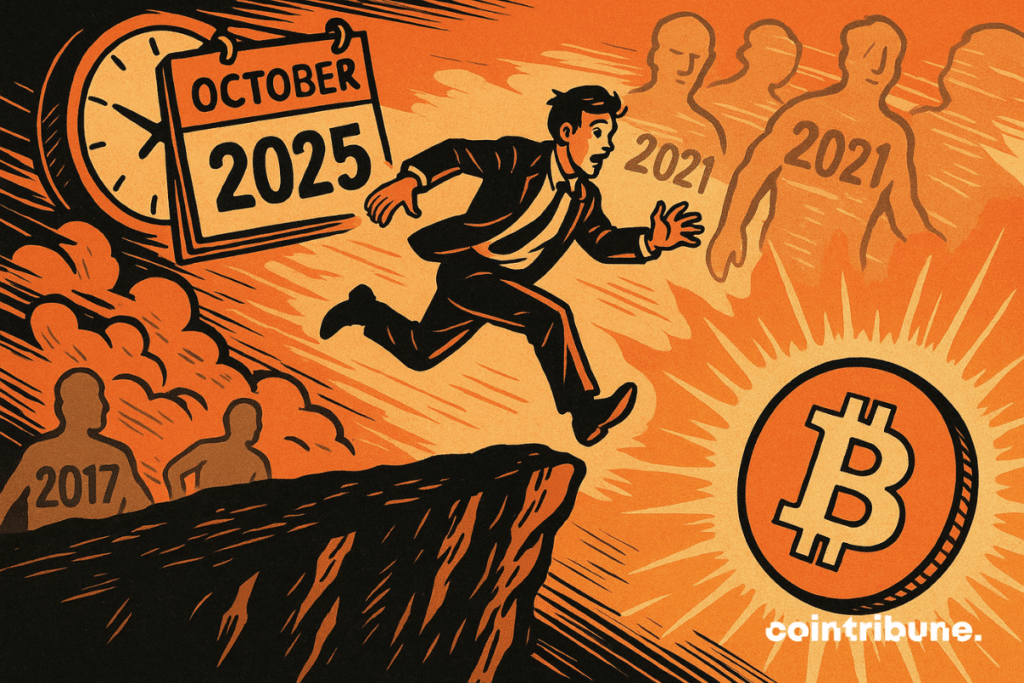

Bitcoin Enters “Uptober” 2025: Can History’s Seasonal Rally Repeat?

Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally.

In brief

- Since 2013, Bitcoin has closed October positive in 10 of 12 years, fueling the “Uptober” momentum narrative.

- Standout years like 2013, 2017, 2021, and 2023 saw surges of 28–60%, shaping October’s bullish reputation.

- September 2025 closed with a modest +1.09% gain, setting a neutral launchpad for possible October upside.

- While history leans bullish, macro shocks and volatility could still disrupt Bitcoin’s seasonal strength.

The Historical Strength Behind “Uptober”

The “Uptober” narrative rests on more than just memes and speculation. Data from Coinglass shows that since 2013, Bitcoin has closed October in positive territory 10 out of 12 years.

Some years stand out with remarkable gains:

- 2013: Bitcoin exploded 60.79% higher, cementing October as a launchpad for early bull market momentum.

- 2017: A 47.81% surge in October carried Bitcoin into the final leg of its historic rally to nearly $20,000.

- 2021: Gains of 39.93% reinforced bullish sentiment, propelling Bitcoin toward fresh all-time highs in November.

- 2023: October delivered a 28.52% climb, proving that “Uptober” could still deliver strong double-digit returns even in a cautious market.

Even moderate rallies—such as the 14.71% rise in 2016, the 10.17% surge in 2019, and the 10.76% gain in 2024—still generated strong year-end momentum.

The exceptions—2014 (-12.95%) and 2018 (-3.83%)—serve as reminders that seasonality is not a guarantee. Still, history supports the perception that October often tilts bullish for Bitcoin. This statistical edge creates a feedback loop: as traders anticipate gains, positioning and liquidity amplify momentum.

By contrast, September has typically been one of Bitcoin’s weaker months. In 2025, the asset has managed a small +1.09% gain for September, a neutral finish that leaves the market reset rather than overheated or oversold. For many traders, this balance makes the current setup a workable launchpad for an “Uptober” push.

Why October Often Matters for Bitcoin

Although no single reason explains why October favors Bitcoin, several recurring factors align around this time of year. Historically, Q4 marks an uptick in trading activity, with investors returning from summer slowdowns and reallocating capital into risk assets. Market sentiment also tends to improve as the year’s final quarter becomes a window for portfolio adjustments.

In addition, narratives play a critical role. When enough traders expect October to be strong, liquidity and buying pressure often meet that expectation. “Uptober” is both a meme and a market force, with optimism generating energy that in turn reinforces optimism.

Still, analysts caution against treating October as a shortcut to profits. Even in positive years, performance has varied widely. A modest +5% gain in 2022 contrasted sharply with the +30% surges in 2015 and 2021. This wide range reinforces the need for risk management.

Entering October with expectations of steady gains each session can set traders up for disappointment. Treating “Uptober” as a setup rather than a certainty keeps the focus on technical confirmations and market structure.

Market Context Heading Into Q4 2025

At present, Bitcoin trades near $109,539, around 11.5% below the year’s highs. This places the asset in a middle ground—not in crisis territory, but not at peak euphoria either. How Bitcoin navigates early October will depend on whether buyers can sustain breakouts, defend support zones, and expand participation through higher open interest and stronger funding flows.

For bulls, history offers encouragement into the current optimism over the coming month. Previous strong Octobers have often served as springboards for multi-week rallies that extended into November and December. A successful defense of current levels, combined with growing demand, could lay the foundation for a renewed climb.

Bears, however, emphasize that historical trends are descriptive rather than predictive. A single macroeconomic shock—arising from interest rate changes, global market fluctuations, or liquidity constraints—has the potential to disrupt seasonal patterns. Hence, they contend that, while “Uptober” reflects market sentiment, it cannot supersede fundamental or macroeconomic forces.

Another lesson from past data is the variability in outcomes. Even within positive Octobers, intramonth swings can be sharp, testing traders’ patience and positioning. That makes tactical flexibility key: monitoring breakout confirmations, watching for higher lows on pullbacks, and adjusting leverage in line with volatility.

Outlook: Anticipation Meets Reality

Data offers insights into the optimism around “Uptober,” one such being that the market has recorded ten green Octobers since 2013. Multiple double-digit gains and a track record of kick-starting Q4 also add to this optimism. With the market cooling from summer highs, the setup favors cautious optimism over blind faith.

Still, the market will ultimately decide whether 2025 becomes another “Uptober” or one of the rare exceptions. Traders will be watching early price action closely for signs of sustained momentum. Breakouts that hold, rising participation, and constructive pullbacks will matter more than seasonal slogans.

For now, the bias leans toward cautious optimism. History suggests that October often rewards patience, but risk control remains vital. If Bitcoin can build on September’s small gain and turn it into higher highs in October, “Uptober” could once again live up to its name.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.