Traders Bet on a Pivot from the Fed

Everyone is eagerly awaiting the Federal Reserve (the U.S. central bank) to start lowering its rates. This is what traders are currently betting on. However, can we expect a pivot anytime soon? What are the consequences that can be associated with a pivot? This is what we are going to look at in detail here.

What does a central bank pivot mean?

Before we go any further, let’s first define the principle of a pivot. Rates are used as a tool by central banks to manage monetary policy. They have two main mandates: price stability and full employment. They will then maneuver their monetary policy according to the situation through these two mandates.

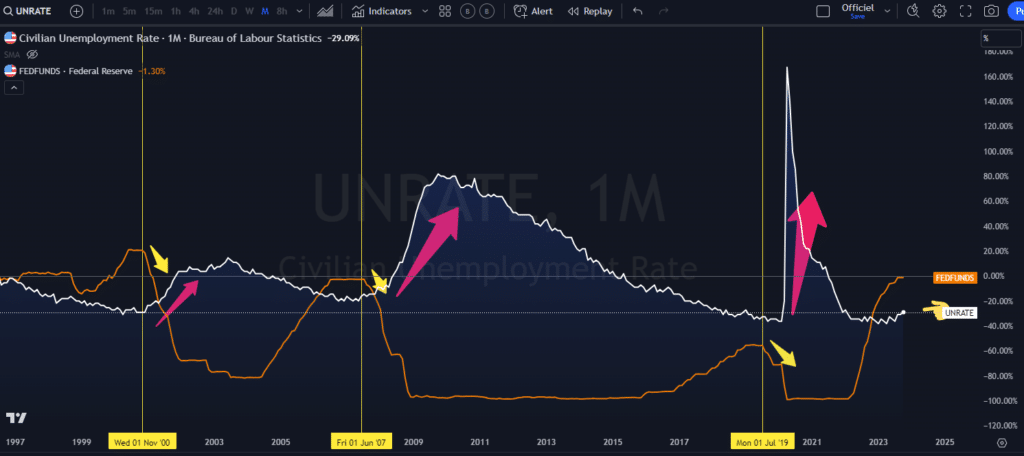

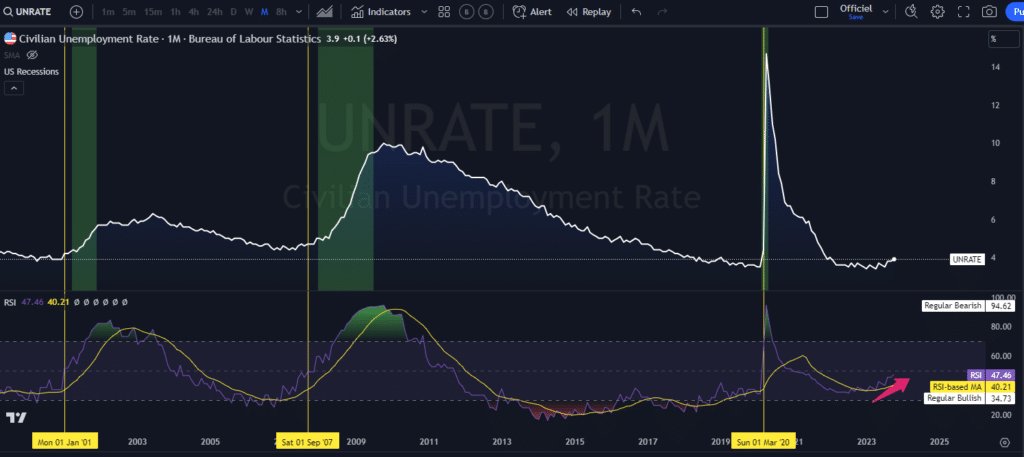

Example: when inflation is too high, it will increase the key interest rates in order to slow down inflation. It thus becomes less accommodative. On the other hand, when the unemployment rate increases, or the level of inflation is too low (deflationary pressure), it will lower its rates to stimulate growth again. Here is the example of the rise in unemployment and the lowering of the Fed’s key rate:

Within this context, the central bank may increase rates, decrease rates (pivot), or pause. A pause is not a pivot but just a cessation of rate hikes for a period. A pivot is a significant change in monetary policy.

In another register, central banks have other tools such as the quantitative tightening and quantitative easing programs (liquidity injection), but we will focus more on the rates in this article.

Traders betting on a Fed pivot

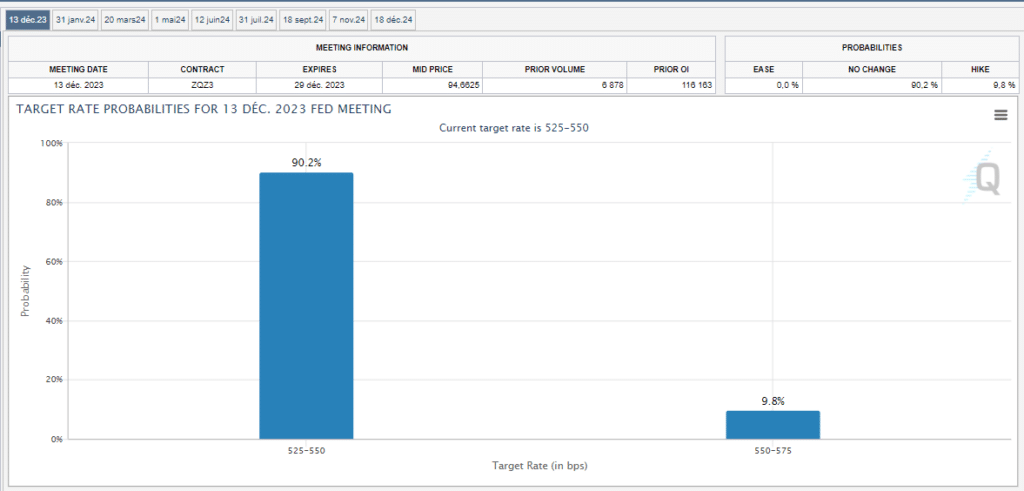

In terms of probability, the projections for the next FOMC (Federal Reserve meeting) are on the side of a continuation of the pause. Moreover, the U.S. central bank has kept its rate at the same level for several months now, which means we are still in a “pause”.

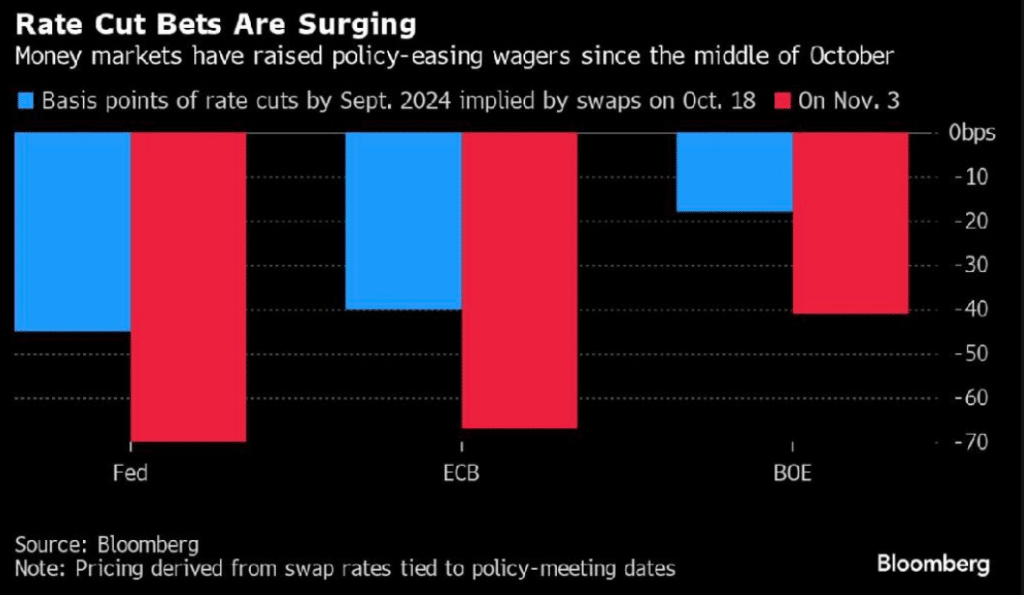

This same dynamic shows traders betting on a pivot by the Fed, but also by the European Central Bank and the Bank of England. This can be seen in the pricing of swaps:

Why bet on a pivot?

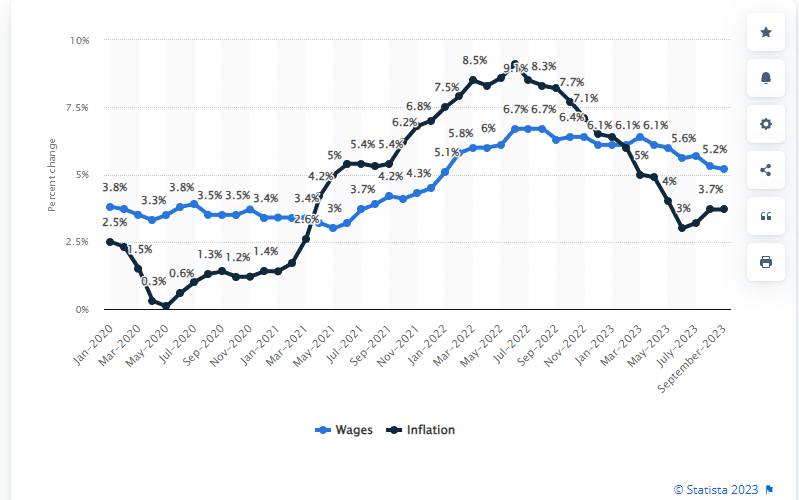

In the past, a pivot resulting in a rate cut is not always a sign that everything is fine and that we will have a soft landing. Generally, when betting on a pivot, it’s because one either thinks inflation will fall towards the target level supported by an economic slowdown or that one bets on a bigger consequence of the business cycle such as an unemployment increase. A rise in unemployment risks triggering the second mandate of central banks, namely the maintenance of full employment. Currently, we know that inflation remains resilient as long as the job market remains resilient. Let’s say wage growth maintains a certain standard of living for consumers. For example, wage growth remains above the level of inflation, which fuels consumption.

Therefore, we want to know if there is any fragility in the job market that could in turn affect consumption. The unemployment figures have gone from 3.4% to 3.9% since the last lows, an increase of 0.5% over the past 6 months. From a technical perspective, this trend is significant as we can see an upward acceleration through momentum indicators. In the past, we can see that each acceleration has a higher probability of preceding a recession:

It is primarily for this reason that operators are starting to bet on a pivot for 2024. Maintaining currently high rates allows the central bank to remain restrictive, since the key rate is higher than the inflation rate. However, the Fed often reminds in its rather hawkish (restrictive) speech the “higher for longer”, meaning to keep rates high for a long time. That said, as economic growth remains in “slowdown” mode, this ability to absorb high rates will eventually run out without an economic rebound. We can see this in the unemployment rate change.

Market performance after a pivot

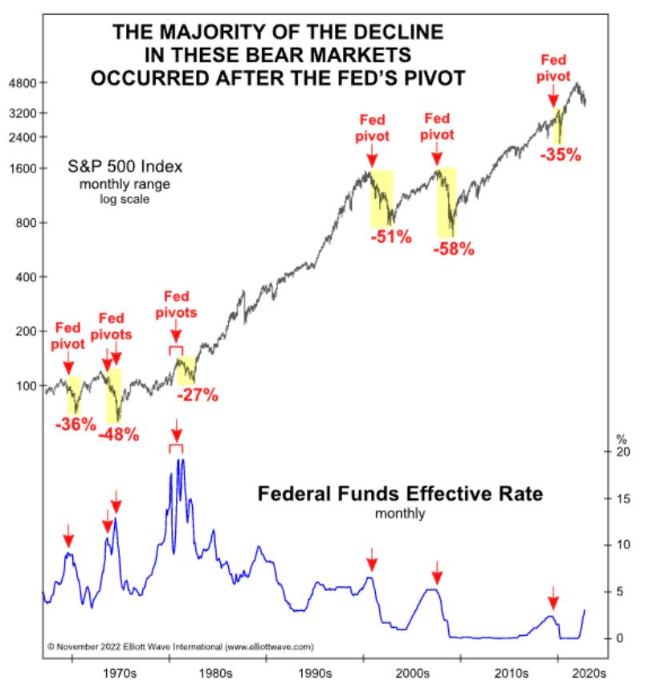

Historically, when the Fed proceeds with a pivot, it’s not always a good sign for financial markets. Given that there is an underlying reason for a pivot such as a rise in unemployment, a liquidity crisis, or a deflationary process, this can have repercussions on financial markets. Here is an example by looking at the variation of the S&P500 as well as the change in the key interest rate:

The S&P500 is a collection of companies. It’s the most watched index since it includes all sectors. Therefore, it is supposed to represent the health of the economy. Even if there can be lags between the two, either between the economy and the financial markets, it often ends up rebalancing. For example, we know that the mega caps, which have a significant place in the index, have stimulated the performance of the S&P500 a lot in 2023. The stock market is above all a supply and demand market, and as the mega caps hold a lot of cash, they have served as a temporary defensive placement. Other mechanisms also explain the gaps, such as operators’ sentiment, the structure and operation mode of derivatives on options, significant flows from CTA…

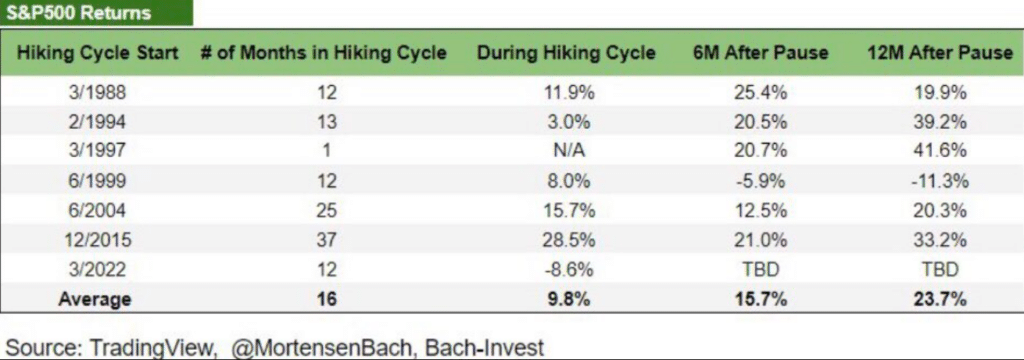

Performance of the S&P500 during a pause

On the other hand, during a pause by the central bank, or simply the anticipation of a pause, financial market performances are promising, hence the performance of the first half of the year. A pause is probable when the central bank believes it has been sufficiently restrictive in terms of rate hikes. The pause allows it to wait and see the often delayed consequences of rate hikes. Here is an example of the performance of the S&P500 after a pause:

Financial markets tend to rebound and react positively as soon as traders bet on a pause or a rate cut next year. Until now, we were a bit like in the dynamic “buy the rumor of a pivot, and sell the news of a pivot”. That said, if traders are betting on a real pivot, when the market realizes that it is no longer a question of rumor but reality, it could react more negatively since in the past, a pivot is not always a good sign. Everything will depend on the job market.

Are there risks of recession in 2024?

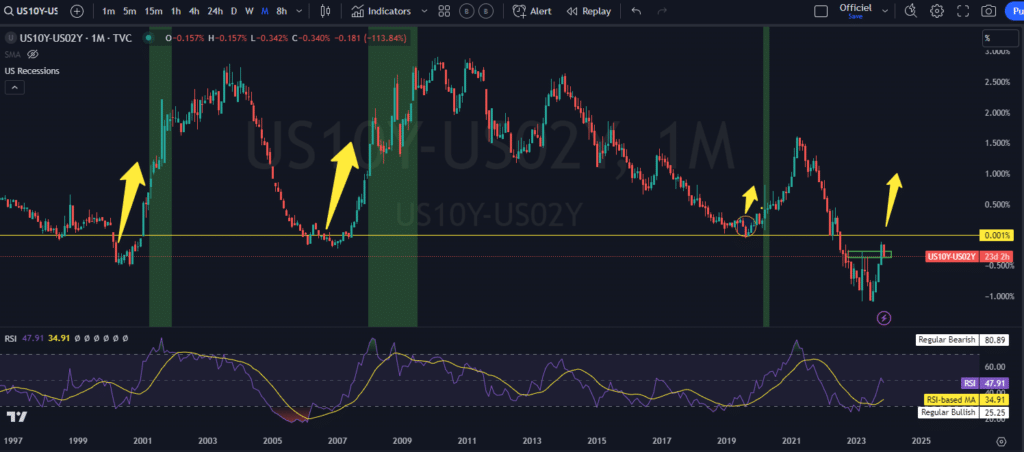

We have several leading indicators that highlight an increase in the probabilities of recession. For example, we have the inverse yield curve. The inversion itself is not the most dangerous signal; it is rather when it bounces back after the inversion that it becomes more problematic (see chart below). Here on the chart, the rebound of the curve since this summer. The curve is close to returning to positive territory.

That being said, the risks of recession have often been postponed since 2022. Wage growth as well as a quite resilient job market so far have pushed these risks to later. Even if probabilities remain high in theory based on leading indicators, trying to time a recession remains quite difficult in practice.

Conclusion

We know that we are still in an economic slowdown and this is likely to continue in the coming months. The sheer fact of wanting to maintain high rates while we are in an economic slowdown is a key element in saying that it risks weakening the economy further. As previously explained, we are starting to see repercussions and fragilities, especially when looking at unemployment. Consequently, the dice are thrown by traders to bet on a pivot in 2024.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.