US Bitcoin Spot ETFs See $1.875B Outflows as Fed Holds Rates Steady

US Bitcoin spot exchange-traded funds (ETFs) have experienced substantial outflows over the past eight trading days, with withdrawals totaling billions of dollars in the run-up to the Federal Reserve’s latest policy announcement. The pattern reflects growing caution among institutional investors amid ongoing market pressures.

In brief

- US Bitcoin spot ETFs have seen total outflows of approximately $1.875 billion over the past eight trading days.

- The largest single-day withdrawal reached $708.71 million on January 21, marking the biggest outflow this year.

- The Fed has kept interest rates steady, signaling a pause in rate cuts while maintaining broader policy uncertainty.

Week of Heavy ETF Withdrawals

From January 16 through the past eight full trading days, US Bitcoin spot ETFs recorded total outflows of approximately $1.875 billion. SoSOValue reported that the largest single-day withdrawal occurred on January 21, reaching $708.71 million—the biggest outflow of the year so far.

Bitcoin itself has struggled in this period, down 11% over the last 13 months and more than 30% below its October all-time high. Cauê Oliveira, a contributor at CryptoQuant, observes that on-chain demand is weakening while retail participation continues to decline, highlighting a cautious and risk-averse market. He adds that fears of a possible US government shutdown are adding pressure, as such an event could tighten the flow of liquidity across markets.

Concurrently, the unwinding of Japan’s carry trade is reducing outbound liquidity, further tightening market conditions. Oliveira notes that a stronger recovery would likely require improved sentiment and renewed retail activity on-chain.

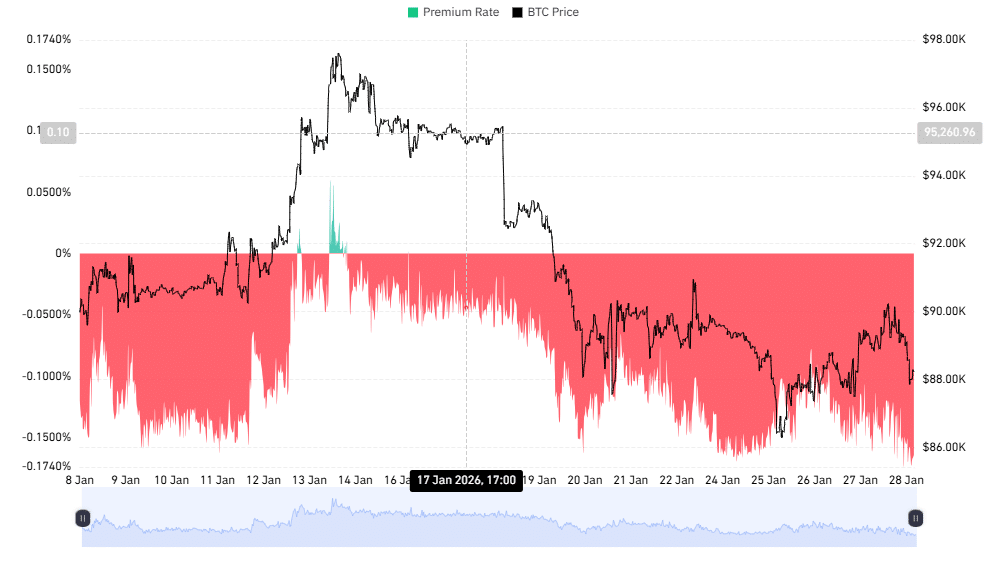

The Coinbase Bitcoin Premium Index, which monitors Bitcoin demand from US traders on the exchange, reinforces this cautious backdrop. Data shows muted buying activity in the US, with only occasional short-lived upticks in premium, indicating pockets of optimism but overall institutional restraint.

Fed Pause Signals Consolidation for Bitcoin

These ETF outflows unfolded ahead of the Federal Open Market Committee (FOMC) decision, showing that institutional caution had already been building before the macro picture became clear. The Fed ultimately opted to pause its rate-cutting cycle, keeping interest rates at 3.50%–3.75%. While this removes immediate policy uncertainty, it signals that interest rates will stay steady for now, which may continue to weigh on speculative assets like Bitcoin.

Analyst Ali Martinez points out on X that Bitcoin often faces heightened volatility during FOMC weeks. Historically, the asset tends to dip following announcements, even though traders often hope for positive outcomes from rate cuts.

Taken together, the recent ETF outflows, muted on-chain activity, and the Fed’s policy stance indicate a phase of consolidation rather than strong upward momentum for Bitcoin. Traders will be monitoring whether renewed retail participation and improving sentiment can spark a rebound in the coming weeks, especially as the Crypto Greed and Fear Index currently reads 26, underlining the cautious mood among investors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.