David Sacks, a key figure in crypto and Trump advisor, calls the New York Times accusations a pure "nothing burger." Between threats of lawsuits, sharp denials and political stakes, this clash reveals much more than a simple media dispute.

Cryptomarket

China has just made a big move: the central bank is further tightening its crackdown on crypto and stablecoins, calling them a major threat. Why this radical decision? What impacts for the global market and investors?

Bitcoin ends this year on a familiar note. Down more than 36% from its annual highs, the asset eerily replicates the movements of the 2022 bear market. This correlation alarms analysts as crypto ETFs register positive inflows again. Between the return of institutional capital and memories of a previous crash, the market oscillates between concern and hopes of a rebound.

Strategy, the Bitcoin giant will only relinquish its precious reserves under one condition, which one? A condition that may reveal dark days ahead for BTC.

The crypto market gave way under the pressure of its own leverage. In a few days, nearly 8 billion dollars of open interest on Bitcoin futures contracts were liquidated, triggering a brutal purge of speculative positions. Behind this shock, a rebalancing is emerging, suggesting that a stabilization cycle could begin.

Crypto is undergoing a revolution in 2025: fundraising has jumped by +150% in one year, smashing all records. Which projects attract billions? Which sectors are booming? Analysis of a historic growth that is redefining the digital economy and opening unprecedented opportunities for investors.

Ethereum is about to revolutionize its network with a gas limit raised to 180 million. Anthony Sassano reveals how this update could reduce fees and boost scalability! A major breakthrough for the crypto ecosystem.

After 18 days in the extreme fear zone, the crypto market shows a first sign of relief. The Crypto Fear & Greed Index rises slightly, finally leaving its lowest level. This rebound occurs while November, traditionally favorable to Bitcoin, ends in uncertainty.

The crypto industry has just proven it can change lives. After the devastating fire in Hong Kong, the deadliest in 80 years, Bitget, Binance, KuCoin, Tron and many other players joined forces to raise $3.2 million. How will these donations transform humanitarian aid?

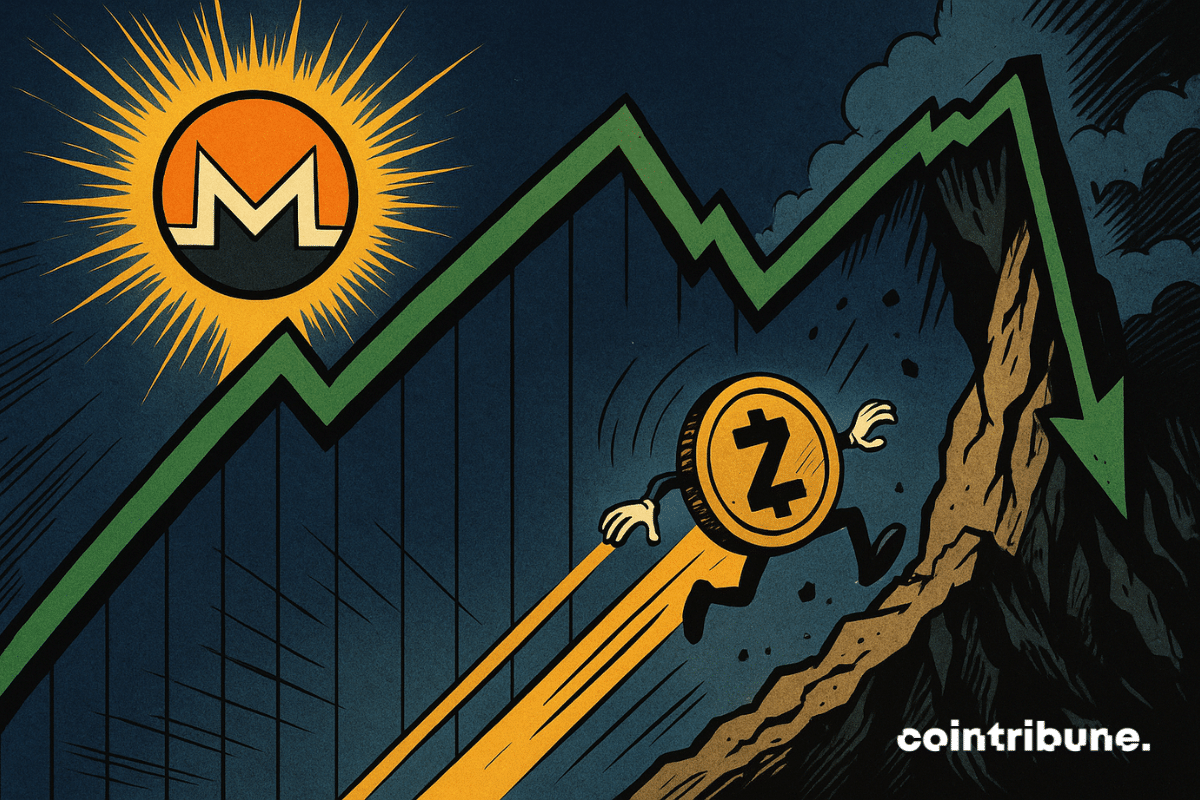

Monero (XMR) gained more than 23% this week, while Zcash (ZEC) dropped by nearly 25%. Such a gap highlights the high volatility of the privacy coins market, in a context of low activity related to Thanksgiving. This divergence between two key privacy assets raises questions about the internal dynamics of the sector.

XRP shows an increase of 0.85% at $2.22, but its trading volume collapses by 31.87%. A puzzling paradox that raises questions: Are crypto traders losing confidence despite rising prices? Analysis of the numbers and stakes to understand what is really at play behind this trend.

Coinbase Ventures has just unveiled its investment strategy for 2026, outlining the strong points of a changing Web3 ecosystem. Nine key areas have been identified, revealing the sectors where capital could soon flow. More than a simple manifesto, this roadmap lays out the technological and economic bets of one of the most influential players in the crypto industry, a strong signal sent to developers, investors, and builders of the decentralized web.

Bitcoin and USDT maintain an inverse relationship that directly influences crypto market movements. According to Glassnode, this negative correlation could well dictate the trends towards the end of 2025. An exclusive analysis that sheds light on investors' strategies and projections for December. Not to be missed.

DeFi is no longer a promise, but a revolution underway. According to Chainlink, it could dominate global finance by 2030—under one condition: regulation. How are institutional funds and stablecoins accelerating this historic adoption? All the answers here.

Bitcoin is crashing, but K33 Research experts see a golden chance. After a 36% drop, is the sell-off approaching saturation? Discover why this correction could be the relative buying opportunity of the year and what analysts forecast for 2026.

The US Federal Reserve could well be starting a decisive turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. A rapid development, which contrasts with the firmness displayed in recent months. If this scenario is confirmed, it will mark the end of an unprecedented monetary tightening cycle and could disrupt the balance of financial markets.

In an economic landscape weakened by persistent inflation and markets still under pressure, the succession at the head of the Federal Reserve becomes a highly strategic issue. The rise of Kevin Hassett, former economic adviser to Donald Trump and close to the crypto world, reshuffles the deck. At the intersection of classical monetary policy and financial innovations, his candidacy intrigues, divides, and could mark a major turning point in the relationship between Washington and the crypto industry.

Revolut makes a big impact: 75 billion dollars valuation and a historic fundraising supported by Coatue, NVIDIA and Fidelity. How is this European fintech, boosted by crypto, redefining global finance?

JPMorgan Chase closes the accounts of Jack Mallers, CEO of Strike, without explanation! This new case of crypto debanking reveals a worrying trend... Why are crypto ecosystem participants excluded from the traditional banking system?

Are financial markets getting ahead of the Fed? While traders are heavily betting on a rate cut as soon as December, the Federal Reserve remains cautious and divided. This potential mismatch between anticipation and reality could disrupt macroeconomic balances and weigh heavily on risk assets.

Bitwise sees Bitcoin, Ethereum, XRP and Uniswap as the stars of 2026. Between major technological updates, institutional adoption and expected rebounds, these cryptos could explode at any moment. Discover the price forecasts for December 2025 and the winning strategies to profit before everyone else.

The Bitcoin Fear & Greed index has just plunged into an extreme fear zone, a rare signal that has often preceded spectacular rebounds. With critical levels at $80,000, the market is at a decisive turning point. Should you buy now or fear a new wave of selling?

Bitmain, Chinese giant of Bitcoin mining, raises concerns in Washington. A secret investigation reveals fears of espionage and sabotage via these ultra-dominant machines. At stake: American security, the interests of the Trump family, and the future of crypto-mining.

Bitcoin has just plunged to $82,000, triggering $2 billion in liquidations and record ETF outflows. Between widespread panic and hidden opportunities, this historic crisis could change everything. Decode the causes, risks, and winning strategies to not miss the rebound — or avoid the trap.

Bitcoin is collapsing, and this time, the culprits are not who we think. JPMorgan unveils an unexpected phenomenon: small investors, once loyal, trigger panic by emptying their ETFs. Who are these mysterious sellers, and why are they shaking the crypto market? The answer will surprise you.

November 2025 sees the Fed paralyzed by uncertainty, while Trump multiplies attacks against Powell, calling him a "mental patient." Between frozen rates and presidential insults, the crypto market wavers. Who will emerge victorious from this chaos?

Quantum computers could cause the collapse of the crypto ecosystem as early as 2028. Vitalik Buterin sounds the alarm and proposes radical solutions. Will crypto survive this imminent threat? Discover the stakes and the answers that could change everything.

The Argentine parliament has just made a big move: in a damning report, it qualifies the promotion of the crypto $LIBRA by Javier Milei as an alleged scam, a scandal that cost investors 400 million dollars. Yet, his allies see it only as a political "buffoonery." Who is telling the truth?

A few days before Thanksgiving, Washington and Beijing are preparing to conclude a decisive agreement on rare earths, these vital materials for the technology industry, defense, and crypto mining. In a tense geopolitical climate, this compromise could defuse a crisis with heavy consequences for global supply chains. Faced with the threat of US customs sanctions and Chinese export restrictions, this agreement marks a strategic turning point, but nothing is decided yet.

While precious metals regain ground and Washington avoids budget paralysis, the crypto ecosystem wavers. Investor sentiment collapses, reaching its lowest level since March. Indeed, alarming technical signals reveal a possible breaking point. In a climate of widespread distrust, the market seems to enter a critical phase where fear now dictates movements. This abrupt trend change raises questions about the solidity of the rebound eagerly awaited by industry players.