Traders Map Bitcoin’s 2026 Risk-Reward With $84M in Bets

Traders are placing sizable bets on Bitcoin’s path through 2026 across leading prediction platforms. Activity on Polymarket, Kalshi, and Myriad suggests a market that expects gradual progress rather than a rapid breakout. More than $84 million in combined volume across seven contracts reflects cautious optimism, balanced by consistent hedging against downside risk. While confidence appears to build later in the year, near-term expectations remain restrained.

In brief

- Polymarket prices a 45% chance of $75K Bitcoin in February 2026.

- Markets assign roughly 40% odds to $100K Bitcoin during 2026.

- Downside hedging appears strong, including positioning near $15K.

- Myriad contract slightly favors $55K before $84K in thin trading.

Traders Hedge Hard as Bitcoin’s 2026 Price Outlook Remains Cautious

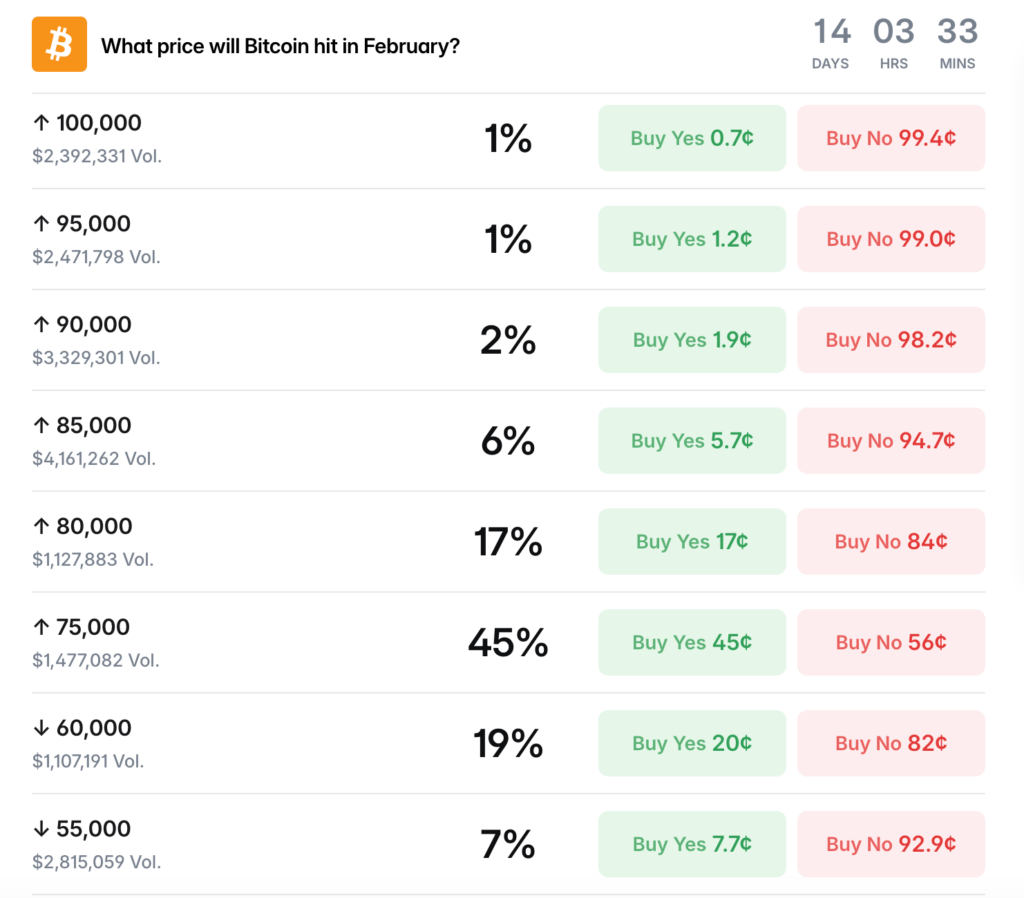

One of the most active contracts on Polymarket asks what price Bitcoin will reach in February 2026. The market resolves “Yes” if any one-minute Binance BTC/USDT candle high touches a listed level during the month. With nearly $61 million in volume, it ranks among the most liquid crypto-related prediction markets currently trading.

Pricing indicates a roughly 45% chance of reaching $75,000. That probability falls to about 17% at $80,000. Beyond that level, expectations fade quickly: $85,000 carries around a 6% likelihood, while $90,000 drops near 2%. Six-figure targets for February are priced at roughly 1% or less, signaling limited belief in a sharp near-term surge.

Trading activity clusters around key psychological levels. Positioning is concentrated near $85,000 on the upside, while $55,000 and $50,000 attract meaningful interest on the downside. Rather than committing to one direction, traders appear to be preparing for both breakout and pullback scenarios.

Several factors help explain how participants are pricing these contracts:

- Volatility remains elevated, encouraging short-term hedging.

- Macro uncertainty continues to influence risk appetite.

- Liquidity concentrates around round-number price levels.

- Traders structure positions to protect against sharp downside moves.

A broader Polymarket contract tracks whether Bitcoin will reach specific price levels before Jan. 1, 2027. Markets currently assign roughly a 40% probability to Bitcoin reaching $100,000 in 2026. Likelihood declines progressively above $110,000, and distant targets such as $250,000 hover near 5%, reflecting limited conviction in extreme upside scenarios.

Kalshi Data Shows Gradual Build in Bitcoin Six-Figure Expectations

Interestingly, notable volume also appears at very low levels, including around $15,000. This positioning likely represents tail-risk hedging rather than outright bearish conviction. Participants appear willing to pay for protection against severe downside events while maintaining upside exposure.

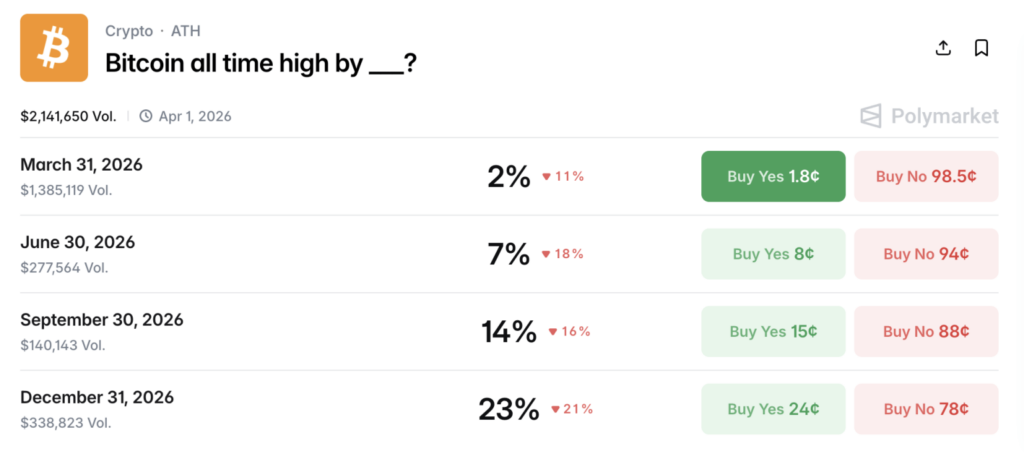

Another timeline-based contract evaluates whether Bitcoin will set a new all-time high by various 2026 deadlines. Near-term odds remain modest—about 2% by March and roughly 7% by June. By Dec. 31, the implied probability rises to around 23%. The gradual increase suggests expectations for a slow recovery rather than a swift rally.

Kalshi offers annual threshold contracts using the CF Bitcoin Real-Time Index as a reference. Traders assign close to a 39% chance that Bitcoin trades above $99,999.99 during 2026. Probabilities step down at $110,000 and $120,000, reinforcing the view that six-figure prices are possible but not widely considered imminent.

A separate Kalshi contract tracking when Bitcoin might reclaim $100,000 outlines a time-based progression. Markets price roughly a 17% chance before May, 24% before June, and 29% before July. Confidence builds as the calendar advances, though without sharp acceleration.

Seven Contracts Point to Measured Recovery Path

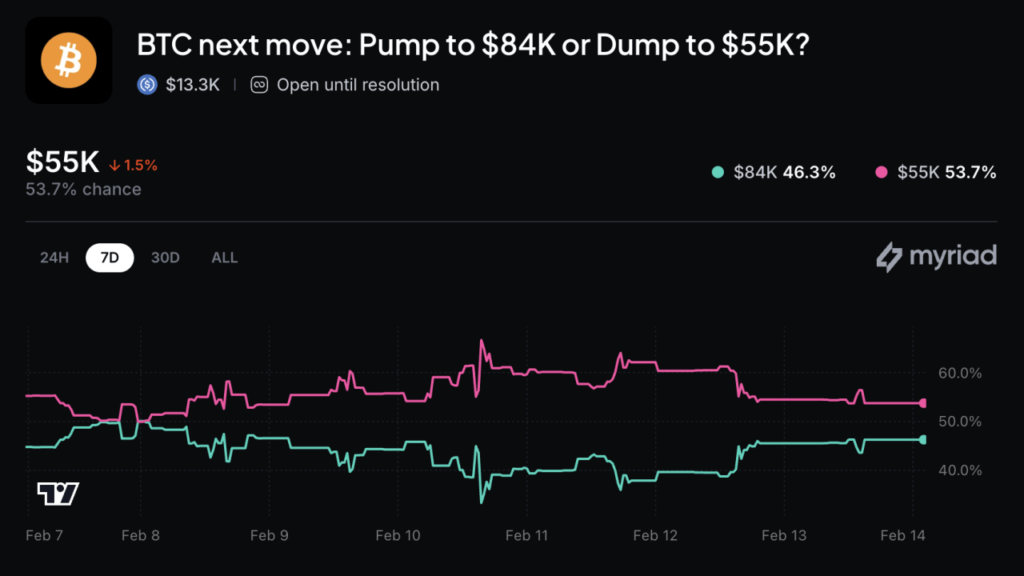

On Myriad, a path-dependent contract asks which level Bitcoin will hit first: $84,000 or $55,000. Current pricing slightly favors $55,000 at roughly 54%, compared with about 46% for $84,000. However, with only around $13,000 in volume, the contract remains thin and could reprice quickly if larger participants enter.

Several structural features of prediction markets help explain these patterns:

- Prices reflect collective positioning, not guaranteed outcomes.

- Thin liquidity can amplify moves in smaller contracts.

- Multi-outcome markets distribute capital across multiple strike levels.

- Traders often hedge across platforms rather than rely on a single contract.

Across all seven contracts, restraint defines the broader picture. Markets are not pricing an imminent breakout to new highs, yet they are also not dismissing upside potential. Moderate appreciation remains plausible, paired with clear recognition of downside risk.

Prediction platforms offer sentiment snapshots at specific moments in time. With millions of dollars committed across Polymarket, Kalshi, and Myriad, current pricing provides a detailed look at how traders are mapping Bitcoin’s risk-reward profile for 2026: measured, hedged, and gradually constructive rather than euphoric.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.