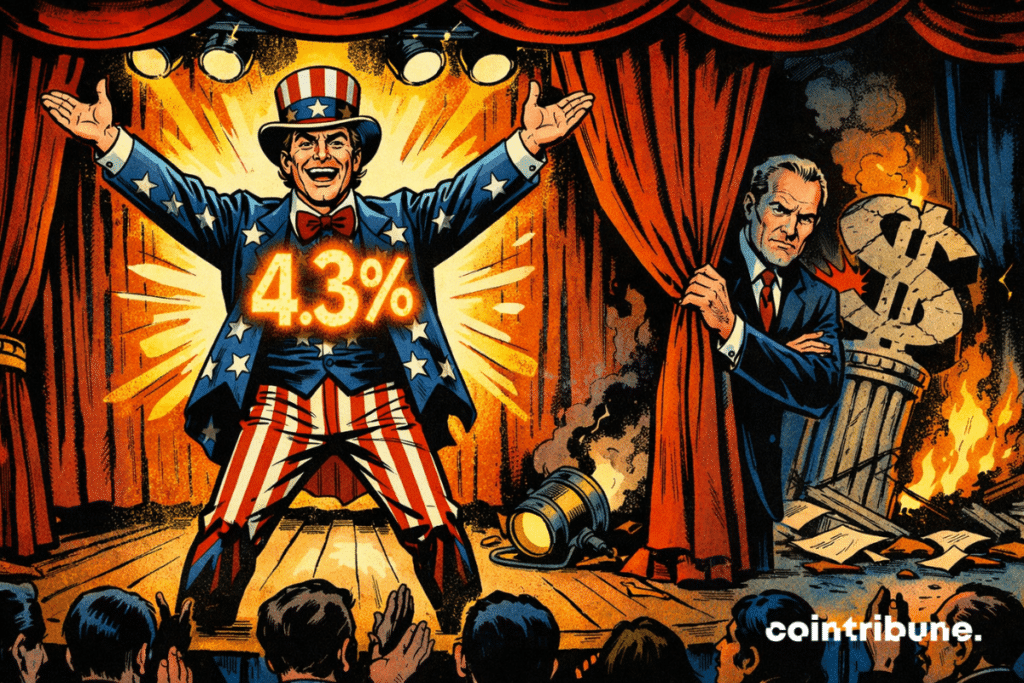

The U.S. Economy Beats Forecasts, but Peter Schiff Warns of a Troubling Flaw

The American economy surprises with a growth of 4.3%. This figure exceeds expectations and seems to reassure the markets. But behind this solid facade, Peter Schiff sees a trap.

In brief

- The growth of the American economy exceeds expectations, temporarily strengthening the confidence of financial markets.

- Peter Schiff warns of an illusion of stability, announcing a monetary crisis related to the dollar.

The American Economy Appears Robust

The latest US GDP figure exceeds the expected 3.3%. It currently stands at 4.3%. This performance supports financial markets and reassures investors. A rising GDP often implies a positive dynamic for risky assets, including cryptocurrencies. The ISM index also remains above 55, reflecting a high level of economic activity.

In this context, bitcoin reacts positively despite short-term volatility. During the bull cycles of 2017 and 2021, similar indicators preceded major crypto rallies. The logic is that a stable economy attracts capital toward cryptocurrencies, perceived as speculative assets.

But this reassuring reading could mask a more fragile reality. High interest rates, combined with persistent inflation, put pressure on households. Some economists remind us that such a context does not exclude a delayed recession.

Peter Schiff Debunks the Official Economic Narrative

For him, this growth masks deep fragility. He points to a loss of confidence in the American currency. The rise in gold and silver reflects, according to him, a flight to safe haven assets, a sign of growing rejection of the dollar.

Schiff also highlights rising debts, dependence on foreign capital, and a weakening of domestic savings. He believes that if the supremacy and confidence in the dollar collapse, it will trigger a wave of sales on US bonds. Added to this would be a spike in interest rates and a sharp drop in purchasing power.

This scenario would weigh heavily on the real economy. The cost of credit would increase, consumption would decline, and companies would face a shock to their revenues. Crypto-assets could benefit from this loss of benchmarks, strengthening their role as an alternative to traditional systems.

The current signals thus contradict each other. While the numbers applaud growth, Schiff anticipates a deep crisis. The coming months will tell if the American economy stays on course or slips into uncertainty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.