Why is gold collapsing by 10% while Bitcoin resists?

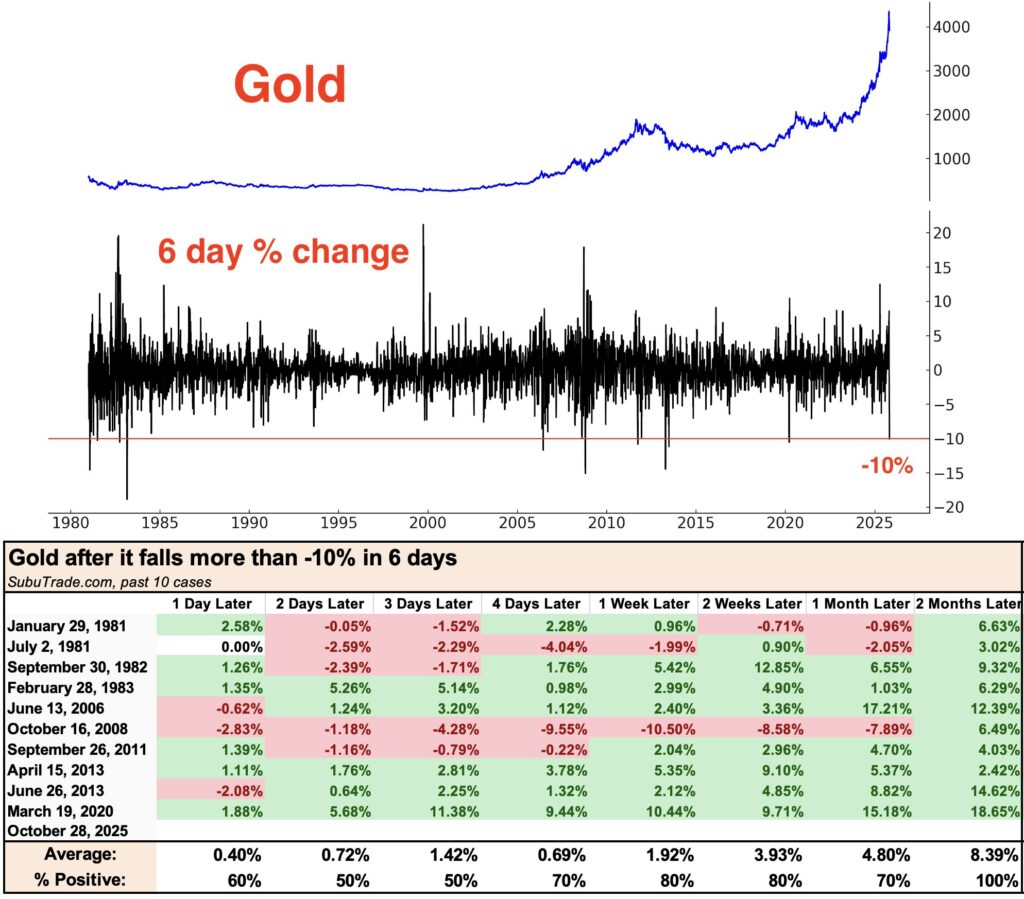

Gold has just experienced a historic drop of 10% in just six days, a rare phenomenon that has only been observed ten times in 45 years. Meanwhile, Bitcoin shows unexpected resistance, reigniting the debate on the role of safe-haven assets. Why this divergence? Is it a sign of a turning point for investors?

In brief

- Gold records a historic 10% drop in 6 days, a rare phenomenon observed only 10 times in 45 years.

- Bitcoin shows unexpected resistance against gold’s drop, reigniting the debate about its role as a new safe-haven asset.

Gold in freefall: a historic correction with major consequences

The era when Bitcoin was reigniting its correlation with gold seems over. In a few days, gold has lost 10% of its value, falling below the symbolic threshold of 4,000 dollars an ounce after reaching a peak at 4,380 dollars in mid-October 2025. This sharp decline recalls past corrections, where gold took on average two months to recover, with an average return of 8.39%. In India, gold futures contracts also fell by 2.35%, reflecting a global trend.

Historical data shows that this drop is not an isolated case. In the last ten similar occurrences, gold always rebounded within the following two months, but with varying performances. Some rebounds reached 17.21%, while others barely surpassed 2%.

This volatility raises questions about the stability of gold as a safe-haven asset.

Why is gold collapsing? 3 key reasons behind the debacle

The fall of gold can be explained by several factors. First, a easing of geopolitical and trade tensions has reduced demand for this safe-haven asset. Indeed, negotiations between the United States and China happening today could lead to an agreement. This reassured markets and decreased the appeal of gold.

Next, the strengthening of the dollar played a crucial role. A stronger American currency makes gold more expensive for international investors, naturally reducing demand. This dynamic is amplified by uncertainties around the monetary policy of the Fed which lowered its rates by 0.25%, without guaranteeing further cuts.

Finally, this drop can be seen as profit-taking after a record year. Gold had experienced a spectacular rise of +60% since the beginning of 2025, reaching a historic peak of 4,380 dollars an ounce in mid-October. Investors are therefore taking advantage of this opportunity to realize their gains, which increases the downward pressure.

Bitcoin resists: towards a shift in safe-haven assets?

While gold collapses, Bitcoin shows remarkable resistance, with a 2% increase over the week. This divergence suggests a change in perception among investors, who may turn to cryptocurrencies as an alternative to traditional assets.

Unlike gold, whose demand is often linked to geopolitical tensions, BTC is increasingly influenced by structural factors such as institutional adoption and programmed scarcity. While gold generally takes 2 months to recover after a 10% drop, Bitcoin could attract capital seeking quicker returns. This dynamic could then accelerate an investment rotation from precious metals to cryptos.

The fall of gold and the resistance of BTC raise a fundamental question: are cryptos replacing traditional assets as safe-haven values? While gold remains a historic pillar, Bitcoin proves it can play a similar, even complementary role. The coming months will be decisive to determine if this trend confirms.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.