Binance Temporarily Halts Its Transfers On July 31, Here’s Why

On July 31, 2025, Binance temporarily blocks all deposits and withdrawals. Behind this 15-minute maintenance lie much deeper issues. This technical decision raises questions about the centralization of the crypto ecosystem and the reliability of infrastructures that millions of users rely on daily.

In Brief

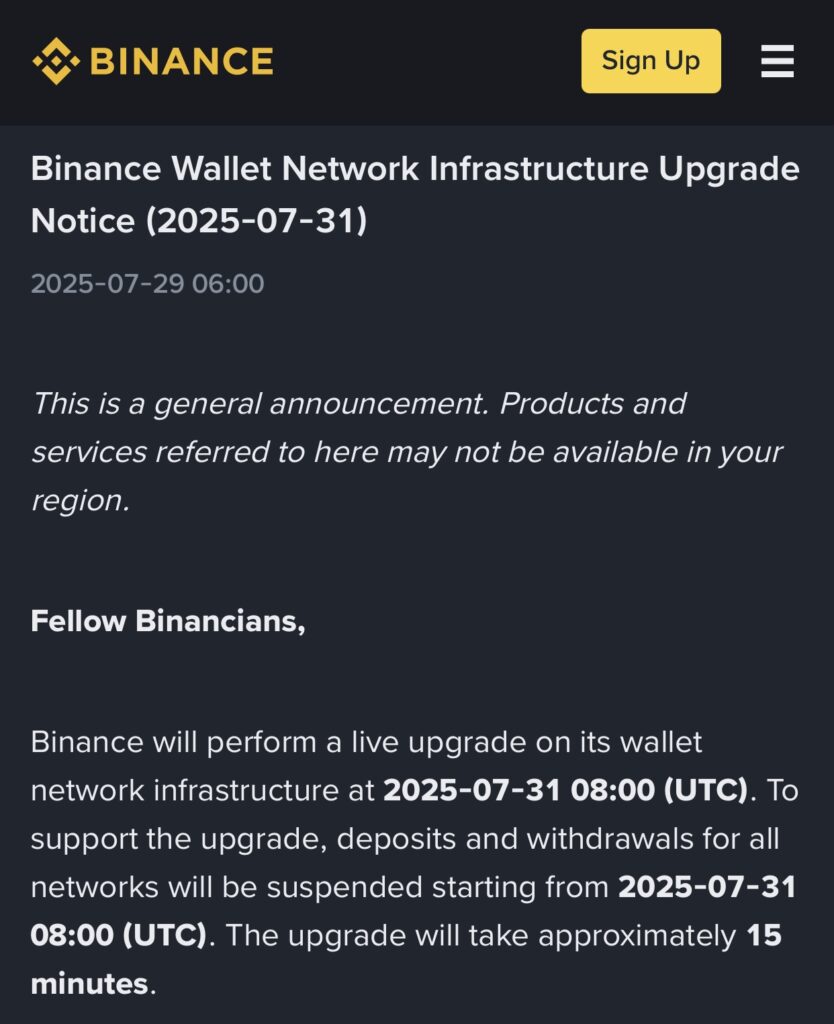

- Binance suspends all deposits and withdrawals on July 31, 2025, at 08:00 UTC for a 15-minute maintenance.

- Trading will remain active, but crypto users risk errors if they attempt transfers during the intervention.

- Binance’s technical outage raises questions about the centralization and reliability of crypto infrastructure.

Binance Maintenance: What’s Really Behind This Flash Outage?

The crypto giant Binance plans maintenance on its wallet infrastructure at 08:00 UTC on July 31, 2025. The intervention, announced to last about 15 minutes, requires a complete suspension of deposits and withdrawals across all networks. The trading service will remain active, a detail Binance has not failed to emphasize.

While the announced duration may reassure users, the opacity of the technical content of the update raises questions. No details about the affected modules or the fixes applied have been communicated. This limits understanding of the real implications for the crypto ecosystem.

Crypto Users: What Are the Real Risks on July 31?

For users, this pause on deposits and withdrawals on Binance on July 31 means a temporary freeze window on access to their funds. The exchange explicitly recommends avoiding any deposit or withdrawal attempts during the intervention. While the 15-minute duration might seem negligible, the concentration of volumes upon resumption could cause processing delays or errors on the crypto network.

The continuity of trading on Binance, presented as an advantage, is not without risks. It could create an illusion of normalcy while transfers are paused. An ill-informed or hasty crypto user might suffer loss or critical latency, especially on congested networks.

Binance, Infrastructure, and Power: The Paradox of a Centralized Giant

This operation aims to strengthen Binance’s technical architecture in a context of increasing pressure on centralized platforms. The continuous growth in crypto volumes, notably driven by the rise of bitcoin, demands infrastructures capable of scaling. Wallet reliability becomes a strategic as well as commercial challenge.

But this dependence on an opaque architecture, managed by a single entity, also highlights the structural limits of a centralized model. The promise of a decentralized financial system struggles to materialize when access to funds can be suspended at the sole discretion of one entity.

Binance’s flash maintenance highlights the technical fragility of the rapidly expanding crypto sector. Behind the displayed performance, the question of centralization remains open. How far can one delegate control of their assets without giving up the very spirit of blockchain decentralization?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.