Traditional finance is shifting into the era of RWAs: Real Finance just raised 29 million dollars to tokenize 500 million in real assets. With Nimbus Capital and giants like Goldman Sachs lurking, this revolution will redefine investment.

Rug World Assets (RWA)

Amundi launches its first tokenized money market fund, letting investors hold and trade fund units digitally alongside traditional channels.

Tokenized gold hits $3.9B with gold-based tokens XAUT and PAXG leading the market while stablecoin supply continues to grow.

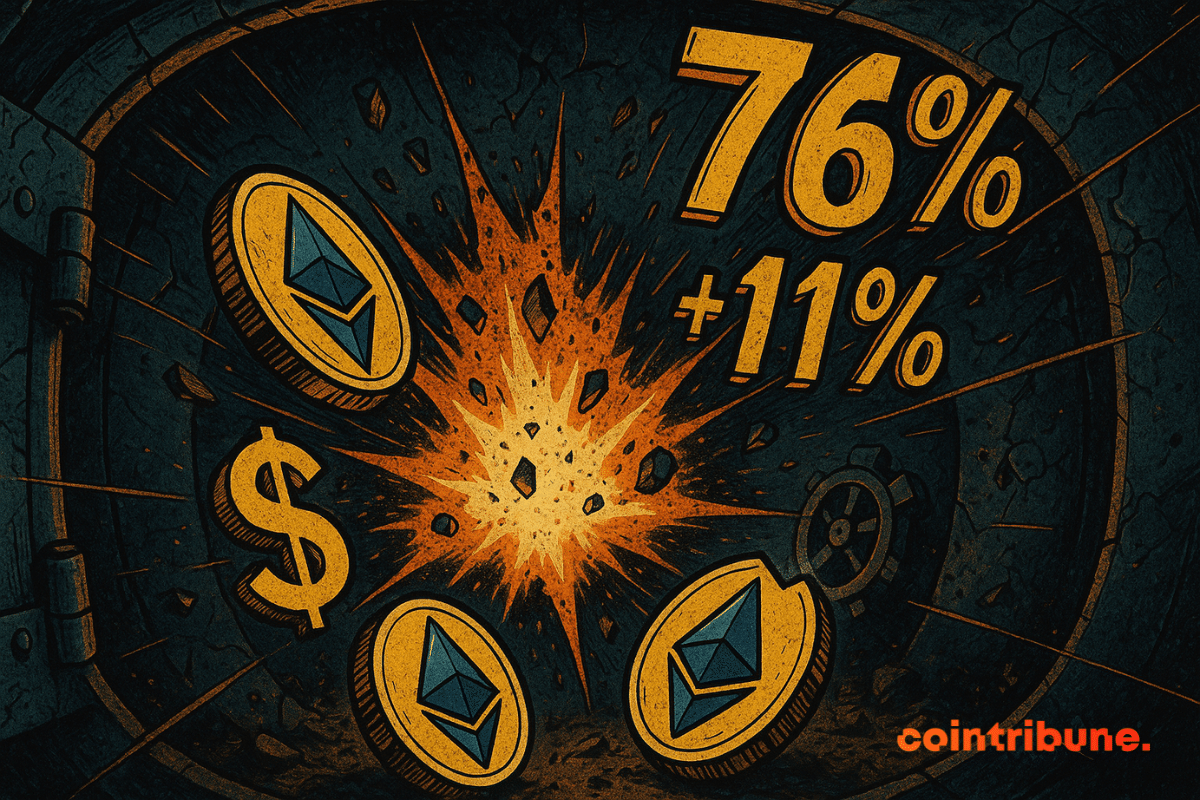

Boom of RWA in crypto: +11% in one week. Focus on this revolution led by Ethereum and BlackRock.

Polkadot Capital Group revolutionizes finance by connecting Wall Street to Web3 through asset tokenization. Discover how this blockchain initiative could transform institutional markets and propel DOT into a new era of adoption and performance.

Tokenized finance has just reached a decisive milestone. Ondo Finance, a pioneer in the tokenization of real-world assets (RWA), has been officially cited in a strategic White House report. A first for an actor coming from DeFi, now recognized in the highest spheres of American power. This recognition could well accelerate the global rise of RWA. And what if this was only the beginning?

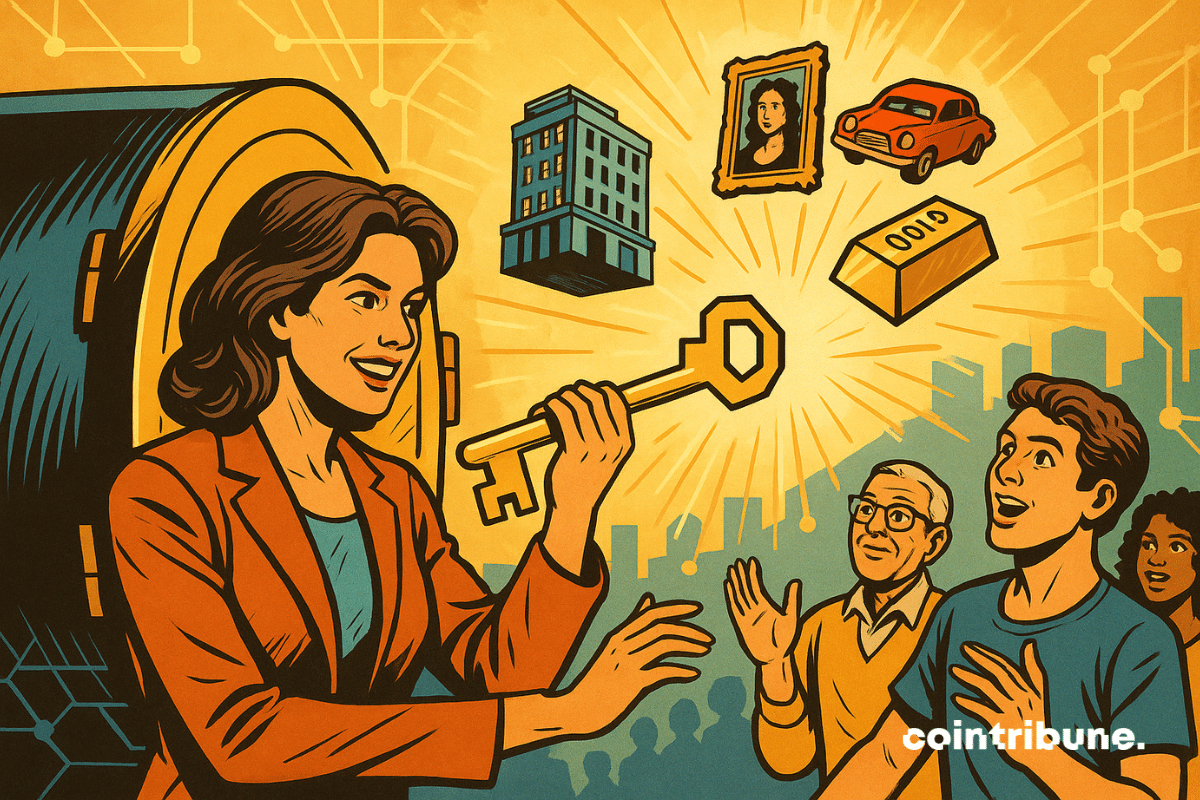

When Bitcoin flirts with unprecedented highs, the spotlight once again shines on the crypto universe. This spectacular rebound, fueled by ETFs and growing institutional adoption, coincides with the emergence of another phenomenon: the tokenization of real-world assets (Real World Assets or RWA). These hybrid instruments, halfway between traditional finance and Web3, attract a new wave of investors seeking stability and diversification.

The world of tokenized real world assets (Real World Assets - RWA) is undergoing transformation as it gradually aligns with the real economy. In this context, Credefi has experienced continuous evolution, moving from an experimental project to a functional infrastructure. With the launch of Credefi 3.0, the platform reaches a new milestone: it fully integrates modules designed to connect decentralized finance and tangible assets. All tools are now available online.

Robinhood’s rollout of tokenized shares “linked” to OpenAI set off a large debate last week. A broader discussion in crypto markets about the future of tokenized private equity, and whether retail investors actually want it.

At a time when DeFi is reinventing uses through groundbreaking innovations, certain trends are literally exploding. In this technological cacophony, RWA — these tokenized real-world assets — are tracing a stunning trajectory: +260% by 2025, for a market of 23 billion dollars. Behind this figure lies a promise: that of tangible, stable returns, grounded in the real economy. A remedy for crypto volatility, a bridge to the traditional world. "Real yield is the new grail," insiders are already whispering. And at the heart of this rise in power, Credefi is quietly laying out its game.

BlackRock paves the way for the regulation of staking and tokenization with the SEC. This moment is as historic as the arrival of the first Bitcoin ETFs. The meeting on May 9 opens the door to a clear regulatory framework, essential for the adoption of real-world assets on blockchain (RWA). The stakes go beyond mere technological innovation. It is a major validation that confirms that RWAs are set to transform modern finance. This dynamic opens up prospects for massive institutional adoption, under the guidance of solid and compliant infrastructures.

Crypto is no longer just a testing ground for decentralization-obsessed geeks. By 2025, it is a fully-fledged financial engine, and the latest wave? Tokenized real-world assets, or RWAs (Real World Assets). Their market has simply exploded: +260% in six months. The sector, still marginal in 2024, now approaches $23 billion. A surge propelled by increasing regulatory clarity in the United States and a redefinition of the borders between traditional finance and blockchain.

Medellín, dubbed the "city of eternal spring," has become a symbol of urban transformation in Latin America. With its modern infrastructure, commitment to sustainability, and exceptional quality of life, the city is increasingly attracting international investors. The El Poblado neighborhood, and more specifically Provenza, is at the heart of this dynamic, offering a unique blend of vibrant nightlife and residential serenity. And all of this is now within reach thanks to RealT.

Every year, billions lie dormant in fixed assets: real estate, raw materials, receivables. The economy suffers, investment stagnates, and inclusion decreases. What if the solution came from Web3? Real believes that everyone should own a share of the real world. Through its dedicated blockchain, it finally makes tokenization fluid, transparent, and inclusive.

The recent scandal surrounding Mantra (OM) has shaken the crypto sphere, rekindling deep concerns about governance and transparency in the realm of real-world assets (RWA). However, beyond the turmoil, some players like RealFin see in this crisis an opportunity: to demonstrate that another model is not only possible but necessary.

The integration of tokenized real-world assets (RWA) into decentralized finance (DeFi) opens up new opportunities for investors and borrowers. Credefi, as a DeFi lending platform specialized in financing SMEs and trade, is well positioned to capitalize on this trend and offer attractive returns while mitigating the risks of the crypto market.

In 2025, venture capital in the crypto sector will continue to grow. According to experts, venture capital investors will focus on three burgeoning areas in the cryptocurrency industry, likely attracting nearly 18 billion dollars in investments.

With a market capitalization of 12 billion dollars, the RWA sector is leading a revolution in crypto finance. The details!

Goldman Sachs is innovating with asset tokenization, opening up new pathways in the crypto market!

McKinsey predicts a $4 trillion market for tokenized real assets (RWA)! A crypto revolution on the horizon.

BlackRock makes a loud entrance onto the crypto scene by storming into the highly coveted niche of tokenized real assets!

The Depository Trust and Clearing Corporation (DTCC) successfully conducted a pilot project to tokenize funds in collaboration with Chainlink and several major US financial institutions. This initiative aims to standardize and accelerate the tokenization process of traditional assets on blockchains.

Real-World Asset (RWA) tokenization protocols are experiencing explosive growth, with crypto TVL reaching $8 billion!