U.S. Jobs Report Sparks Market Volatility as Bitcoin Surges and Stocks Slip

Reports from the U.S. labor market sent shockwaves through the financial space, prompting risk assets like Bitcoin to experience sharp price swings. With job data for August coming in lower than expected, predictable alarms erupted regarding a looming recession, which could drive fresh appetite towards risk assets.

In brief

- August jobs data showed just 22,000 payroll gains, far below forecasts, raising alarms over a weakening U.S. economy.

- Unemployment rose 4.3% as layoffs surged, highlighting cooling labor demand and increasing recession risks.

- Bitcoin spiked above $113K before retreating, while Ethereum and gold also saw major price moves after the report.

- Traders now see an 88% chance of a Fed rate cut, with Bank of America predicting two cuts this year to stabilize the economy.

Labor Market Weakness Triggers Recession Fears

BTC, alongside other crypto assets, recorded volatile price movements on Friday as reports from the U.S. Bureau of Labor Statistics revealed that only 22,000 nonfarm payrolls were added to the economy in August, about 70% below the predicted figure of 75,000.

Data also shows that the unemployment rate surged to 4.3% in August, up from 4.2% the previous month. Another concerning data point from Bloomberg further highlights this drop in the U.S. workforce strength. According to the international news agency, American companies announced just 1,494 new jobs last month—the lowest tally in the past 16 years.

Layoffs climbed by 39% to 85,979 as unemployed Americans outnumbered available jobs. The weak job reports suggest that businesses are likely holding off on hiring, which typically signals weak demand and slowing activity.

Notably, the three-month average shows a sharp drop, which aligns with the current cooling trend in the labour market. Experts warn that this ongoing trend can affect consumer spending and overall growth, thus fueling recession risk.

Following the release of the labour report, Bitcoin rose to $113,000 before dropping to around $110,736 at the time of writing. Ethereum also dropped to $4,300, while gold hit a record $3,580 during the same period.

Meanwhile, the stock market indices S&P 500 and Nasdaq fell by 0.8% and 0.6%, respectively. The Dow Jones Industrial Average dropped 363 points after touching a fresh high earlier on Friday.

Sluggish Jobs Data and Fed Cut Bets Boost Bitcoin Outlook

Zach Pandl, head of research at Grayscale, believes that the latest economic report could bode well for cryptocurrencies like Bitcoin—assuming stocks and other risk assets hold up. He also noted that reports such as the labor data would likely trigger tension over a possible recession fueled by reduced immigration numbers.

We know stocks fall in a recession, but they may not fall in a sluggish labor market driven by immigration cuts. We know that reduced immigration has played a big role, and the slowing jobs market is not just about firms pulling back on hiring or on labor demand.

Zach Pandl

Fed Chair Jerome Powell also admitted to the steep drop in immigration in the past months. During a speech in Jackson Hole, Powell explained that the labor market had reached a point of sluggish demand and supply for workers—a sign of further negative movements for the system.

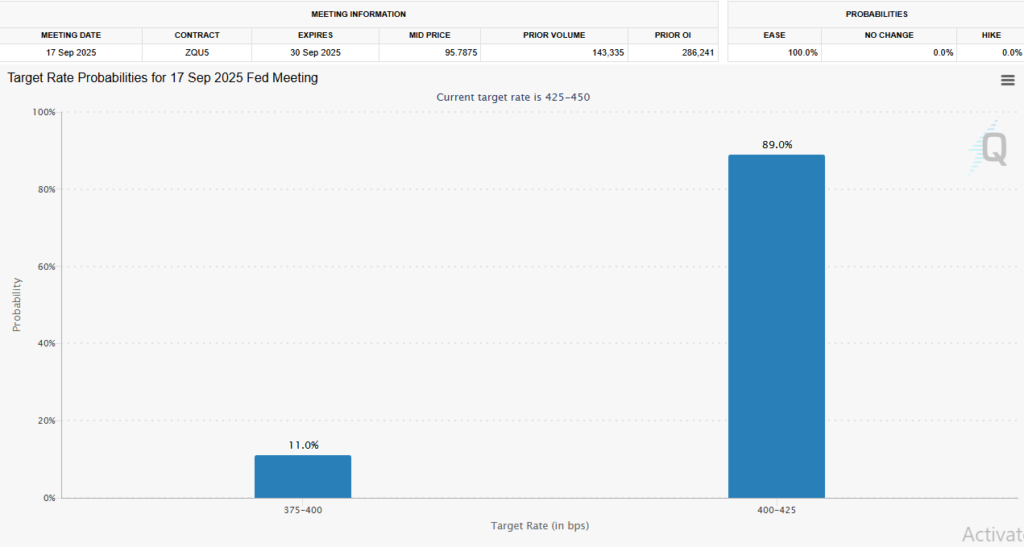

With weakening economic scores, traders are increasingly confident about a possible rate cut. According to CME FedWatch, markets assigned an 89% chance of a quarter-point rate cut and an 11% chance of a larger half-point cut.

Bank of America also revised its earlier forecasts, predicting the Fed to slash interest rates twice this year. While the recent jobs report marks a key point in the US economy, it also fuels a strong narrative for risk assets like Bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.