Panic on the crypto planet: whales flee, the small ones bite the hook... what if this widespread fear was just a foretaste of a spectacular comeback?

Trader

Despite the frenzy around Bitcoin, some signals cool the optimism of crypto traders. Discover the details in this article.

While small wallets tremble, banks are piling up bitcoin. CZ watches, half amused, half worried: the crypto Wild West is changing sheriffs without warning.

The crypto sector, already weakened by tax issues and complex regulation, faces a new threat: the leak of sensitive data. An investigation in France reveals that a tax agent allegedly exposed private information about crypto owners. This revelation raises concerns about the security of tax data and the increased risk of physical attacks against investors. Such a scandal highlights the vulnerabilities of a system meant to protect citizens' confidentiality.

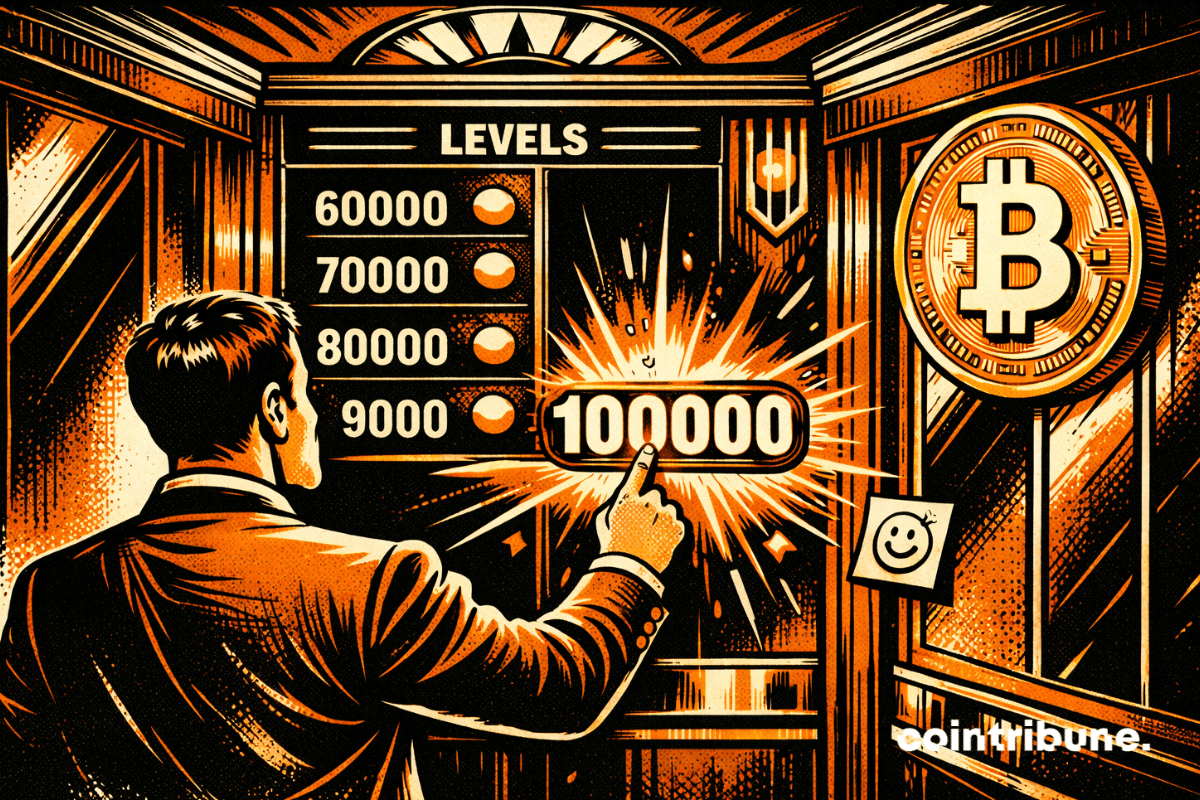

Options traders are betting big: Bitcoin could target $100,000 as soon as this month. Complete analysis in this article.

Telegram begins 2026 with mixed financial results. The messaging service records 870 million dollars in revenue in the first half of 2025 and targets 2 billion dollars for the year. However, these ambitions come with net losses and an unstable crypto environment. Between economic growth, the fall of Toncoin, and regulatory pressures, the platform is at a strategic crossroads, while an initial public offering is still under consideration.

While bitcoin seems frozen around 88,000 dollars, the apparent calm masks growing tension in the markets. Between hopes for a rebound and fears of a brutal correction, investors position themselves at daggers drawn. This polarization intensifies as volumes on Binance reveal tactical movements, and technical indicators flirt with key levels. The market holds its breath, watching for the signal that will decide between a bullish continuation or a sharp return to much lower thresholds.

Bitcoin is soaring, Binance is struggling, shrimps flee, whales dance… and ETFs scoop up the stakes. Here's a crypto-comedy that would be funny if it weren't so serious.

While bitcoin is bogged down under the spotlight, fleeing ETFs and traders under Lexomil: the crypto star rediscovers the joys of the plunge, 2022 version, remixed 2025.

The crypto market is wavering again, and the same question arises: has bitcoin finally hit rock bottom? While analysts are getting carried away and predictions are proliferating, the Santiment platform calls for caution. According to it, the real market bottoms never occur when everyone is expecting them. Behind collective optimism, it sees a formidable emotional trap, where overconfidence could precede a new downturn. What if the worst is not over yet?

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

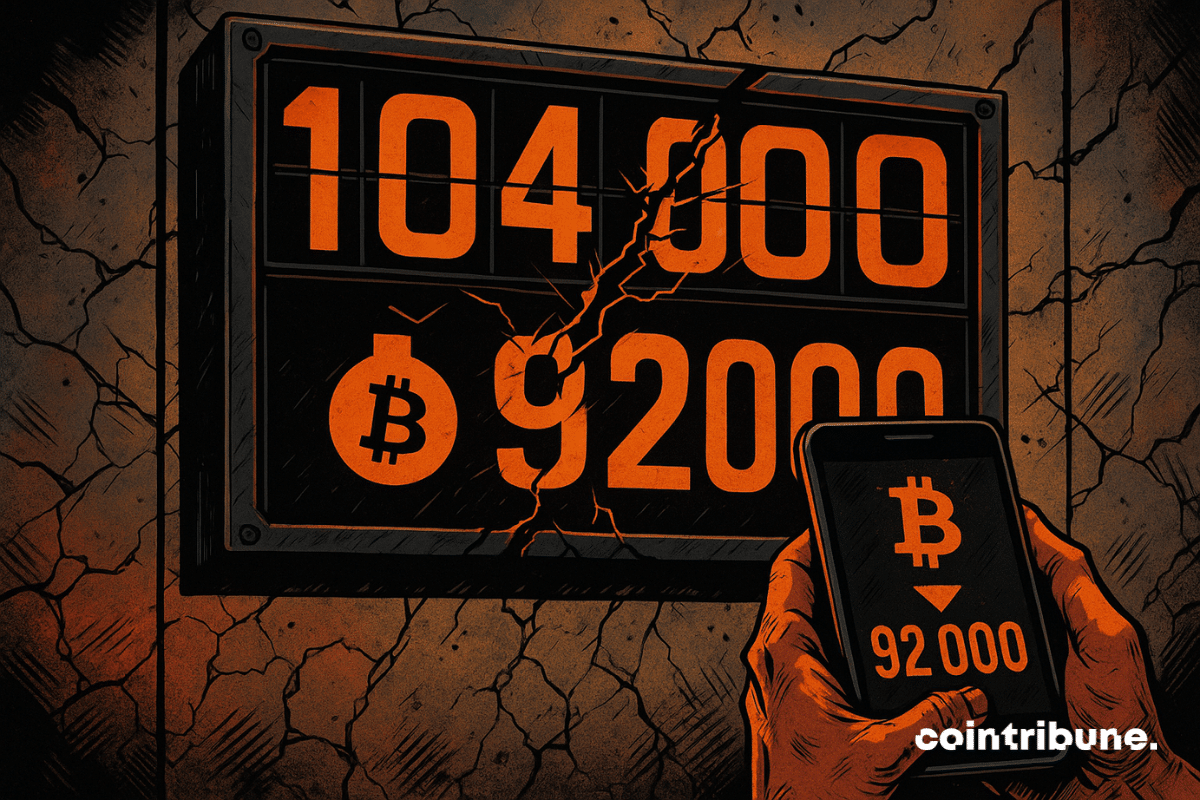

Bitcoin slips, whales abandon, small holders capitulate... what if the famous $92,000 gap became the new stopover? Bearish mood guaranteed.

While institutional interest in cryptos is rising again, the decisions of major players capture all the attention. This November 1st, Ripple plans to unlock 1 billion XRP, which is more than 2.4 billion dollars at the current price, from its escrow accounts, as part of a mechanism established in 2017 to regulate the supply. A regular operation, but one that, in the current climate, raises questions about liquidity strategies and market balance.

The crypto market, already known for its volatility, has just experienced another major shock. In just 24 hours, over $1.1 billion has been liquidated, revealing the ecosystem's fragility against increasingly influential macroeconomic forces. The fluctuations of bitcoin and altcoins have not escaped investors' attention, who saw their positions swept away by this wave of liquidations, increasing the risks associated with this uncertain market.

In a digital world saturated with unverified information, Intuition introduces a blockchain infrastructure designed to anchor reputation, knowledge, and structured data directly on-chain. Its ambition : to create a foundation for verifiable, composable information systems that serve both users and AI agents. Backed by $8.5 million in funding and strong testnet performance, the project enters production as one of the few Layer 3s to demonstrate real pre-launch traction.

Solana (SOL) hovered near $191.95 on October 25 after briefly testing $195 earlier in the day. The token has shown resilience amid shifting market momentum, with traders watching to see if it can turn the $192–$195 range into a new support zone.

The ghost Satoshi watches his bitcoins melt by 20 billion. Still silent, still rich... How long will the king of silence let chaos reign without a word?

When Solana releases a war engine called Ultra v3, it’s not the crypto traders who complain, but the competitors who cough. Fees falling, precision skyrocketing.

Cryptos are going through a storm. Bitcoin plunges more than 9%, Ethereum loses 6%, and XRP tumbles 15% within a week. Behind this debacle, a persistent belief divides investors: will the legendary four-year bitcoin cycle seal the market's fate, or is it an outdated relic in the age of institutional adoption?

While gold shines like never before, Peter Schiff brings out his anti-bitcoin refrain. What if this time, the crypto undertaker was (somewhat) right? To be continued...

Spot Bitcoin ETFs have just recorded their second-best historical week, with $3.24 billion in net inflows. This spectacular resurgence of interest occurs amidst an still uncertain economic climate, but rekindles hope for a dynamic fourth quarter for the crypto market. Far from a mere rebound, these massive flows reflect a clear reversal in institutional investors’ sentiment, on the eve of an October historically favorable to Bitcoin.

Memecoins attract, but the profits escape those who buy them. According to a report by Galaxy Research, these tokens, booming on Solana, primarily benefit platforms and trading bots. Far from the community image they project, they feed a fast market where retail investors, often losers, serve a well-oiled industrial mechanism.

When crypto goes up, he goes down. @qwatio, a relentless speculator, burns millions on XRP… and could well blow up at the next green candle. What are we waiting for to stop him?

Bitcoin in full panic, the index collapses... what if the storm was announcing a clearing? While the charts are turning red, some are arming themselves with patience.

James Wynn, the man who flirted with billions in crypto, now bets on ASTER… An airdrop, a 3x leverage, and a lot of boldness: hold-up or hara-kiri?

Bitcoin attracts bettors, Ethereum seduces bankers, Dogecoin dreams of an ETF and Tether dresses in gold: the crypto circus continues its show, between promises, glitters and persistent doubts.

Cardano fans are sulking, whales are stirring, and ADA is bouncing back. Yet another crypto farce where the impatience of small holders fattens the big holders.

Ethereum takes the prize for the big players, Bitcoin clings to its throne. A duel of numbers, egos and billions: who will emerge victorious from this digital waltz?

While Ethereum was showing off at nearly $5,000, Bitcoin was crashing… Traders saw their dreams evaporate faster than a presidential alibi.

While the wait around Pi Network drags on, a discreet statement from a moderator reignites hopes. Millions of users are still waiting to access their mined tokens, but a second migration to the mainnet could change the game. This signal, although unofficial, comes amid growing frustration. If it materializes, it would mark a strategic turning point for a project still locked in its mainnet, far from the promises of a truly accessible blockchain.