Zcash Developer Activity Slumps Amid Governance Disputes and Prolonged ZEC Decline

Zcash’s developer activity has fallen to its lowest level since late 2021, as governance disputes and prolonged market weakness continue to cloud sentiment. The slowdown comes amid a sustained decline in ZEC’s price, even as large holders continue to accumulate the token. At the same time, these trends point to an increasingly complex outlook for one of the crypto sector’s longest-standing privacy-focused networks.

In brief

- Zcash developer activity dropped to its lowest level since 2021, coinciding with a two-month, 40% decline in ZEC’s price.

- Governance tensions between Electric Coin Company and Bootstrap continue as ECC plans a split while development efforts slow.

- Market sentiment remains bearish, with ZEC down 14% weekly despite ongoing accumulation by whales and new wallets.

- Competition intensifies as Monero overtakes Zcash in market cap, while Grayscale moves forward with a potential ZEC ETF.

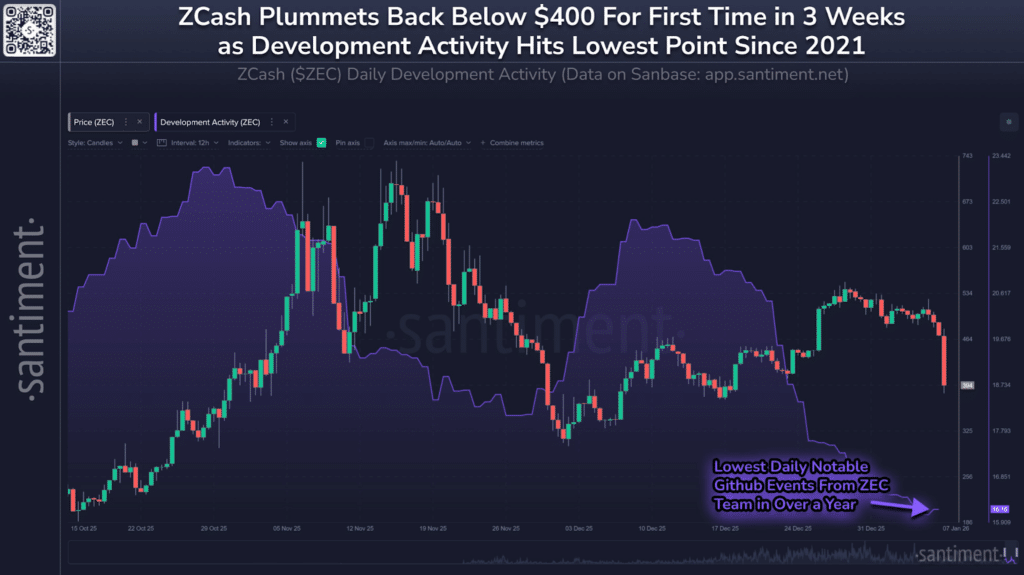

ZEC Drops 40% in Two Months as Zcash Developer Activity Hits Multi-Year Low

According to data shared by blockchain analytics firm Santiment, development activity tied to Zcash has dropped to its weakest level since November 2021. The update, published Thursday on X, coincided with a sharp sell-off in ZEC. Over the past two months, the token has lost roughly 40%, extending a broader downturn that has eroded investor confidence.

Santiment noted that shifts in developer activity often serve as early indicators of future market performance. Projects that maintain consistent development tend to weather broader market weakness more effectively, while those experiencing slowdowns often struggle to regain traction. Zcash now appears to be facing the latter challenge, as internal disagreements divert attention away from technical progress.

Those disagreements center on a governance conflict between Electric Coin Company (ECC), the primary development team behind Zcash, and Bootstrap, a non-profit organization that supports the protocol. ECC recently announced plans to separate from Bootstrap and establish a new entity, citing what it described as malicious governance actions by the organization.

Zcash Foundation Says Protocol Unaffected Despite ECC–Bootstrap Split

Bootstrap, for its part, said board discussions had focused on attracting outside investment and exploring potential structural changes related to Zashi, a self-custodial wallet designed for private Zcash transactions. Despite the dispute, ECC developers said work continues on a new wallet, cashZ, which is expected to launch within the coming weeks.

Several developments now define Zcash’s current position:

- Developer activity at its lowest level since 2021.

- ECC’s planned separation from Bootstrap following governance disputes.

- Continued development of the cashZ wallet despite organizational conflict.

- Persistent weakness in ZEC’s market price.

- Ongoing accumulation by whales and newly created wallets.

In a separate statement, the Zcash Foundation sought to reassure the community that the dispute would not affect the protocol itself. The foundation emphasized that Zcash’s open-source structure prevents any single organization from exerting control over the network, allowing it to function independently of internal organizational changes.

Bearish Sentiment Persists Despite Whale Accumulation

Market sentiment, however, has remained firmly negative. ZEC fell 14% over the past week and was trading near $43 at the time of writing. Broader sentiment indicators remain bearish, with the Fear & Greed Index at 25, a level associated with extreme fear. Only 13 of the past 30 trading days ended with gains as the coin dropped by roughly 94% from its all-time high.

Despite ongoing price pressure, on-chain data from Nansen shows that large holders accumulated approximately $1.17 million worth of ZEC over the past week. Newly created wallets added a further $2.14 million during the same period, suggesting selective confidence among certain market participants.

Competition within the privacy-focused cryptocurrency space has also intensified. Monero surpassed Zcash in market capitalization on Thursday, underpinning the shifting dynamics within the sector.

Looking ahead, Grayscale has filed a Form S-3 with the U.S. Securities and Exchange Commission to convert its Zcash Trust into a spot exchange-traded fund. If approved, the fund would list on NYSE Arca and track the CoinDesk Zcash Price Index, potentially becoming the first U.S.-based ETF linked to a privacy-focused cryptocurrency.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.