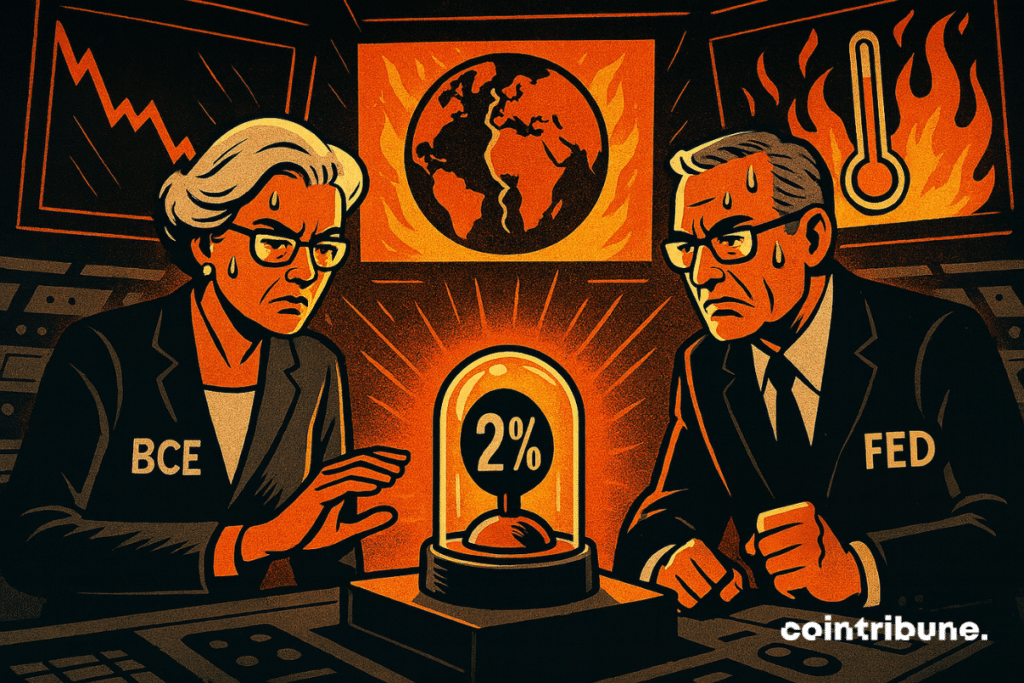

The ECB freezes rates at 2% despite inflation and transatlantic tensions

Central banks are at the center of debates, both in Europe and the United States. Faced with inflationary pressures and trade tensions, each decision weighs on the global economy. The ECB has chosen caution: it freezes its rates at 2%, a strategy seen as a compromise between stability and uncertainty. But this status quo raises questions: is it really a controlled pause or a headlong rush, while the FED prepares for a reverse turn?

In brief

- The ECB maintains its deposit rate at 2%, despite near-zero growth.

- Transatlantic trade tensions complicate economic outlooks, notably with US tariffs of 15%.

- In the US, the FED considers a rate cut despite inflation still near 3%.

- Markets react: euro rises, dollar falls, crypto and gold become alternative barometers.

ECB: between monetary caution and trade storms

Is Europe already ruined, and the ECB too tired to save it? In any case, it has decided to maintain its deposit rate at 2%, confirming the pause started in June. Inflation, close to the set target, remains controlled with forecasts at 2.1% in 2025, 1.7% in 2026, and 1.9% in 2027. However, growth remains sluggish: +0.1% in the second quarter, after 0.6% previously.

Christine Lagarde stresses a “more balanced” view of risks but highlights an still unstable trade climate. US tariffs of 15% on European exports illustrate this challenge. Some sectors, like pharmaceuticals, have found a favorable framework, while others, like wine and spirits, remain uncertain.

The economic impact could increase if Donald Trump’s threats of new retaliations materialize. Lagarde acknowledged that trade uncertainty has eased, but it has not returned to a normal level.

The ECB therefore opts for a “meeting by meeting” approach, avoiding any rigid forecast. Markets, which anticipated this decision at 99%, confirm that the European economy is settling into a middle ground: neither crisis nor strong rebound.

The FED facing its dilemma: support the economy or contain inflation

In the United States, the situation is different. Despite inflation reaching 2.9% in August, its highest level in seven months, the FED prepares to cut its rates on September 17. Markets estimate over 90% probability of a 25-basis-point cut.

The reason? A slowing labor market. In August, only 22,000 job creations were recorded against 75,000 expected, and unemployment claims jumped to 263,000, a four-year record.

At the Jackson Hole symposium, Jerome Powell acknowledged an unprecedented dilemma: “In the short term, inflation-related risks lean upwards, and employment-related risks downwards“.

This shift, dictated by political and social pressures, worries some analysts. Bank of America points out that:

So far, the Fed has been more concerned with inflation than with the labor market. But Powell’s speech indicated a possible change of course toward prioritizing the labor market.

Between fragile growth and persistent prices, the American economy illustrates the complexity of a monetary turn that could weigh durably on the FED’s credibility.

Between euro, dollar, and crypto: markets seek a course

This transatlantic divergence shakes currencies and alternative assets. The euro rose by 0.4% to $1.1735, while the greenback index fell. US Treasury yields briefly dropped below 4%, reflecting expectations of monetary easing.

The reaction also affected crypto. After the CPI publication, bitcoin price dropped 0.5%, from $114,300 to $113,700, before rebounding. Analysts say the market is in a waiting phase:

- If inflation remains moderate, crypto could trigger a new rally;

- If it accelerates, the dollar strengthens and BTC corrects;

- In case of balance, bitcoin consolidates around $113,500.

For many, this dynamic reminds that crypto has become an alternative barometer of monetary tensions. Gold also benefits, rising slightly after the CPI report. In this fractured global economy, the role of the ECB and FED goes beyond borders and redraws the balance between stability and speculation.

Across the Atlantic, the showdown between Donald Trump and the FED reaches a critical point. The president has already called Jerome Powell “too late,” and now targets Lisa Cook. For her, only the judiciary prevents her dismissal, to Trump’s great dismay. A weakened economy and a FED under pressure: the American equation remains explosive.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.