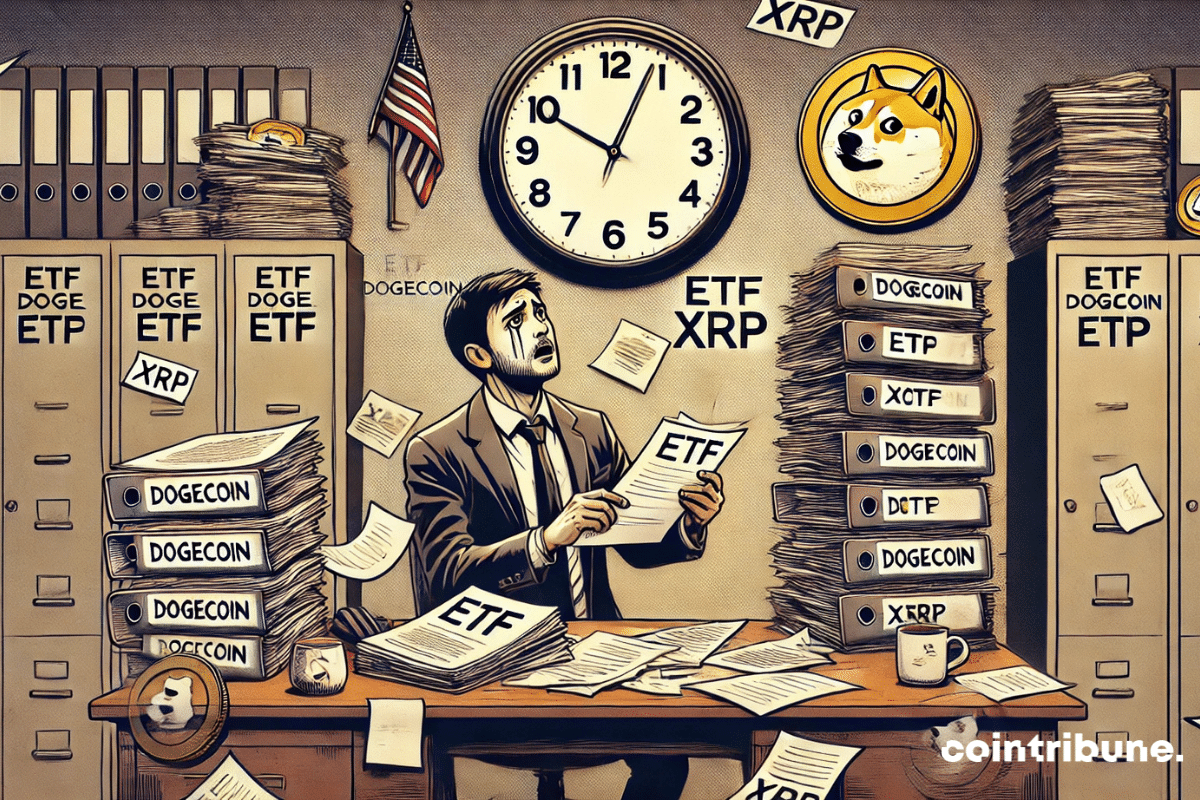

The U.S. Securities and Exchange Commission (SEC) has once again postponed its decisions regarding two highly anticipated crypto ETFs. The Bitwise Dogecoin and Grayscale Hedera ETFs will have to wait until November 12 to learn their fate.

Grayscale

Solana speeds like lightning but stalls below 215 dollars: ETF lurking, record upgrade and flashy meme-coins. Crypto hesitates between a surge and a scheduled slip.

Crypto ETF issuers are just waiting for the SEC to release its stamp. They move forward, file, correct, refine. Like a conductor confident in his score, Grayscale continues to play its own regulatory symphony. And this time, it is Cardano taking the stage, ready to secure its ticket to Wall Street. The countdown is on, the lines are moving, and investors are already sharpening their order books.

Cardano (ADA) ignites the crypto market with a surge in its futures volume, reaching nearly 7 billion dollars. This bullish momentum, driven by the shadow of a potential ETF, places ADA back at the center of discussions. Towards a lasting return above 1 dollar?

After a $3.7 billion binge, Ethereum ETFs take a pause. Digesting break? Cunning move? Behind the scenes of crypto, the big wallets sharpen their next moves...

Cardano posted one of its strongest single-day performances of 2025, jumping more than 17% in 24 hours as speculation swirled over a possible Cardano-focused ETF from Grayscale Investments. The rally left Bitcoin and Ethereum trailing and pushed ADA to the number two spot among the day’s top gainers in the crypto market.

Grayscale eyes a Cardano ETF, prices soar, and traders speculate. But will ADA be able to maintain its top position or will it fall victim to its own crypto success?

It’s been a full year since spot Ethereum ETFs went live in the U.S., and the market is celebrating with a strong streak of inflows and bullish sentiment. Despite being overshadowed by Bitcoin ETFs, these funds have quietly carved out a substantial presence.

While crypto ETFs are hitting record highs, volumes are evaporating. Blackrock and Fidelity are leading the influx, but the market seems to be holding its breath. Boom on the surface, empty underneath?

Ripple wants to become a banker, XRP attempts a spectacular comeback, and Wall Street applauds. The once rebellious crypto is settling into the plush chairs of regulators. How far will it go?

The crypto industry is in shock. Grayscale has just requested the SEC to suspend trading on its multi-asset ETF containing Solana and XRP, just days after its approval. What is behind this sudden turnaround?

The crypto ecosystem takes a symbolic leap with the accelerated validation by the SEC of the conversion of the Grayscale Digital Large Cap Fund (GDLC) into an ETF. This green light is not limited to Grayscale. It marks the entry of altcoins into the regulators' field of action. In a context where the political climate is softening towards cryptos, this decision could pave the way for a new generation of ETFs focused on assets like XRP, Solana, or Cardano.

When bitcoin ETFs are making numbers like never before, investors are jigging while Wall Street rediscovers crypto, their eyes fixed on curves that rise steadily.

Grayscale upends the crypto hierarchy: XRP, ADA, and BNB fall out of its Top 20 in favor of Morpho and Avalanche. Details here!

While Bitcoin struts its stuff, Ethereum is digging its furrow. Discreet but robust ETFs, stealthy rebalances, rock-bottom fees... what if the little brother became the darling of the big wallets?

The crypto market attracts $1.9 billion in a week. Should we ride the wave or be cautious? Discover the key figures in this article!

While Bitcoin is napping around $103,000, institutional funds are buzzing like ants around a sweet $600 million ETF.

Bitcoin (BTC) dominance falls to 62.6%, a slight decline against the rise of Ethereum and altcoins. Zach Pandl from Grayscale believes that this dominance will soon stabilize despite an uncertain macroeconomic context that continues to influence investor behavior.

BlackRock's Bitcoin ETF records 18 consecutive days of gains. A powerful bullish signal for BTC? Analysis.

Are crypto ETFs in danger? The SEC prolongs the wait despite a new pro-crypto president. The details in this article!

Numbers are plummeting, volumes are exploding, and institutional investors are quietly slipping away. Bitcoin ETFs may be entering this pivotal moment where silence speaks louder than words.

A Polkadot crypto ETF filed with Nasdaq: 21Shares is betting big! Here is everything you need to know about this initiative.

The Securities and Exchange Commission (SEC) has officially recognized the proposal from NYSE Arca to list and trade a spot exchange-traded fund (ETF) based on Cardano (ADA) on behalf of the cryptocurrency asset manager Grayscale. This recognition, occurring on February 24, 2025, marks the beginning of the regulatory process during which the SEC will evaluate the proposal and make a decision on its approval or rejection.

The SEC, once inflexible, is making a turn towards crypto: Dogecoin and XRP are entering the fray, and time is working against the regulator, stuck in a tight schedule until October.

Bitcoin is facing a new setback, shaken by a market that is reevaluating its expectations. Indeed, the publication of a solid economic report in the United States has strengthened the dollar, which reduces the likelihood of an imminent interest rate cut by the Federal Reserve. Such a reaction has led to a correction below $93,000. This has temporarily stalled the bullish momentum of crypto. However, Grayscale remains confident and views this pullback as mere turbulence rather than a reversal of trend. According to Zach Pandl, head of research at the company, the strength of the dollar and the restrictive monetary policy are temporarily weighing on the market, but the fundamentals of Bitcoin remain strong. With rising institutional adoption and a changing regulatory environment, the bullish trajectory seems intact despite short-term fluctuations.

In the tumultuous arena of crypto, the bloodless Bitcoin ETFs find an unexpected resurgence after Christmas, like a benevolent wink from Santa Claus.

Investor exodus hits Grayscale Bitcoin Trust: 21 billion dollars evaporated in one year. The details in this article!

Historic influx in Bitcoin ETFs: $34.58 billion in inflows in 10 days. Discover why this asset is attracting so much!

Exchange-traded funds (ETFs) Ether recently experienced a record influx of $431.5 million on December 5, 2024, marking nine consecutive days of positive flows. This trend reflects growing confidence among investors in Ethereum, supported by major players like BlackRock and Fidelity, and strong performance in the crypto market.

In the depths of finance, BlackRock holds a treasure: 500,000 BTC, 48 billion digital dreams. The giant anchors itself in the legend of cryptocurrencies.