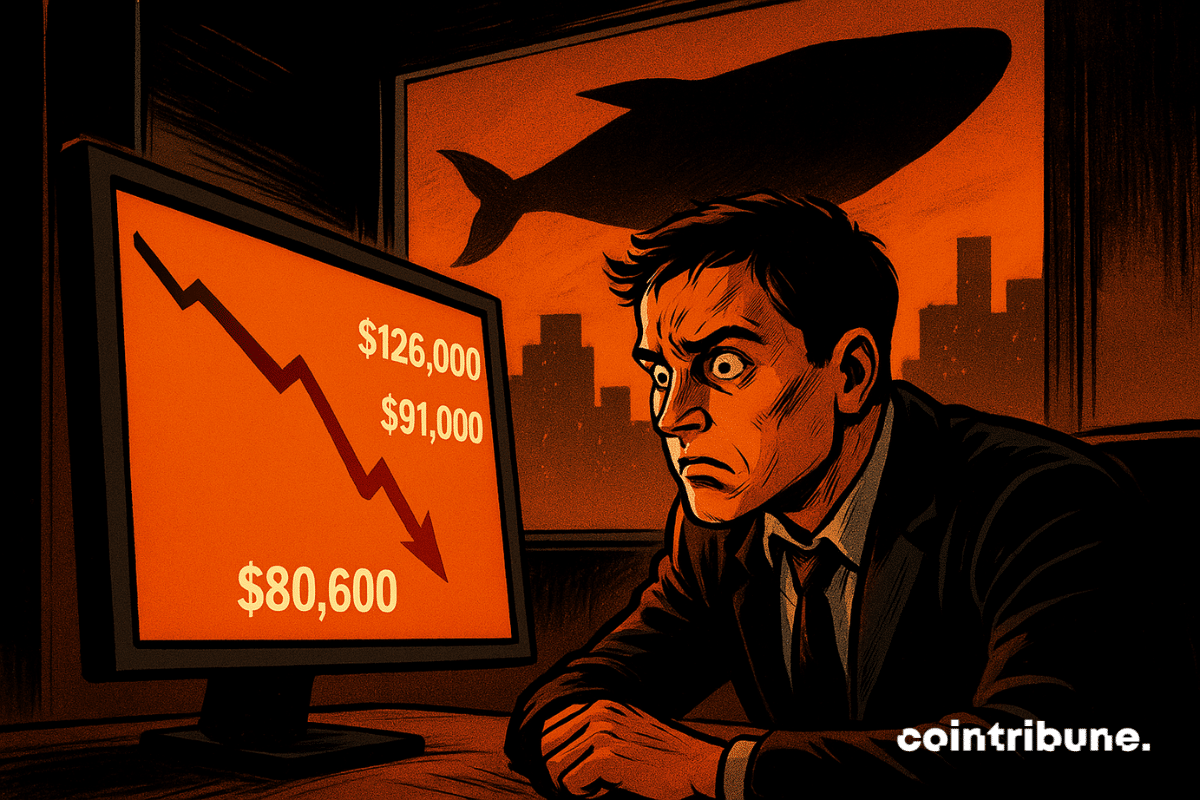

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

Ethereum (ETH)

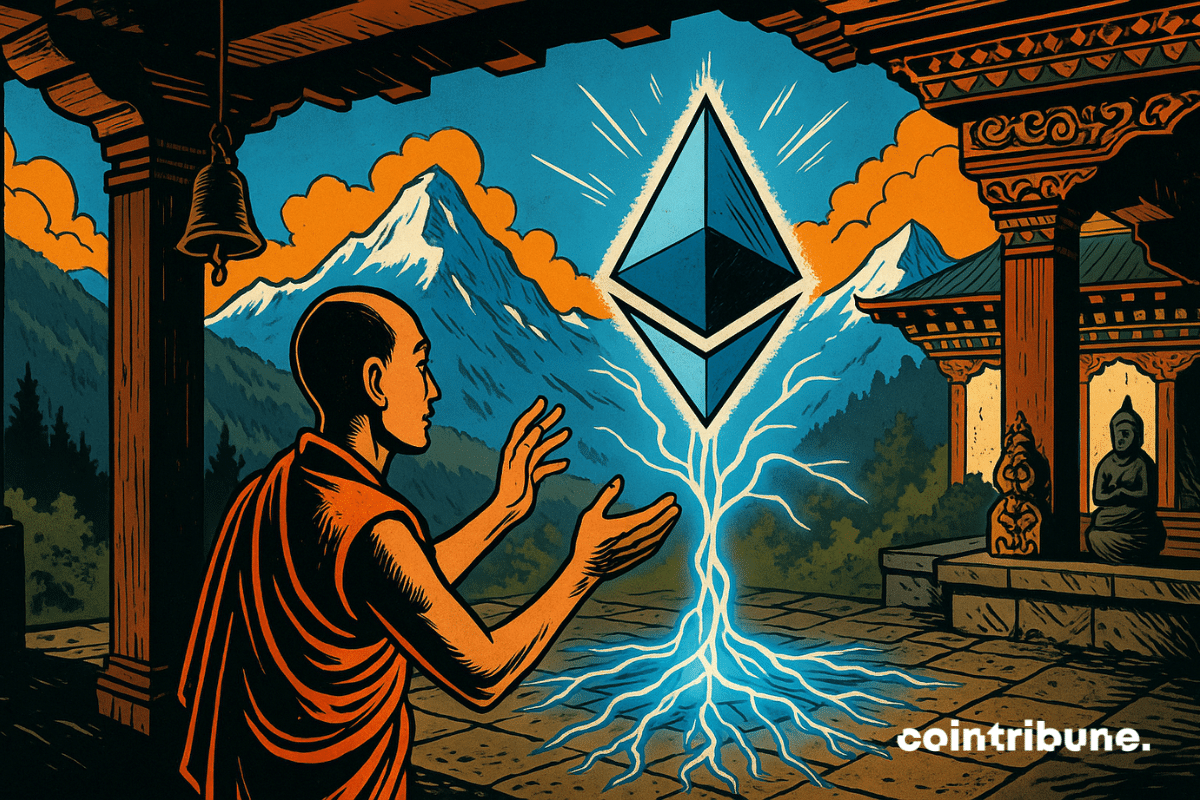

Bhutan surprises by entering the Ethereum universe. This small Himalayan state staked 320 ETH, nearly one million dollars, via the Figment validator, thus asserting a clear strategy of integration into the blockchain. Far from a simple investment, this initiative is part of a broader technological shift, where digital sovereignty and public infrastructure meet on Ethereum. A rare approach at the state level, redefining the contours of national engagement in the crypto ecosystem.

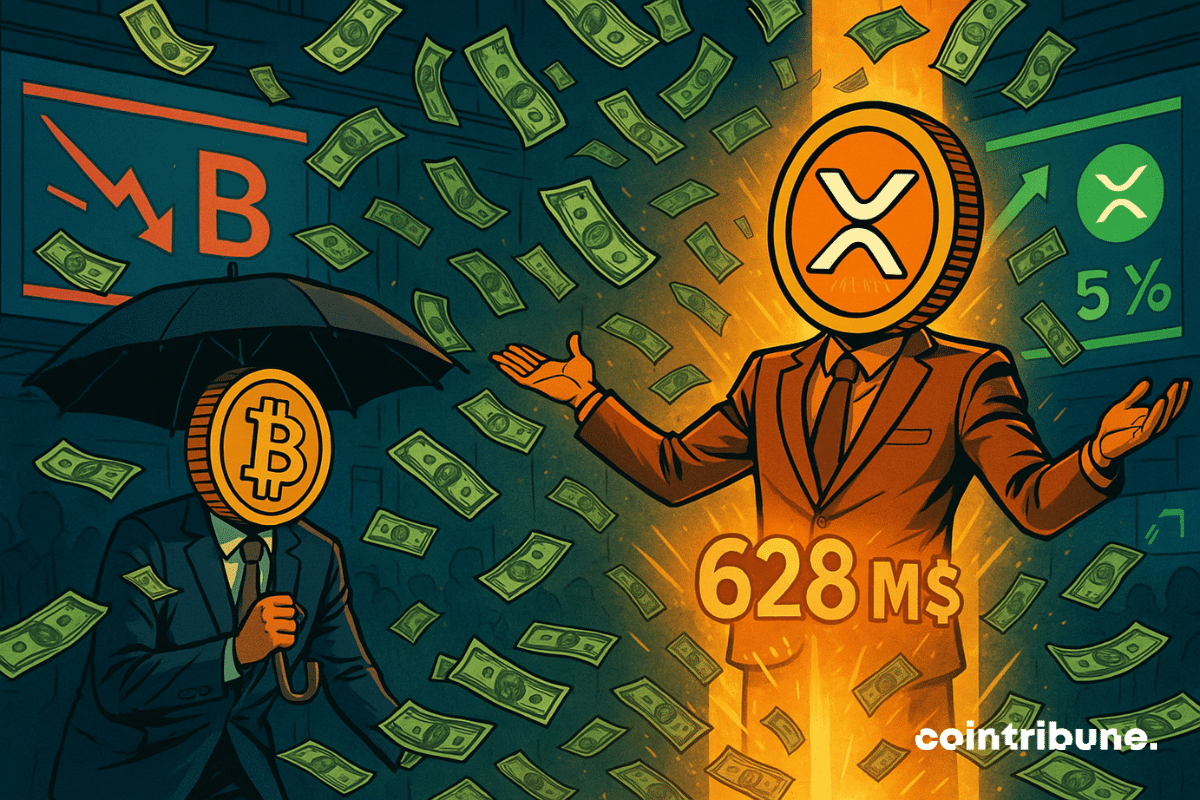

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.

Strong market interest returned to TON, with the token climbing to $1.60 after an 8.33% daily rise. Growing activity across Telegram-linked applications, steady technical signals, and a packed month of ecosystem releases added fresh confidence to traders. Even while the broader market continues to struggle, TON stands out as one of the sharpest moves among major networks.

Ethereum struggles to regain height after its recent correction, oscillating below major technical levels despite the loyalty of its long-term holders. The second largest crypto market capitalization tries to revive its upward momentum, but the demand engine runs at low speed. Without new capital inflows, the recovery remains fragile, dependent on the patience of long-term investors.

Banned but coveted, China plays it cool and reconnects its bitcoin machines. Silence in Beijing, but business is booming in provinces where electricity costs nothing.

Bitcoin as a global payment rail? For BlackRock, this is clearly not the core issue. For now, clients of the world’s largest asset manager mainly play the digital gold card, not the everyday currency one.

Strong inflows returned to major crypto ETFs at the end of the week after several days of uncertainty across digital asset markets. Bitcoin, Ether, and Solana products all posted gains on Friday, hinting at early stabilization following sharp swings and heavy withdrawals earlier in the week. Sentiment remains cautious, but renewed allocations to key products suggest that some investors are selectively re-entering the market.

Bitwise sees Bitcoin, Ethereum, XRP and Uniswap as the stars of 2026. Between major technological updates, institutional adoption and expected rebounds, these cryptos could explode at any moment. Discover the price forecasts for December 2025 and the winning strategies to profit before everyone else.

Ethereum crashes, BitMine persists: MAVAN, dividend, patriotism... The ultimate crypto pirouette of a giant who prefers to bet big rather than fold to Wall Street.

Ether (ETH) dropped nearly 30% in one month, breaking the symbolic $3,000 threshold. This brutal setback endangers the finances of an entire segment of the crypto ecosystem. Behind the curve, companies exposed to ETH see a year of gains evaporate.

Quantum computers could cause the collapse of the crypto ecosystem as early as 2028. Vitalik Buterin sounds the alarm and proposes radical solutions. Will crypto survive this imminent threat? Discover the stakes and the answers that could change everything.

BlackRock takes a staking cure for its Ethereum: a developing ETF that promises yield for large portfolios. Crypto, meanwhile, continues to trot towards Wall Street.

Fragmentation across Ethereum’s Layer 2 networks has become a growing concern, pushing the Ethereum Foundation to propose a new direction. Scaling has delivered faster transactions and lower fees, but it has also complicated the user experience. Bridges, chain-specific wallets, and scattered liquidity continue to slow activity across the ecosystem. The proposed Ethereum Interop Layer (EIL) aims to bring these parts back together and restore a more unified experience.

VanEck's Solana ETF has just entered the scene, and it's not just another product on the altcoin shelf. We are witnessing a real flood of crypto funds on the stock market, with Solana and soon Dogecoin at the forefront. Between slash fees, integrated staking, and a race against regulatory time, a new battle is playing out far from traditional exchange platforms.

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

Tom Lee says Ethereum is entering the same supercycle that propelled Bitcoin’s historic surge, noting the move will require holding through market ups and downs.

A wave of panic is blowing over crypto ETPs. In the space of one week, over $2 billion has been withdrawn from these financial products, marking their largest outflow since February. This is a strong signal for an institutional market plagued by doubt, amid economic uncertainties and monetary tensions. As traditional markets waver, investors are reassessing their exposure to cryptos. This situation could mark a turning point in the strategy of major holders.

Ethereum faces steady ETF outflows, with investors viewing it as riskier than Bitcoin, signaling caution in the market.

After BitMine, SharpLink plays the crypto rentier: a safe filled with Ethereum, dividends pouring... and a strategy that would make many central banks envious.

A sharp shift in sentiment has taken hold across digital assets after a week of sell-offs, weaker macro signals, and thinning liquidity. Markets now sit in a cautious posture, with fear climbing as large-cap tokens retreat toward multi-month lows.

Growing interest in digital assets is prompting investors to reassess which tokens deserve long-term attention. Recent shifts in sentiment around Solana, XRP, and other major networks reflect a market still trying to determine its next set of leaders.

While the crypto market seeks a new balance, an analysis by Glassnode reveals a major strategic divergence: bitcoin holders hold, Ethereum holders mobilize. Beyond community rivalries, these data reveal two opposing visions of crypto value. One is based on reserve, the other on use. This behavioral gap, often neglected, could well redefine the power balance within a rapidly evolving ecosystem.

While crypto traders tremble at the thought of a crash, the charts whisper promises. Should you flee or buy? Breath-taking suspense in the token jungle.

The crypto market is going through a period of intense turbulence. While Bitcoin dangerously slips below the symbolic threshold of 100,000 dollars, gold and silver shine brightly. Investors are turning away from digital assets to seek refuge in commodities. But what explains such a turnaround?

A muted end to 2025 may be laying the groundwork for a stronger crypto breakout in 2026. Bitwise chief investment officer Matt Hougan says the absence of a late-year rally strengthens his view that next year will bring the next major upswing for digital assets.

Big corporate holders of Bitcoin are entering a more competitive phase as new entrants add crypto to their balance sheets. While activity remained steady in October, shifting buying patterns eroded the dominance of long-standing leaders, bringing greater attention to new corporate holders of Bitcoin and major altcoins.

Under Atkins, the SEC pulls out the highlighter to sort tokens. Congress, meanwhile, is stalling. And crypto projects? They are sharpening their passports for more stable skies.

A former BlackRock executive has just thrown a wrench in the works. For him, Ethereum will not be just another blockchain. This network will actually become the digital backbone of all global finance. A bold vision as crypto has just lost a key support at 3,600 dollars.

Bitcoin explodes in ETFs with $524M in 24h: simple rebound or massive return of institutions? Complete analysis here!