Bitcoin wobbles again, caught in the turmoil of a tense global economic context. As sensitive political deadlines approach, fear returns to the markets and revives a well-known pattern: the fall of the dollar often precedes a bottom for BTC. This inverse correlation, already observed in previous cycles, intrigues investors once again. While bitcoin tries to rebound, macroeconomic signals multiply and suggest a new episode of high tension for the market's leading crypto asset.

Getting informed

Bitcoin under pressure, Strategy surprises. This new massive purchase fuels tensions within the crypto community. Details here!

When Washington argues, crypto collapses! Between shutdown threats, a thunderous Trump and triumphant gold, bitcoin discovers it is not truly a golden refuge.

The crypto market is going through a brutal digestion phase since the October shock. However, a message comes up from the professional desks. Indeed, many institutions believe that bitcoin is worth more than its current price. The idea is not new, but the timing is intriguing.

Bitcoin is trading around $87,000 as market momentum slows. Bloomberg’s Mike McGlone warns investors to stay cautious amid early 2026 market pressures.

A new academic paper warns that influence campaigns powered by autonomous AI agents may soon become far harder to detect and stop. Instead of obvious bot networks, future operations could rely on systems that behave like real users and adjust their actions over time. Researchers say this shift poses serious risks to public debate and platform governance.

Binance founder Changpeng Zhao (CZ) has issued a stark warning about the future of work as artificial intelligence spreads across industries. He argues that rapid AI adoption will erase millions of jobs worldwide. Against that backdrop, Zhao believes cryptocurrencies can serve as financial protection for those who prepare early.

In five days, spot Bitcoin ETFs lost $1.72 billion. A sharp drop shaking an already tense market, undermined by an extreme fear sentiment. The Crypto Fear & Greed Index confirms this persistent distrust, while cautious investors seem to be massively withdrawing their positions. This movement, more than a simple technical pullback, raises questions about the current confidence in bitcoin-related products.

Ten banks join forces to create Qivalis, a stablecoin designed for fast crypto payments in euros. Details here!

The specter of a shutdown looms again over Washington, and this time, the alert comes from predictive markets. On Polymarket, bets on a closure of the US government are exploding, revealing growing distrust in the political deadlock. As Democrats and Republicans clash over the budget, signals multiply: the deadlock seems near.

A boastful hacker, a dubious federal contract, and millions in crypto gone: when family cyber-arrogance turns Washington into the stage for a burlesque digital burglary.

GameStop moved all its treasury in bitcoin, that is 4,710 BTC valued at over 422 million dollars, to Coinbase Prime. This massive transfer, spotted by CryptoQuant, could signal an imminent sale. For a company that became a symbol of finance for individuals since the Reddit saga, this strategic shift is surprising. Indeed, GameStop had until now displayed a firm position on bitcoin, inherited from its dealings with Michael Saylor. Should this be seen as a discreet disavowal of the crypto bet?

Vitalik Buterin has just reminded us of something the crypto industry forgets too quickly: being open does not mean saying yes to everything. In a fairly broad interview, the Ethereum founder sets a clear limit. A community that applauds everything that drives the price up ends up shooting itself in the foot. Not immediately. But surely.

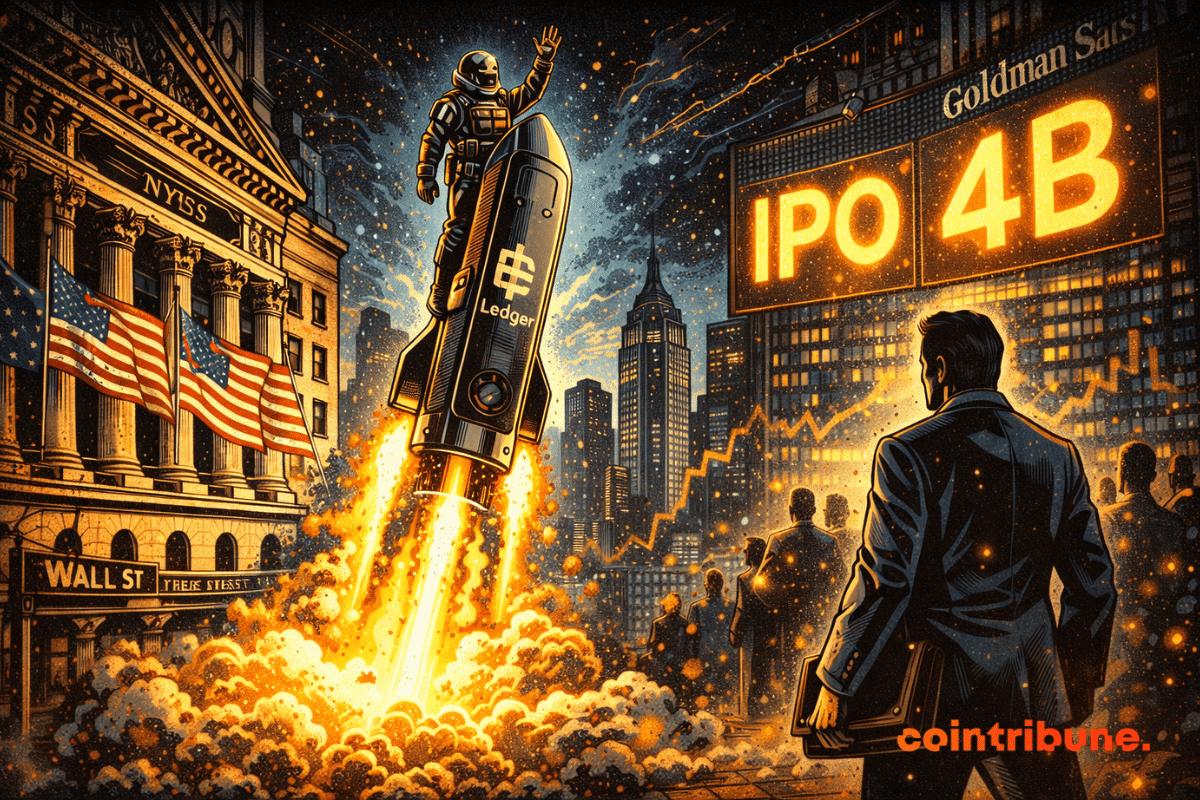

The French make USB keys, the Americans make billions: Ledger crosses the Atlantic, hoping Wall Street will finally open the vaults of global crypto-finance for it.

Binance is bringing back tokenized equities after its 2021 debut, offering investors a bridge between traditional stocks and crypto markets.

Solana is taking a new bet: making hardware a driver for crypto adoption. And, this week, the scenario took an unexpected turn. The token linked to the Seeker smartphone, $SKR, jumped more than 200% in a few days, according to CoinGecko data. The movement followed the TGE and the airdrop associated with Solana Mobile's second phone: a $500 Android, designed from the start for on-chain uses. Everyone expected volatility. But the speed and magnitude of the increase clearly awakened the market.

XRP Ledger continues to show strong on-chain activity while Ripple leadership outlines where the crypto market may head next. New network data points to steady usage, low costs, and large transaction volumes. At the same time, Ripple executives are setting expectations for how institutions may engage with crypto in the coming years.

Stablecoin adoption is rising across Africa as individuals and businesses search for faster cross-border payments and protection from rising prices. Speaking at the World Economic Forum in Davos, economist Vera Songwe said stablecoins are filling gaps left by costly remittance systems and weak local currencies. Growing usage is also drawing closer attention from regulators across the continent.

In a network where every line of code can become a manifesto, the slightest technical signal takes on the appearance of a political declaration. BIP 110, supported by a growing fraction of Bitcoin nodes, illustrates this internal tension. Behind this seemingly minor proposal lies a clear intention: to tighten control over data insertion into the blockchain and defend a stricter vision of the protocol.

Trump acts tough with Europe, but financiers of the Old Continent are sharpening their response: a stock market exodus that could make him swallow his "America First."

Can a simple meme trigger a frenzy in the crypto market? That's exactly what a White House post showing a penguin alongside the US president caused. Within hours, the memecoin PENGUIN, unknown the day before, soared in value by more than 350 times. With no announcement, no news, this Solana token attracted a massive speculative wave, illustrating once again how the attention economy brutally reshapes market dynamics.

While US markets showed mixed signals this Friday, another trend emerged on the sidelines of major indices: the strong rise of shares linked to bitcoin mining. This contrast with the Nasdaq’s dynamic and the Dow’s decline raises questions about a possible repositioning of investors towards crypto-correlated assets, ahead of key economic decisions. A careful reading of these movements reveals much more than a simple technical variation.

While quantum computers sharpen their circuits, Ethereum brings out the heavy artillery: cryptographers, millions, and devnets. The blockchain wants to last a hundred years, even if it ages before us.

Ethereum is rejoicing, its counters are exploding! Except that 80% of the activity might be clever spam. Progress? Or just hackers who learned how to do sales?

BlackRock’s 2026 Thematic Outlook positions Ethereum as core financial infrastructure rather than a speculative asset. The report frames the network as a potential “toll road” for tokenized assets—capturing value through issuance, settlement, and transaction fees as real-world assets move onchain. For investors, the central question is whether growth in tokenization activity can translate into durable economic demand for ETH.

Coinbase is forming an expert panel to tackle future quantum threats and strengthen blockchain security before the technology becomes a real risk.

The security of crypto data falters once again. The French platform Waltio, specializing in tax declarations, was the victim of a massive leak of sensitive information. In response, an investigation was opened by the French authorities, mobilizing the National Gendarmerie. This incident rekindles concerns about the vulnerability of services related to cryptos, including those outside the blockchain. As the use of tax tools becomes widespread, users' trust is severely tested.

The crypto ETF dance does not slow down. It changes tune. After Bitcoin and Ethereum, now the market attacks more "political" tokens, more linked to ecosystems, thus more sensitive to regulators' scrutiny. And Grayscale, true to its style, does not timidly knock on the door: it files a dossier and forces the conversation.

In a context of persistent tensions between the crypto ecosystem and U.S. regulation, the SEC has just taken an unexpected step. The agency has definitively dropped its civil action against Gemini Trust, marking the end of the Gemini Earn case. This decision, legally qualified as "dismissal with prejudice," raises questions about the regulator's strategic shift regarding crypto yield products, and what this might imply for future relations between platforms and authorities.

A public reserve in Bitcoin without tax or debt? Kansas proposes a shock law that disrupts traditional financial codes.