Tim Draper Sees Bitcoin Reaching $250K in Just Six Months

The price of Bitcoin (BTC) continues to generate strong interest from analysts and investors, with forecasts ranging from cautious to highly optimistic. Billionaire venture capitalist Tim Draper, a longtime supporter of the cryptocurrency, has renewed his bullish outlook for 2026. Draper expects Bitcoin to experience a major surge. The target? Potentially reaching his $250,000 mark within the next six months. Beyond that, he envisions Bitcoin eventually challenging the dominance of the U.S. dollar.

In brief

- Tim Draper expects Bitcoin to reach 250000 USD within six months, reaffirming his long-term bullish stance.

- Bitcoin is currently facing short-term pressures, including a drop below $90,000, ETF outflows, and low investor confidence reflected in the Fear and Greed Index.

- Despite these challenges, underlying market dynamics and ongoing accumulation by large Bitcoin holders indicate resilience and potential for recovery.

Draper’s Bitcoin Journey and Early Predictions

Tim Draper’s involvement with Bitcoin spans more than a decade, marked by both setbacks and foresight. He first purchased BTC at just $4 but lost his holdings in the collapse of the Mt. Gox exchange. Undeterred, he later acquired Bitcoin again through a U.S. Marshall’s auction, paying $632 per coin.

Draper has a history of accurately predicting Bitcoin’s trajectory. In 2014, when Bitcoin was trading at $180, he forecasted it would reach $10,000 within three years—a prediction many dismissed at the time. By 2017, BTC had indeed crossed that threshold, validating Draper’s view. He set his $250,000 goal in 2018, anticipating the cryptocurrency would reach this milestone by 2022. However, market crises, including the Terra-Luna collapse and the FTX downfall, delayed this timeline. By the end of 2022, BTC had fallen to roughly $16,000, forcing Draper to adjust his projections.

Past Drivers Behind Draper’s $250,000 Projection

At that time, Draper highlighted the influence of women, noting they accounted for approximately 80% of retail spending, and suggested that their adoption of Bitcoin could significantly drive demand and support market growth.

In 2025, Draper reinforced his $250,000 projection, citing improved conditions for Bitcoin adoption. He emphasized that the pro-crypto policies under President Trump and increasing interest from companies holding Bitcoin on their balance sheets had created a more supportive environment. According to Draper, past policy barriers had slowed progress, but these improvements now put BTC back on track toward his long-term target.

Bitcoin’s Long-Term Potential Faces Short-Term Hurdles

Beyond price targets, Draper has suggested that Bitcoin could eventually rival the U.S. dollar. He predicts that network growth and broader adoption could drive Bitcoin’s value toward $10 million before it starts replacing the dollar in daily transactions. In contrast, he sees the dollar gradually losing influence, while Bitcoin continues to expand its reach.

Despite this optimism, Bitcoin itself is currently experiencing short-term challenges that suggest caution

- The cryptocurrency recently slipped below $90,000 as price pressures persist.

- The U.S. BTC spot ETF has recorded outflows for three consecutive days.

- Market sentiment also appears cautious, with the Bitcoin Fear and Greed Index reading 20, indicating that overall investor confidence remains low

Market Activity and Accumulation

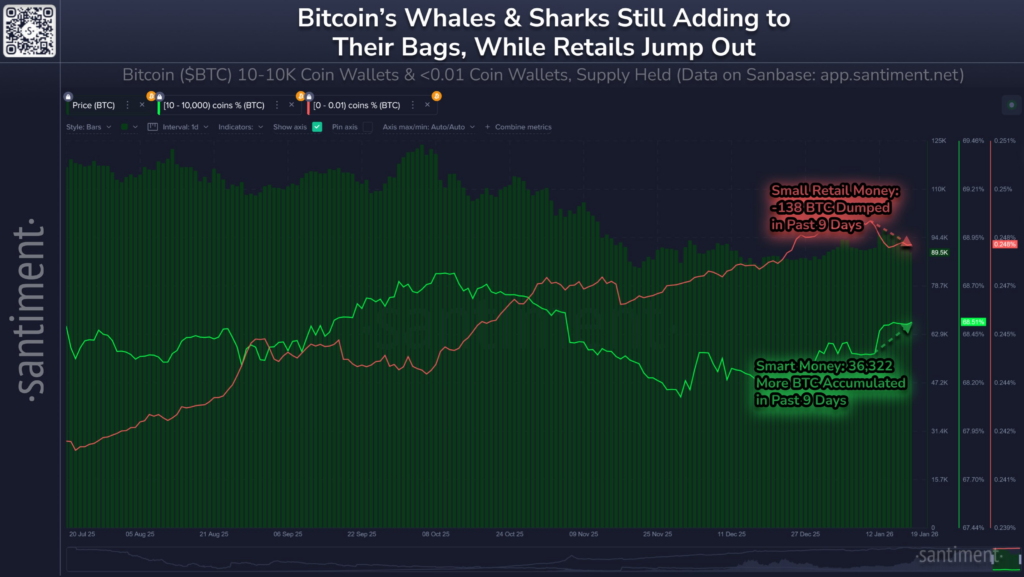

While retail investors show signs of reducing exposure, larger Bitcoin holders are accumulating. Addresses holding between 10 and 10,000 BTC added over 36,000 coins in a nine-day span, while wallets with less than 0.01 BTC sold a small portion of their holdings. Market analytics firm Santiment notes that this divergence—experienced investors accumulating while retail participants sell—has historically aligned with longer-term bullish trends.

This pattern suggests that despite current volatility, underlying market dynamics remain constructive for BTC’s growth. Draper’s bullish stance, combined with strategic accumulation by large holders, could set the stage for renewed upward momentum in 2026.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.