Bitcoin: After the green light from the ETF, Gary Gensler stabs us in the back!

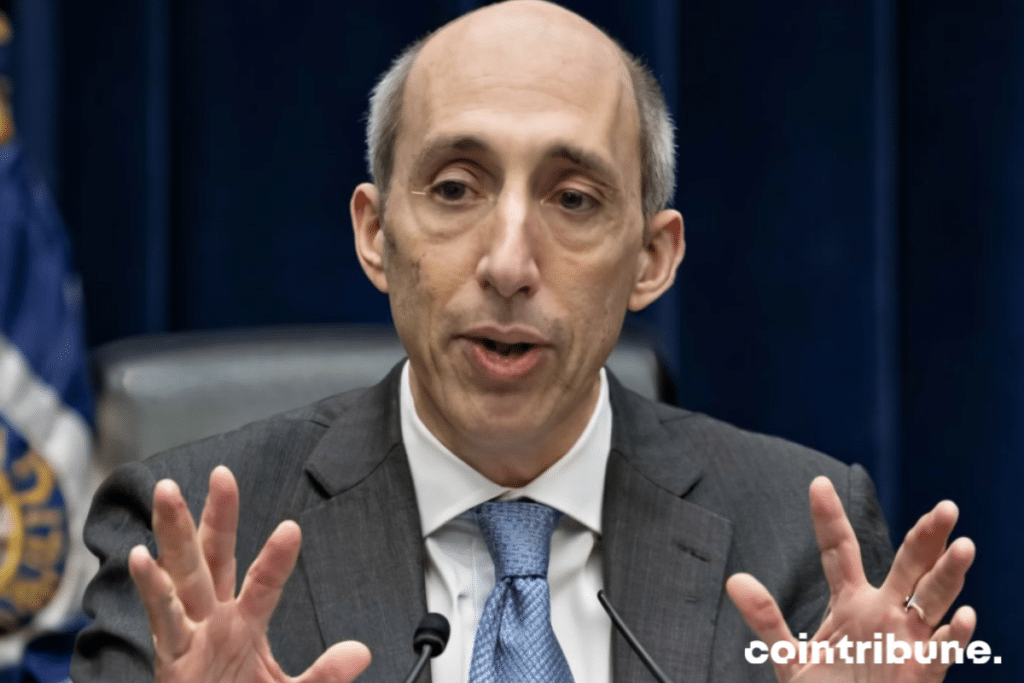

While the debate rages on over the legitimacy of Bitcoin as a currency, SEC Chairman Gary Gensler recently highlighted distinctions between crypto and fiat currencies like the US dollar. His response once again resonates as a critique towards Satoshi’s invention.

Gary Gensler comments on Bitcoin, the US dollar, and ETFs

On January 10, 2024, SEC Chairman Gary Gensler announced his green light for Bitcoin Spot ETFs, paving the way for mass adoption of the cryptocurrency. Yet, behind this apparent benevolence, Mr. Gensler has consistently expressed doubts about Bitcoin’s legitimacy.

His recent media statements, especially his interview on CNBC on January 14, suggest as much. Indeed, Mr. Gensler stressed that traditional currencies like the dollar are backed by central banks that follow monetary policies aligned with economic areas. Bitcoin, on the other hand, does not have this kind of institutional anchor.

“You have a central bank and you support a currency, usually by economic region. That’s what we don’t have here [with bitcoin],” said Mr. Gensler. According to him, this creates “a very real economic difference” between these two asset classes.

The critique of decentralization

Some Bitcoin advocates tout its decentralized nature as the rationale for their trust in this digital currency over currencies issued by central banks. Mr. Gensler challenges this argument.

“Bitcoin is not that decentralized,” he claims, explaining that finance has historically tended to centralize. In reality, only a small group of cryptos currently dominate the market.

Moreover, Mr. Gensler points out that record-keeping with blockchain has never been a determining factor for most traditional investors. What matters most to them is the value and reliability of the underlying asset.

Bitcoin, a speculative asset, really?

When asked about distinct Bitcoin use cases aside from ransom payments, Mr. Gensler deflects: “speculative investment.” In other words, its value rests more on speculative movements than on any real economic utility, making it a high-risk asset.

This statement contradicts the SEC’s recent approval of Bitcoin Spot ETFs. However, Mr. Gensler defends himself from promoting cryptocurrency: these funds are only meant to regulate exchanges, without making a “value judgment” on Bitcoin.

Regulator ambiguity or misunderstanding of Bitcoin? Crypto advocates might see this as a lack of foresight regarding the future of this asset. Regardless, the SEC Chairman’s remarks underscore the challenges that still lie ahead for the queen of cryptos before widespread adoption.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.