Stablecoins want to buy U.S. debt. 2 trillion in their sights. The Treasury panics, 30-year bonds suffer. Tether is rubbing its hands.

Theme Stablecoin

While the cryptocurrency market undergoes a phase of decline marked by strong risk aversion, Tether's USDT shows an opposite dynamic. The stablecoin records record adoption, driven by practical uses such as savings, payments, and cross-border transfers, confirming its central role in crypto ecosystem liquidity and stability.

Stablecoins reach $141 billion of illicit activities in 2025. A record that reignites the debate on global crypto regulation!

Paying employees in USDT, making purchases without going through a traditional bank… What seemed exclusively reserved for DeFi a few years ago is becoming a measurable reality. A global BVNK report, published in early 2026, paints a striking portrait of stablecoin adoption accelerating far beyond crypto circles.

Crypto use within human trafficking networks is rising, according to new data from Chainalysis. Yet the firm argues that blockchain’s open ledger may also expose those same networks to investigators. A recent report shows a sharp increase in crypto flows tied to suspected trafficking operations, many of which operate across Southeast Asia. Analysts believe transaction visibility could give law enforcement a tactical edge.

As Bitcoin and Ethereum lost ground in Web3 casinos, stablecoins have established themselves as the new currency. Driven by their stability, speed, and massive adoption, they are redefining player habits and the economic structure of online gaming platforms.

Tether ended 2025 with strong momentum, even as the broader crypto market weakened following October’s sharp sell-off. New data shows its dollar-pegged stablecoin, USDT, continued to attract users, activity, and capital during a period of reduced risk appetite. While competing stablecoins stalled or contracted, USDT expanded across nearly every major metric—highlighting growing demand beyond speculative trading.

In the fourth quarter of 2025, Tether's USDT recorded historic on-chain activity, with 4.4 trillion dollars transferred and 2.2 billion transactions. While the overall cryptocurrency market underwent a sharp contraction, the USDT market cap reached a record 187.3 billion dollars, driven by massive retail adoption and a user base exceeding 534 million worldwide. Tether thus confirms its growing role as a stable and reliable financial infrastructure.

Bitcoin’s price remains under strain as selling pressure continues to weigh on the market. The OG coin fell to an intraday low of $72,945 in the previous session as market pullback continues across risk assets. While retail traders have largely maintained bullish positions, institutional investors have begun to retreat. Current data points to a growing divide between these two groups, raising questions about where Bitcoin may head next.

BBVA joins a banking consortium to launch a euro stablecoin against dollar stablecoins. All the details in this article!

While bitcoin showed its worst performance since 2022, a massive capital movement was preparing in the shadows. Stablecoin volumes reached 10 trillion dollars in January, nearly a third of the annual activity of 2024 concentrated in just 30 days.

Tether claims a valuation of 500 billion dollars, but investors remain skeptical. Between reduced fundraising, announced profits, and regulatory challenges, the company divides opinion. Dive behind the scenes of a stablecoin that defies the market and questions the future of crypto.

White House: Donald Trump pushes for a deal on stablecoins. Coinbase and banks are tearing each other apart over rewards.

Five New York prosecutors denounce a major legal gap in the US regulation of stablecoins. According to them, the GENIUS law protects issuers more than fraud victims. Tether and Circle find themselves at the center of explosive accusations.

Venture capital and institutional investors are moving back into digital asset companies at the start of 2026, even as crypto markets remain under strain. Industry data shows around $1.4 billion committed through venture rounds, ecosystem funds, and public listings. Activity spans on-chain finance, market infrastructure, and consumer-facing platforms, pointing to renewed confidence in select areas of the sector.

Tether, the world’s apex stablecoin issuer, reported a sharp decline in profit in 2025 while continuing to expand its holdings of U.S. government debt. New financial data shows a clear shift toward capital preservation and liquidity as global demand for stablecoins rises. Despite weaker earnings, asset growth remained strong throughout the year. The results confirm Tether’s continued importance to global crypto market activity.

A Fidelity token arrives on Ethereum and threatens $500 billion in bank deposits. We provide all the details in this article.

Binance plans to move its primary user protection fund from stablecoins into Bitcoin within the next 30 days, marking a major shift in how the exchange backs emergency safeguards. The transition will convert the Secure Asset Fund for Users (SAFU) entirely into Bitcoin, reflecting what company leadership describes as long-term confidence in Bitcoin’s role in the digital economy. Critics and industry observers warn that increased exposure to Bitcoin’s price volatility could weaken user protections during periods of market stress.

Messari alerts: DePIN crypto projects generate massive revenues despite a 99% collapse. More details in this article!

Tether has quietly become one of the world’s largest private holders of physical gold. The issuer of the world’s biggest stablecoin is buying bullion at a pace that now rivals national governments. Executives say the strategy is driven by rising concerns over monetary stability and declining confidence in paper-based assets. The expanding gold reserves also reinforce the backing of Tether’s gold-linked products.

Tether has introduced USAt, a new U.S. dollar–backed stablecoin designed to comply with U.S. federal regulations. The token marks Tether’s first effort to issue a stablecoin specifically for domestic use under a new legal framework. Additionally, the initial exchange listings represent its first public rollout.

When crypto shakes Wall Street: Standard Chartered fears that stablecoins siphon off bank deposits. Subdued panic in glass towers and bankers' cafes.

Ten banks join forces to create Qivalis, a stablecoin designed for fast crypto payments in euros. Details here!

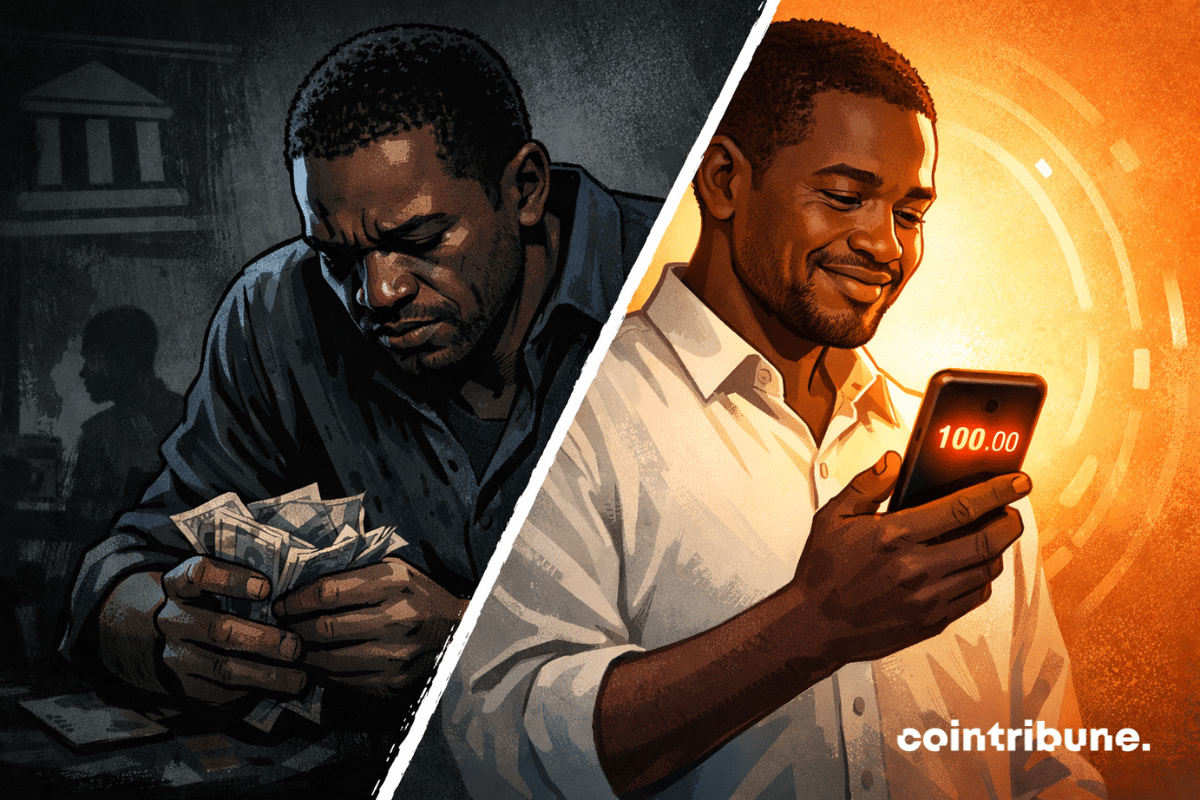

Stablecoin adoption is rising across Africa as individuals and businesses search for faster cross-border payments and protection from rising prices. Speaking at the World Economic Forum in Davos, economist Vera Songwe said stablecoins are filling gaps left by costly remittance systems and weak local currencies. Growing usage is also drawing closer attention from regulators across the continent.

Saga, a Layer-1 blockchain protocol, has paused its Ethereum-compatible SagaEVM chainlet after a $7 million exploit triggered unauthorized fund transfers. The attack involved assets being bridged out of the network and swapped into Ether. Although the affected chainlet remains offline, Saga says the broader network continues to operate normally.

The crypto A7A5, Moscow’s digital weapon? This token allowed Russia to move billions despite the Western embargo.

In Davos, the head of Circle promises that stablecoins will not blow up banks. What if crypto became the secret weapon... of AI? Allaire swears no, or almost.

Davos 2026: Ripple and Trump unite to transform the United States into a crypto empire. All the details in this article.

For years, the narrative has been well-oiled: Bitcoin as the ultimate reserve, the rest of the market playing more or less exotic satellites. Yet, some lines are starting to crack. According to crypto analyst and YouTuber FireHustle, the next wave of institutional adoption could well be built elsewhere. More precisely around Solana. A bold hypothesis, almost uncomfortable for maximalists, but deserving more than a shrug.

Scaramucci warns that banning yield on stablecoins could make the US dollar less competitive globally as other countries offer interest on digital currencies.