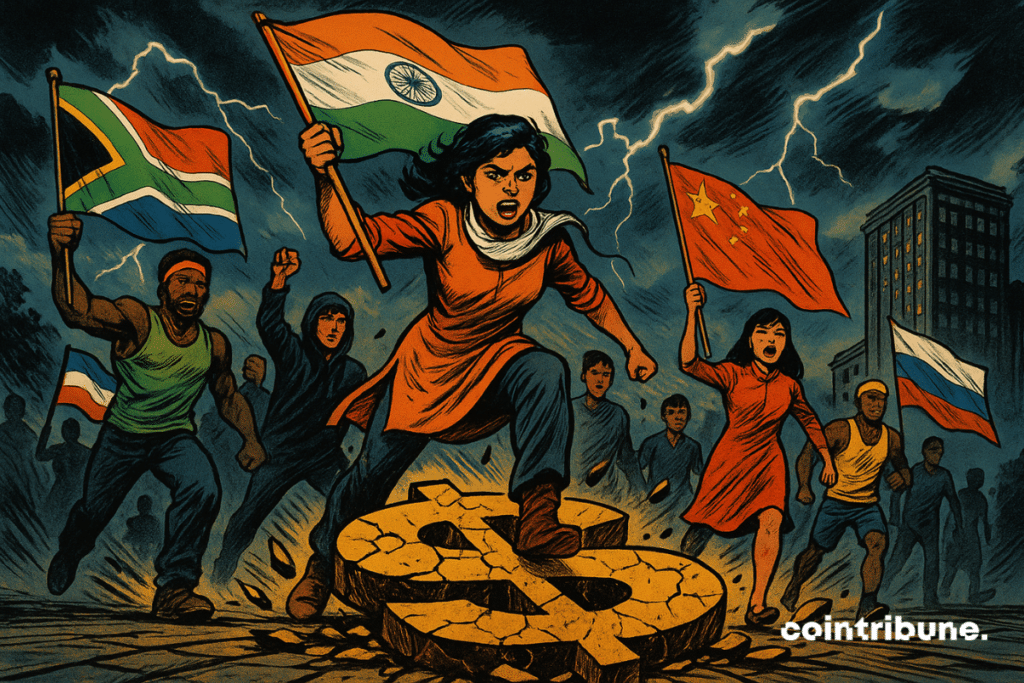

U.S. Tariffs vs BRICS: Could This Be the Dollar’s Breaking Point?

Donald Trump’s announcement of 10% tariffs on BRICS countries reignites a strategic debate: are the United States risking accelerating dedollarization by trying to defend its leadership? Behind this trade offensive lies a deeper fracture, where emerging powers seek to break away from the dominance of the greenback. As geo-economic tensions intensify, the question arises: is Washington actually hastening the challenge to the monetary order it strives to maintain?

In Brief

- The United States is considering imposing a 10% tax on imports from BRICS countries, a decision announced by Donald Trump.

- Economist Igbal Guliyev warns of the risks of such a measure, which he believes could accelerate dedollarization globally.

- The BRICS are responding by consolidating a parallel financial architecture aimed at reducing their dependence on the dollar and Western systems.

- Beyond trade exchanges, the tensions reflect a geopolitical realignment challenging the dollar's historical dominance.

Tariffs: The Announcement That Fractures

While Trump has threatened the BRICS with an unprecedented trade war in recent days, tensions rose another notch on July 10th when economist Igbal Guliyev, affiliated with MGIMO University in Russia, warned about the impact of an American tariff plan targeting members of the BRICS bloc.

Responding to Donald Trump’s announcement of a 10% tax on exports from the group’s countries, Guliyev stated: “the BRICS countries are rapidly forming a parallel architecture in the financial, technological and institutional areas, thereby challenging the existing status quo and the dominance of the dollar.”

These remarks highlight a fracture that goes beyond commerce alone, touching on the central issue of global monetary power.

For the Russian economist, this tariff offensive is not just an economic dispute. He sees it as part of “a general geopolitical realignment dynamic.” Far from isolating its targets, Washington could instead accelerate their strategic coordination. Several concrete elements illustrate this perspective:

- The BRICS are organizing around a systemic alternative to the current architecture, dominated by the dollar;

- Efforts are already underway to bypass the SWIFT system, considered too dependent on Western interests;

- China has denounced these tariffs as a form of “economic coercion,” confirming an open fracture line;

- The BRICS are not reacting in isolation or on impulse but are developing a coordinated, long-term response.

This strategy could mark the beginning of a profound questioning of the current global economic order, according to Guliyev, who believes economics will soon be inseparable from global geopolitical stakes.

Toward a Structural Alternative to the Dollar?

The rise of a multipolar financial system is no longer a mere theoretical scenario. Igbal Guliyev emphasizes that the BRICS countries could respond to this American offensive in a structured and proactive way: “The reaction of the BRICS countries will probably be not only tit-for-tat, but also strategically thought out – from accelerating de-dollarization to creating a new system of international settlements.”

These remarks reveal a long-term posture, where the goal is less about retaliation than emancipation.

Concretely, several signals indicate this transition is already underway. China has publicly labeled the tariffs as “economic coercion,” and discussiwfons about payment systems independent of Western standards are multiplying.

According to Guliyev, “the world is entering a period of turbulence, where non-economic factors will increasingly determine the economic future.” This phrase underscores the growing intrusion of politics into international economics and the rise of an alternative order.

By bypassing traditional networks like SWIFT and developing their own settlement methods, the BRICS are creating the conditions for a monetary ecosystem independent of the dollar. In the medium term, this could weaken the United States’ capacity to use its currency as a tool of geopolitical influence. If the US hoped to contain the rise of emerging powers, it risks instead accelerating a global monetary decoupling dynamic. The question remains whether this shift will occur peacefully or through confrontation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.