With Pectra, Ethereum promises the future but stacks ETH with the big players: decentralization or private club? The small stakers, on the other hand, count their crumbs on the blockchain.

Archive May 2025

Doodles promised mountains and wonders with its airdrop. The result: a free fall worthy of a failed soufflé in the crypto kitchen.

A massive $2 billion investment in Binance, backed by a stablecoin linked to the Trump family, is shaking Washington. Senators are calling for an investigation into Donald Trump and Changpeng Zhao. Amid conflicts of interest, potential presidential pardons, and foreign influence, a politico-crypto shock threatens the American regulatory balance.

This month, a significant phenomenon is shaking the crypto market: XRP whales are back. The massive accumulation of tokens by these large investors, in the context of a strong rise in Bitcoin and Ethereum, reveals much more than just a market movement. This renewed interest in XRP could signal a new price dynamic, while redefining the perception of major market players regarding this long-underestimated cryptocurrency.

The European Union is ending anonymity in crypto transactions. Starting July 1, 2027, any transfer exceeding €1,000 will be required to reveal the precise identity of the sender and the recipient. According to Paschal Donohoe, president of the Eurogroup, these new anti-money laundering rules (AMLR) clearly place blockchain and digital assets under the direct oversight of European authorities. For crypto enthusiasts, this measure represents both a necessary revolution and a painful betrayal.

The prestigious investment bank Goldman Sachs is increasingly strengthening its position in the crypto ecosystem. With a $1.4 billion stake in BlackRock's Bitcoin ETF, it now stands as the largest institutional holder of this financial product. What does this massive investment reveal about the future ambitions of the banking giant?

Refounding or not, the Ethereum Foundation continues to support the ecosystem: millions distributed, subsidized crypto-tech, Vitalik in quantum mode, and pampered developers. Who said austerity?

Ethereum on the verge of exploding? Peter Brandt, known for his bearish forecasts, is changing course. His technical analysis reveals a strong bullish signal, suggesting a possible "moon shot." With a symmetrical triangle forming, a breakout from resistance could propel ETH towards 4,000 dollars.

After a long dry spell, altcoins are finally showing signs of awakening. Ethereum has just surged more than 32% in a week, reviving hopes for a true "altseason." As Bitcoin's dominance reaches 65% of the total market capitalization, many analysts see it as a precursor to an imminent shift.

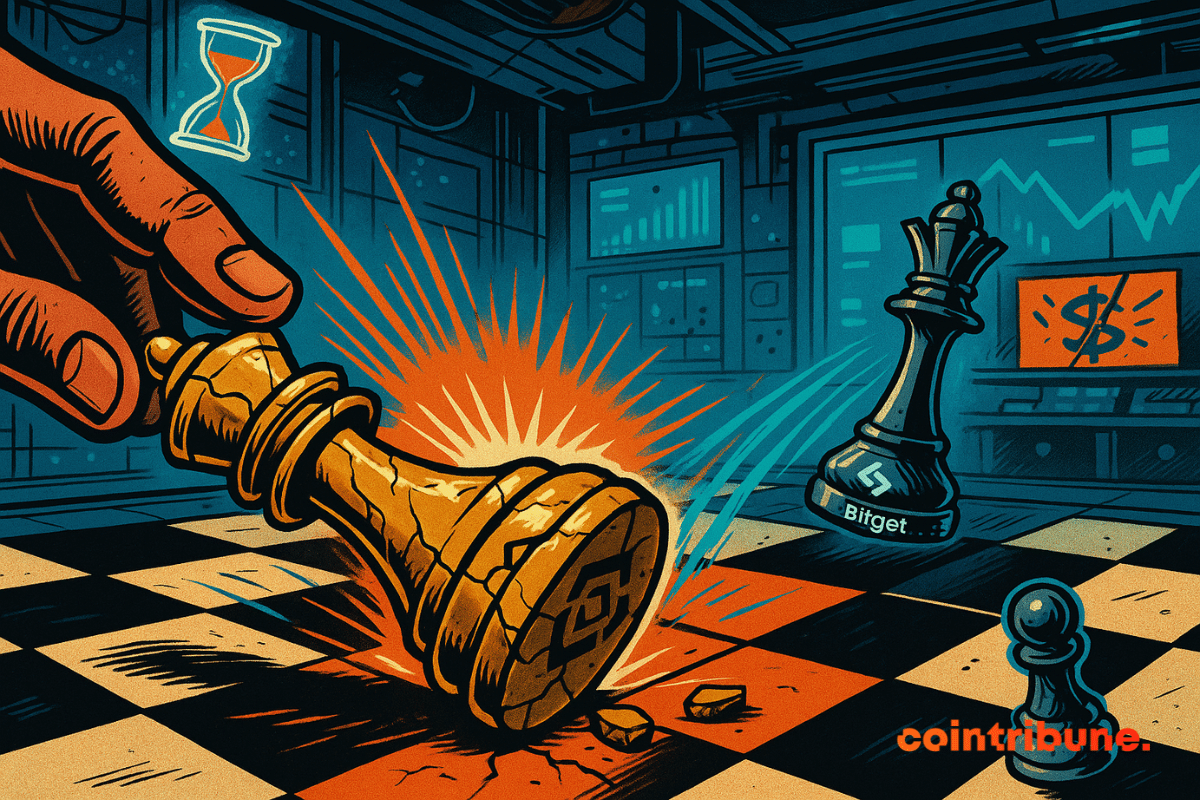

When a giant stumbles, the entire crypto ecosystem holds its breath. In April 2025, CoinGecko published an unfiltered snapshot of the centralized exchanges (CEX) market, revealing an unprecedented shift in the balance of power. While Binance remains at the top, its dominance is waning in the context of an accelerated reconfiguration of the players. The spectacular movements of Gate.io and Bitget, combined with a global contraction in volumes, raise questions about the future of the sector.