3 radical innovations happening on Bitcoin (BTC)

The Bitcoin ecosystem is a real anthill of innovation, constantly pushing back the boundaries of what’s feasible. While some are inclined to portray Bitcoin as an outdated protocol, relegated to the shadow of Ethereum, the reality is quite different. Ambitious initiatives such as Fedimint, Magma and Miniscript are at the forefront. These technologies have the potential to catalyze large-scale institutional adoption of Bitcoin, redefining the contours of finance in the 21st century. At last, you’ll have the arguments to answer the shitcoiners.

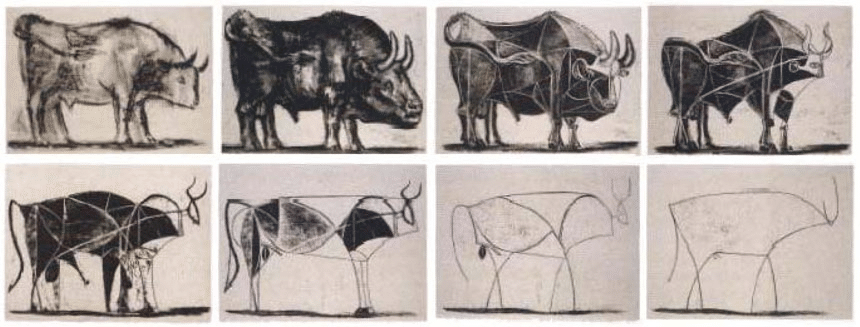

Bitcoin : Less is more

When Satoshi Nakamoto unveiled Bitcoin to the world in 2008, he was offering a peer-to-peer electronic money system. This revolutionary invention, based on the principles of decentralization, immutability and transparency, turned the concept of money on its head.

However, many underestimate the innovations that are continually developing within the Bitcoin ecosystem. This misconception is based on the idea that Bitcoin is an obsolete and stagnant protocol, unlike Ethereum’s shitcoins.

Bitcoin’s design was certainly simple, but it was a deliberate and strategic choice. Gall’s Law, advocating simplicity and progressive development, states:

“A complex system that works is invariably found to have evolved from a simple system that worked. The converse is also true: a complex system developed from scratch will never work, and you’ll never get it to work. You have to start from the beginning, with a simple system.”

Bitcoin’s early developers surely had Gall’s Law in mind when they designed the protocol. Bitcoin was up and running as early as the Genesis block and has been running ever since. Quite a feat. Bitcoin’s simplicity has enabled a solid foundation to be laid, with an emphasis on security and resilience, which has favored the establishment of a secure, decentralized network without excessive complexity.

To a certain extent, Bitcoin’s basic protocol can be compared to the Internet Protocol (IP) – minimalist, but allowing the construction of additional layers of complexity, such as TCP/IP, HTTP, SMTP.

Bitcoin doesn’t stand still

One example is the introduction of Segregated Witness (SegWit), which led to the creation of the Lightning Network, a layer 2 solution that enables fast, cost-effective transactions.

Other examples include the Liquid Network, which enhances confidentiality and enables tokens to be issued, and Taproot, which offers more functionalities for the execution of smart contracts and improves confidentiality.

Today, we are seeing the emergence of innovative companies using Bitcoin and its second-layer protocols in new ways.

In this article, we’ll highlight three innovative projects to show how Bitcoin continues to progress, adapt and maintain its leadership position in the crypto world.

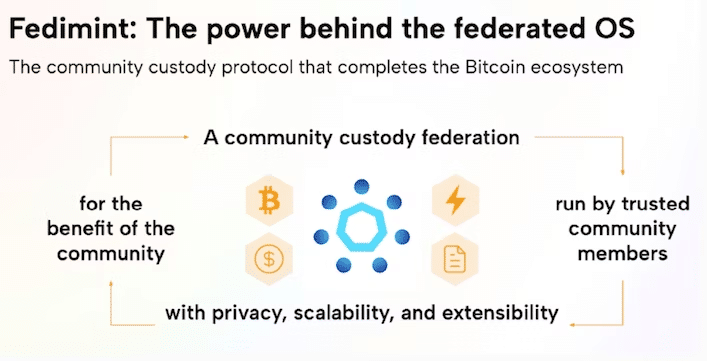

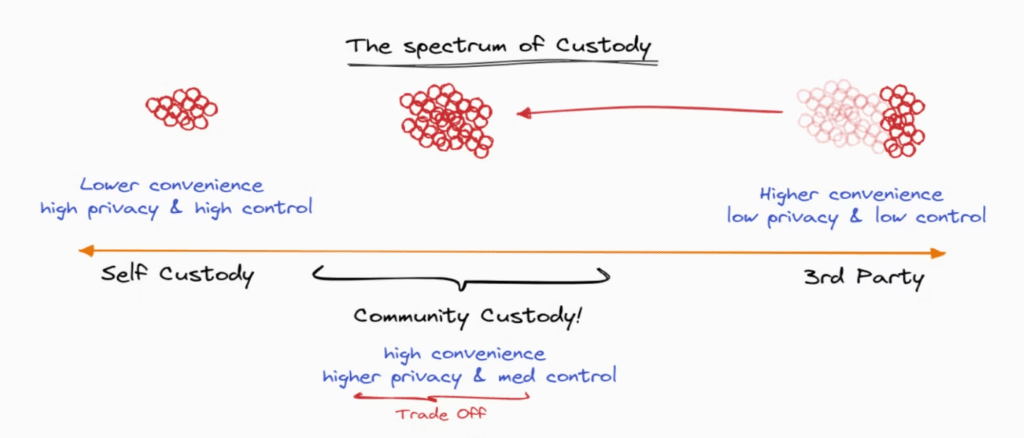

Fedimint: collaborative custody on Bitcoin

Fedimint is a new protocol that enables individuals to come together to manage and secure each other’s BTC. It represents a major innovation in the world of Bitcoin custody, offering an intermediate solution between third-party custody and self-management.

Fedimint embodies a form of collaborative custody suitable for people who prefer not to entrust their BTC to third parties, but rather to trusted individuals in their community. It eliminates the technical challenges and risks associated with managing their own nodes and owning their own keys, while reducing the need to trust a centralized third party. Fedimint offers a balance between cost, confidentiality, ease of use and security.

At the heart of Fedimint is a simple yet ingenious strategy that tackles the challenge of storage head-on. It recognizes that within every group, some individuals are more comfortable with technology than others. These “group keepers” therefore take charge of managing Bitcoin wallets and transactions, while the rest of the group benefits from a simple application experience with the Fedi wallet. Imagine this: Your tech-savvy cousin helps your grandmother manage her BTC – that’s Fedimint!

Custodians within the federation assume responsibility for maintaining the community’s multi-signature wallet and authorizing bitcoin spending within and outside the federation. Federations divide the custody of the group’s BTC among all custodians, ensuring that majority agreement is required for transactions and that the system can handle minor custodian failures.

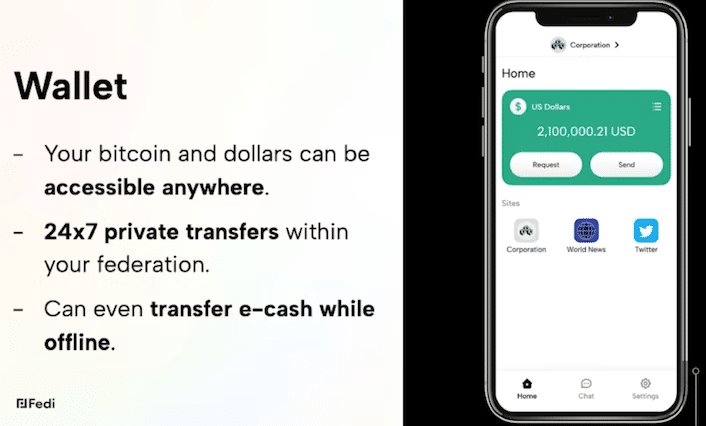

Fedi

Fedi is a wallet that introduces a new approach to custody and confidentiality, based on trust and community ties. This wallet facilitates access to dollars and BTC and enables 24/7 private transfers within a federation.

Fedi also features a functional browser that can host any website on the Internet. It can host corporate websites directly within a federation, again protecting user data. What’s more, if the corporate website supports the Lightning Network, Fedi can seamlessly integrate with it, enabling BTC transfers between Fedi and the corporate website.

Amboss Technologies

Amboss specializes in Lightning Network analysis. It offers data visualization services to help users understand the behavior of their Lightning nodes. By providing this information, Amboss helps merchants and consumers identify optimal payment channels, taking into account factors such as cost, reliability, reputation and risk management.

The Lightning network offers many advantages, including fast, low-cost transactions, while continuing to rely on Bitcoin technology. However, it presents a major problem: the “incoming liquidity problem”. When one person opens a Lightning channel with another party, all the liquidity is on the side of the person who opened the channel.

For a company that primarily receives payments, this is a problem. If a company opens channels on the Lightning network, it can send payments but cannot receive them. The solution to this problem is for others to open channels with the company, or for the company to use a service to “buy” incoming cash.

Magma

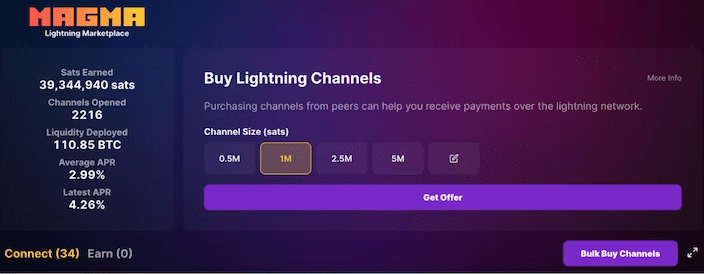

This is where Amboss comes in with Magma, a peer-to-peer marketplace of Lightning channels. Magma allows a company or user to determine how much another node operator will charge for opening a new channel, thus providing inbound liquidity. They can also examine the reputation of the node operator to ensure channel quality.

Since its launch a year ago, liquidity deployed via Magma has increased almost fivefold, reaching 110.85 BTC today. Node operators are motivated to sell Lightning channels to those in need of liquidity, as they can earn a return on their bitcoins by opening Lightning channels for other businesses, companies and users.

Amboss has also introduced a new reference rate called LINER (Lightning Network Rate). According to Amboss, LINER is similar to LIBOR (London Interbank Offered Rate) in traditional finance, but without the credit risk.

LINER is an index made up of two elements. On the one hand, there is the LINER cost, which indicates how much it costs someone to obtain liquidity. On the other, there’s the LINER yield, which indicates what people require in terms of return to use their bitcoin savings to open up a new payment channel.

With a reference rate for the Lightning Network, users can now understand the return on investment they can expect when they bring liquidity to the network with their savings, as well as the opportunity cost of not doing so. This risk-free reference rate could serve as a basis for the development of capital markets around Bitcoin, such as loans and investments.

AnchorWatch

AnchorWatch is an innovative company in the Bitcoin ecosystem, looking to improve the protocol’s custody and assurance systems using the Miniscript programming language. Miniscript, an enhancement of Satoshi’s original Bitcoin Script, is designed to make it easier to create, analyze and understand Bitcoin scripts, which define the rules for carrying out Bitcoin transactions.

Think of Miniscript as a Lego set. Each block represents a rule or condition that can be combined with others to define the criteria for a Bitcoin transaction. This offers greater flexibility and security in determining how your Bitcoins can be spent.

The way Bitcoin insurance is currently structured is problematic. Most custodians offer insurance that covers only a fraction of the total assets they manage, leaving a large proportion of bitcoins uninsured. In addition, current approaches to Bitcoin storage resemble those for physical gold, or involve the use of Multi-Party Computing (MPC), which fragments a private key and stores it in multiple locations. MPC has significant shortcomings, including the cybersecurity risk as it is always connected to the Internet, and the reliance on human processes that can be exploited.

Miniscript offers a solution to these problems, helping to distribute custody risks. Using Miniscript, you can program the logic directly into a multi-sig configuration and no longer have to rely on additional human processes. It also means that it’s possible for one key to outperform all others, enabling a hierarchy of keys.

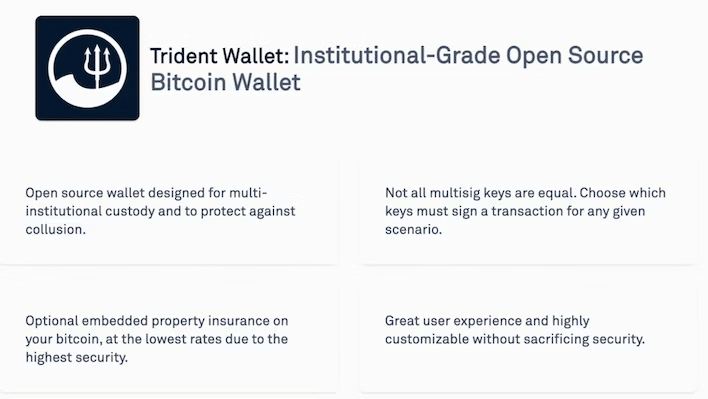

Trident Wallet

AnchorWatch has developed a new wallet, Trident Wallet, which uses Miniscript to create unique multi-sig configurations for its customers. Trident Wallet also makes it possible to set up novel insurance policies, where AnchorWatch cannot move funds unilaterally and the customer cannot move funds without AnchorWatch’s consent during the term of the insurance policy. However, once the insurance policy has expired, the BTCs can be unlocked and the customer can withdraw the funds unilaterally, eliminating the need for trust in the insurance company.

In short, through the use of Miniscript, AnchorWatch hopes to reduce the risks associated with holding Bitcoin, which could encourage wider adoption by institutions. The aim is to make large institutional groups feel more comfortable investing in bitcoin in the future.

Bitcoin developers at the forefront

Bitcoin developers continue to build on the protocol. The work undertaken by companies such as Fedi, Amboss Technologies and AnchorWatch is clear evidence of this. Fedi offers a collaborative custody solution based on the Fedimint protocol and the Lightning network, and aims to enable users to regain control of their data and money.

Amboss Technologies sets up liquidity markets on the Lightning network and creates the first Lightning reference rate, which could serve as a benchmark for Bitcoin financial products in the future. Finally, AnchorWatch is using the power of Miniscript to reduce custodial risk and provide stronger insurance, which will hopefully attract more institutional capital.

Far from stagnating, the Bitcoin ecosystem is a hotbed of continuous development, and companies like Amboss and AnchorWatch are at the forefront, pushing the boundaries of what’s possible with this transformative monetary technology.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.