Tether Outpaces Germany With $120 Billion In Treasury Bonds

Tether, the issuer of the USDT stablecoin, has just reached a historic milestone by surpassing Germany in holding U.S. Treasury bonds. With over 120 billion dollars invested, the company now ranks as the 19th largest global holder, overtaking several nations.

In Brief

- Tether now holds more than 120 billion dollars in U.S. Treasury bonds, surpassing Germany’s 111.4 billion.

- This position makes Tether the 19th largest global holder of Treasury bonds among all countries.

- Tether’s diversified reserves generated more than one billion dollars in profits in the first quarter of 2025.

- The adoption of stablecoins continues to accelerate with the USDT total capitalization reaching 151 billion dollars.

Tether Surpasses Germany in U.S. Treasury Bonds

Tether has just written a new page in financial history. The issuer of USDT, the world’s leading stablecoin, has officially surpassed Germany in the ranking of holders of U.S. Treasury bonds.

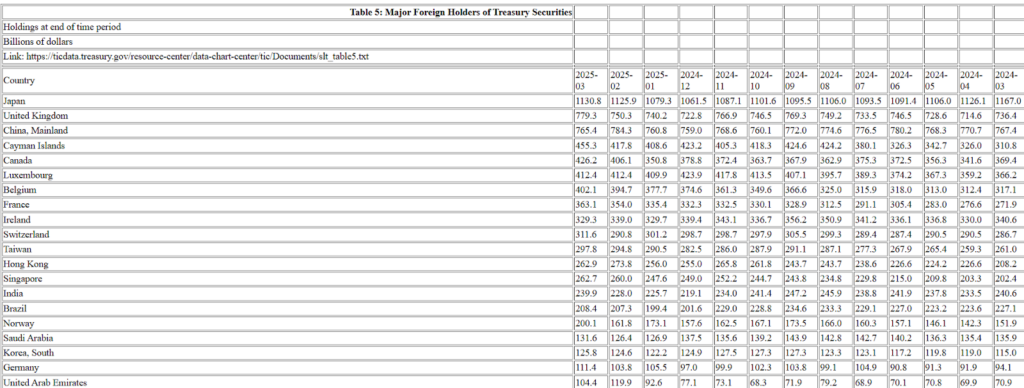

The figures are impressive: according to the U.S. Department of the Treasury, Tether has invested more than 120 billion dollars in these sovereign debt securities, compared to 111.4 billion for Germany. This spectacular leap places the crypto company 19th worldwide among all investing countries.

This rise is not new. Already in 2024, Tether had climbed to 7th place among the largest annual buyers of Treasury bonds, ahead of several economic powers such as Canada, Taiwan, Mexico, and Norway.

“This milestone strengthens our cautious reserves management strategy while highlighting our growing role in the global dollar liquidity distribution“, Tether explained in its latest quarterly report.

This rise coincides with the explosion in USDT’s capitalization, which recently crossed 150 billion dollars. Tether now dominates 61% of the global stablecoin market, consolidating its position as the undisputed leader in this booming sector.

A Diversification Strategy Bearing Fruit Despite Crypto Volatility

Tether’s traditional investments proved particularly savvy amid crypto market turbulence during the first quarter of 2025.

The company declared more than one billion dollars in profit from its “traditional investments“, mainly thanks to the solid performance of its U.S. Treasury bond portfolio.

Tether’s attestation report also notes that its gold reserves have “almost offset” losses related to crypto market volatility.

This diversification strategy demonstrates the growing maturity of the stablecoin issuer, which has skillfully navigated between traditional finance and crypto innovation.

This success comes as Washington is active on the regulatory front. Two major bills are under debate in Congress: the STABLE Act, already approved in a committee in the House of Representatives, and the GENIUS project, which faced political resistance in early May. These initiatives aim to clearly regulate stablecoins on U.S. soil.

Meanwhile, Tether is preparing to launch a new stablecoin specifically targeted at the American market, aimed at regulated financial institutions. A strategic initiative that could further strengthen its dominant position in the ecosystem.

Tether’s meteoric rise in traditional financial markets marks a historic turning point in the global economy. As stablecoins gain ground, the boundary between conventional finance and crypto innovation is gradually blurring. Venture capital investors clearly understand this, betting massively on this sector whose capitalization could reach 2,000 billion dollars by 2028.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.