Traders are placing sizable bets on Bitcoin’s path through 2026 across leading prediction platforms. Activity on Polymarket, Kalshi, and Myriad suggests a market that expects gradual progress rather than a rapid breakout. More than $84 million in combined volume across seven contracts reflects cautious optimism, balanced by consistent hedging against downside risk. While confidence appears to build later in the year, near-term expectations remain restrained.

Theme Trading

X is preparing to introduce Smart Cashtags, a new feature that will let users view stock and cryptocurrency data directly from their timelines. The rollout is expected in the coming weeks, according to X head of product Nikita Bier. Alongside the feature launch, the company is tightening rules around spam and automated activity linked to crypto promotions.

Vitalik Buterin calls for a change of course for prediction markets, which he sees trapped in a short-term speculative logic. According to him, these platforms could become much more than betting tools: real instruments for hedging economic risk. This position comes as these markets gain influence in the crypto ecosystem and beyond.

A key valuation indicator today places bitcoin at an unprecedented level since March 2023, a period when BTC traded around 20,000 dollars. After several months of correction following its last all-time high, the market shows a reading rarely seen during the cycle. This configuration, based on on-chain data, raises questions about the real state of the market and the position of bitcoin in its current phase.

In Washington, the regulatory future of cryptos may be decided in the coming months. Amid market volatility, the CLARITY Act stands as a pivotal text for the American crypto industry. Treasury Secretary Scott Bessent advocates for its rapid adoption, believing that legislative clarification could soothe investor sentiment. Behind this tight schedule lies a major political stake: securing the crypto framework before the 2026 electoral balances reshuffle the cards.

Within a few sessions, bitcoin has plunged back into a turbulence zone rarely seen since previous major crashes. On-chain data reveals $2.3 billion in realized losses over seven days, a shock that ranks this episode among the most violent in its recent history. This wave of capitulation follows a brutal correction of BTC, falling heavily after its peak above $126,000.

The crypto market sends contradictory signals. Indeed, investor sentiment has just reached a historic low, reflecting a strong distrust towards bitcoin. At the same time, some data from Binance indicate a slowdown in selling pressure. This discrepancy between market psychology and real flows raises a central question: are we witnessing a simple technical lull or the beginnings of a lasting rebalancing?

Crypto ETFs were supposed to mark the definitive entry of institutional investors into the ecosystem. A few months later, the reality is more mixed. While the market tries to identify a bottom, a clear gap is widening between bitcoin and Ethereum. The latest figures show that ETH ETF holders find themselves in a significantly more exposed position than their counterparts invested in Bitcoin ETFs. An imbalance that raises questions about the relative strength of the two assets during this correction phase.

While bitcoin evolves in a persistent volatility climate, ETFs backed by the leading crypto have just sent an unexpected signal to the market. After several weeks dominated by capital outflows, these investment products record a marked return of inflows. This movement, closely observed by institutional investors, comes at a pivotal moment where confidence remains fragile and every flow variation can reshape crypto market expectations.

The crypto market is entering a new phase according to Mike Novogratz. End of explosive gains? Analysis of a major turning point in this article!

Beast Industries has acquired Step to help teens and young adults develop practical money skills through mobile banking and financial education.

While bitcoin and Ethereum make headlines with their ETFs, Ripple chooses the right moment to assert itself with XRP. From February 11 to 12, the company is hosting the XRP Community Day 2026, a global digital event dedicated to its native asset and innovations of the XRP Ledger. This initiative occurs within a context of growing institutional interest, driven by massive flows into XRP ETFs. For Ripple, it is more than a community meeting: it is a strategic demonstration on a global scale.

The fragile calm of the crypto market has shattered. In a few sessions, bitcoin fell sharply to nearly $60,000, reviving doubts about the strength of the bullish cycle. This 32% correction since the halving prompts questions: simple turbulence or market pivot point? A study by Kaiko Research puts forward a strong hypothesis: bitcoin may have reached the midpoint of the bear market.

A sudden sale of 245,000 bitcoins by historic holders shakes the market, revealing an unexpected signal in an intense macroeconomic tension phase. These investors known for their solidity surprised even the most seasoned analysts. Is it a capitulation or a repositioning strategy? As monetary uncertainty persists and volatility settles in, on-chain indicators reveal a more nuanced reading.

While bitcoin was falling sharply to 60,000 dollars, Michael Saylor surprised the entire market. His company Strategy invested 90 million dollars to buy 1,142 BTC at a price well above the market rate. This choice, far from trivial, raises questions about the accumulation strategy of one of the largest BTC holders in the world. Why buy so high in a declining market? And what are the consequences for investors and the sector’s dynamics?

Gold collapsed in just a few hours, surprising investors and analysts after a historic peak. This sudden shock revealed the speculative mechanisms shaking global markets. Amid the flood of interpretations, that of Scott Bessent, former strategist of the Soros fund and current advisor to the US Treasury, hits the mark. He accuses leveraged speculation by Chinese traders, amplified by margin tightening, for causing what he calls a "speculative blow-off."

While market attention is focused on every move of the Federal Reserve, a subtle adjustment is emerging. Economist Lyn Alden mentions the Fed entering "gradual print" mode: a progressive monetary creation, calibrated to nominal GDP growth. Far from the massive injections of 2020, this subtle strategy could disrupt interest rate expectations, redefine the balance of financial markets, and profoundly influence the evolution of cryptos like bitcoin.

XRP surprised this weekend with a sudden surge of +2,860% on its spot flows in barely eight hours. This historic peak, occurring in a quiet market, reignites speculation about a possible cycle change. While some see it as a simple technical rebound, others detect a precursor signal. In any case, this volatility spike breaks the stupor that had surrounded crypto for several weeks.

U.S. spot Bitcoin exchange-traded funds (ETFs) showed signs of stabilization on Friday after several days of sustained selling pressure. The rebound was led by BlackRock’s flagship product, even as the broader crypto market continued to experience sharp price volatility. While inflows returned, recent data indicate that investor sentiment remains cautious, with market participants closely monitoring ETF flows for signals on near-term direction.

The Bitcoin network has just absorbed a major technical shock. Its mining difficulty has dropped by 11.16%, the biggest decrease recorded since the mining ban in China in 2021. This sharp decline, revealing structural tensions, renews concerns about the system's robustness and the growing pressure on mining companies. While difficulty is supposed to guarantee protocol stability, its current plunge acts as a silent warning about the network's real state and the resilience of its infrastructure.

Markets are holding their breath ahead of the next Fed meeting with a possible monetary turning point as early as March. As inflation slows and the political context becomes more complex, an unexpected signal is gaining strength. According to CME data, more than 23% of traders are now betting on a rate cut. This shift in sentiment, still a minority but growing, could well reshuffle the cards.

Bitcoin has just crossed a critical threshold that changes the game. According to CryptoQuant, the break of its 365-day moving average is no longer a mere technical signal: it marks the clear entry into a new bearish cycle. This slide occurs in a context of institutional demand withdrawal and degraded on-chain signals. The bullish momentum now seems behind, replaced by a market dynamic structured around caution, watchfulness... and the risk of prolonged decline.

In the space of 24 hours, bitcoin recorded nearly 900 million dollars of realized losses, a level never seen since the collapse of FTX in 2022. This chilling figure, from on-chain data, illustrates much more than a simple drop, but marks a brutal turning point in investor sentiment. Such a massive and sudden wave of loss-making sales signals a new phase of capitulation, revealing the persistent fragility of a market still far from regaining its balance.

Bitcoin bounced back on February 6, crossing 70,000 $ again after falling below 60,800 $ a few hours earlier. This stunning recovery, amid extreme volatility, occurs in a market shaken between bullish hopes and selling shocks. Should this be seen as a simple technical rebound or the beginning of a lasting reversal?

Ether has fallen below $2,000, confirming a marked retracement phase. Indeed, the movement is accompanied by a visible disengagement of holders, an influx toward exchanges, and degraded technical signals. This threshold break tests the market structure and investor resilience.

The crypto market has sharply declined. In a few hours, major assets lost several months of gains, bringing bitcoin, Ethereum and Solana back to forgotten levels. After the 2025 momentum, investors hoped for consolidation. Instead, a wave of panic took over. More than 2 billion dollars were liquidated, revealing an atmosphere of extreme fear. The entire ecosystem is affected, from tokens to listed stocks, indiscriminately.

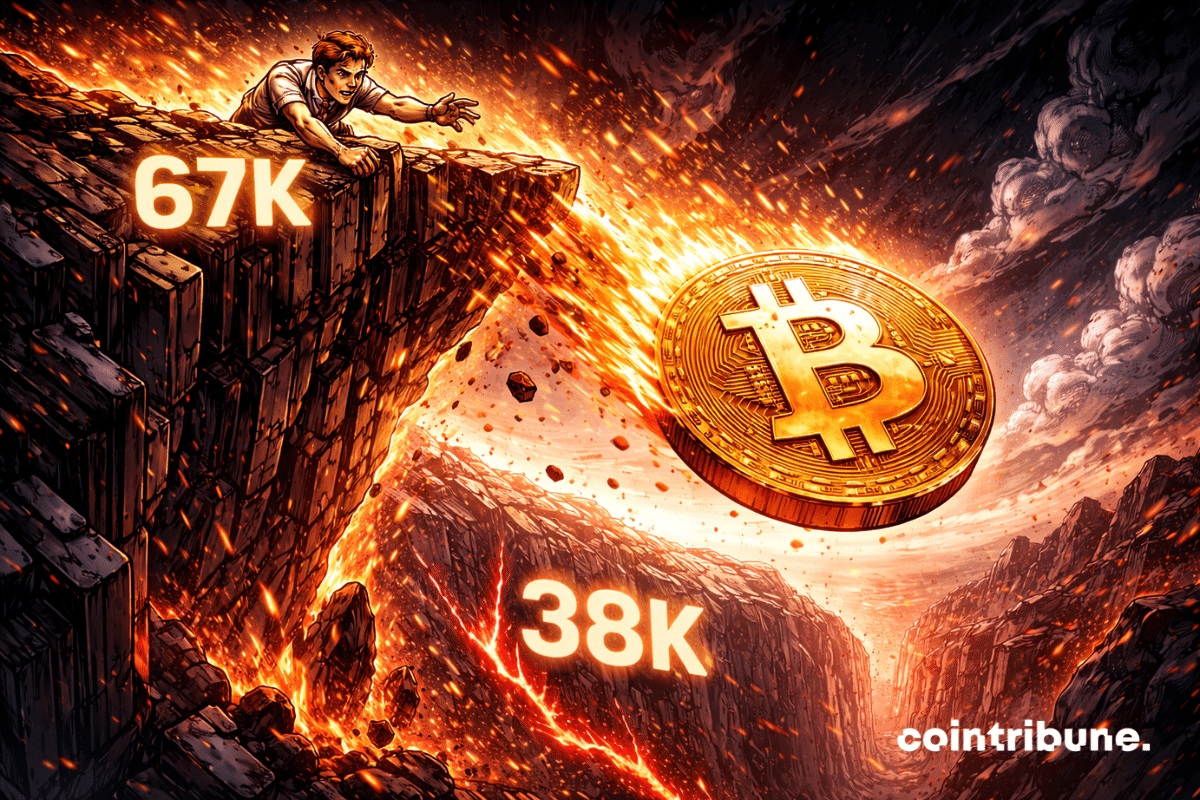

Bitcoin wavers below 67,000 dollars and concern is rising. In an already fragile context, Stifel bank issues a severe warning: a return to 38,000 dollars is now possible. Such a retreat, over 40% decline, would far exceed usual corrections. This scenario, supported by technical and macroeconomic signals, brings crypto market volatility back to the forefront. And this time, it is no longer a mere warning.

Gold recovered to 5,000 per ounce after a historic drop, with major banks including J.P. Morgan forecasting further gains later in 2026.

Binance creates a staggering gap. CoinMarketCap's Proof of Reserves report reveals overwhelming domination: $155.6 billion in assets, far beyond any other platform. As transparency becomes a vital requirement in a market under regulatory pressure, this ranking raises a crucial question: who can be trusted today? Binance establishes itself decisively.

Crypto.com bets big on a crypto prediction app with up to $500 offered at sign-up. Discover the details in this article.