Bitcoin may keep breaking records in 2025, but public enthusiasm is dangerously waning. Between falling Google searches and a drop in market sentiment, warning signs are multiplying. Have retail investors definitively turned their backs on the queen of cryptos?

News

The GENIUS law, presented as the solution to secure stablecoins, hides alarming flaws according to the Federal Reserve (Fed). Michael Barr sounds the alarm: systemic risks, regulatory arbitrage, and threats to your crypto investments. Are stablecoins really stable?

While gold shines like never before, Peter Schiff brings out his anti-bitcoin refrain. What if this time, the crypto undertaker was (somewhat) right? To be continued...

The dollar, the cornerstone of the global financial system, once again finds itself at the heart of a geopolitical controversy. Donald Trump accuses the BRICS of wanting to undermine its supremacy. In response, the Kremlin firmly denies any intention of destabilization, stating that the alliance does not target any foreign currency. Behind this tense exchange, one question remains: are the BRICS quietly working to reshape the global monetary order, or is this an alarmist reading of the ambitions of this emerging bloc?

This week, the bitcoin fear and greed index dropped to its lowest level in a year, plunging investors into uncertainty. This sudden decline fuels speculation: should one give in to panic or take advantage of this correction to accumulate at low prices? For Bitwise analysts, this fear phase could actually signal the start of a new accumulation cycle, thus offering a strategic investment opportunity in a volatile market.

On October 16, bitcoin sharply dropped below $108,000, disrupting an already fragile market. Such a sudden fall after a period of stability raises questions about the factors behind this destabilization. This event affects millions of investors and redefines crypto market dynamics.

Prediction platform Polymarket is broadening its reach into traditional finance with a new feature that lets users bet on stock and index movements. The move highlights the platform’s growing ambition to connect crypto-native speculation with mainstream financial markets, as investor interest in event-based trading continues to accelerate.

At Google, they are serious: an AI that talks, films, and directs? Veo 3.1 arrives with sound, style... and a little desire to dethrone Sora.

What if Europe finally disrupted the established order of stablecoins? Oddo BHF launches EUROD, a 100% euro stablecoin, challenging the dollar's dominance in crypto. A financial revolution underway! Discover the stakes and challenges of this innovation that could change everything.

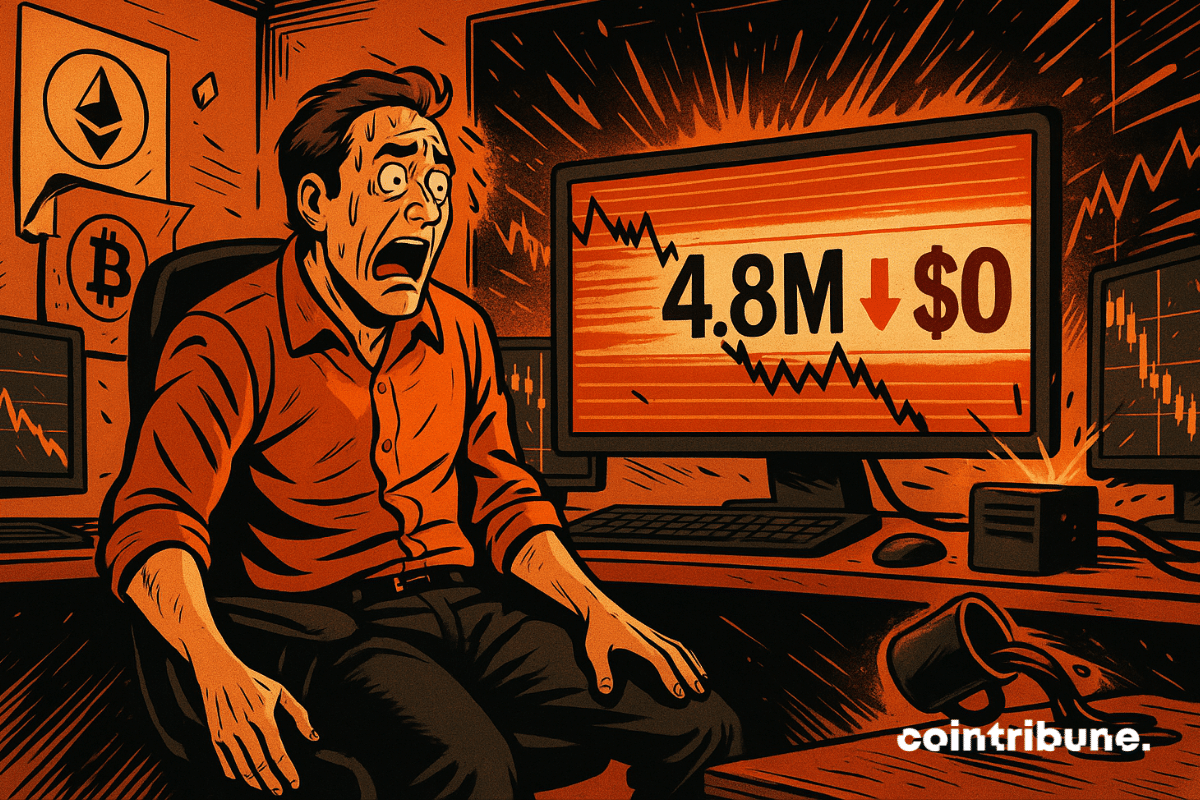

James Wynn lost $4.8 million in high-leverage crypto trades, continuing a pattern of risky bets that have made him a cautionary figure in the market.

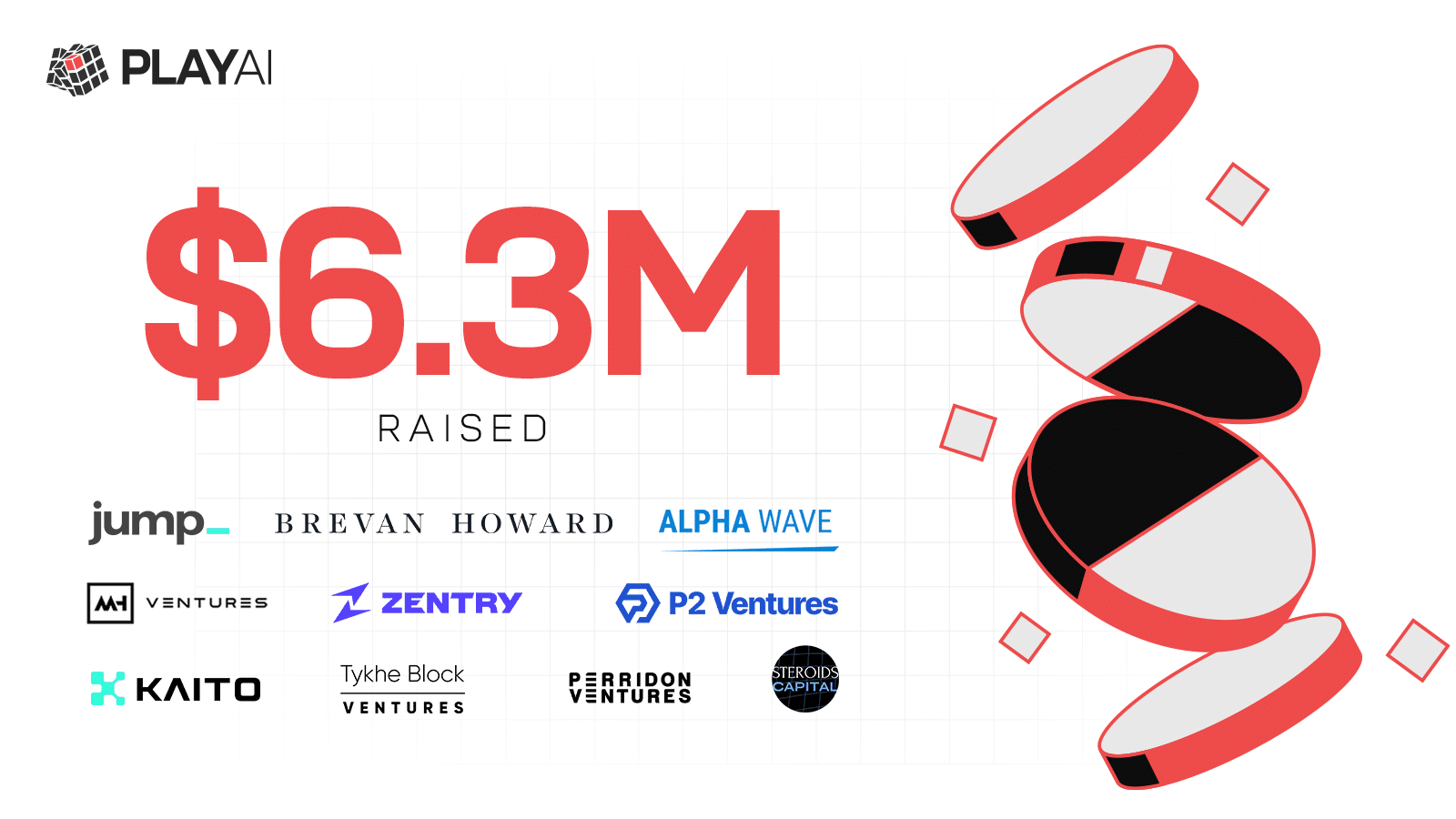

Following new strategic funding and the upcoming mainnet launch, PlayAI has now raised $6.3 million, accelerating its mission to make AI-powered automation native to the blockchain.

PlayAI has just announced the official launch of its mainnet following a $2 million community fundraising led in partnership with Kaito. This news brings the project's total funding to $6.3 million, reinforcing its mission: to democratize automation powered by blockchain-native AI.

Cloudflare has partnered with Visa, Mastercard, and American Express to help shape the future of digital payments through a secure foundation for “agentic commerce.” The collaboration aims to develop authentication systems that enable trusted software agents to make purchases and payments autonomously—while protecting merchants from fraudulent bots.

In Q3 2025, bitcoin makes a big impact: 172 companies now hold 1.02 million, or 4.87% of the total supply. Why are these giants betting heavily on this crypto? Strategies, risks, and opportunities.

Ethereum is running out of steam... but that's because it's breathing emptiness! Between ETF injections, staking fridges, and digital treasures, ether is evaporating. And the price could explode.

Coinbase is preparing to list BNB, the flagship token of its historic rival Binance. Such an unexpected gesture contrasts with past tensions between the two giants. In a climate of enhanced regulation and strategic repositioning, this decision could mark a turning point in the power dynamics of the sector. Calculated opportunism or signal of appeasement? This rapprochement intrigues as much as it raises questions.

Donald Trump declared that the United States is in a trade war with China. This statement, made in Washington, marks an escalation of economic tensions. In the aftermath, the markets wavered. Bitcoin, particularly sensitive to geopolitical shocks, plunged. This declaration comes as the administration targets Chinese technological imports, directly threatening the mining industry. The American trade offensive now takes a strategic turn with immediate repercussions on the crypto ecosystem.

Bitcoin dropped as it approached its all-time high. In a few hours, the market erased several billion dollars, revealing once again its extreme volatility. Despite this marked correction, several analysts maintain a bullish scenario, estimating that this pullback does not call into question the underlying trend.

The Hong Kong subsidiary of one of the largest Chinese banks has just made history by tokenizing a colossal fund on the Binance blockchain. A bold initiative that comes in a highly tense regulatory context.

Two crypto bullish stars promise an ETH at $10,000... But between ETFs, staking, and crashes, is the prophecy more of a miracle than a mathematical model?

Crypto crash: NFTs lose $1.2B, then timidly recover. Are investors really coming back? Full breakdown.

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

Japan’s financial regulators are planning new rules to prevent insider trading in cryptocurrencies and boost market confidence.

While the market is bleeding, Bitget releases a report: crypto investors still want to load up. 2025, a year of gains... or shocks?

Stablecoins continue to dominate blockchain activity, with Ethereum remaining at the center of this growth. Recent data shows stablecoin transactions on Ethereum hitting record highs, highlighting rising adoption and the network’s expanding role as a global settlement layer. Despite short-term price volatility, network fundamentals remain strong.

In addition to the $283 million distributed on Monday, Binance offers an additional 400 million dollars to support crypto traders after the recent crash. A marketing move or a desperate maneuver to restore investor confidence after the fiasco?

Eric Adams, the self-proclaimed "Bitcoin Mayor" of New York, has just created the very first American municipal office dedicated to digital assets and blockchain. A bold move marking his exit before the scheduled January change of guard.

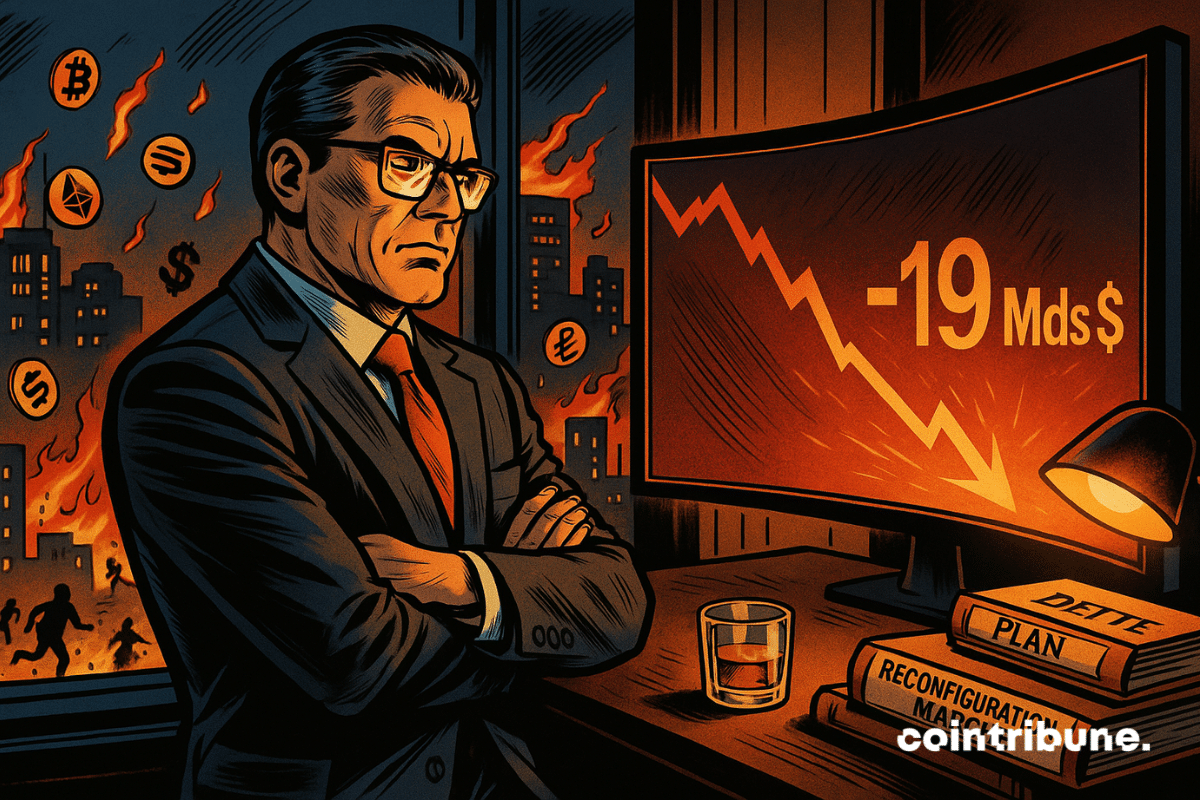

Last Friday, the crypto market experienced a brutal reversal, with nearly 19 billion dollars of open interest wiped out in a few hours. A correction of such magnitude, even in an ecosystem accustomed to volatility, immediately caught analysts’ attention and revived fears of an uncontrolled collapse. However, behind this spectacular drop, the first analyses reveal a very different scenario, that of a planned deleveraging rather than a generalized panic.

Faced with persistent inflation, geopolitical tensions, and unchecked money creation, investors are seeking solid refuges. Gold and bitcoin, long seen as opposites, now move in tandem. One is a millennial pillar, the other a digital outsider, but their curves converge at a historic level, reigniting the debate on bitcoin's role as digital gold.

As the global race for artificial intelligence accelerates, Elon Musk returns to the crypto spotlight. In a message published on X, the Tesla CEO presents bitcoin as a bulwark against the inflationary drift of fiat currencies, stating that it is "based on energy" and therefore immune to state manipulation. This stance puts the flagship asset back at the heart of international monetary debates.