Trump announces a historic shift for the Fed: Is Bitcoin ready?

Donald Trump’s announcement about the future direction of the Fed shakes the markets. With the promise of “much lower” interest rates, bitcoin and cryptocurrencies could enter a new era. But between speculation and uncertainty, where to position yourself?

In brief

- President Trump announces a new Fed leader favorable to a significant cut in interest rates.

- Despite current volatility, crypto markets remain stable, speculating on the impact of a more accommodative Fed, historic for boosting bitcoin demand.

- A looser monetary policy and a more favorable regulatory environment could propel bitcoin, often correlated with rate cuts.

Trump promises a new very accommodative Fed chair

Donald Trump recently stated that the next Fed chair will significantly reduce interest rates. This statement comes as Trump holds multiple interviews to appoint Jerome Powell’s successor, whose term ends in May 2026. Among the candidates, Christopher Waller, Fed governor and cryptocurrency supporter, and Kevin Hassett, director of the National Economic Council, stand out.

In a speech, Trump emphasized that the new chair will be someone who believes in “much lower” rates. A promise aimed at restarting the economy and easing financial market tensions before the 2026 midterm elections. This appointment is crucial, as it could redefine U.S. monetary policy for the years to come.

Trump’s remarks immediately sparked reactions. The markets await official confirmation, but speculation is rife. One thing is certain: this appointment could mark a turning point for the economy and cryptocurrencies.

Volatility and uncertainty: where to position while awaiting Trump’s official announcement?

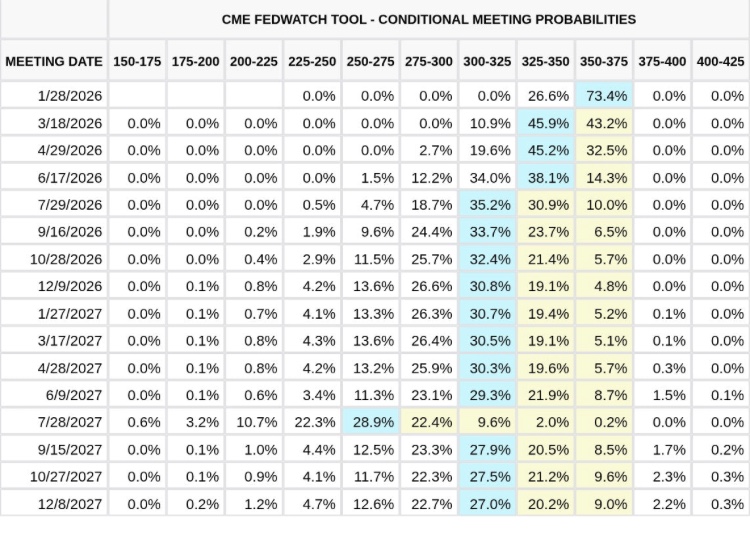

Bitcoin and cryptos remain stable, but volatility persists. Investors are waiting for the official appointment of the new Fed chair, creating an atmosphere of uncertainty. CME Group’s FedWatch Tool indicates a 73.4% probability that the Fed will not cut rates next month, but speculation on an accommodative shift after the appointment fuels debates.

Crypto traders and analysts adopt a cautious approach. Some see this period as a buying opportunity, while others prefer to wait to avoid risks. Macro indicators remain mixed, and a late announcement or unexpected appointment could trigger sharp market movements.

In this context, investors must remain vigilant. Current volatility reflects anticipation and expectation, but also fears of a market on hold. Where to position yourself? The answer will largely depend on Trump’s final appointment and the new Fed leadership’s first actions.

Bitcoin, the big winner of a more flexible Fed?

If the new Fed chair significantly cuts rates according to Trump, bitcoin could be the big beneficiary. Historically, BTC performs well during monetary easing cycles, often seen as a hedge against inflation and a store of value. Experts like Tom Lee from BitMine believe a change in Fed leadership could support a broader crypto market recovery in 2026.

Moreover, a Fed more open to cryptocurrencies would favor institutional adoption of BTC, strengthening its position in financial markets. However, risks persist. But if the low-rate promises materialize, bitcoin could well enter a new growth phase. Investors must still be cautious, as markets remain sensitive to announcements and monetary policy changes.

Trump’s announcement about the Fed’s future direction could mark a turning point for bitcoin. Between promises of low rates and uncertainties, markets are eagerly waiting. If speculations come true, BTC could be the big winner. But in such a volatile environment, one question remains: how should investors prepare for this new era?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.