Crypto exchange Bybit officially launches its payment card in the European Economic Area with an exceptional welcome offer of 20% cashback. An aggressive strategy to conquer the European crypto payments market.

Getting informed

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this trend flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

Analysts say Bitcoin could fall below $100K before recovering, with key levels and market trends guiding the outlook.

Russia requires banks to monitor ATM withdrawals for fraud and notify customers, a move that may affect cash-heavy crypto operations.

The decentralized finance (DeFi) landscape continues evolving beyond traditional crypto-collateralized lending, with platforms like Credefi pioneering a revolutionary approach that bridges digital assets with tangible real-world collateral. This innovative platform addresses one of DeFi's most persistent challenges: the volatility inherent in crypto-backed lending protocols.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is advancing its European expansion. Bybit EU Group took this next step with the formal application submission for a license under the Austrian implementation act of the Markets in Financial Instruments Directive (MiFID II) through one of its Austrian entities, Bybit X GmbH.

Crypto crime cases related to digital assets are taking an increasingly worrying turn in Europe. In France, a new kidnapping involving a young Swiss person has just been foiled, recalling previous waves of attacks that had sown panic in the Web3 ecosystem. Seven suspects have been arrested, but many grey areas remain.

The European Central Bank intensifies its communication around the digital euro. Piero Cipollone, board member, presented new arguments in favor of the project to the European Parliament. Will the ECB manage to rally users who are still largely detractors?

Software supply-chain attacks are evolving in a disturbing way as cybercriminals use Ethereum smart contracts to hide malicious code within open-source libraries. Research presented by a security firm ReversingLabs shows that hackers now insert command-and-control instructions within blockchain contracts, complicating detection and closure by defenders. This approach signifies the increased complexity of malware distribution and blockchain becoming a tool of cybercrime.

In the great Trump crypto fair, Justin Sun goes from ally to suspect. His tokens frozen, his political friendship gone.

Coinbase puts its engineers on a dry diet: AI already codes 40% of the in-house software. Armstrong rejoices, skeptics grumble. Rapid layoffs for latecomers.

Is bitcoin approaching a decisive turning point? As signs of fatigue accumulate, a new analysis rekindles the specter of an imminent bearish cycle. According to a fractal modeling aligned with historical four-year cycles, October could mark the beginning of a deep correction. After the euphoria of the highs, the market enters a phase of uncertainty where every technical signal is scrutinized. This scenario, increasingly discussed among analysts, calls into question the strength of the current upward trend.

The ghost of 2017 is haunting speculators again. While some are betting on a comeback of XRP, comparisons with the last bull run are multiplying. However, the current market has little to do with that of yesterday. New dynamics, increased competition, divergent technical signals: does the analogy still hold? Behind the hope of a bullish rebound, a colder reading of the data tells a different story.

Cardano fans are sulking, whales are stirring, and ADA is bouncing back. Yet another crypto farce where the impatience of small holders fattens the big holders.

American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.

In July 2025, a Microsoft vulnerability exposed over 400 public organizations, including the U.S. agency that manages the nuclear arsenal. Hospitals paralyzed, schools ransomed, and a post-quantum deadline now set: 2025 reminds governments that they won't win the cybersecurity race with late patches and centralized architectures. Faced with this reality, one question emerges: how do we build a truly resilient trust infrastructure?

Trust Wallet has added tokenized U.S. stocks and ETFs, allowing users to trade real-world assets directly from their wallets.

A BNB whale fell victim to a $13.5 million phishing attack on Venus Protocol. The platform paused operations, but the stolen funds were later recovered.

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

The United States has leaped to the second spot on the Chainalysis 2025 Global Adoption Index due to regulatory clarity and increased ETF adoption. India retained its leading position as the third consecutive global leader, and Pakistan, Vietnam, and Brazil were the top five. This ranking reflects a broader trend, crypto adoption is expanding rapidly in both mature markets with clearer rules and emerging economies where digital assets address real financial needs.

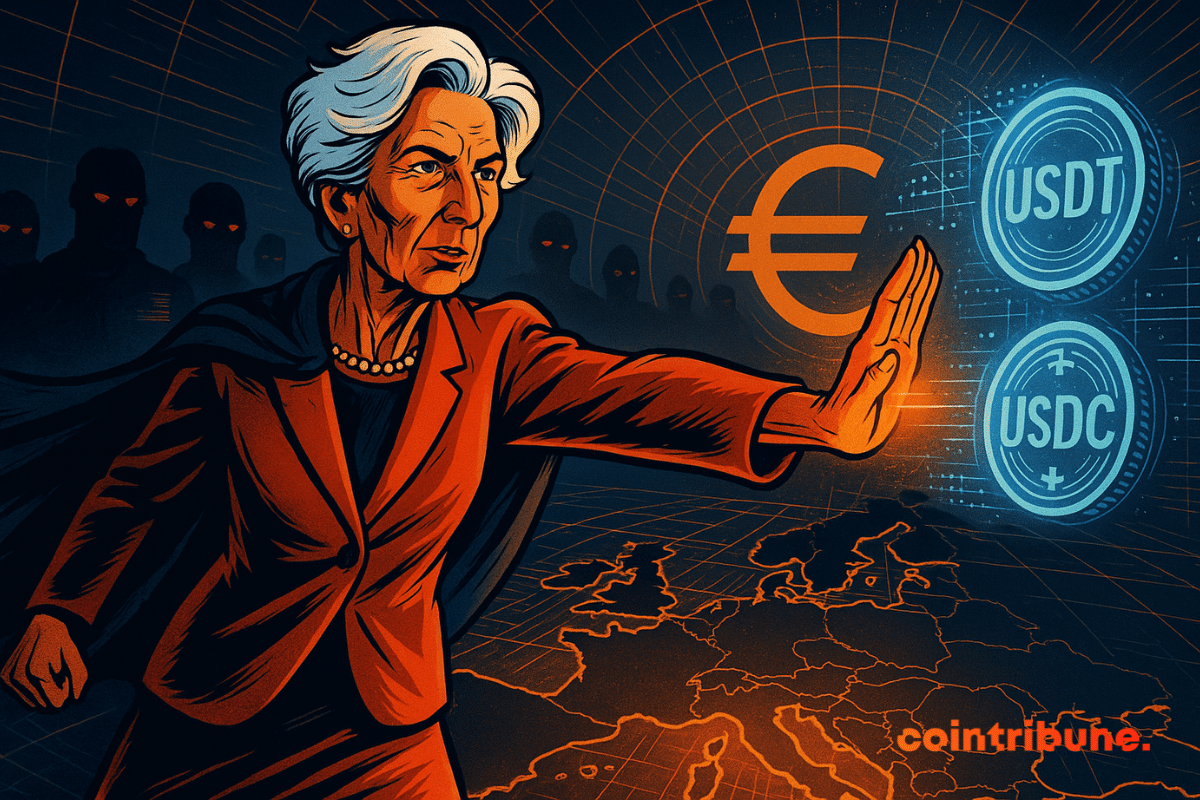

The President of the European Central Bank steps up against dollar-backed stablecoins. During a conference in Frankfurt, Christine Lagarde demanded "firm" guarantees for any foreign issuer wishing to operate in the EU. A strong signal of European fears regarding the growing influence of the greenback in cross-border digital payments.

While bitcoin and Ethereum take center stage, Solana (SOL) quietly establishes itself as the new asset to watch. Driven by strong technical signals and record interest in derivative markets, the crypto is now assigned a target of $1,000. However, behind this bullish momentum lies a paradox: real activity on the network is collapsing. Between speculative frenzy and on-chain exhaustion, Solana intrigues as much as it questions.

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

September, long synonymous with a downturn for bitcoin, seems to be losing its curse. This historically unfavorable month for risky assets is starting, for the third consecutive year, a contrary dynamic. Supported by a flexible macroeconomic context and structuring institutional flows, the market is giving signs of maturity. The queen of cryptos no longer suffers the calendar: she redefines it.

Two weeks before a crucial Federal Reserve meeting, the governor, expected to succeed Jerome Powell in 2026, stood out with an unambiguous statement. He wants a rate cut as early as September. In an interview with CNBC, he said the US economy requires an immediate adjustment, breaking with the caution shown by other monetary officials.

Ethereum Foundation sells 10,000 ETH on centralized platforms. Pragmatic or heresy? The community cries out DeFi betrayal, the foundation pleads transparency… Schizophrenic atmosphere among cryptophiles.

Regulated exchange platforms can conduct spot cryptocurrency trading activities, according to a joint statement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on September 2, 2025. This policy clarification marks a key regulatory step that could help drive crypto trading and promote investor protection.

Despite the recent bitcoin correction, the institutional rush on bitcoin continues to strengthen.

After the January explosion, interest in memecoins sees a more measured return. Google searches indicate persistent curiosity, but less euphoric, reflecting a new caution among investors. Without the usual noise from social networks and Crypto Twitter, this crypto dynamic could mark an evolution towards a more mature market approach.