From January 31 to February 2, 2025, Alephium, a next-generation blockchain, will participate in CryptoXR, the second largest crypto conference in France, to organize a large-scale hackathon in partnership with LSW3 (League for Web3 Security). This event promises to make Auxerre the French capital of Web3, attracting over 3,000 visitors, 70 speakers, and innovative projects.

France

Michael Saylor, the visionary co-founder of MicroStrategy, sees considerable potential for Bitcoin adoption in France. This statement follows a meeting with Sarah Knafo, a Member of the European Parliament, during a lunch where they discussed the future of cryptocurrencies and energy.

According to economic projections and analysis by international experts, no European economy will be among the top ten world powers by 2050.

For the past two years, the French real estate market has been undergoing a deep crisis, fueled by soaring prices and difficulties in accessing credit. In response to this critical situation, François Bayrou, the Prime Minister, presented a set of measures aimed at revitalizing this vital sector for the national economy. Focused on tax incentives, increased support for construction, and regulatory adjustments, these proposals seek to address current challenges while considering social and environmental issues. While these initiatives spark hope for a rebound, they also raise many questions about their effectiveness and implementation.

The concept of wealth is complex to grasp, as it varies according to social, economic, and cultural contexts. Nevertheless, it generates constant interest in public debates. At what amount can one be considered wealthy? A recent study, based on data from the Bank of France and the criteria of the Observatory of Inequalities, provides a precise insight. It sets this threshold at 555,000 euros in net assets, far removed from the images of extreme luxury often associated with wealth. In fact, this figure, which concerns about 20% of French households, raises essential questions about wealth distribution and social inequalities. How does this definition influence our perception of wealth? And what are its implications for public policies and social justice?

David Lisnard, Mayor of Cannes, announced an ambitious initiative aimed at encouraging and training local merchants in the integration of cryptocurrencies for payments. This initiative is part of the city's Web3 strategy, which aims to modernize and invigorate the local economy. However, this initiative does not seem to please everyone and is receiving strong criticism.

The French rental market is going through an exceptionally severe crisis, threatening access to housing for many households. Despite a slight recovery in the real estate sector, rentals remain under intense pressure, with a plummeting supply and prices that continue to rise. According to the National Federation of Real Estate (Fnaim), structural problems and poorly adjusted regulatory choices are exacerbating this situation. With the rise of short-term rental platforms and new constraints related to energy renovation, challenges are piling up, highlighting the urgency to act. This crisis, beyond the numbers, involves major social and economic issues for both tenants and investors.

Under the darkened skies of the budget, the Medef proposes a sharp reform: to withdraw retirees' valuable tax allowance. An idea where the economy dialogues with injustice.

The housing credit market in France is undergoing a significant shift. After a period marked by high interest rates, which hindered access to property ownership, the trend is reversing. François Villeroy de Galhau, governor of the Bank of France, announced that mortgage rates fell below 3.4% in November 2024, down from 4% in January. This drop is attributed to a slowdown in inflation, which is expected to reach 1.5% in 2025, after having weighed on the economy in recent years. This development is a relief for borrowers, but its implications go beyond the real estate sector. A relaxation of credit costs generally promotes economic recovery, restoring purchasing power to households and encouraging investment. This dynamic could also impact other asset classes, particularly cryptocurrencies. A more stable economy and smoother access to financing prompt some investors to reassess their strategies. With this drop in rates and the anticipation of possible monetary easing by the European Central Bank (ECB), the real estate market could regain a more favorable dynamic.

When a country imports more than it exports, its economy weakens and its dependence on external markets increases. In November 2024, France's trade deficit stood at 7.3 billion euros, which represents an improvement of 0.3 billion euros compared to the previous month. This slight reduction in the deficit is primarily explained by an increase in energy exports, which grew faster than imports. However, this improvement does not call into question the structural fragility of French foreign trade. Despite this temporary improvement, the imbalance between exports and imports remains critical. The domestic industry struggles to compete with international competition, and the trade balance remains largely in deficit. This situation raises questions about the competitiveness of French companies and their ability to sustainably establish themselves in foreign markets. Thus, the evolution of the deficit in the coming months will largely depend on the energy situation and the economic policies implemented to rectify the trade balance.

After two years of noticeable decline, the real estate market appears to have reached a turning point. According to Charles Marinakis, president of Century 21 France, the correction in prices is nearing its end, paving the way for stabilization, or even a slight rebound in 2025. In Paris, the price per square meter has dropped by nearly 10% over two years, a similar decline observed throughout Île-de-France. This correction, exacerbated by rising interest rates, has allowed sales to gradually restart. However, the market's evolution will depend on several factors, including the continued decrease in credit rates and the ability of sellers to adjust their prices to match the new expectations of buyers.

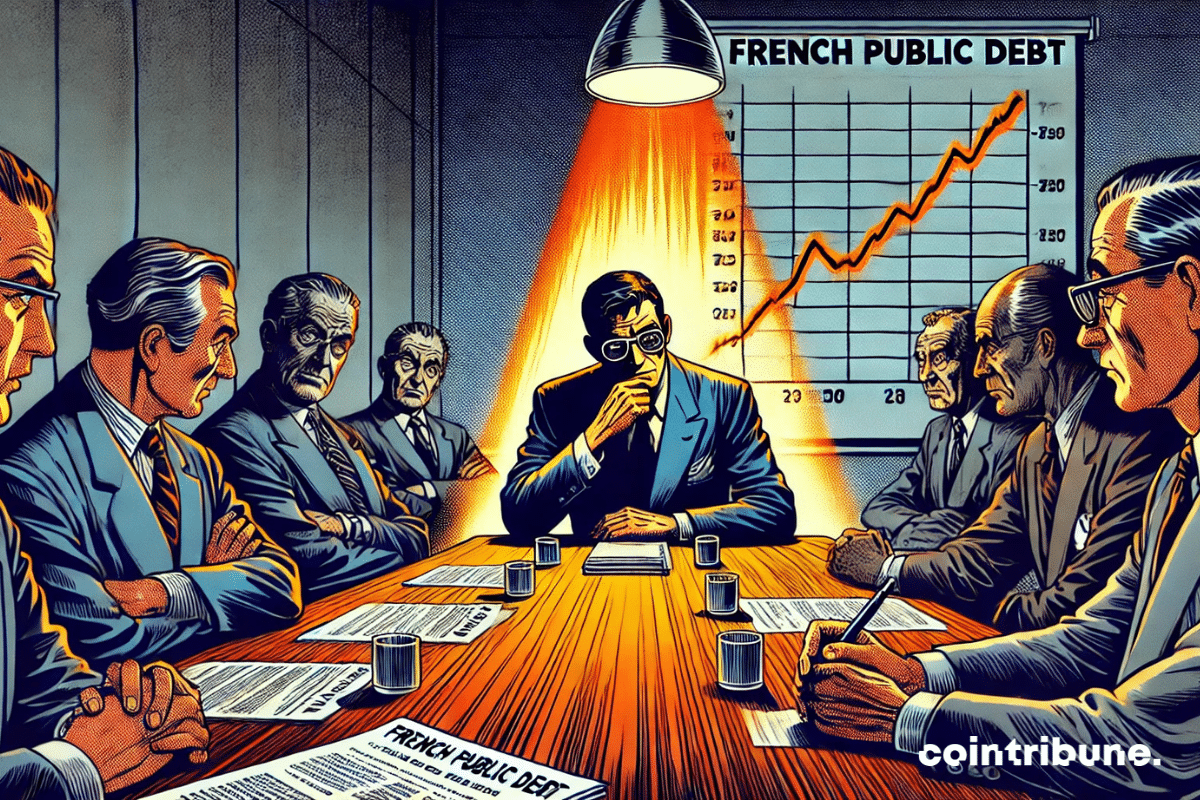

The French state is preparing to face a year of high tension in the financial markets. With 300 billion euros to borrow in 2025, an unprecedented level of debt, Bercy must maneuver in a particularly unstable environment. The French Treasury Agency (AFT), responsible for debt issuance, faces a double challenge: ensuring the financing of the country without destabilizing the markets and reassuring increasingly cautious investors. Indeed, political uncertainty further complicates the situation. Since the fall of the Barnier government, France has been operating without an approved budget, which strengthens doubts about the country’s budgetary trajectory. A special law adopted in emergency allows for the maintenance of borrowing, but this temporary solution is not enough to dispel the concerns. In the markets, signs of instability are multiplying. The spread between French and German rates, a key indicator of investor confidence, has doubled in a year to exceed 80 basis points. This signal reflects a riskier perception of French debt and could increase the cost of financing. In this climate of uncertainty, Bercy must find the right balance. Will the AFT’s strategy, based on predictability, regularity, and flexibility, be enough to avoid an excessive rise in interest rates? With only a few days until the first auctions, pressure is mounting on financial officials, while investors are waiting for guarantees on the country’s budgetary stability.

Since January 1, 2025, the French real estate sector is entering a new era. The changes go beyond a simple revision of previous rules. They reflect a political will to strengthen ecological requirements and adapt the tax framework to an uncertain economic context. The ban on renting energy-rated G housing, for example, embodies this priority given to the energy transition. At the same time, major fiscal upheavals, such as the end of the Pinel scheme or the postponement of the Zero-Rate Loan, are redefining incentives for investors and households. Finally, the continuation of the "anti-Airbnb law" and the stability of notary fees complete this picture of reforms, where each measure shapes the delicate balance between the expectations of property owners, the needs of tenants, and environmental imperatives. These adjustments, far from being anecdotal, herald a profound transformation of the real estate market.

The year 2024 marks a major shift for the French real estate market. Indeed, the dynamics that have structured this sector for decades are gradually fading, giving way to profound changes. The massive decline in transactions, the hesitant restart of real estate purchasing power, and the growing importance of energy criteria are reshaping the priorities of buyers and sellers. These transformations go beyond the numbers: they reflect the cumulative impacts of the crisis that began in 2022 and economic uncertainties. Through their 2024 Real Estate Report, the Notaries of France shed light on these contrasting developments. Their analysis goes beyond mere observation. It explores short-term perspectives and opens pathways for a potential recovery in 2025. These projections illuminate immediate challenges, as well as the necessary adaptations to face a market in full transformation.

On the chessboard of cryptocurrencies, AI is the king of scammers, ruining the French in a game where only fraudsters win.

In a global economic context marked by successive upheavals, few sectors manage to maintain enduring stability. Long perceived as an unsinkable fortress, luxury, the quintessential symbol of prosperity and exclusivity, also faltered in 2024. Indeed, the fortunes of emblematic figures such as Bernard Arnault, Françoise Bettencourt Meyers, and François Pinault suffered colossal losses amounting to over 70 billion dollars combined. Such a decline finds its origins in a set of closely related factors: a slowing Chinese economy, national political tensions, and increased volatility in stock markets. These combined elements have shaken the pillars of the sector, revealing an unexpected fragility.

The real estate market is at the center of concerns in 2025, attracting attention from investors as much as from first-time buyers and economists. This evolution of mortgage rates, a true indicator of economic and financial health, plays a decisive role in this dynamic. Between 2023 and 2024, rates saw a significant decrease. Thus, they dropped from 4.5% to 3.23%, a change that illustrates both the effects of the European Central Bank’s flexible monetary policies and the banks' strategy to stimulate access to property ownership. This decline is not just a simple statistic. It has already increased the borrowing capacity of thousands of households, creating an unprecedented opportunity to revive an already fragile market. In a context marked by increased competition among financial institutions, this trend could intensify in 2025, potentially ushering in a new phase of growth for real estate.

"Great news awaits holders of a Livret d'Épargne Populaire (LEP). Starting December 31, 2024, more than 2.5 million French citizens will benefit from the annual payment of interest. Discover the details and the impact of this measure on their purchasing power."

While most European bond markets show relative stability, the situation in France raises serious concerns. The yields on 10-year government bonds have reached 3.05%, an exceptionally high level for a major eurozone economy. This dynamic reflects a combination of economic tensions and political dysfunction, which reinforces doubts about the country's budgetary management. With public debt exceeding 112% of GDP and a deficit stagnating above 6%, France stands out as a worrying case within the European Union. These developments signal a loss of investor confidence but also highlight the urgency for structural reforms to prevent an even more marked deterioration of its position in financial markets.

The French real estate market is going through a turbulent period, despite signs of calm after two marked years of depression. Indeed, the figures recently published by the Notaries of France reveal a double observation: real estate prices have dropped, but this decrease has not been enough to revive sales. Thus, in 2024, the number of transactions has seen a spectacular drop, illustrating a deep blockage in the sector. This situation, both paradoxical and alarming, raises questions about the factors that are hindering the market's revival and the economic and political dynamics that amplify its complexity.

In a tense political context following the fall of the Barnier government, Parliament definitively adopted the "special" budget law on Wednesday, December 18, allowing for the continuity of essential state services starting in January 2025. This emergency measure, unanimously approved by the Senate, comes two weeks after the motion of censure that led to the government's resignation.

Bybit, the crypto exchange platform, announces the cessation of its withdrawal and custody services for French users starting January 8, 2025. This decision comes as regulatory pressures intensify in the country.

The French Republic is experiencing a new institutional upheaval with the forced appointment of François Bayrou as Prime Minister.

The year 2023 marked a significant break in the evolution of the wealth of French households. After eight consecutive years of growth, it experienced a decline to 14,567 billion euros, a drop of 0.9% compared to 2022. This downturn, confirmed by a study from Insee and the Bank of France, sheds light on profound changes in the French economy. Mainly attributable to the drop in real estate prices, this phenomenon reflects the impact of recent monetary decisions, notably the increase in the European Central Bank's key interest rates, which has raised the cost of loans and dampened demand. Real estate, once an essential driver of household wealth, has been at the center of this crisis. Furthermore, prices, down by 4.7%, have weighed heavily on national wealth, although the 8.3% increase in financial assets has partially mitigated the losses.

The fall of the Michel Barnier government marks a political and economic turning point in France. While the adoption of the 2025 budget remains pending, uncertainty threatens to weigh heavily on households, businesses, and market confidence.

As economic and climate challenges redefine political priorities, the French Senate is making its mark on the state's budget for 2025. Between measures to revive a stagnant real estate market and tax adjustments in favor of the environment, these decisions crystallize political and economic tensions.

Despite the uncertainties surrounding the global context, the French economy surprises with its ability to maintain a precarious balance. While the projected zero growth for the end of the year could have heralded dark days, several indicators suggest an unexpected resilience. However, this picture is neither black nor rosy, according to the words of the Governor of the Bank of France, François Villeroy de Galhau.

Real estate taxation, already complex, is once again a topic of discussion. This time, it is property owners who find themselves at the center of a significant tax controversy. A technical error in the issuance of tax notices has led many property owners to be wrongly taxed on properties declared vacant. This unexpected situation, which affects an as yet undetermined number of taxpayers, sheds more light on the challenges related to data management and compliance with reporting obligations.

The European Union is about to sign a historic agreement with Mercosur, leaving France on the sidelines. Despite protests from Paris, the European machine seems to be moving at full speed. But what is really happening behind the closed doors of Brussels? When Europe ignores French protests France says no,…

The Bank of France, like a warrior of old, demands order over the chaos of cryptocurrencies, calling for Esma for support.