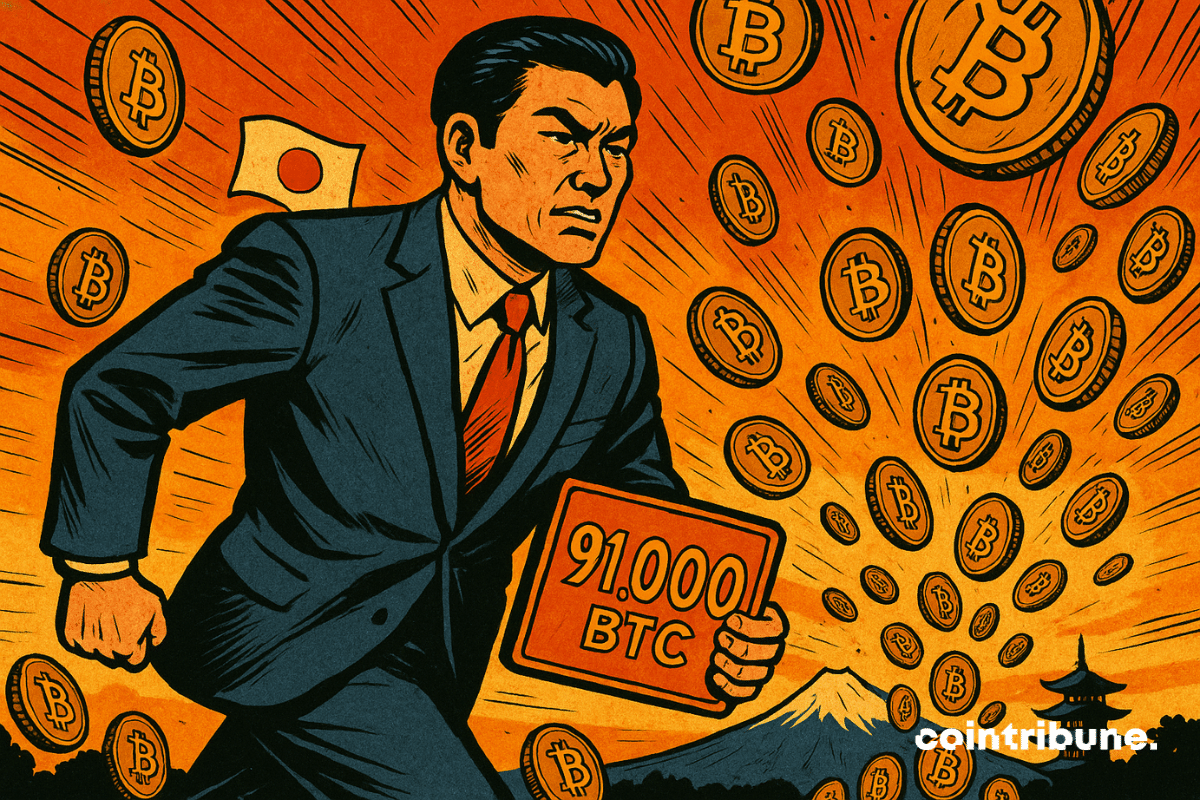

While Saylor rallies the crowds, a Japanese outsider nibbles on 10,000 bitcoins... through zero-interest bonds. Metaplanet, or how to charm Tokyo with encrypted promises.

Investissement

Schiff gets carried away, gold soars, bitcoin wavers. What if behind the raging tweets lies a discreet farewell to the digital utopia?

Seven giants align for Solana ETFs, the SEC plays the waiting game: suspense, thrills, and staking in the plush backrooms of the American regulatory temple. Stay tuned...

As Israel bombs, Iran fumes, and the markets stir, the old wolves of Bitcoin are shopping. Panic among traders, calm among strategists…

When Michael Saylor proposes to Apple to exchange its shares for bitcoin, it's not a joke... or maybe a crypto revolution wrapped in an iPhone, who knows?

As the crypto market experiences increasing volatility, choosing the right investment can become a challenge for investors. This is where a tool like the Bitpanda Crypto Index (BCI) comes into play. What is it? It is an automated, diversified, and regulated solution that allows capturing market performance without having to worry about manually selecting each crypto asset.

As traditional finance giants struggle to reinvent their reserve strategy, a Japanese company is stepping off the beaten path. Metaplanet, boldly dubbed "the Japanese strategy," is no longer just flirting with bitcoin. It is now entering an economic war with a clear ambition: to own 100,000 BTC by the end of 2026. This is no longer just a bet; it is a manifesto.

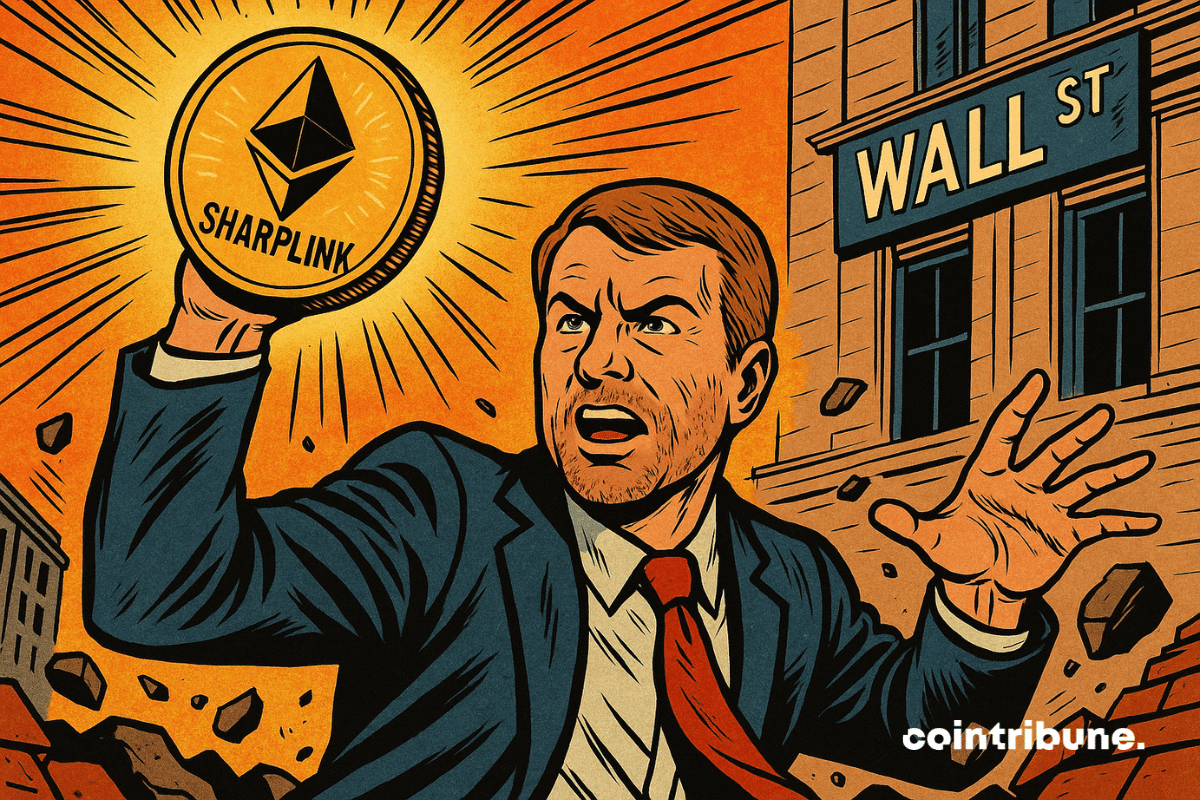

One billion. Not in bonds, not in gold. In Ether. When SharpLink Gaming opens its checkbook, it’s not to play — it’s to bet everything on the Ethereum table. While old finance clings to its interest rates like a lifebuoy, a sports betting company has just dropped a thermonuclear bomb on the crypto landscape.

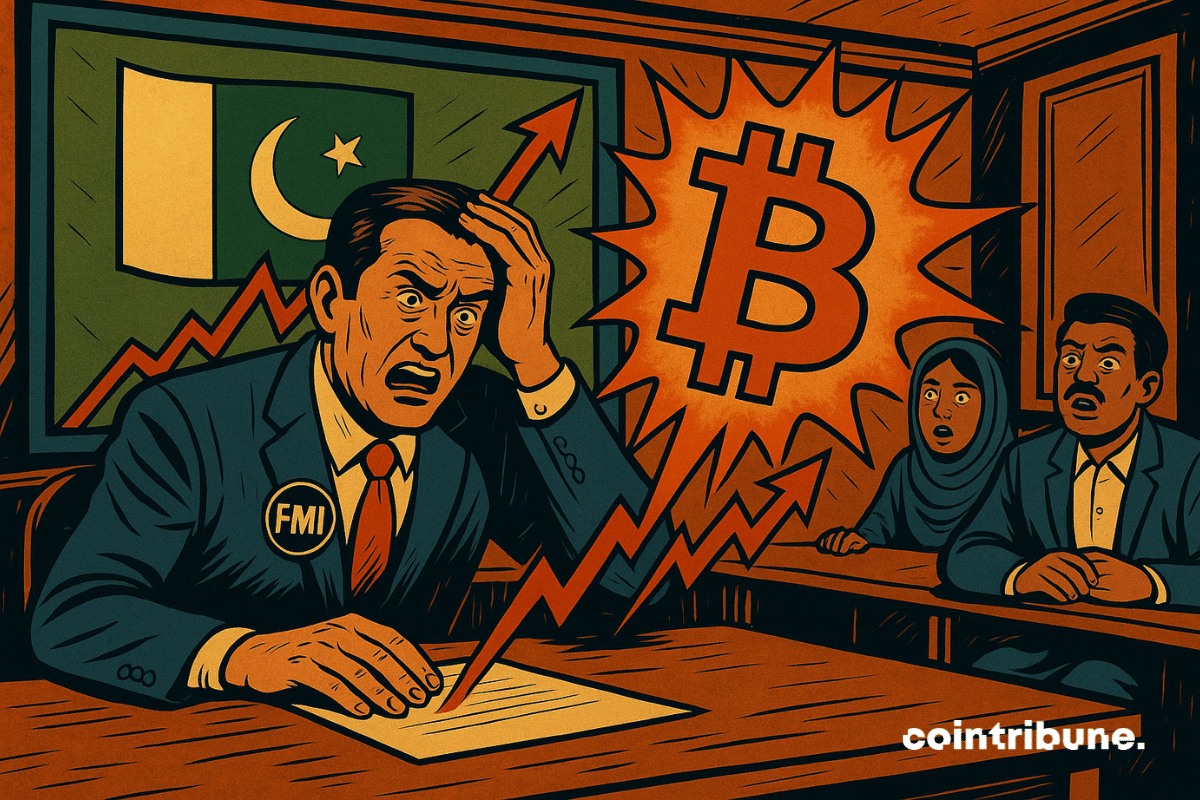

Pakistan wants to power up its machines to mine bitcoin, but the IMF, thermometer in hand, fears a diplomatic power outage. Who will falter, the state or crypto?

Crypto: despite 59% losses, Shiba Inu retains 78% of loyal holders. In this article, discover why.

While uncertainty reigns in the markets and regulators tighten the noose, BlackRock continues its crypto strategy without faltering. The American asset manager has just injected an additional 37 million dollars into bitcoin through its IBIT fund. A strong move, going against the prevailing hesitations, which confirms a methodical accumulation. Through this new purchase, BlackRock reaffirms its confidence in the leading crypto and strengthens its role as a catalyst for institutional adoption.

Crypto ETFs are in free fall: $795 million withdrawn last week. Discover more details in this article!

As macroeconomic tensions intensify, gold continues to break records and reaches a new high of $3245. Driven by the fall of the dollar and rising bond yields, the precious metal confirms its role as a safe haven. An analysis of a bullish trend that seems far from over.

The figures published by DappRadar show a growing disinterest in crypto games, except for the infrastructure. The details here!

The crypto market, with its promises of exceptional returns, attracts thousands of new investors every day. However, in this volatile and complex ecosystem, mistakes can prove particularly costly. Amidst the deluge of contradictory information, fraudulent projects, and unpredictable fluctuations, navigating the crypto universe requires meticulous preparation and a rigorous strategy. Here is a detailed guide to the pitfalls to absolutely avoid in order to turn your crypto experience into lasting success.

The investment of 686,567 ADA by Cardano during the crypto market crisis: a winning or risky strategy? Analysis.

In a global market in complete chaos, Warren Buffett stands out as an exception. While the richest fortunes are recording massive losses, the American investor makes 23.4 billion dollars in just a few months. This performance contrasts with the general trend and raises the question: how does the oracle of Omaha manage to thrive where so many others falter? At the head of Berkshire Hathaway, he once again demonstrates that discipline, foresight, and rigorous management can still dictate the rules, even in times of instability.

Once again, GameStop defies expectations. Known for its stock surges and status, the video game retailer makes a new move by raising $1.5 billion through a convertible debt issuance. The stated goal: to integrate bitcoin into its balance sheet. A bold shift for a company in search of rebirth, amid a turbulent legacy and crypto ambitions.

The world of crypto continues to blur the lines with traditional finance. This time, it's BlackRock making a media splash by integrating Solana into its tokenized monetary fund, BUIDL. This decision is not just a simple technical adjustment, but a strong signal: blockchain is no longer a marginal experiment. It is becoming the backbone of a financial revolution in progress.

The United Arab Emirates, now members of the BRICS, will invest 1.4 trillion dollars in the United States over ten years. Announced after a meeting with Donald Trump, this maneuver reshapes global balances. Between technological ambition, diplomatic calculation, and projection of influence, Abu Dhabi is shaking up the lines of a world now structured by variable geometry economic alliances.

The Bitcoin bull hesitates, the crowds are not rushing... or perhaps they already have, quietly, through an unexpected path that no chart had traced.

Crypto: a state fund for seized assets? Discover the bold proposal from the authorities in Russia and the hidden stakes of the project.

In response to the strategic urgency, France is changing course: to support its defense industry, the state is inviting citizens to invest at least 500 euros in a fund managed by Bpifrance. This unprecedented call for popular savings comes amid growing geopolitical tensions and accelerated rearmament, raising as many questions as it intrigues regarding the risks and ambitions of such a financial commitment.

Crypto ETFs are crashing down like an uncontrollable wave. Avalanche joins the dance, but history has taught us that markets sometimes have a short memory... and a brutal correction.

The EU defends its economy against new American sanctions. We provide all the details in this article.

The BlackRock behemoth is walking a tightrope: a net of Bitcoin in its portfolio, 2% of audacity, a breeze of panic among the maximalists. Who will give in first?

Spoofy and Metaplanet are buying Bitcoin on the dip: Genius strategy or manipulation? Full analysis in this article.

Strategy strengthens its position with 20,356 bitcoins purchased for $2.00 billion. Discover the details of this acquisition in this article!

Warren Buffett is not a man who speaks into the void. When he speaks, the financial world listens. At 94 years old, the legendary investor uses his annual letter to shareholders to deliver a blunt message to Washington: budgetary excesses and monetary instability threaten the American economy. This alarm signal comes at a time when Berkshire Hathaway is recording spectacular financial performances, with a record profit and a historic cash reserve of $334.2 billion. Thus, in a market where investment opportunities are becoming scarce, Buffett favors caution and is preparing to hand over to his designated successor, Greg Abel.

The LIBRA token, briefly supported by Argentine President Javier Milei, has proven to be a financial disaster for the majority of its investors. According to a study conducted by a blockchain research firm, over 13,000 traders suffered losses exceeding a total of 251 million dollars.