The United States Grants Unprecedented Banking Status to Five Crypto Companies

The Office of the Comptroller of the Currency has just opened a historic door for five major players in the crypto sector. Ripple, Circle, Paxos, BitGo, and Fidelity Digital Assets have received conditional approval to operate as national trust banks. A breakthrough that reshapes the contours of American finance.

In Brief

- The U.S. bank regulator (OCC) conditionally approved the banking charter applications of five major crypto companies.

- BitGo, Fidelity Digital Assets, and Paxos are converting their existing trust companies into national banks.

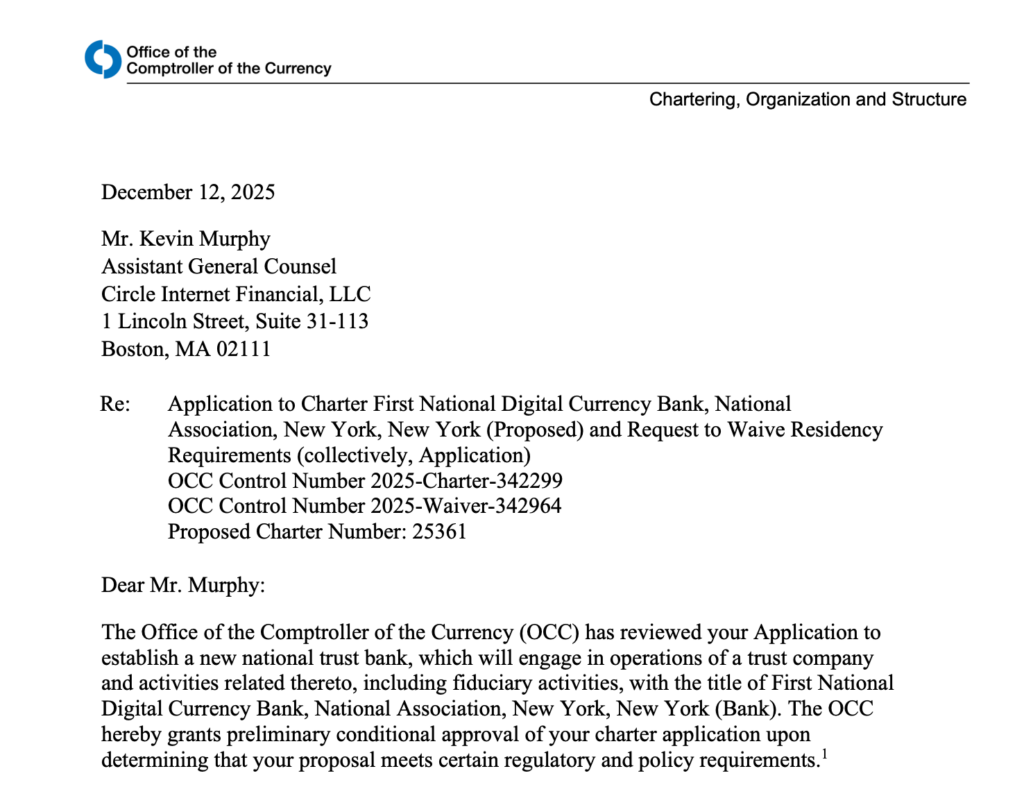

- Circle and Ripple are obtaining new charters to become federal trust banks.

- These approvals will allow custody of digital assets and, in some cases, the issuance of stablecoins.

Paxos, Circle and Ripple Join the Circle of Trust Banks

The Office of the Comptroller of the Currency (OCC) released on Friday a series of approvals marking a turning point. BitGo, Fidelity Digital Assets, and Paxos received authorization to convert their state trust companies into national banks. Circle and Ripple are starting directly with a new federal banking charter.

This decision radically transforms the status of these crypto players who previously operated in a more ambiguous regulatory zone.

For BitGo, Fidelity Digital Assets, and Paxos, this is a promotion. These three companies already operate state trust companies. Their new federal charter gives them enhanced legitimacy and direct supervision by the OCC. Circle and Ripple, however, start from scratch with entirely new applications.

The arrival of new players in the federal banking sector is a good thing for consumers, the banking sector, and the economy, said Jonathan Gould, Comptroller of the Currency. His message is clear: financial innovation deserves its place in the traditional banking ecosystem.

These approvals are not just administrative formalities. They will allow companies to offer digital asset custody services under strict federal supervision.

Paxos confirmed that its regulated platform will enable companies “to issue, custody, exchange, and settle digital assets with clarity and confidence.” The company notably retains the right to issue stablecoins, cryptocurrencies pegged to the dollar.

Divergent Strategies to Conquer Wall Street

The ambitions of the five companies go beyond obtaining a banking charter. BitGo is actively preparing for its IPO. The Securities and Exchange Commission (SEC) is currently reviewing its filing submitted in September.

The company aims for a listing on the New York Stock Exchange and claims about 90 billion dollars in assets under management. A valuation that reflects the sector’s growing maturity.

Circle has already passed this milestone. The USDC stablecoin issuer went public last May on the NYSE. This dual role – trust bank and publicly traded company – could become a model for other sector players.

In contrast, Ripple takes a different stance. Monica Long, the company’s president, ruled out any IPO idea in November. Paxos also has not communicated intentions in this direction.

One detail draws attention in the approval letters: Ripple will not be able to issue its RLUSD stablecoin under this banking charter. This restriction contrasts with the rights granted to Paxos and raises questions about the different regulatory approaches applied depending on the companies.

The movement far exceeds these five pioneers. Coinbase, the largest American exchange platform, filed its own application in October. The company however specifies that it has “no intention of becoming a bank” in the traditional sense. This nuance illustrates the varied strategies of crypto players in response to regulation.

The OCC is thus opening the doors to a new chapter for the crypto industry. By integrating these companies into the federal banking system, the regulator acknowledges the lasting place of digital assets in modern finance. It remains to be seen whether this regulatory trust will accelerate the long-awaited institutional adoption.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.