The Crypto Market in Brazil Jumps 43% in 2025

In 2025, Brazil establishes itself as the epicenter of financial innovation in Latin America. With a record 43% growth in crypto transaction volume, the country is redefining investment rules. Who are these new players and why such an explosion?

In Brief

- The Brazilian crypto market recorded a record growth of 43% in 2025, with an average investment per user exceeding 1,000 dollars.

- Investors, increasingly younger and more diverse, adopt multi-asset strategies in Brazil.

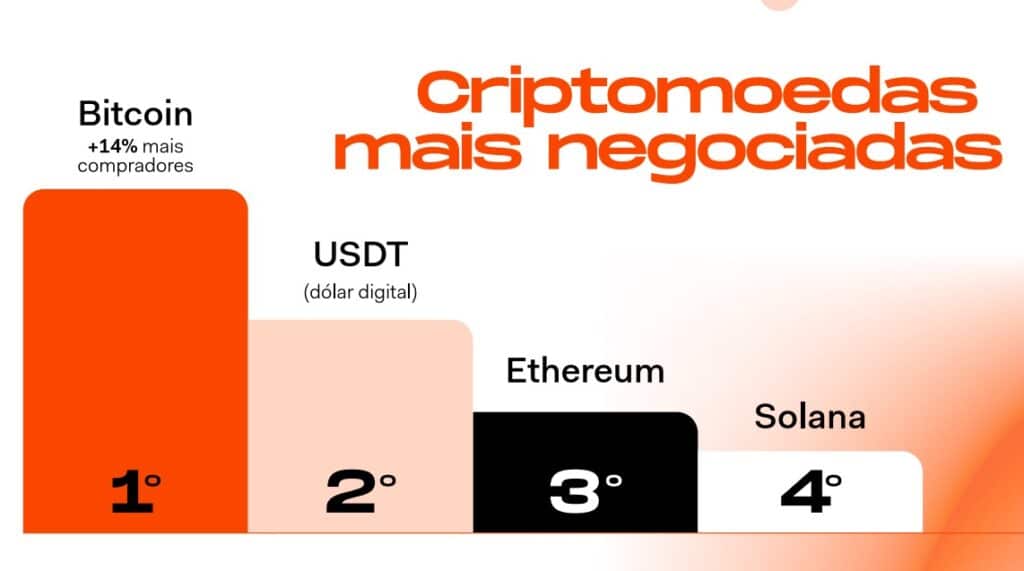

- Despite its volatility, Bitcoin remains the most traded asset, seen as a hedge against inflation.

The Brazilian Crypto Market in 2025: A Record Growth of 43%

Brazil recorded a spectacular 43% increase in crypto transaction volume in 2025, a figure that places the country at the forefront of emerging markets. Indeed, each investor injected an average of more than 1,000 dollars, approximately 5,700 Brazilian reals, into digital assets. Moreover, digital fixed income products, such as Renda Fixa Digital (RFD), experienced a 108% growth, with 325 million dollars distributed.

Stablecoins, such as USDT, have seen their transactions triple, attracting those seeking to avoid the volatility of traditional cryptos. The Southeast and South regions, with São Paulo and Rio de Janeiro leading, still dominate the market. However, the Center-West and Northeast emerge as new hubs of activity, reflecting a democratization of access to digital assets.

Who Are the New Brazilian Crypto Investors?

The face of Brazilian crypto investors has radically changed in 2025. Young people under 24 represent a growing share of the market, with a 56% increase in one year. Yet, this trend is not limited to the young: institutional profiles and experienced investors are increasingly interested.

Diversification has become a key strategy. Indeed, nearly 18% of investors now hold multiple crypto assets, combining bitcoin, Ether, solana, and stablecoins. This approach reflects a growing market maturity, where speculation gives way to structured financial planning.

Bitcoin: Between Volatility and Safe-Haven Asset Status, a Brazilian Paradox

Despite a price drop to 87,998 dollars in 2025, bitcoin remains the most traded asset in Brazil. Why such enthusiasm for such a volatile crypto?

The answer lies in its unique status: both a speculative asset and a safe haven. Brazilians certainly see BTC as protection against inflation and monetary crises despite its fluctuations. Some experts even describe bitcoin as a distinct asset, endowed with a unique return profile and a potential hedging role.

Yet, stablecoins are gaining ground, offering a more stable alternative. This duality between volatility and safety illustrates the paradox of the Brazilian crypto market. BTC embodies financial freedom, while stablecoins meet the need for stability.

In 2025, Brazil confirms its position as a crypto leader in Latin America, with record growth and massive adoption. Yet, questions remain: can bitcoin remain a safe haven asset despite its volatility? Will regulation be able to govern this expansion without stifling innovation?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.