The BNB crypto just plunged 15% in a few days, triggering panic and speculation. Between technical divergences, community backlash, and Binance's 400 million fund, a burning question arises: is this a simple correction or the start of a collapse?

One World Loyalty Posts To Read RSS

Bitcoin may keep breaking records in 2025, but public enthusiasm is dangerously waning. Between falling Google searches and a drop in market sentiment, warning signs are multiplying. Have retail investors definitively turned their backs on the queen of cryptos?

What if Europe finally disrupted the established order of stablecoins? Oddo BHF launches EUROD, a 100% euro stablecoin, challenging the dollar's dominance in crypto. A financial revolution underway! Discover the stakes and challenges of this innovation that could change everything.

PlayAI has just announced the official launch of its mainnet following a $2 million community fundraising led in partnership with Kaito. This news brings the project's total funding to $6.3 million, reinforcing its mission: to democratize automation powered by blockchain-native AI.

In Q3 2025, bitcoin makes a big impact: 172 companies now hold 1.02 million, or 4.87% of the total supply. Why are these giants betting heavily on this crypto? Strategies, risks, and opportunities.

Two crypto bullish stars promise an ETH at $10,000... But between ETFs, staking, and crashes, is the prophecy more of a miracle than a mathematical model?

Crypto crash: NFTs lose $1.2B, then timidly recover. Are investors really coming back? Full breakdown.

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

Japan’s financial regulators are planning new rules to prevent insider trading in cryptocurrencies and boost market confidence.

While the market is bleeding, Bitget releases a report: crypto investors still want to load up. 2025, a year of gains... or shocks?

As the crypto market collapses, BNB hits a record at $1,370. Discover all the details in this article!

Bitcoin collapses, Trump threatens, Beijing counterattacks, and cryptos suffer: meanwhile, Dogecoin still seeks a way out of the crisis. Should we laugh or buy?

XRP and Solana have just made spectacular rebounds, recovering billions in market capitalization despite geopolitical tensions. Discover why institutional investors are betting big on these cryptos, with explosive price targets for the end of October.

Ethereum has just experienced a historic flash crash, losing 20% in a few hours before bouncing back strongly. Crypto whales are massively accumulating, and derivative markets are stabilizing. Should we expect a triumphant return to $4,500?

After a spectacular drop that tested investors' nerves, bitcoin is slowly regaining its composure. This brutal correction, though painful, could prove beneficial for what lies ahead. Analysts are now scrutinizing the charts for clues, and several technical signals suggest a vigorous recovery.

Bybit EU offers a promotional campaign with 63,750 USDC, 5 portions of 0.3 ETH, 10 Ledger Stax, 20 Samsung Galaxy Tab A9+, 40 Shokz OpenDots ONE and 80 JBL Grip. Launched shortly after obtaining its MiCA license in Austria, this initiative is part of a strategy to acquire European users. But beyond the attractive numbers, what are the real mechanisms? What traps to avoid? This article analyzes the "Autumn's Lucky Times" campaign rigorously.

Zcash (ZEC) has just blasted past $230 after three years in the shadows, with an explosion of +220% in two weeks! Between regulation, technological innovations, and influencer support, this private crypto establishes itself as the asset to watch… how far will it go? #Zcash #crypto

As the cryptocurrency ecosystem reaches unprecedented maturity in 2025, Kraken has emerged as one of the leaders in global crypto trading. Kaiko has ranked Kraken as the #1 global crypto exchange for Q3 2025 their first-ever top finish, achieving a steady rise from #3 in Q1 2025 and #2 in Q2. This remarkable achievement reflects the platform's relentless focus on client-first innovation and institutional-grade infrastructure that has redefined cryptocurrency trading standards.

Arthur Hayes announces it: bitcoin crashes linked to the 4-year cycle are over! But beware, this does not mean all risks have disappeared. Discover the 3 new rules for investing in 2025 and how to benefit before everyone else.n#Bitcoin #BTC #ArthurHayes #Crypto

The startup unveils a layer-1 infrastructure dedicated to RWAs, backed by Wiener Privatbank and designed to solve the security-decentralization-compliance "trilemma".

The Ethereum Foundation takes a new step by launching the Privacy Cluster, a team entirely dedicated to network privacy. A strategic initiative that responds to the growing concerns about digital surveillance and the increasing need to protect user data.

"All that glitters is not gold." This 17th-century proverb applies wonderfully to flashy innovations. For several years, Artificial Intelligence (AI) has been presented to us as a revolution comparable to electricity or the Internet. But is it really a revolution? Or rather a spectacular optimization of what already exists? As we know it, AI revolutionizes nothing. It merely oils the gears of an already established system and mainly fits within the continuity of a centralized paradigm. At the same time, another technology, much less publicized but much more radical, pursues its trajectory: Bitcoin and decentralization. Unlike AI, Bitcoin does not just improve existing systems. It questions them, and sometimes even makes them obsolete. The true revolution today, the only one, is Bitcoin. Because it does not make the old world faster, it builds a new one.

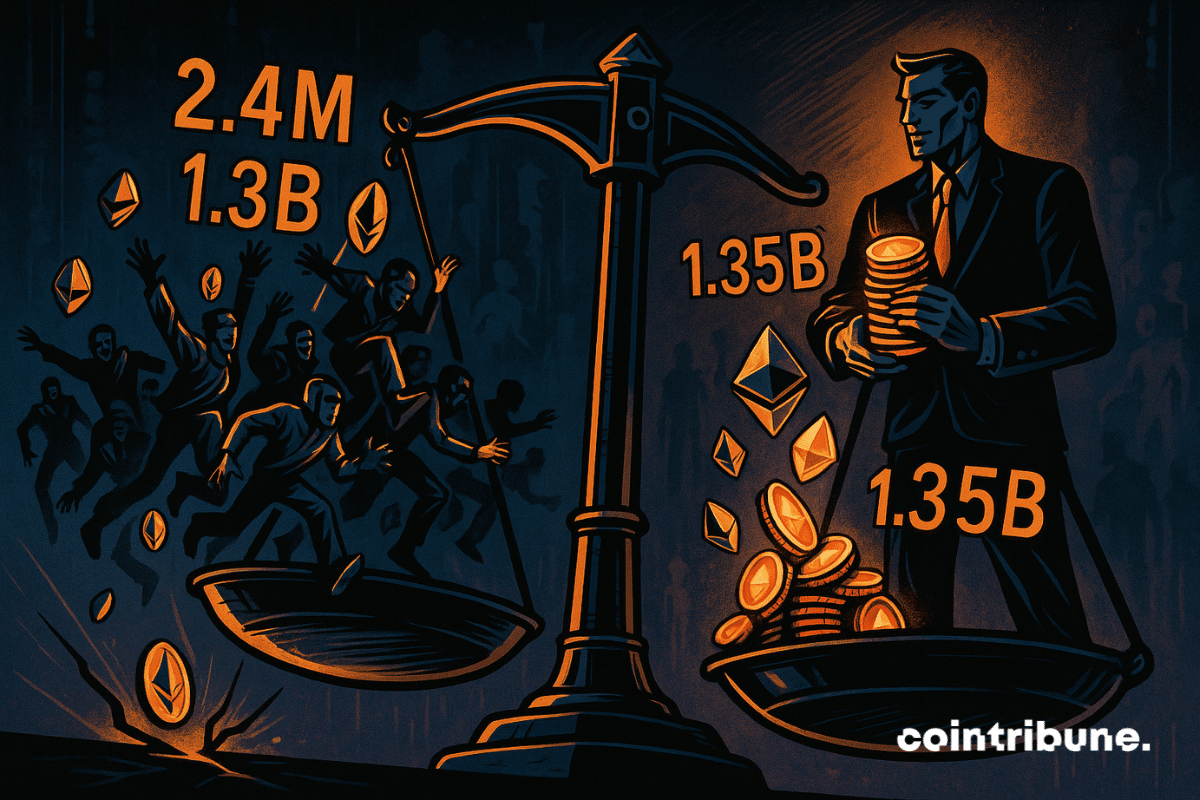

10 billion dollars in Ethereum are waiting to be sold as validators massively leave the network. Details here!

The memecoin $TRUMP, in free fall by 90%, is betting everything on a record fundraising of 200 million dollars to avoid collapse. Between hopes of a rebound and risks of failure, can this crypto poker move save the token linked to Donald Trump? #Trump #memecoin #crypto

ASTER, the 300x leverage DEX token, shakes Binance in 2025! The mega whales massively accumulate this ultra-volatile crypto project, but behind the rapid rise lie huge risks. Should you jump into the arena? #Crypto #Aster #Binance

Bitcoin and gold are both hitting record highs, with analysts projecting Bitcoin could reach $644K after its next halving as gold continues to surge.

Kraken recently completed a major acquisition of Breakout, making it the first major crypto exchange to enter proprietary trading. This strategic move represents a significant shift in how crypto traders can access capital, offering funded accounts with substantial leverage without risking personal funds once the evaluation phase has been successfully completed.

On September 3, 2025, the United States Securities and Exchange Commission (SEC) released the Post-Quantum Financial Infrastructure Framework (PQFIF). This strategic document, submitted to the U.S. Crypto Assets Task Force, officially designates Naoris Protocol as the reference model for the financial sector’s transition to post-quantum cryptography. This recognition places the protocol at the center of U.S. regulatory priorities in cybersecurity, at a time when the rise of quantum computers poses an existential threat to the protection of digital assets.

From October 7 to 9, 2025, Madrid becomes the epicenter of blockchain innovation with MERGE Madrid, the must-attend event bringing together over 3,000 participants and 200 speakers from Europe and Latin America. This year, one player is determined to steal the show: Qubic (QUBIC), the blockchain boasting record-breaking performance and a disruptive vision combining artificial intelligence and decentralized computing.

Less than two years after the entry into force of MiCA, the ambition of a unified European framework for cryptos is faltering. Amid national divergences, institutional criticisms and tensions over passporting, the European Union struggles to deliver the promised coherence. And now, ESMA is advocating to take back control, at the risk of reigniting tensions between Brussels and national regulators.