has seen its value skyrocket.

The M^0 protocol, developed by M^0 Labs and supported by Pantera Capital, could indeed disrupt the stablecoin market by enabling institutions to easily issue stable tokens backed by US Treasury bonds.

Towards the end of the 1990s, the emerging Internet technology at the time raised doubts and skepticism about its adoption potential. However, here we are nearly three decades later, with the Internet having become ubiquitous in everyday life. Will cryptocurrencies, which cannot be issued without blockchain technology, follow the same path? Or, on the contrary, will they experience a different fate and fizzle out over time? In a recent report, leading investment bank Architect Partners attempts to answer these crucial questions in light of the crypto industry's recent momentum. Here, in this article, is the essence of what should be remembered from it.

Peter Schiff, a notoriously skeptical economist about cryptos, has just come to their rescue. He is outraged by the new rules adopted by the Securities and Exchange Commission (SEC) to regulate the sector.

The ownership of Bitcoin has been the subject of debate and legal battles for several years. London judges potentially have the opportunity to definitively settle the matter. In any case, a trial has opened for this purpose in the capital of the United Kingdom. It pits Craig Wright against a representative entity of the crypto sector.

"From the remarkable rise of Bitcoin ETFs to the rise of Solana in the DeFi space, to the strategic initiatives of financial giants such as Visa, the crypto ecosystem continues to demonstrate its resilience and innovation. While Binance forges alliances with the Swiss banking sector to strengthen the security of digital assets, Visa is simplifying crypto transactions in 145 countries, highlighting the increasing integration of cryptocurrency into the traditional financial system. Meanwhile, Russia is considering the use of cryptocurrencies for foreign trade, defying international sanctions and exploring new paths for the digital economy. These developments, among others, not only shape the current landscape of cryptocurrency but also outline its future. Let's dive together into a detailed recap of these significant events."

The world of cryptocurrencies continues to evolve at a rapid pace in 2024, offering investors new opportunities to generate passive income through staking. This practice, which involves locking a certain quantity of tokens to participate in the validation of transactions on a blockchain network, attracts many enthusiasts. But which cryptocurrency should one invest in if they decide to embark on staking? This article answers this question by presenting six promising cryptocurrencies for staking in 2024.

According to JPMorgan, the growing dominance of USDT in the stablecoin market is negative for the overall crypto ecosystem.

Discover how Solana is redefining the crypto landscape by surpassing a billion dollars on its DEX, asserting its position.

As usual, the cryptocurrency market is facing a bearish situation. This is not insignificant. It is indeed due to the accumulation of several factors that particularly influence the confidence of crypto investors. Here's what it is.

In the dynamic world of blockchain and cryptocurrencies, the concept of Maximum Extractable Value (MEV) has emerged as an essential topic of discussion. This complex yet crucial phenomenon influences how transactions are processed and secured on blockchain networks, particularly Ethereum. MEV Bots are also gaining popularity. While MEV offers profit opportunities, it also raises questions of fairness and security. This article explores in detail how MEV works, its implications, its interaction with Ethereum 2.0, and its role in decentralized finance (DeFi).

On the occasion of its 30th anniversary, Vitalik Buterin, the brain behind Ethereum, has published a reflection on his journey in crypto. While he recognizes having played a pioneering role, he now believes that 'it is time for the new generation to take over.

The Argentine government of Javier Milei, known for its pro-Bitcoin positions, has just presented a bill to eliminate the possibilities of cryptocurrency tax declaration that have been in effect until now.

The crypto market is notoriously known for being both volatile and difficult to predict. In this context, artificial intelligence (AI) tools dedicated to crypto trading appear to be positioning themselves as relevant solutions to this challenge. The observation, in any case, is that these tools are increasingly used by traders. For good reason, they are able to analyze a significant amount of data in a very short period of time. This facilitates the detection of trends and trading opportunities that humans may not easily identify. With all this potential, the AI tools market is expected to have a significant impact on the crypto market in the coming years. Let's see how in this article.

Solana has broken records with a staggering transaction volume of 951.9 billion, a growth of 30% since December.

According to recent analysis by Standard Chartered, the United States Securities and Exchange Commission (SEC) could be on the verge of approving a cash exchange-traded fund (ETF) for Ethereum as early as May. This prospect, long-awaited by investors and crypto market players, could not only further validate Ethereum as an institutional investment asset but also propel its price to unprecedented highs.

The US Commodity Futures Trading Commission (CFTC) warns of the increasing scams fraudulently using artificial intelligence (AI) to attract crypto investors with the promise of whopping returns.

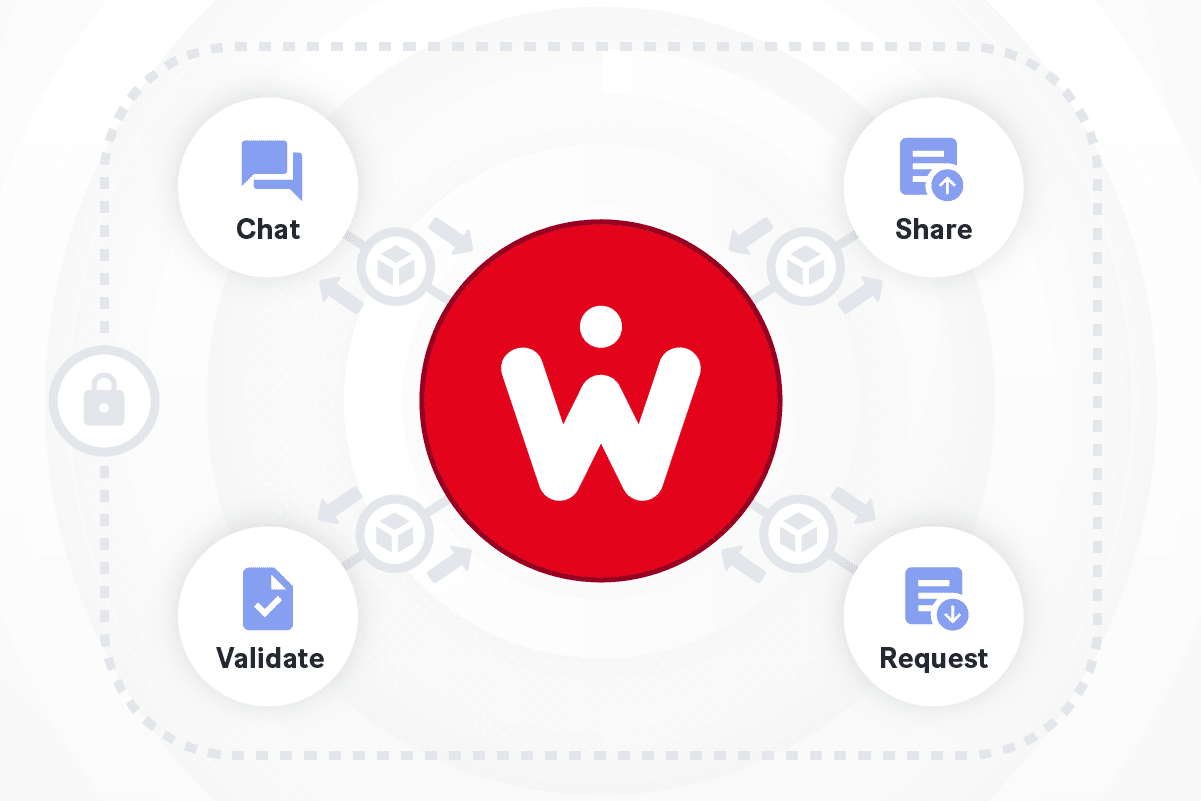

After successfully entering Bitstamp with great success and experiencing a meteoric rise, the Wecan Token is ready to take a new significant step. Wecan Group's cryptocurrency will soon also be available on the Uniswap exchange. A listing that promises to offer new perspectives for investors.