Tom Lee's ether treasury company is not slowing down. Bitmine Immersion Technologies has just announced a massive purchase of ether, consolidating its position among the largest institutional holders of the world's second largest crypto. A strategy that raises questions and comes at a time when Ethereum is showing signs of awakening.

Theme Staking

World Liberty Financial is moving to consolidate governance power by introducing a six-month staking requirement for voting rights. A newly proposed framework would require holders of unlocked WLFI tokens to stake them for at least 180 days before gaining access to protocol governance. The initiative introduces capital-tiered participation levels tied to large staking commitments and USD1-related incentives.

The Ethereum Foundation stakes 70,000 ETH and becomes a validator. A strategic turning point that could change the balance of the Ethereum market.

The market collapses, traders panic... and BitMine doubles down! Tom Lee bets everything on Ethereum while the crypto is being cut down by the stock market chainsaw.

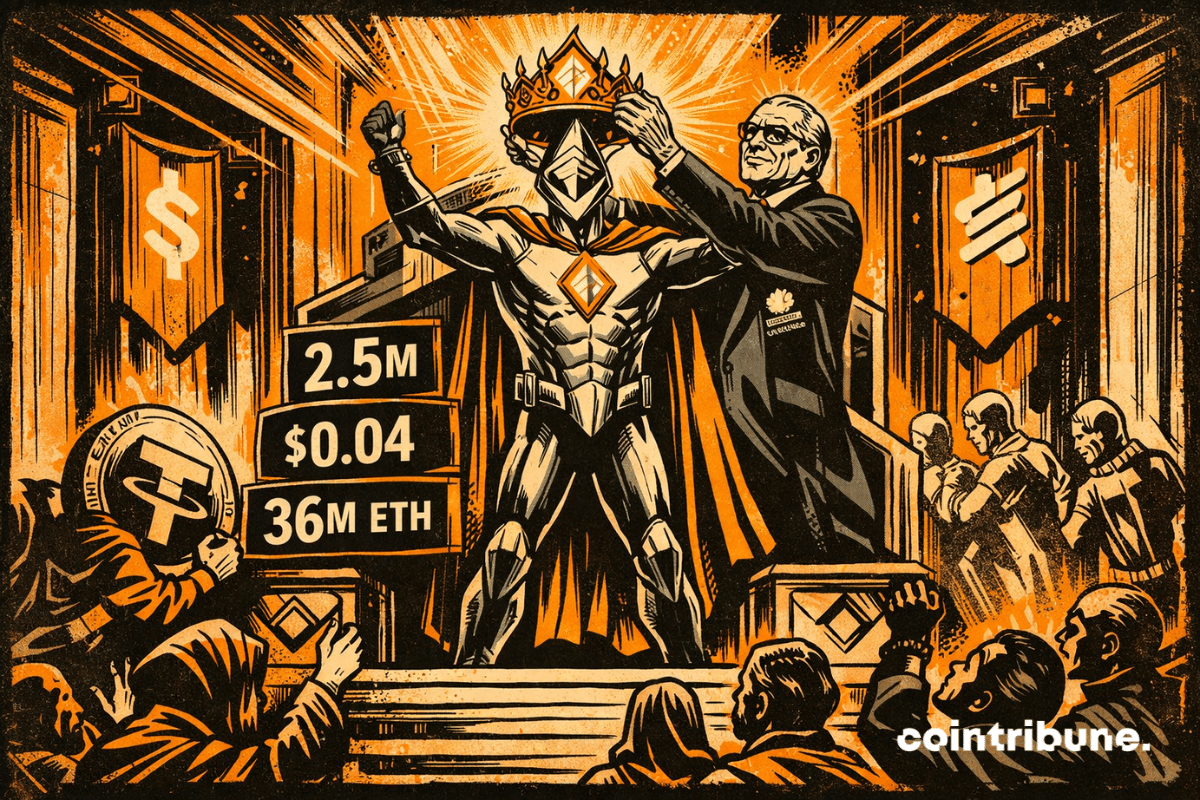

A silent revolution is underway on Ethereum. The network has reached a major milestone with 36.6 million ETH staked, representing 30% of the total supply. Giants like Bitmine and BlackRock are accumulating and locking their positions, radically transforming the crypto market structure.

BitMine Immersion Technologies falters under the weight of an unprecedented collapse: more than 6 billion dollars of latent losses on its Ether treasury. This rout, amid massive selling and prolonged crypto market decline, raises questions about the strength of institutional strategies. Between excessive concentration, illiquidity, and heightened volatility, this situation exposes the limits of the system facing extreme volumes. The shock is technical, but the consequences could be systemic.

Crypto: a forgotten Ethereum hack becomes a secret weapon against cyber threats. We bring you all the details in this article.

While the great powers hesitate, El Salvador stacks gold and bitcoin. Bukele dreams of a treasure safe from crises... and the Fed's lessons.

While volatility continues to drive the crypto market, Bitmine Immersion Technologies charts a more structured path. The company reveals a clear strategy: to turn its Ethereum holdings into a stable and sustainable revenue source through staking. Its latest report, backed by figures, reveals a massive accumulation of ETH and a confident vision. Behind this maneuver is a clear message: staking is no longer an experimental option but a central pillar of asset management for institutional players.

Injective has voted on a plan to rarify INJ. An aggressive crypto strategy that could disrupt the rules of the game.

As the year 2026 is just beginning, Ethereum is already breaking transaction records and showing negligible fees. Analysis!

Wall Street panics its block: Jefferies trades bitcoin for bullion. Reason? Quantum computers, these little geniuses capable of cracking digital vaults.

When a former politician buys a medical company to stack Bitcoins, crypto becomes a politico-financial novel where health and speculation share the same digital core.

While Bitcoin naps, BitMine stacks ETH: one million staked, billions locked... and an ambition that would make even traditional finance blushing on Ethereum drip.

While crypto coughs, SharpLink stacks millions on Ethereum: from staking to restaking, the company turns its digital treasury into a well-oiled cash machine.

BitMine restarts the race to Ethereum with $105M in cash and an explosive treasury of $915M. All the details here!

Morgan Stanley strengthens its presence in cryptos. The American bank has filed a form with the SEC to create a spot Ethereum ETF, including a staking component. A first at this institutional level, which occurs as market interest in crypto products intensifies.

Grayscale reaches a historic milestone. For the first time in the United States, a crypto ETF will pay its investors income from Ethereum staking. This unprecedented move disrupts traditional finance codes and paves the way for a new generation of investment products combining cryptos and on-chain yield. In a context where regulation is being structured and innovation becomes a strategic lever, this decision propels Grayscale to the forefront of a rapidly evolving market.

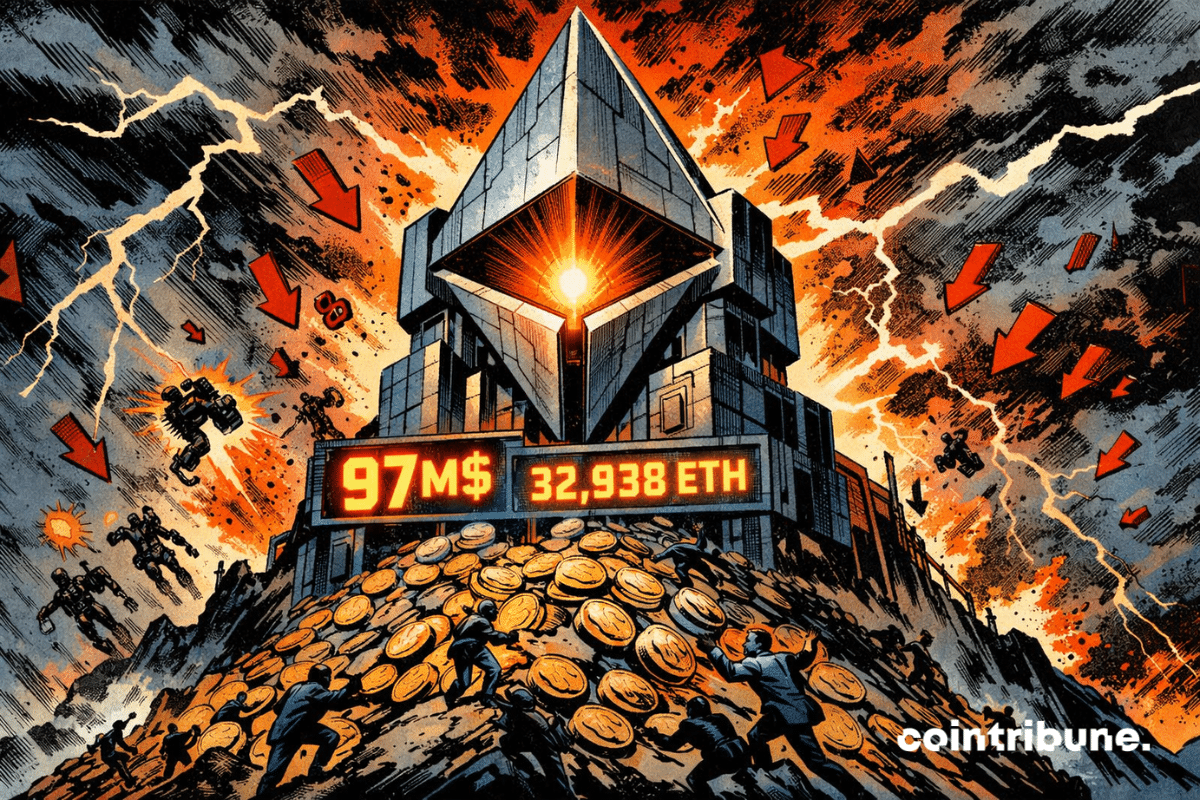

Bitmine has just added +259 million dollars in ETH, driving the Ethereum validator queue to nearly one million. A record that reveals institutional enthusiasm for staking and raises a crucial question: Can Ethereum absorb this pressure without compromising its decentralization?

While the market coughs, Tether, on the other hand, is gobbling up bitcoin… A frenzy of crypto-purchasing that intrigues, worries, and could well shake more than one stablecoin in a business suit.

BitMine bets 97M$ on Ethereum in the middle of a bearish market. A risky bet or a calculated plan? Detailed analysis in this article.

Bitmine has just deposited 219 million dollars in ETH into staking, marking a historic turning point for Ethereum. With over 540 million invested in one month, this move could redefine the institutional rules of the game. A risky or visionary strategy? Decoding a bet that is already shaking up the crypto market.

Bitcoin falls, Saylor buys. Two billion injected in two weeks, while the market panics. What if, after all, the crypto oracle wore a tie and sold shares?

Bhutan is pushing its digital economy forward by placing portions of its traditional reserves on blockchain infrastructure. As tokenized real-world assets gain momentum, the country is securing an early foothold. The introduction of TER, a gold-backed token from Gelephu Mindfulness City (GMC), strengthens Bhutan’s ongoing blockchain plans.

BlackRock discovers Ethereum staking and joins the yield banquet. But who is really dining at the table? The investor, the institution... or the tax authorities watching?

Ether has entered an important phase as exchange balances drop to their lowest level in nearly ten years. Supply continues moving into staking and long-term holding, leaving fewer tokens available for trading. Market structure is tightening even as investor sentiment remains cautious. Recent network events and steady institutional demand are also adding to this overall market trend.

The Fusaka update nearly caused Ethereum crypto network finality to be lost. We give you all the details in this article!

Bhutan surprises by entering the Ethereum universe. This small Himalayan state staked 320 ETH, nearly one million dollars, via the Figment validator, thus asserting a clear strategy of integration into the blockchain. Far from a simple investment, this initiative is part of a broader technological shift, where digital sovereignty and public infrastructure meet on Ethereum. A rare approach at the state level, redefining the contours of national engagement in the crypto ecosystem.

Ethereum crashes, BitMine persists: MAVAN, dividend, patriotism... The ultimate crypto pirouette of a giant who prefers to bet big rather than fold to Wall Street.

BlackRock takes a staking cure for its Ethereum: a developing ETF that promises yield for large portfolios. Crypto, meanwhile, continues to trot towards Wall Street.