Ethereum’s network shows record stablecoin activity, $6T in Q4 settlements, low fees, and steady prices above $3,000.

Ethereum (ETH)

Ether has entered an important phase as exchange balances drop to their lowest level in nearly ten years. Supply continues moving into staking and long-term holding, leaving fewer tokens available for trading. Market structure is tightening even as investor sentiment remains cautious. Recent network events and steady institutional demand are also adding to this overall market trend.

BPCE, a heavyweight in the French banking sector, launches its crypto trading service this week through its mobile applications. A revolution: buying Bitcoin will become as easy as checking your balance.

While bitcoin is bogged down under the spotlight, fleeing ETFs and traders under Lexomil: the crypto star rediscovers the joys of the plunge, 2022 version, remixed 2025.

The Fusaka update nearly caused Ethereum crypto network finality to be lost. We give you all the details in this article!

Europe-based ETF issuer 21Shares has opened a new chapter for Sui-linked investment products in the U.S. after receiving approval to list the first exchange-traded product tied to SUI. The debut comes as crypto ETFs continue to roll out across major exchanges, attracting steady interest from both retail and institutional traders.

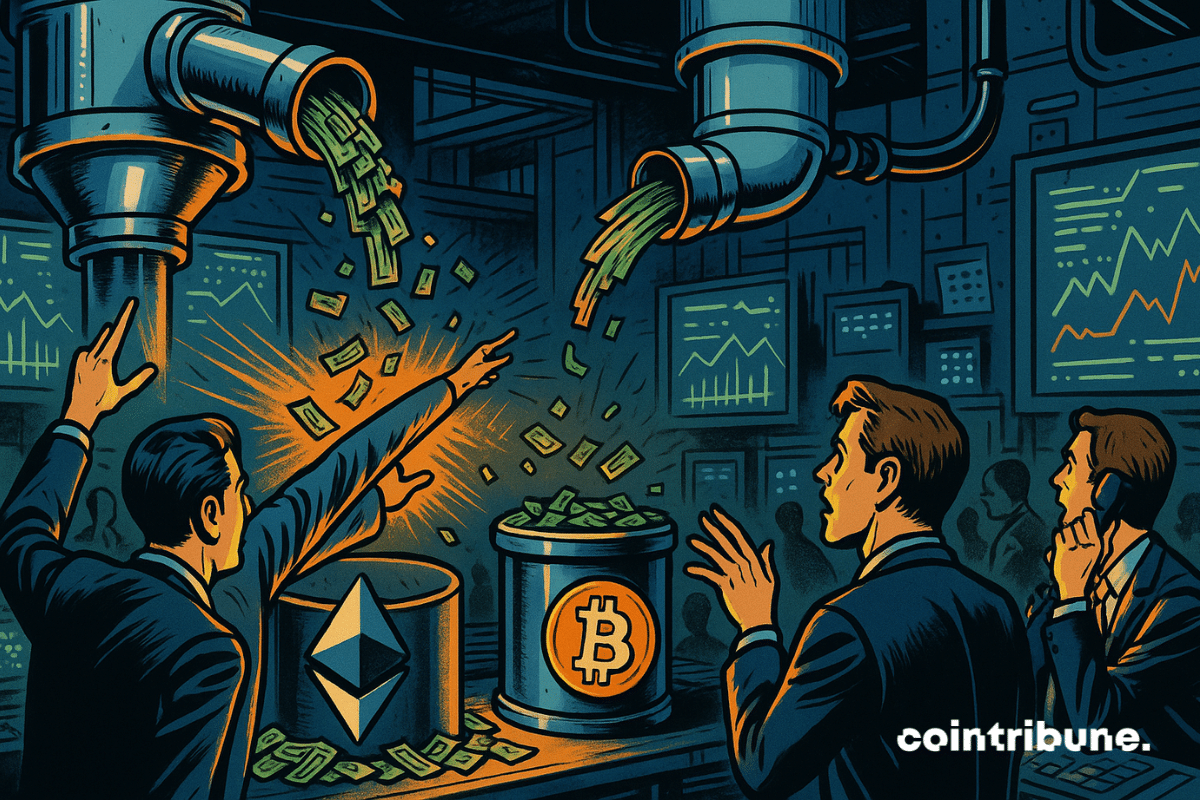

Supported by record inflows into spot ETFs and favorable technical setup, Ethereum quietly outperforms bitcoin. As flows shift and retail interest rises again, a turning point is happening. Is the trend changing permanently?

While Bitcoin is leading a new rally, Solana sends a much more puzzling signal: capital is exiting ETFs but continues to flow on the blockchain. On one side, 21Shares sees its TSOL crypto ETF lose $42M. On the other, over $321M redeploy directly on-chain on Solana. An apparent contradiction that says a lot about the real state of the market.

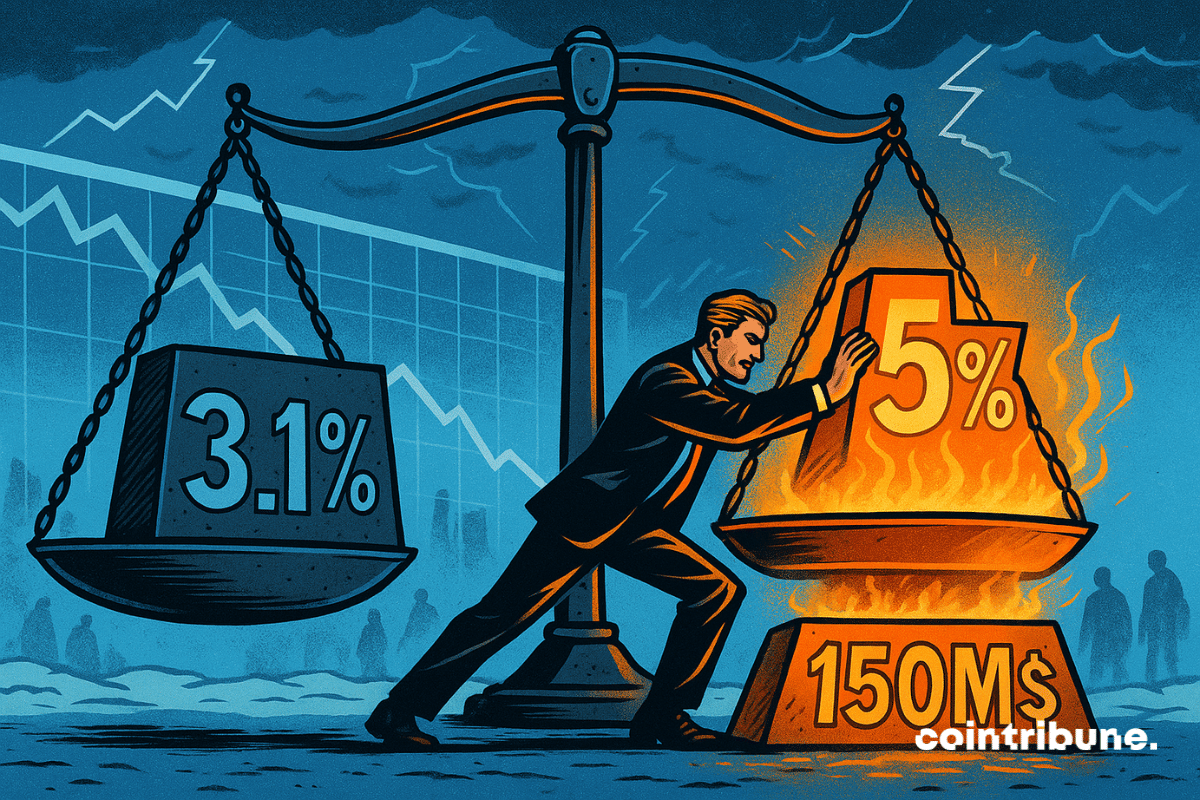

While the small holders sell, BitMine stuffs itself with ether: $150 million at once, aiming for 5%. Soon, Ethereum will be to Tom Lee what Twitter is to Musk.

When Ethereum no longer inspires companies, BitMine feasts, the small ones die... and the crypto market wonders: is it a pause or the end of recess?

The Ethereum Fusaka update is finally active, marking a historic turning point for the blockchain. With faster transactions, reduced fees, and unprecedented scalability, this evolution could redefine the future of crypto. Discover in detail the immediate changes and their impacts on the Ethereum ecosystem.

ZK Secret Santa uses zero-knowledge proofs to let users interact anonymously on Ethereum, keeping actions and identities private while ensuring fairness.

Ethereum just experienced a historic purge: 6.4 billion dollars in leverage evaporated, causing its price to drop. Yet, whales are taking advantage to massively accumulate. Why this paradox? A crisis or an opportunity? Analysis of a decisive turning point for crypto.

2026 will mark a historic turning point: real world assets (RWAs) tokenized are establishing themselves as the new standard for global payments. Programmable stablecoins, digitalized government bonds, and massive adoption by banks — this financial revolution is already redefining liquidity and transactions. Ready to understand how these assets are transforming the economy?

BitMine buys $70M of Ethereum in 3 days. Supercycle coming? Discover all the details of this massive operation.

An arithmetic bug, billions of tokens, a hurried hacker… and Yearn retrieving $2.4M in commando mode. In the crypto jungle, treasure hunts are intensifying.

Vanguard, asset management giant, has just shaken up the market by opening its doors to crypto ETFs for its 50 million clients. A decision that could cause Bitcoin to explode and redefine institutional investment. Why this turnaround, and what will be the consequences?

After a month of massive disengagement, crypto investment products record a spectacular comeback. In a single week, crypto ETPs attract 1.07 billion dollars, breaking a series of four consecutive weeks of outflows totaling 5.5 billion $. This renewed interest marks an unexpected turning point in a highly uncertain monetary context, where markets scrutinize Fed signals.

In the derivatives market, a milestone has just been reached. For the first time, Ether (ETH) futures contracts have generated more volume than those on bitcoin (BTC) on the Chicago Mercantile Exchange. This reversal occurs in a climate of high volatility, reflecting a marked repositioning of institutional players. Such an overtaking could then signal a deeper change in the balance between the two main assets.

A hacker, a forgotten division, and nine million vanished... The arithmetic falters, the vaults empty, and Yearn's coders mourn their yETH. Crypto drama or bad comedy?

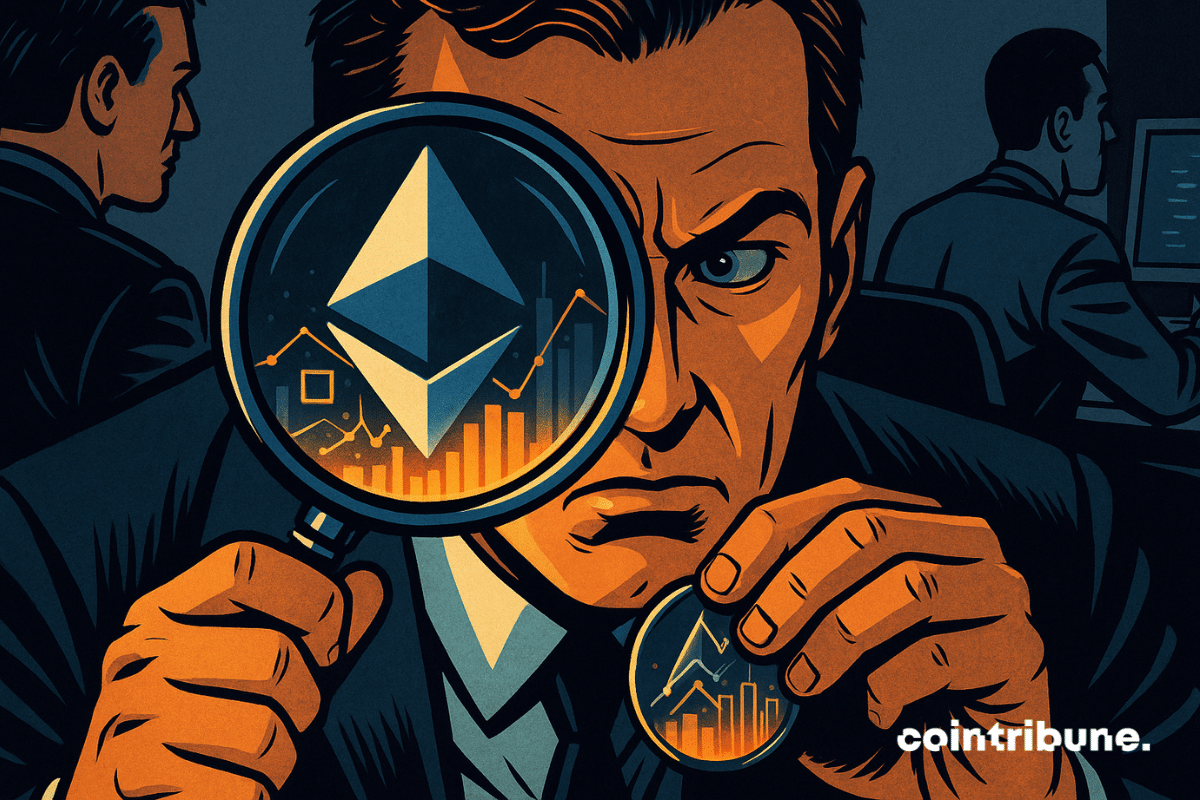

What if Ethereum was worth much more than the market thinks? According to a study conducted by CryptoQuant, 9 valuation models out of 12 estimate that ETH is currently largely undervalued. For Ki Young Ju, CEO of the platform, these analyses reveal a significant gap between the current price of Ether and its real theoretical value. This finding rekindles the debate on how cryptos should be valued.

Heavy withdrawals hit BlackRock’s flagship Bitcoin ETF in November, but company executives say the activity reflects normal market behavior, not a shift in long-term sentiment. Momentum from earlier in the year continues to guide the firm’s outlook, supported by the strong demand that once pushed IBIT toward a major milestone.

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

The crypto market rebounds: ETFs fill up, BlackRock frowns, Solana hesitates. What if whales knew the weather before everyone else?

Ethereum is about to revolutionize its network with a gas limit raised to 180 million. Anthony Sassano reveals how this update could reduce fees and boost scalability! A major breakthrough for the crypto ecosystem.

Arthur Hayes is stirring debate across the crypto market with sharp criticism of Monad, a new layer-1 chain that launched with significant attention and industry backing. His remarks challenge the project’s early momentum and raise broader questions about high-valuation tokens supported by venture capital.

Ripple USD has entered a new phase of market growth as it surpasses the one-billion supply mark on Ethereum. RLUSD’s fast expansion has strengthened its position among major stablecoins, showing steady demand across trading platforms, wallets, and payment services. For an asset less than a year old, this milestone represents a notable achievement for the dollar-pegged stablecoin.

BitMine is drawing fresh attention as its aggressive buying spree in Ethereum continues. New on-chain activity suggests the company may be preparing another significant purchase, prompting traders to watch whether continued accumulation can steady sentiment in an uneven market. Interestingly, BitMine’s recent purchase activity comes amid broad macro pressures that remain a persistent drag on digital assets.

Bitcoin still under $100,000... but the crypto industry is rejoicing. Whales sell, small buyers buy, hopes rise: what if the crypto winter was just an illusion?

At Ethereum, the gas never goes down! 60 million on the counter, and an engine ready to explode. Small validators will have to pedal faster than ever.