Bitcoin in Your Wallet: An Opportunity?

The principle of investing in stock markets is to seek reward in exchange for the risk taken. Consequently, the concept of gain is linked to risk. However, the financial markets can sometimes be quite volatile. That’s why we’re going to look at whether including bitcoin in a portfolio can be a positive element.

The Importance of Diversification Within a Portfolio

Diversifying a portfolio is an art. To maximize and optimize the diversification of a portfolio, one must choose assets that are negatively correlated with each other. That is, they fluctuate in opposite directions. In general, stocks and bonds are assets that are negatively correlated, but primarily in a deflationary environment. It’s the opposite case in an inflationary environment. That’s why a large portion of investors have often followed the 60/40 portfolio. Diversification is primarily used to reduce exposure to risk. Furthermore, in portfolio management, it’s important to define the client’s profile. If they are very comfortable with risk, a more aggressive portfolio with a strong weighting in stocks is often recommended. Conversely, a balanced portfolio assumes having a 50% fixed income and 50% stocks distribution.

What Is a 60/40 Portfolio?

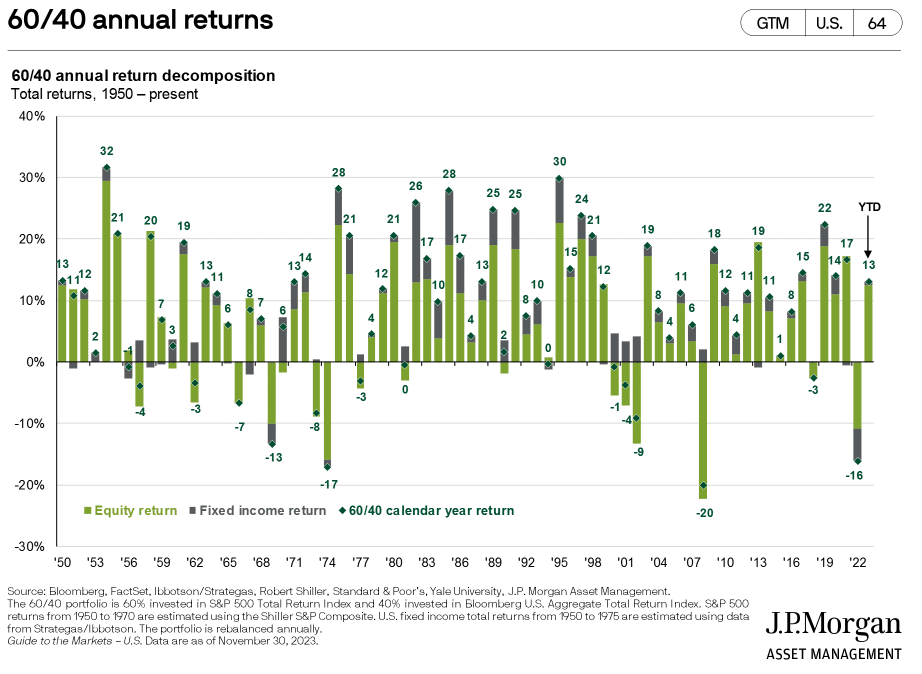

Before starting, it’s important to explain the concept of the 60/40 portfolio. This is one of the most used model portfolios. The principle is to buy 60% U.S. stocks (in the form of index ETFs) and 40% U.S. bonds. Individuals replicate this model by using ETFs that take a basket of assets and a basket of long-term bonds. This type of portfolio allows for diversifying the types of assets in order to reduce risk. This model is quite popular because for a long time, bonds and stocks were negatively correlated. Therefore, during the crises of 2008 and 2020, a 60/40 portfolio experienced fewer losses than a 100% stocks portfolio. Performance can be seen in the table below:

However, since the rise in inflation, the correlation has reversed. Bonds and stocks are now positively correlated. That’s why it is crucial to understand that this type of portfolio is quite efficient in terms of diversification when both assets are negatively correlated. Consequently, as long as inflation remains high (above the target rate), such a portfolio has concentrated risk.

Integrating Bitcoin into a 60/40 Portfolio

As ETFs for a spot bitcoin are still awaiting SEC approval, it should be noted that bitcoin could be included in portfolios. It is easier for a portfolio manager to integrate a bitcoin ETF than to integrate bitcoin itself. ETFs also make it possible to add bitcoin to tax-advantaged investment accounts. Bitcoin is currently available on specialized external cryptocurrency exchange platforms that are not centralized.

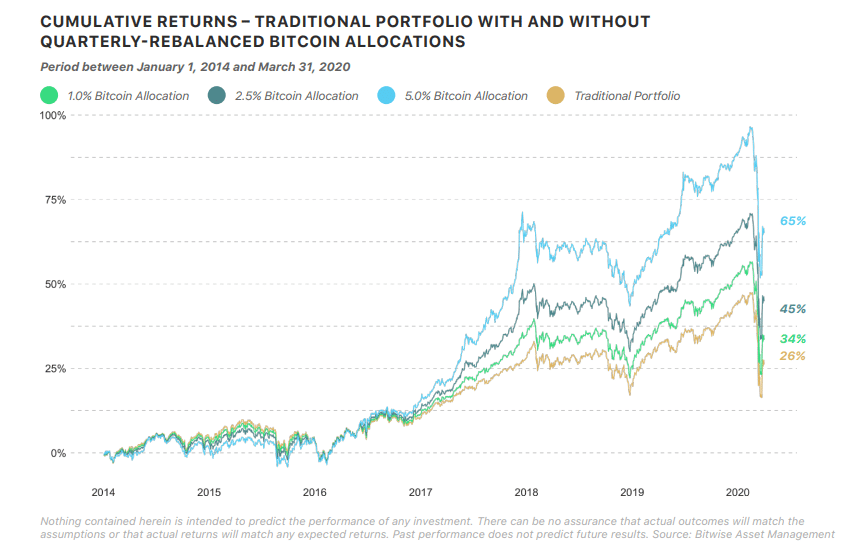

As a result, an investor cannot benefit from the advantages that ETFs can offer, such as those afforded in tax-advantaged accounts. ETFs will allow on a larger scale to attract investors. That is why there have been some studies conducted to see the impacts of integrating bitcoin into a portfolio. On the graph below, the curves represent a traditional portfolio by integrating 1-2 and 5% of the portfolio into a modified 60/40 model portfolio vs a traditional 60/40 portfolio.

Of course, this study was conducted taking into account past performances of bitcoin. But beware, past performance cannot guarantee future results. This is even more the case when institutionalizing bitcoin. The more an asset is capitalized, the less volatile its variation will be. That’s why small market capitalizations are more volatile than large ones. The same principle applies to bitcoin and altcoins. Moreover, it can be added that each new bitcoin bull run is less volatile.

Limits in Terms of Allocation

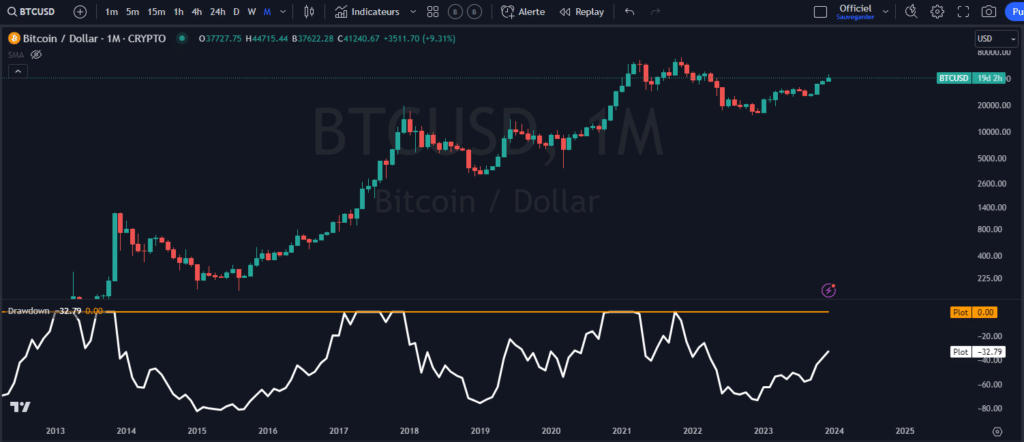

As shown in the table above, bitcoin allocations are less than 5%. It is very likely that institutions will not place more than 5% of bitcoin in a portfolio. A high allocation in bitcoin can’t be integrated unless one is very comfortable with the risk because drawdown levels are quite significant. A bear market in bitcoin can be quite painful if one is not comfortable with the cycles and losses. Here’s an idea of the drawdown during bear markets:

Therefore, losing 70% on a 5% allocation does not have the same impact as losing 70% on a 50% allocation.

The Sharpe Ratio: A Measure of Risk in Favor of Bitcoin

This type of financial calculation highlights the relationship between performance and risk. It allows, in other words, to measure risk within a portfolio and the opportunity cost. When the Sharpe ratio is above 1, it is interesting for an investor because it implies that the reward will be higher in return for the risk taken. From a more technical viewpoint, the calculation compares the risk-free rate and the portfolio’s rate of return. Most of the time, bitcoin’s Sharpe ratio is higher than that of the S&P500.

Cash Allocation vs. the Risk Premium

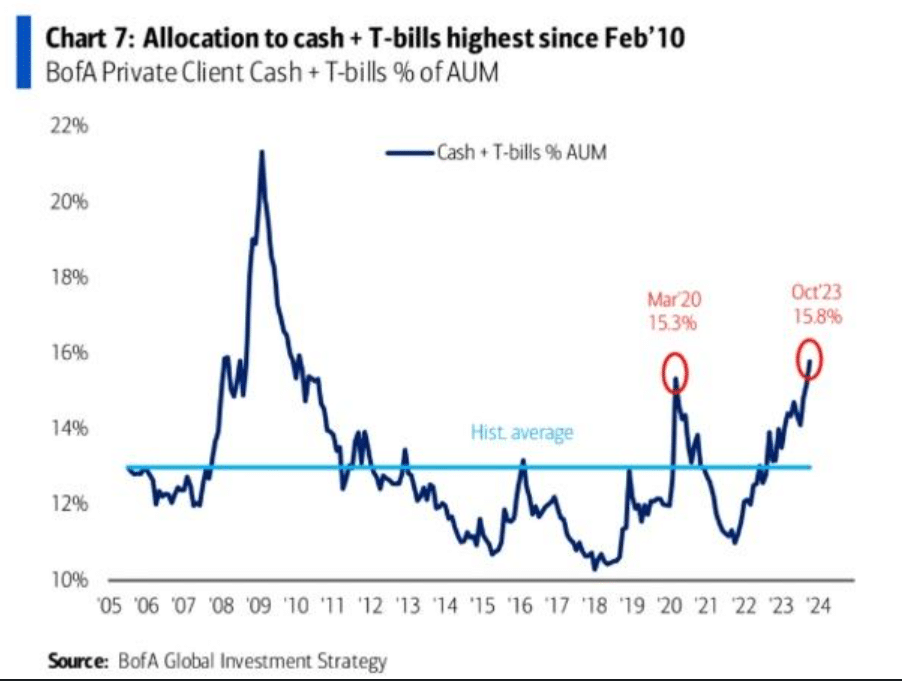

Today, the risk premium on stocks is quite low. Generally, one compares the stock yield with the bond yield to see if the risk premium is appealing. This means that currently, bonds are supposed to be cheap compared to stocks. Capital flows have accumulated in cash because it is better remunerated as short-term rates are more interesting than those offered long-term.

Moreover, the yield on cash around 5% is higher than the earnings yield of the S&P500. This is a quite unprecedented situation. However, since investors always seek performance, they might be tempted to turn to bitcoin. Simply integrating a small allocation can add performance to their cash portfolio. This is where the release of bitcoin ETFs will be a plus for those looking for more performance in exchange for a low-risk level considering the level of allocation.

Diversification with Bitcoin: Not Just a Matter of Performance

When deciding to add bitcoin to a portfolio, it’s not just about adding performance. There are also fundamentals. Bitcoin has a form of protection against currency devaluation and liquidity injections. One of its characteristics is that it has a limited supply of 21 million. Another important aspect is the halving, which reduces the available supply every 4 years. It also allows people in countries where the population does not have bank accounts to have access to bitcoin. From a technological perspective, it has popularized blockchain technology.

Conclusion

Depending on one’s risk tolerance, integrating bitcoin into a portfolio can be an asset in several forms. Since it’s a highly cyclical asset, it’s just a matter of defining the allocation you want to provide in order to be comfortable with your investment.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.