Solana is deploying record volumes and seeing its TVL climb, but the price remains stuck below $130, held back by resistance. The crypto market is still waiting for the trigger for a rally.

Solana (SOL)

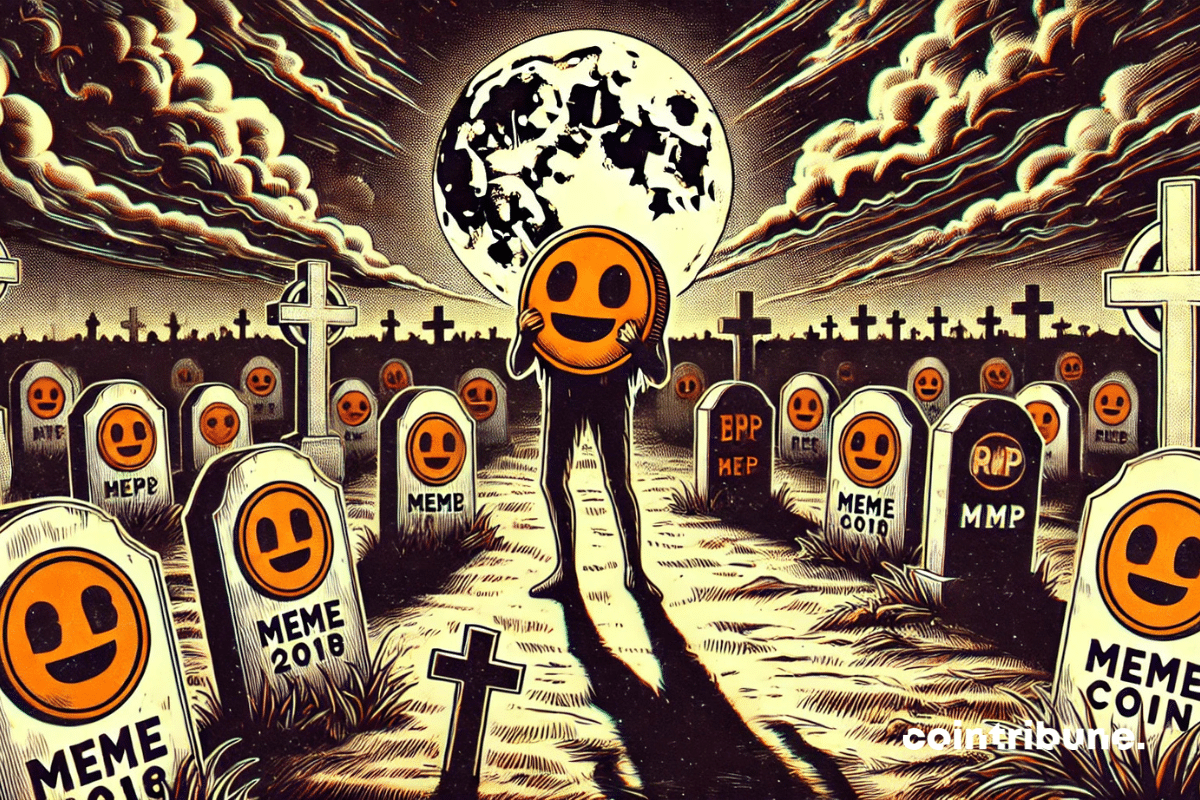

After five months of suspension, the memecoin creation platform Pump.fun is gradually reintroducing its live streaming feature. This relaunch is accompanied by new moderation measures and comes in a challenging context for the memecoin ecosystem.

When the crypto market succumbs to hype and spectacular narratives, fundamental signals get drowned out in the noise. However, it is precisely in these phases of disconnection between valuation and on-chain data that real dynamics take shape. Solana embodies this paradox today. Driven by metrics in sharp progression, yet underestimated by the market, the blockchain offers a very real potential that few seem willing to face.

The crypto market may soon experience a major new phase with the impending approval of Solana ETFs. For several years, investors have been seeking to diversify their crypto portfolios through regulated financial products. The introduction of ETFs based on assets like Bitcoin and Ethereum has already shown increasing interest. Today, Solana may well follow this trend.

PayPal is accelerating into the crypto space by directly integrating Solana (SOL) and Chainlink (LINK) into its wallet. This new feature is currently reserved for American users and associated territories. More than just a technical update, this decision is a significant boost for the massive adoption of cryptocurrencies. The intermediary MoonPay is no longer needed, making the experience seamless: buying, selling, and transferring these tokens becomes as simple as a few clicks. But behind this novelty lie much broader stakes. Here’s what you need to know.

Solana groans, Bitcoin stumbles. The crypto market, drunk with hope yesterday, is reeling under the blows of tariffs. Trump did not free the dollar, but rather chained digital assets.

XRP's Drop: Ripple's Crypto Becomes the Weakest in the Top 10. A Comprehensive Analysis of a Descent into Hell that Worries Traders.

In just ten days of existence, PumpSwap has established itself as a major player in the decentralized exchange ecosystem. This platform, launched by Pump.fun, already shows impressive figures that testify to its rapid adoption by the crypto community.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic conflicts. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Solana is experiencing an unprecedented surge in activity: 11.12 million active addresses. In a crypto market where actual usage now takes precedence over promises, this figure marks the return of a network that some said was losing momentum, now propelled by visible, measurable, and concrete adoption. This dynamic, more than symbolic, repositions Solana as a structuring player in the ecosystem, with clear signals of resilience and traction.

Under the March rain, Solana bends its back. But the stars whisper of a bullish spring. Skeptics laugh, while dreamers are already sketching the curves of a comeback.

Is Solana about to deliver a fireworks display for investors? After breaking an ultra-bullish technical pattern, SOL is taking off and now aims for 235 dollars. But the road is fraught with obstacles: mere excitement or the beginning of a real rally? An analysis of a high-stakes April.

The world of crypto continues to blur the lines with traditional finance. This time, it's BlackRock making a media splash by integrating Solana into its tokenized monetary fund, BUIDL. This decision is not just a simple technical adjustment, but a strong signal: blockchain is no longer a marginal experiment. It is becoming the backbone of a financial revolution in progress.

The spectacular rise of Solana (SOL) by 8% this Monday, along with Bitcoin (BTC) nearing $90,000, illustrates the current volatility of the crypto market. However, this impressive momentum is closely linked to global economic developments, particularly the trade tensions caused by the United States, which weigh on the future of cryptocurrencies and investor confidence.

ETPs, the heavily scrutinized investment vehicles, have delivered a resounding verdict: Ethereum is losing ground against XRP and Solana. According to CoinShares, net outflows from ETH-related products reached 86 million dollars in one week, while its rivals are nibbling away at market shares. Bitcoin, on the other hand, confirms its status as a safe haven with 724 million in inflows. Is this a breaking scenario or just a simple correction? A deep dive into the entrails of a boiling market.

In the arena of cryptos, Solana plays the gladiators. Despite a turbulent sea, it withstands, shines, and aims for a peak that could very well shake the skeptics.

A Polkadot crypto ETF filed with Nasdaq: 21Shares is betting big! Here is everything you need to know about this initiative.

Solana, the rising star of cryptocurrencies, dances with the giants of the CME. Its futures contracts sow the hope for an ETF, but the SEC plays the cautious divas. Guaranteed suspense!

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

XRP, this rebellious insurgent, rises from the ashes while Ethereum stumbles. The crypto-sphere holds its breath: the established order wavers, and the throne of altcoins threatens to change hands.

The crypto market is buzzing, traders are accumulating, stablecoins are soaring. A prelude to a bullish party or the swan song before an unexpected crash? The riddle persists.

The craze for memecoins on the Pump.fun platform is drastically fading. The survival rate of tokens has fallen below 1% for four consecutive weeks, reflecting a growing disinterest from investors in this type of speculative asset.

The rapid rise of the Solana network at the beginning of the year seemed to herald a new era for its ecosystem. Fueled by an unprecedented speculative frenzy around memecoins, the blockchain recorded record revenues, reaching $55.3 million per week. However, the party was short-lived. Within weeks, the excitement evaporated, leading to a brutal collapse. Today, Solana's weekly revenues have fallen back to $4 million, a staggering drop of 93%. This sudden turnaround raises a central question: Can Solana survive the end of this euphoria and find a sustainable growth model? On one hand, the frenzied speculation around meme coins has revealed an undeniable pull of the network, but on the other hand, its dependence on these ultra-volatile tokens undermines the entire economy.

The crypto market is going through a phase of uncertainty, where every technical indicator is scrutinized closely. Solana, long considered one of the most promising projects in the sector, finds itself at a decisive crossroads today. As its price records a notable drop, a feared signal from analysts threatens to increase the pressure: the death cross. This technical event, often interpreted as a bearish indicator, could well influence investor behavior and trigger a new cycle of volatility. But is this signal really heralding a prolonged downtrend, or could it precede an unexpected rebound?

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a realm of limitless innovations and a battlefield of regulatory and economic conflicts. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The history of cryptocurrencies is marked by episodes where volatility defies the logic of markets. Solana (SOL), one of the most promising blockchain ecosystems, is currently experiencing an intense phase of fluctuations. While its price has seen a significant drop in recent days, its trading volume has witnessed a spectacular surge. Over 5.18 billion dollars have flowed through the platforms, a movement that is as intriguing as it is concerning. This resurgence of activity reveals a complex dynamic where financial losses and hopes for a rebound intertwine.

On the crypto scene, Trump plays the alchemists: he transforms tokens into gold… but the magic primarily works for those around him.

The volatility of cryptocurrencies spares no one, and Solana (SOL) is no exception. After reaching a low of $125 on February 28, the native token of the Solana blockchain saw a rebound of 17%, hinting at a possible return towards $180. However, this recovery is far from guaranteed. Still down 50% from its all-time high of $295, SOL is facing several obstacles that could hinder its ascent. Between the slowdown in its on-chain activity, the lack of demand in the derivatives markets, and the concentration of transaction fees in the hands of a handful of users, the Solana ecosystem is wavering. What are the signals that could trigger a bullish rally?

The NFT eldorado has turned into a frozen desert: 13.7 billion in volumes vanished, a crash worthy of the most beautiful digital illusions. Who will still bet on these mirages?

The crypto ecosystem is going through an expansion cycle where competition among blockchains is intensifying, especially in the decentralized exchanges (DEX) market. Indeed, long dominated by Ethereum, this sector is seeing the emergence of a significant competitor: Solana, whose trading volumes briefly surpassed those of Ethereum in February. This unexpected performance occurred despite an unprecedented crisis in the memecoin segment, these speculative cryptos that have long been a key economic driver of the network. Solana is holding on to its place among the DEX leaders, but the recent collapse of memecoins raises a major question: can the network maintain its position without this asset?