Bitcoin in freefall: Cryptoinvestors on the brink of financial disaster?

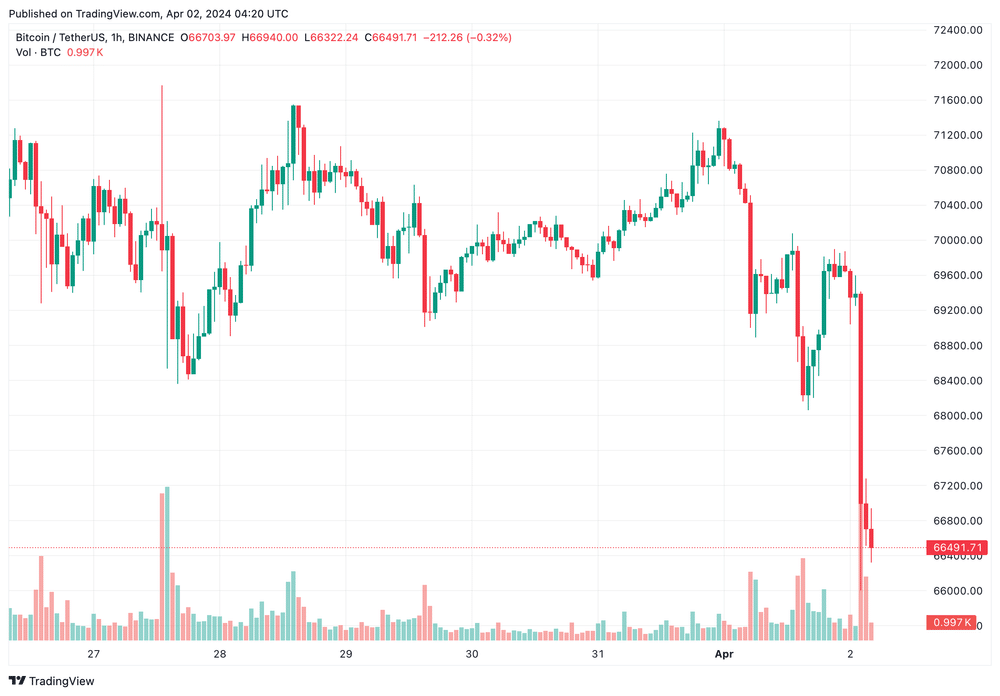

With less than 20 days to go until the Bitcoin Halving, the queen of cryptocurrencies exhibits heightened volatility. Its price alternately shoots above 70,000 dollars and then suffers harsh corrections, like today. The latest data indicates that BTC is deep in the red.

Bitcoin: Plunge into the Depths of the Cryptosphere

This pre-Halving instability of Bitcoin is raising concerns among crypto analysts. In this context, some predict a surprising rise of Ethereum. However, the difficult (but temporary) economic situation affects not only Bitcoin: most cryptocurrencies are facing similar struggles.

According to CoinPedia, the cryptosphere is rocked by a sharp drop in Bitcoin, falling to an alarming level of 66,000 dollars. This debacle triggered massive liquidations, causing shockwaves across the Bitcoin network. In just one hour, liquidations totaling 157 million dollars were recorded, mostly long orders worth 144 million dollars.

But it’s not just Bitcoin that’s sinking into the abyss of speculation. The big names in altcoins are not spared. Ethereum has fallen by 6.71% and Solana by 9.32% in the past 24 hours, registering colossal losses of 92.26 million dollars and 17 million dollars, respectively.

While the titans of the cryptosphere are floundering, an intriguing trend emerges: the flow of liquidity is leaving Bitcoin and other major altcoins to head towards memecoins, creating a “bizarre bull market”. While Bitcoin, Ethereum, and Solana are faltering, the total market cap of memecoins is exploding to 70 billion dollars.

This rush towards meme cryptocurrencies is fuelled by the buying frenzy of recently launched tokens like “Dogwifhat” and “Book of Meme”, as well as the persistent enthusiasm for classic memes such as Pepe and Bonk.

In the midst of this turmoil, Binance Labs also finds itself in the spotlight, accused of selling some of its investment tokens during the market crash. Massive transfers of GMT tokens, equivalent to 3.14 million dollars, were reported from Binance Labs to Binance Deposit, fueling speculation about the behind-the-scenes maneuvers of one of the largest cryptocurrency trading platforms.

The Fed Stands Firm Despite Market Fluctuations

As the eyes of the financial world are focused on cryptocurrencies, the U.S. Federal Reserve holds steady, even as the waters are choppy.

Bitcoin, the unrivaled leader of the virtual currency sphere, is experiencing periods of turbulence. This volatility only adds to an already tense atmosphere on the cryptographic markets. If U.S. economic data surprise with unexpected growth, they also diminish investors’ appetite for an imminent cut in Fed interest rates.

Markets, reacting to this new situation, are cautious. Investors are now looking for signs of change in U.S. monetary policy, as the persistent volatility of cryptocurrencies fuels doubts about their long-term stability.

In this atmosphere of caution, the U.S. Federal Reserve remains unflappable, resisting the siren calls of the market. Despite dwindling expectations of an interest rate cut, the Fed stays cautious, carefully evaluating evidence before making any decisions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.