Bitcoin (BTC): Humanity's Great Reset

When an innovation appears, its importance and impact can be difficult to grasp. A major technological innovation, once it has taken root in the mainstream, is unshakeable. This is precisely where Bitcoin’s power lies: a technological earthquake that is reshaping finance, energy, politics and morality with a view to regenerating humanity.

Comparing Bitcoin and cars

Let’s take the example of the automobile to understand Bitcoin.

When the innovation of personal vehicles assembled on a large scale and using oil as fuel emerged, few anticipated that it would sound the death knell for horses. Even fewer envisioned the total metamorphosis of cities, housing, work and almost every aspect of daily life that would result from this invention.

Countries that didn’t adopt the automobile (and oil as an energy source) found themselves lagging behind those that did. Despite growing criticism of their dangers, cars have multiplied and been perfected.

In the early days of the automobile, the lack of suitable roads was the subject of much criticism. Today, our country has millions of kilometers of roads designed for cars, far more than for horses, bicycles and pedestrians.

In short, nothing could stop this evolution once it had begun, and those who didn’t follow were left behind.

Imagine life without the automobile. Living without fast, affordable and accessible personal transport now seems unthinkable. Yet those who lived in a time when the horse was the main means of transport did not consider it primitive.

Fiat advocates will be tomorrow’s Amish

In 1910, the U.S. horse population peaked at around 27.5 million. Today, the United States has over 278 million registered cars, more than ten times the number of horses at their peak.

We continue to measure the power of our cars in “horsepower”, evoking the strength of these animals that we can summon simply by pressing the gas pedal. But there are no more horses in our cars.

This power is just a mathematical equivalence. Most of us don’t really understand what goes on under the hood of our cars, but that doesn’t matter.

Many of us miss the low-tech simplicity of yesteryear. A life swept away by the automobile. But we can’t go back.

Because a technology that gives its owner so much power, enables him to crush his competitors. To deny oneself this power is in fact to be a lackey of one’s adversary, who will use it without guilt.

This reasoning will soon be applied to currency. To deprive oneself of a sound currency, which is infinitely more efficient than a manipulated one, will be seen as a sign of suicide. And no one will dare turn back the clock.

A breakthrough in the field of money

Bitcoin represents a breakthrough in the concept of money.

Bitcoin replaces gold

Like the automobile, a personal means of transport replacing both the horse and the steam locomotive, bitcoin is destined to supplant forms of money it renders obsolete.

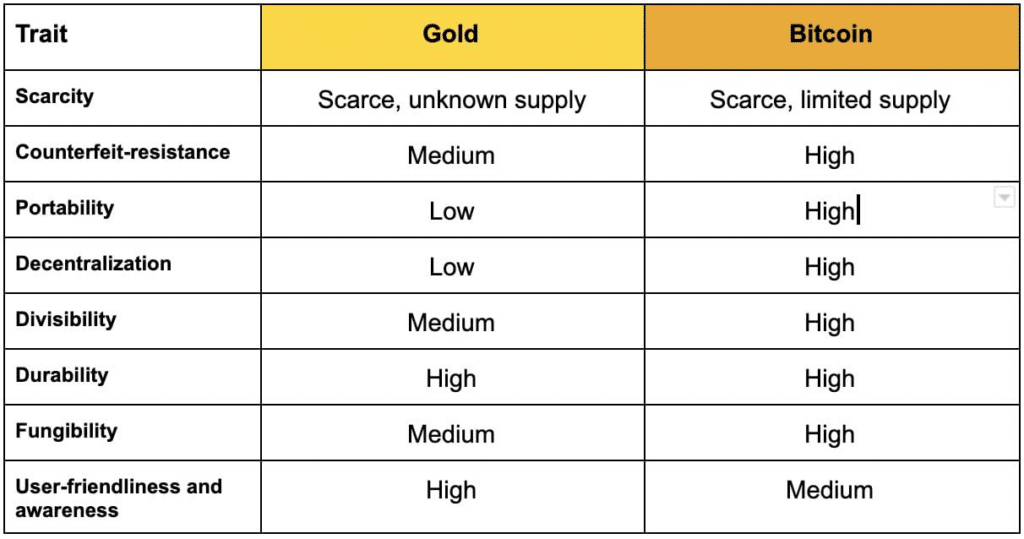

Bitcoin replaces gold, a natural form of money largely abandoned for all monetary uses except as a store of value.

Bitcoin is more easily divisible and verifiable than gold. Its rarity is precise, known and proven by all. Bitcoin can be secured and stored in a way superior to gold: up to the point where confiscation would be impossible.

Those who sincerely wish to return to sound money, who are aware of the damage inflicted on our modern civilization by unstable currency, and who are not simply attached to gold out of romanticism (or financial interest), are among the first to perceive bitcoin’s revolutionary potential.

Bitcoin replaces fiat currency

Bitcoin also replaces fiat currency, a human invention that does a great disservice to ordinary people. fiat currency hinders people’s ability to save, making them vulnerable to government incompetence and corruption.

It also makes many, if not all, people dependent on government influence or control for access to essential services such as health, education, self-defense, even food and housing.

The monetary advance represented by bitcoin is so considerable that it leaves many skeptical.

The same was true of the automobile, which was often referred to as the horseless carriage, raising doubts as to how a car could move forward without a horse to pull it, or as to the benefits of such an invention.

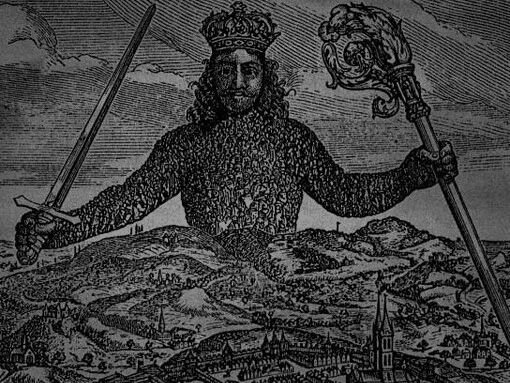

Bitcoin is a “currency without government”, an even more disconcerting idea for many, as it challenges a long-established status quo: that of the absolute necessity of a state in the management of human affairs.

Challenging the state beast

Bitcoin could be the innovation with the most dramatic long-term impact on our lives. Bitcoin is a liberating technology that could reshape governments.

Just as the automobile reshaped transportation, fiat currency has reshaped governments. But in the case of fiat currency, it’s not for the better, but for the worse.

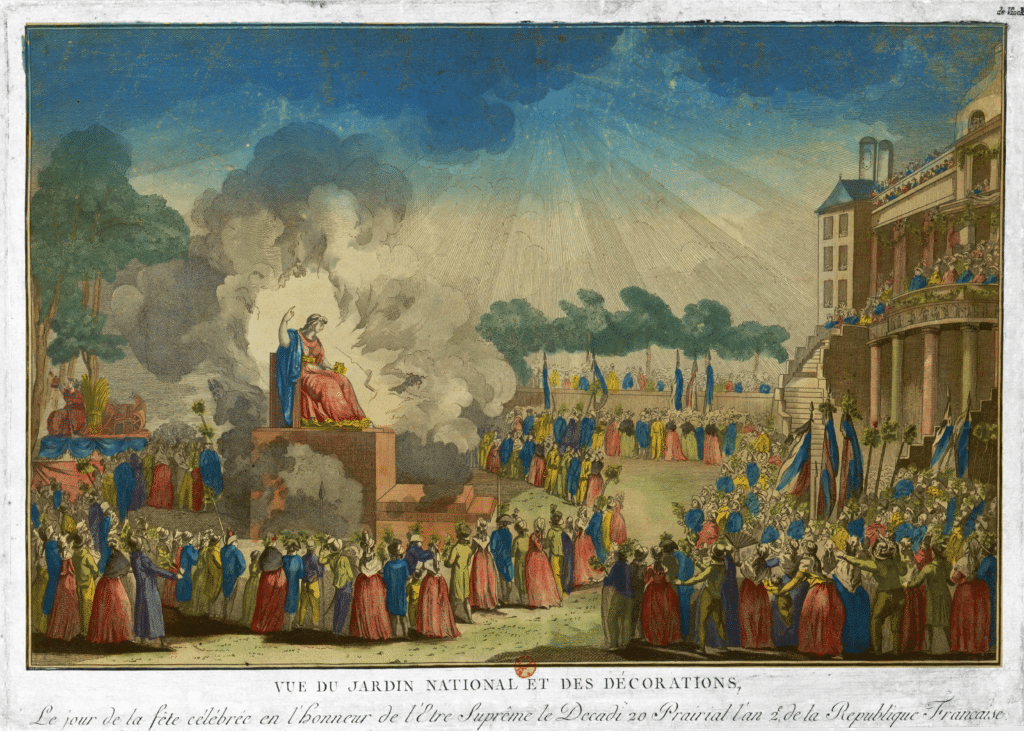

Before fiat currency, it was rare to hear politicians promise to provide services they couldn’t afford to provide with money they didn’t have. On the contrary, they often warned against making such things possible.

When the government took complete control of money in 1971, the very nature of government changed. Spending money through deficits that would never be repaid and winning elections by promising to spend that money represented progress, even if the negative consequences outweighed the positive ones.

Money printing, deficit printing

Just look at the long-term deficit curves. Even the deficits incurred during the Second World War, in the mid-1940s, are microscopic compared to what they have become since 1971.

It took only five years of fiat currency’s existence to accumulate deficits greater than those needed to fight and win the greatest war in the history of the world.

Unlike fiat currency, bitcoin is a currency that cannot be effortlessly manufactured in insanely increasing quantities, even by governments. In fact, its supply and issuance schedule are forever limited to a publicly known and easily verifiable quantity: 21 million.

What’s more, the emission is not distributed according to political favor and power. Rather, it is distributed to those who transform energy to secure the protocol, thereby giving value to the protocol.

This process is so fundamentally different from the production of fiat currency, which is monopolized by the government, that when they first learn about it, many people immediately conclude that governments are therefore going to stop Bitcoin or make it illegal.

Green, decentralized energy

Bitcoin is also becoming a central part of energy production, helping to balance supply and demand while creating a revenue stream for surplus energy. The protocol could help foster the development of renewable energy sources and solve intermittency problems.

Bitcoin makes it possible to decentralize energy production, bringing additional stability and efficiency to the power grid.

By consuming surplus energy, Bitcoin can enable the creation of more robust and cost-effective energy infrastructures. It could also help reduce dependence on fossil fuels for peak power generation. It’s a paradigm shift that could have a major impact on the way we manage energy in the future.

Bitcoin therefore offers a new vision of energy: not as a limited resource to be consumed, but as a force to be channeled to create value. It reinvents the way we produce, distribute and consume energy. It is therefore not only a breakthrough in the field of money, but also in the field of energy.

This new relationship between Bitcoin and energy is still under development, and it will take time to see the full effects. However, early signs indicate that it could be a significant breakthrough, one that could transform our relationship to energy in the same way that the automobile transformed our relationship to transportation.

Bitcoin and the end of financial bubbles

Bitcoin offers an alternative to modern finance. Its limited supply and decentralization make it impossible to create money out of thin air. This means that funding can no longer be used to inflate asset values or create debt. Instead, resources are allocated more fairly and transparently, based on their true value.

Bitcoin extends the principle of decentralization to energy. There are no central banks or governments controlling the money supply. This means that funding for things like education, housing and business must be based on the real value these services bring, not on artificial price inflation.

This may seem like a challenge to our current financial system, but it’s actually an opportunity. It’s an opportunity to rethink how we finance things and create a fairer, more balanced system.

This means we may have fewer financial bubbles, less unsustainable debt and more opportunity for all. It’s a new way of thinking about money and finance.

In short, Bitcoin offers an alternative to excessive financialization and artificial price inflation.

Responsible, sovereign people

Bitcoin encourages us to think differently. It’s a precious and limited currency. There’s no room for reckless spending. It’s a change of mentality. We need to make thoughtful decisions and weigh our options carefully.

We have to be responsible.

By owning bitcoins, we assume personal responsibility. It’s our money. We have to learn how to manage it, how to keep it safe. It takes time, patience and effort. But it’s worth it. It gives us total control over our money.

We become sovereign.

Bitcoin also promotes a quality economy. Bitcoin owners won’t give up their precious currency for low-quality products. They demand the best. They want durable, beautiful, quality goods. This can stimulate innovation and the production of higher-quality goods.

We need aesthetes.

Bitcoin encourages savings. It’s a good way to preserve value over time. Unlike fiat money, which loses value, bitcoins tend to increase in value. This is an incentive to save and invest wisely.

Bitcoin: the regeneration of humanity

In short, Bitcoin is not just a new form of currency. It’s a revolution that can change the way we think about and use money. It can make us more responsible, more thoughtful and more attentive to the quality of the goods we buy.

“Bitcoin isn’t just money we use on the Internet. It’s the first time we’ve had a decentralized, trustless system, where you can transmit value around the world without the need for intermediaries. The implications of this rupture are so profound that they call into question the very nature of the economy and the state. It’s an innovation that has the potential to change the world as radically as the Internet itself did”, Andreas M. Antonopoulos.

We’re at the dawn of a protean revolution: Bitcoin. In time, this innovation will change everything. It’s difficult to predict the precise nature of these changes or how long they will take, as it all depends on the combined creativity of all humanity to embrace this progress. However, just as the automobile represented a breakthrough that altered many aspects of our way of life that had been the same for thousands of years, rendering them primitive, we can expect the changes Bitcoin will bring to be just as significant.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.