Bitcoin's New Era: Corporations Take the Lead

In 2025, companies establish themselves as the main buyers of bitcoin, surpassing individuals and ETFs. This strategic shift places BTC, designed for decentralization, back into the hands of centralized actors. Can the crypto queen still embody a popular alternative in the face of this growing concentration?

In brief

- Companies now dominate bitcoin, surpassing ETFs, governments, and individuals.

- This massive accumulation by companies centralizes the asset, contradicting Satoshi Nakamoto’s decentralized vision.

- Bitcoin becomes a speculative treasury strategy, threatening its role as a popular and antifragile tool.

Bitcoin captured by companies: towards a crypto oligopoly?

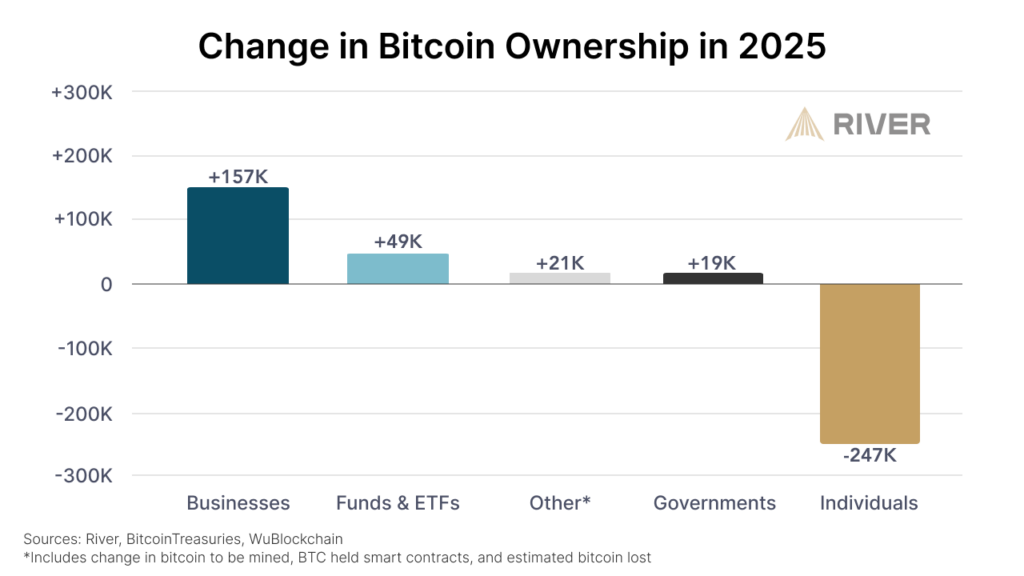

Companies have acquired 157,000 BTC since the beginning of 2025, according to a recent study. They far exceed ETFs (49,000 BTC) and governments (19,000 BTC), while individuals have sold 247,000 BTC. This progressive centralization of bitcoin creates a structural imbalance.

While the Bitcoin protocol imposes a limited production of 450 BTC per day, massive purchases by private companies are making the available supply scarce. As these “corporate whales” lock increasing amounts of BTC, the market risks losing its initial resilience and openness.

Strategy and associates: when corporate treasury becomes speculative

The example of Strategy, which alone holds 77% of corporate acquisitions in 2025, illustrates a double-edged strategy. By converting its treasury into bitcoin, the company bets on long-term appreciation rather than fiat liquidity stability. This approach spreads to other firms like Rumble or River Financial, who justify their purchases with three main objectives:

- Diversify against flaws in the traditional financial system;

- Increase shareholder value through a deflationary asset;

- Redirect capital towards product innovation.

A trend documented by River, which claims a strong commitment to bitcoin.

Individuals drop out, companies scoop up: a turning point for bitcoin?

As companies strengthen their positions, individual investors withdraw from the market. This dynamic reveals a growing gap between two approaches to investing in bitcoin. Increased volatility, post-halving price rises, and macroeconomic uncertainties have led many small holders to secure their profits.

Meanwhile, companies accumulate at an industrial pace. This retail disengagement raises a fundamental question: can we still talk about a popular, accessible, and antifragile asset when large holders dictate the trend?

What bitcoin has become… opposite to Satoshi Nakamoto’s vision

In the original white paper, Satoshi Nakamoto presents bitcoin as a peer-to-peer monetary system, without intermediaries, allowing each individual to become their own bank. The goal was to disintermediate finance, in direct response to systemic abuses by large institutions.

However, massive holding of Bitcoin (BTC) by companies introduces:

- A recentralization of monetary governance, with increased power to the wealthiest;

- An access gap, with individuals marginalized in asset accumulation;

- A risk of market manipulation by these “corporate whales” with unlimited resources.

This therefore goes against the ideal of a decentralized, egalitarian, and free network as conceived by Nakamoto. Bitcoin remains technically decentralized, but economically, it is becoming increasingly centralized.

Bitcoin changes face: from a libertarian asset held by the people, it becomes a strategic reserve in the hands of companies like Metaplanet, which surpasses El Salvador in BTC and now aims for 1% of the crypto market. This centralization shifts market balance. Can bitcoin remain a tool of individual sovereignty in the face of rising corporate interests? The debate is still open.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.