A Bitcoin Crash Is No Longer Possible: Arthur Hayes Buries the 4-Year Cycle

The four-year cycle is dead. The statement signed by Arthur Hayes definitively buries a persistent myth: that of a bitcoin doomed to periodic crashes after each halving. Discover the new pillars that now redefine BTC’s future and what it means for crypto investors.

In brief

- Arthur Hayes states that bitcoin’s 4-year cycle is obsolete and that the programmed drop is no longer current.

- Investors must now monitor interest rates, inflation, while exploring Bitcoin ETFs to adapt to this new dynamic.

- Three scenarios for bitcoin: massive adoption as a store of value, increased regulation limiting transactions, or technological integration.

Bitcoin: the end of the four-year cycle and the era of new rules

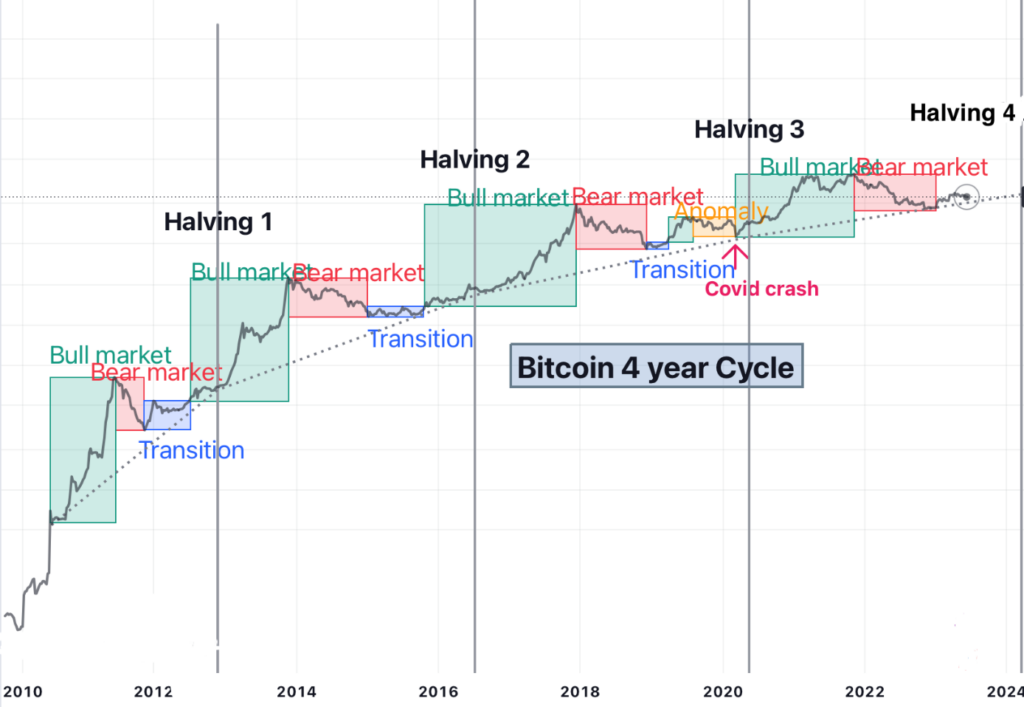

For more than a decade, bitcoin seemed doomed to a relentless four-year cycle: spectacular rises after each halving, followed by brutal crashes that discouraged investors.

This pattern, linked to the programmed scarcity of the asset, long fueled market psychology – and fears of predictable corrections. Yet, according to Arthur Hayes, this era is over and the traders who cling to it ignore the macroeconomic forces that now redefine its evolution.

Why does bitcoin’s four-year cycle belong to the past?

Historically, bitcoin crashes occurred after post-halving price peaks, when speculation waned. Now, monetary policies of major powers, such as the US and China, directly influence BTC’s price. Between 2021 and 2025, decisions by the Fed and the People’s Bank of China (PBOC) have redefined the rules of the game, rendering traditional forecasts ineffective. In his analysis, Arthur Hayes points out that traders blindly apply historical patterns without understanding that the current dynamic is dictated by monetary policy, not predictable cycles.

To this end, the Fed has alternated between tightening and easing monetary policy, while China has tried to restart its economy after a period of deflation. These fluctuations have created an environment where bitcoin now reacts to global economic announcements rather than a preset schedule.

What are the consequences for investors and the crypto market?

Warning: no total immunity, but a new deal. Indeed, the end of the four-year cycle does not mean bitcoin is immune from any correction. Only crashes linked to cyclical speculation disappear. Investors must now watch macroeconomic indicators, such as:

- Interest rates;

- Inflation;

- Credit policies.

For individuals, this means diversifying sources of information and adopting a more flexible approach. Bitcoin ETFs offer regulated exposure, while staking and DeFi platforms allow generating passive income. However, risks persist:

- Volatility remains high;

- Regulators could harden their stance against massive cryptocurrency adoption.

Towards a new model for bitcoin: scenarios and opportunities

As bitcoin’s 4-year cycle fades, which scenarios emerge for BTC? Here are three main possibilities:

1. Massive adoption

If monetary policies remain accommodative, bitcoin could become a global store of value, especially in economically troubled countries like Argentina or Nigeria. Less volatility = fewer brutal crashes

2. Increased regulation

Governments might impose strict restrictions, limiting transaction freedom. This could stabilize the market but also slow its growth.

3. Technological integration

Thanks to advances like the Lightning Network, bitcoin could become a common means of payment, competing with fiat currencies. Thus reducing the risk of collapse.

Bitcoin is therefore entering an unprecedented era: crashes linked to the four-year cycle are no longer a threat. Now, its value depends on geopolitical and economic decisions – no longer on a predictable schedule. Despite the recent BTC drop, its fundamentals remain strong and the crypto queen is far from disappearing. What about you, do you really think it’s the end of the 4-year cycle?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.