PayPal is doubling down on crypto. The payments giant just revealed a new checkout feature that lets U.S. merchants accept payments in over 100 cryptocurrencies, including Bitcoin, Ethereum, Solana, and major stablecoins like USDT and USDC.

Short news

Ethereum is attracting strong interest from corporate treasuries and institutional investors. A new report from Standard Chartered revealed that companies have bought 1.26 million ETH in just two months. That amount equals roughly 1% of the total ETH supply. This pace nearly matches the 2 million ETH acquired by ETFs over the same period. Analysts called it the strongest buying wave ever seen for Ethereum ETFs. Geoffrey Kendrick, the bank’s global head of digital assets research, expects this trend to intensify.

E-commerce giant JD.com is getting ready to enter the stablecoin race as Hong Kong’s regulatory regime for digital currencies officially kicks off. The company has registered two potential stablecoin-linked entities, Jcoin and Joycoin, through its fintech arm JD Coinlink Technology, just days before the city’s new framework takes effect.

Saylor the enlightened, billionaire or prophet? He splashes out 2.5 billion on five-figure bitcoin. A speculative mass on the stock market... with monthly dividends, please!

Galaxy Digital moved nearly 3,800 BTC, worth about 450 million dollars, to exchange platforms. Despite this, bitcoin remains stable around 119,000 dollars, showing no signs of panic. Even a brief drop to 117,000 dollars was not enough to change the trend.

Binance suspends crypto withdrawals on July 31 for maintenance. A quick cutoff, but one that reveals hidden tensions in the wallet infrastructure. Centralization, risks, strategy: discover what this technical pause really says about the Binance universe.

On July 29, Brian Armstrong, CEO of Coinbase, stated that "bitcoin is probably the best form of money ever created." Indeed, this statement resonates in a context where bitcoin is regaining traction among institutions. As the crypto ecosystem redefines itself, Armstrong reignites the debate on the monetary legitimacy of bitcoin and once again establishes himself as one of the most listened to voices in the sector.

Could Bitcoin be surpassed by Cardano? Charles Hoskinson, founder of ADA, claims that his project offers more yield, utility, and potential. Discover why Cardano could very well disrupt the balance of the crypto market by 2025.

Is the euro capitulating to bitcoin? Once marginal, the idea is now making a strong impression as the European currency hits new historical lows against the leading cryptocurrency. Max Keiser, a figure in Bitcoin maximalism, reignites the debate with a shocking prediction. This is a strong signal in a context where monetary mistrust is gaining ground, and where technical fundamentals seem to support advocates of a global monetary shift.

While Bitcoin wavers after flirting with its all-time highs, Michael Saylor quotes Phil Knight sharply. Through this nod to the founder of Nike, the founder of Strategy reaffirms his tough stance. A strong reminder directed at weakened investors, in an environment where trust is measured by shifting trends.

Could XRP sign one of the biggest crypto rebounds of the year? With favorable regulation, anticipation of an ETF, and growing institutional adoption, all signals seem to align. Discover why analysts remain confident despite the recent correction.

European monetary sovereignty is wavering. In the face of the meteoric rise of dollar stablecoins, the ECB admits its limitations. The digital euro alone will not be enough. To avoid ceding more power to the United States, the Union must bet on private innovation, euro stablecoins, and decentralized technologies. A call for boldness.

Confiding your doubts to an AI is not like talking to a confidant; it’s like writing in a notebook that others can read. In the era of OpenAI, your words become data, exploitable... even in front of a court.

Monero, the privacy-focused crypto veteran, is looking at a potential existential crisis as rival blockchain Qubic inches closer to launching a 51% attack. This is a rare, controversial, and deeply destabilizing move in the crypto world.

Digital asset investment products saw $1.9 billion in inflows this week, a 15-week run of positive sentiment, as reported by CoinShares. So far in July, inflows have hit $11.2 billion, outpacing the $7.6 billion recorded back in December 2024 after the U.S. election. The United States led the charge with $2 billion, while Germany contributed an additional $70 million. On the flip side, outflows from Hong Kong, Canada, and Brazil totaled $160 million, $84.3 million, and $23.2 million, which somewhat balanced out the demand from the U.S.

Crypto funds have just recorded their fifteenth consecutive week of inflows, confirming a bullish momentum despite market volatility. Ether stands out significantly, attracting the majority of capital on its own. Bitcoin, on the other hand, shows a slight decline, giving way to the rise of altcoins.

Trump wants to launch his Bitcoin ETF via Truth Social, the SEC hesitates, and the Democrats scream: regulation or crypto blessing for a former president who knows how to inflate his tokens?

After a sharp surge, XRP and Dogecoin have just experienced a brutal correction, sending new entrants back to their uncertainties. This sudden turnaround highlights the fragility of unconsolidated rises and calls into question the strength of the rebound observed in recent weeks.

Strategy, Michael Saylor's company, did not purchase any bitcoin during the last week of July, a surprising first, as the price of the flagship asset remains above 118,000 dollars. This slowdown starkly contrasts with the sustained pace of previous months and coincides with a fundraising of 2.5 billion dollars in preferred stocks. A calculated pause or a warning signal? Investors are questioning.

A former Goldman bets on the absurd, rakes in 68 million with joke tokens, and sparks a battle of memes, egos, and liquidity in the crypto jungle. Guaranteed folklore.

Ethereum is once again in the spotlight. While Bitcoin stabilizes, the second giant of the crypto market may be preparing for a historic breakthrough. Several crypto analysts anticipate a parabolic run towards a new peak. The path to $5,000 appears clear... but how far can ETH really go?

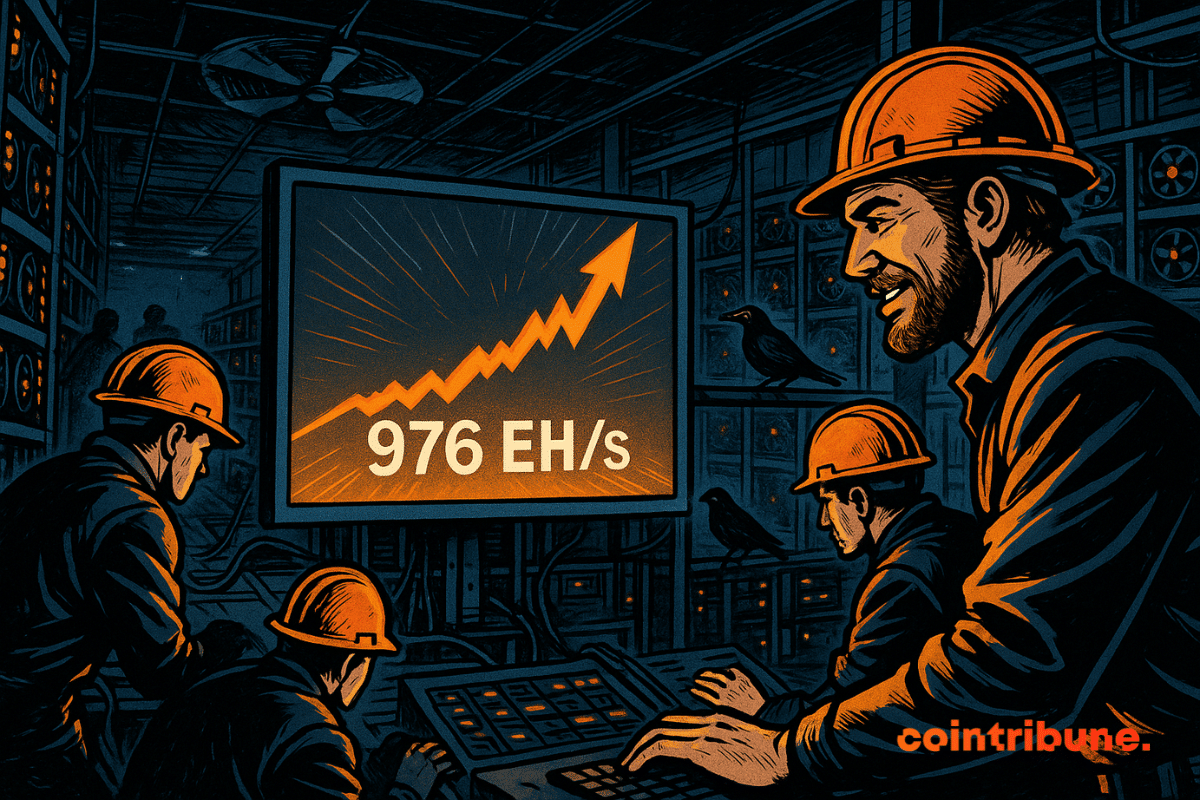

Bitcoin’s computational power has recorded an uptick in the previous day, surging close to previous levels—a trend that is viewed as a net positive for miners. As the higher hash rate boosts the blockchain’s security and robustness, miners benefit from increased profits.

SharpLink shakes up the crypto market with a massive purchase of 77,210 ETH, surpassing the network's monthly issuance. This strategic move, combined with the excitement for Ethereum ETFs, could propel the price of ETH towards $5,000 soon.

In the face of the fragilization of the global monetary system and the contested dominance of the dollar, the BRICS are moving discreetly but surely towards a strategic alternative: a common currency backed by sovereign digital infrastructures. Driven by a now-expanded and economically influential bloc, this initiative aims to reshape the global monetary balance. As the instability of fiat currencies worsens, the emergence of such a project raises questions for markets, institutions, and observers: is this a strong signal towards a new multipolar economic order?

Tether Gold redefines safe haven by merging real gold and crypto technology. Between rarity, security, and global accessibility, XAUt asserts itself.

Ethereum is regaining market attention as investors turn their eyes away from Bitcoin after weeks of record highs. At the time of writing, the global crypto market cap has climbed to $3.88 trillion, up 1.81% in the last 24 hours. Ethereum is trading at $3,743.91 with a 2.42% daily gain, while Bitcoin’s market dominance has slipped slightly to 60.53%.

Michael Saylor has just published a new signal on X that is shaking up the crypto markets. The founder of Strategy shared the famous SaylorTracker chart, a habit that traditionally precedes his bitcoin acquisitions. This time, the accumulation machine seems ready to get back in motion.

While Ethereum is losing its whales, Cardano attracts them. But behind these mysterious comings and goings, the crypto ocean hides monsters and a barely concealed war of influence.

As global trade lines are redrawn under geopolitical pressure, Donald Trump reveals his cards. Before a meeting in Scotland with Ursula von der Leyen, the American president warns: no customs tariff lower than 15% will be granted to the European Union. This firm stance, with direct repercussions on transatlantic flows, could also impact strategic sectors such as digital and blockchain. Behind this maneuver lies an economic showdown between two opposing views of commercial sovereignty.

While the spotlight seemed to be focused elsewhere, BNB surprised the entire market by setting a historic record at $851.48. The surge, which occurred over the weekend, triggered a series of massive liquidations, revealing the extent of leveraged exposure. This sudden spike places Binance's crypto at the center of the action, amidst rising activity on the BNB Chain and institutional players beginning to stake their positions.