Seven giants align for Solana ETFs, the SEC plays the waiting game: suspense, thrills, and staking in the plush backrooms of the American regulatory temple. Stay tuned...

Archive 2025

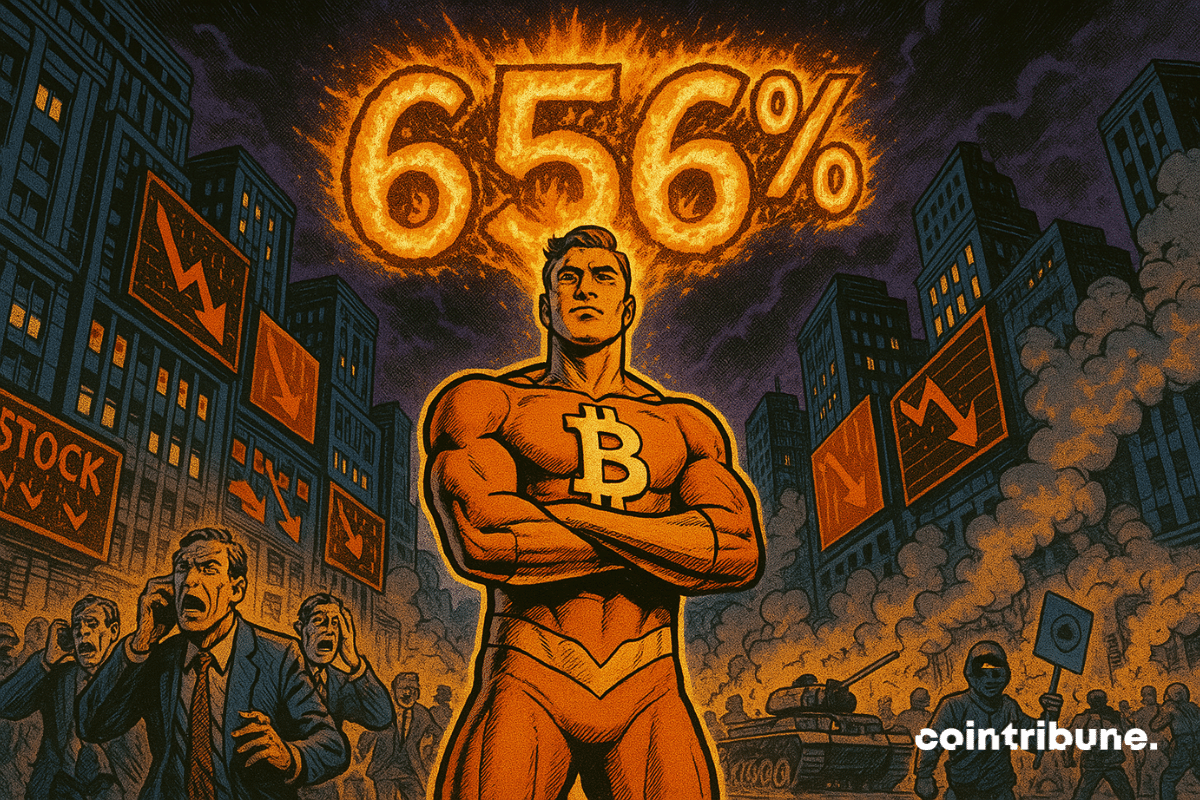

The world is faltering, but Bitcoin holds strong. While missiles rain down in the Middle East and traditional markets hold their breath, an almost surreal dynamic is taking shape: investors are pouring billions into Bitcoin ETFs. Under normal circumstances, so-called "risky" assets flee at the slightest geopolitical tremor. But here, it's the opposite. It seems as if Bitcoin is in the process of changing its status: from speculative asset to emerging safe haven. This very real metamorphosis is rooted in a series of recent events that it would be reckless to ignore.

Israeli airstrikes against Iran are disrupting the calculations of the American Federal Reserve (Fed). While Donald Trump is ramping up pressure for monetary easing, central bankers must now contend with a new factor of uncertainty: the geopolitical escalation that is driving oil prices up.

Schiff gets carried away, gold soars, bitcoin wavers. What if behind the raging tweets lies a discreet farewell to the digital utopia?

In a world where every geopolitical explosion shakes the financial markets, crypto seems strangely unflappable in the face of recent tensions between Israel and Iran. Yet, this apparent serenity may only be temporary. How long can greed, an irrational but powerful driver, keep the sector afloat?

As tensions mount between Israel and Iran, Michael Saylor revives the machine. The co-founder of Strategy (formerly MicroStrategy), a fervent advocate of bitcoin, suggested this weekend a new massive purchase of BTC. This announcement comes in an explosive context, with targeted strikes in Tehran and risks of regional escalation. Against the grain of traditional markets, Saylor confirms his accumulation strategy, once again defying the logic of cycles and crises.

Despite a sluggish market, Ethereum rekindles interest on two major prediction platforms. Far from institutional analyses, it is thousands of anonymous traders injecting millions of dollars into a bet as bold as it is unexpected: seeing ETH climb to $6,000. This speculative resurgence, fueled by Polymarket and Kalshi, awakens interest around an asset whose trajectory seemed frozen. Behind these bets, a conviction persists: the major movements of Ethereum are not behind, but yet to come.

While some stash their gold under the mattress, Binance piles up billions in bitcoin... and no need for a Swiss safe for crypto to keep shining!

June 13, 2025 marks a turning point in the Iran-Israel conflict. Massive Israeli strikes targeted the heart of the Iranian military infrastructure. Iran retaliated later that evening with 300 ballistic missiles, crossing a new threshold in this long-standing war.

As geopolitical tensions shake traditional markets, Bitcoin continues to demonstrate its resilience with remarkable cyclical performance. According to Glassnode, the leading cryptocurrency has shown a gain of 656% since 2022, a progression that draws the attention of analysts.