Essential Crypto Updates: Bitcoin, Binance, Ethereum, Solana, and More!

Here’s a summary of the most impactful news from the past week about Bitcoin, Ethereum, and Solana, etc., a journey to the heart of the innovations and debates that have animated the crypto sector in recent days.

Bitcoin Climbs to 8th Rank of Global Assets!

Bitcoin achieves a historic feat by surpassing silver to become the 8th most important financial asset in the world. This meteoric rise is driven by an impressive increase of more than 60% in its value since the beginning of the year. Bitcoin’s market capitalization has thus reached over 1,400 billion dollars, an absolute record for cryptocurrency.

The key factor in this exceptional growth lies in the resounding success of Bitcoin spot ETFs, which have attracted billions of dollars in investment since their approval. Analysts remain optimistic, considering a possible rise beyond the capitalizations of giants like Google and Amazon if Bitcoin exceeds the respective thresholds of $85,000 and $94,000. This remarkable performance signals unexplored growth potential for Bitcoin, despite market volatilities.

Ethereum Ushers in the Near Zero-Fee Era with Dencun

Ethereum reaches a major milestone with the rollout of Dencun, a significant update aimed at drastically reducing transaction fees. This advancement, the result of several years of development, promises to revolutionize user experience by making transactions on Layer 2 (L2) scaling networks almost free. The introduction of Proto-Danksharding, the central element of this upgrade, marks a giant leap towards improving Ethereum’s scalability and financial accessibility, offering a viable alternative to the prohibitive costs associated with transactions.

Proto-Danksharding, conceptualized by Vitalik Buterin, redefines the way data is processed on Ethereum, thus allowing parallel processing and greatly increasing the network’s transaction capacity. This technical innovation aligns with Ethereum’s long-term vision of achieving unprecedented scalability, capable of supporting millions of transactions per second with no perceptible fees for users. Dencun and Proto-Danksharding are just the first steps towards full Sharding, which aims to accommodate hundreds of scaling networks for truly unlimited scalability, paving the way for a new era for Ethereum and blockchain.

Solana Reaches a Capitalization of 82 Billion Dollars

Solana, the blockchain known for its speed and efficiency, has made history by reaching a staggering market capitalization of over 82 billion dollars, establishing a new record for the ecosystem. This impressive milestone comes after Solana overcame challenges posed by the collapse of FTX, showing not only resilience but also growing adoption by giants such as Shopify and Visa. Solana’s valuation, now in the fifth rank of digital assets in terms of market capitalization, reflects its potential as a serious competitor to Ethereum, offering a faster and more cost-effective alternative.

The significant increase in SOL’s price, which is trading around 200 dollars, and its impressive growth of 5.63% in 24 hours and 31.74% over a week, highlight the growing appeal for Solana. Its success among traders of memecoins, seeking low transaction fees, as well as the growing recognition of its technology, contribute to its rise.

The Increasing Challenge of Bitcoin Mining

Despite a cryptocurrency market characterized by significant volatility, the difficulty of mining Bitcoin has reached a record level of 83.95 trillion hashes, evidence of heightened competition among miners and massive investment in computing power. This difficulty level, automatically adjusted by Bitcoin’s algorithm to maintain a constant mining time per block, reflects the miners’ sustained confidence in the long-term value of Bitcoin, even in the face of dramatic price fluctuations.

This increase in mining difficulty comes in a context where the Bitcoin price had briefly reached a historic high before undergoing a severe correction, reminding of the unpredictable nature of the market. The resilience of miners, who continue to secure the network despite these challenges, underscores the community’s commitment to the longevity and security of Bitcoin. This commitment persists even as the industry approaches the next halving, an event that will cut the mining reward in half, potentially putting additional pressure on less efficient miners.

Dogecoin, Musk’s New Favorite for Tesla

Elon Musk has once again shaken the cryptocurrency world by announcing the possibility of accepting Dogecoin (DOGE) as a payment method for Tesla electric vehicles. This announcement not only propelled DOGE’s value but also marked a potentially transformative moment for the adoption of cryptocurrencies in general. Dogecoin, originally created as a joke in 2013, has since evolved to become a major digital asset with a dedicated online community and a market capitalization that makes it one of the world’s largest cryptocurrencies.

The potential integration of DOGE by Tesla for vehicle purchases follows the prior acceptance of the cryptocurrency for merchandise, and underscores Musk’s ongoing interest in the disruptive potential of cryptos. This move could not only be a game-changer for Dogecoin, transforming it from a “meme crypto” into a viable payment tool, but also signal a major turning point in the acceptance of cryptocurrencies by major corporations.

Binance Strengthens Its Regulatory Compliance

In an effort to improve its reputation following the regulatory challenges encountered in 2023, Binance, one of the world’s largest cryptocurrency exchange platforms, has announced a significant strengthening of its listing criteria. This initiative is intended to increase investor protection by now requiring a minimum of one year of listing for new tokens, as opposed to the previous six months. A measure aimed at discouraging malicious actors from engaging in dubious practices such as “rug pulls,” where developers disappear with investors’ funds shortly after new tokens are listed.

Furthermore, Binance is also adjusting the allocations granted to market makers in order to ensure sufficient market liquidity upon the launch of new tokens. Despite some concerns regarding the potentially excessive advantage granted to these institutional investors, Binance asserts that these changes are crucial to restore investor trust and promote a safer and more transparent crypto ecosystem. Through these measures, Binance hopes not only to improve the quality of projects listed on its platform but also to fortify its standing with regulators and investors concerned about the safety of digital assets.

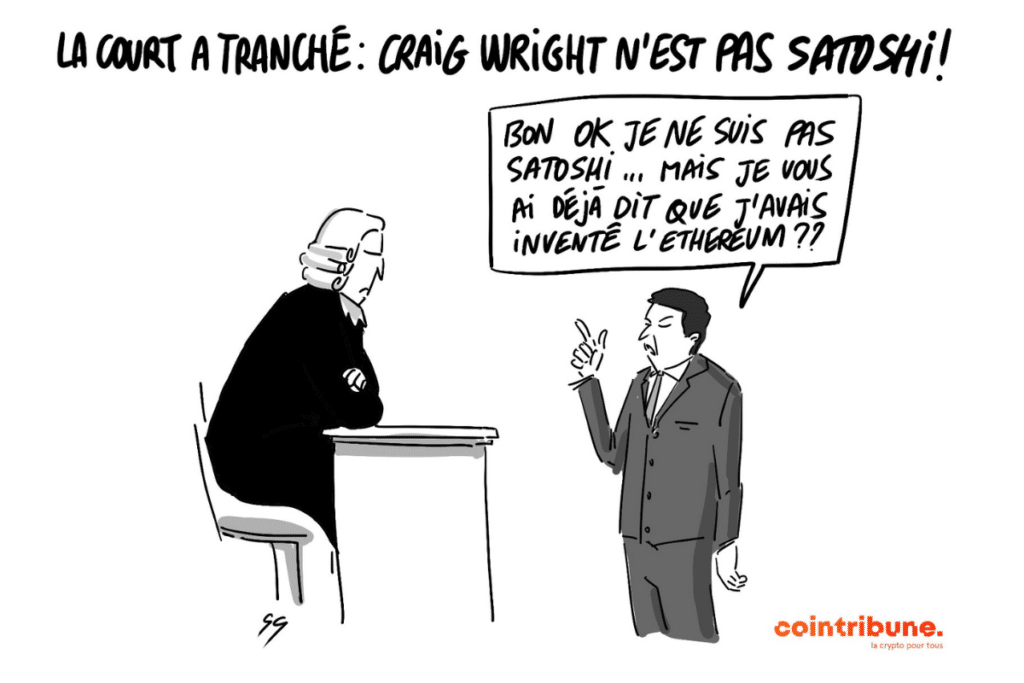

Craig Wright Is Not Satoshi Nakamoto, Rules the Court

The British judiciary has delivered its verdict in the long-disputed case regarding the identity of Satoshi Nakamoto, the mysterious creator of Bitcoin. Craig Wright, an Australian entrepreneur who claimed to be the mind behind Bitcoin, has been officially declared by the British High Court not to be Satoshi Nakamoto. The judgment emphasizes the lack of reliable and verifiable evidence presented by Wright to support his claims, ending a long period of speculation and controversy in the crypto community.

Moreover, the COPA association, which led the charge against Wright, has highlighted its intention to ask British prosecutors to consider criminal proceedings against him for perjury and obstruction of justice, potentially marking the end of a saga that has captivated and divided many in the crypto world.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.