BIS Sounds The Alarm: 90% Of Crypto Payments Are Pure Speculation

A new report from the Bank for International Settlements (BIS) highlights a disturbing reality. Cross-border flows in crypto reach $600 billion, but with a strong dominance of speculation. Behind the apparent rise of cryptocurrencies, global finance is encountering its old demons again.

In brief

- The majority of global crypto flows are driven by speculation, according to a BIS report.

- Bitcoin and stablecoins also serve as an alternative solution to costly transfers in emerging countries.

Crypto: Speculation dominates cross-border payments according to BIS

According to the BIS, nearly $600 billion were transferred via bitcoin, Ethereum, USDT, and USDC in the second quarter of 2024. Certainly, this figure may create the illusion of massive adoption of crypto-assets. However, the reality is quite different.

The institution indeed points out that the majority of these flows are driven by speculative investments. In other words, they are highly sensitive to global financing conditions.

Our findings highlight speculative motives and global funding conditions as the main drivers of native crypto asset flows.

The study also establishes a clear correlation between restrictive monetary policies and the decline in volumes. Indeed, it points to increasing interconnection between crypto-assets and traditional finance.

The crypto market is therefore no longer isolated. Its behavior increasingly aligns with that of classic risky asset classes. Volatility is no longer only endogenous to the sector; it is now also dictated by macroeconomic factors.

Crypto: between payment solution and inflation escape

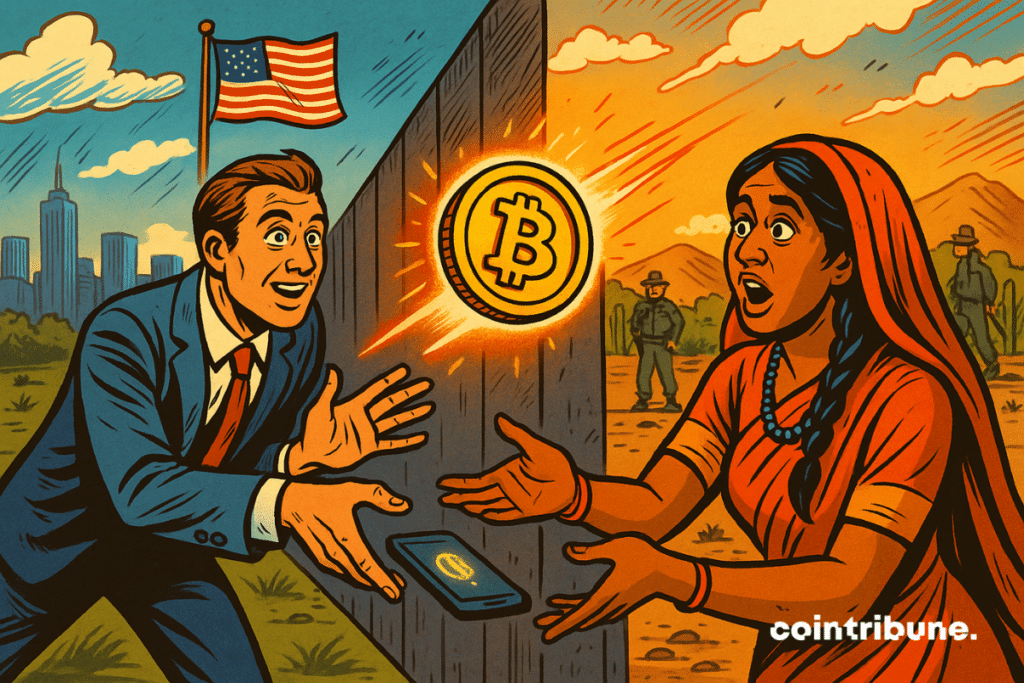

Despite this strong speculative trend, the report highlights concrete uses of cryptocurrencies. It mainly refers to international money transfers. Stablecoins and low-value bitcoin are indeed used in emerging markets as alternatives to costly or hard-to-access banking systems.

High transfer fees and rampant inflation in certain regions foster the use of crypto as a payment method. The study points out that certain countries concentrate a significant share of flows. Notably mentioned are:

- Turkey;

- Russia;

- United States;

- United Kingdom.

In this context, crypto becomes both a financial safe haven tool and a gateway to global markets, especially for populations excluded from traditional systems.

Crypto thus oscillates between a global speculative tool and an alternative solution for money transfers. The BIS report calls for rethinking the real uses of these digital assets in the face of growing economic and social challenges.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.