Bitcoin: Panic on the Market, Whales Seize the Treasure!

The recent fall of Bitcoin has created waves, turning the market into a theater of spectacular maneuvers. As panic grips the small fish, the whales seem to play a different tune altogether. With an almost theatrical ease, they seize this opportunity to accumulate more, thus revealing the subtleties of a market as volatile as it is innovative.

The Sophisticated Ballet of Major Investors on the Market

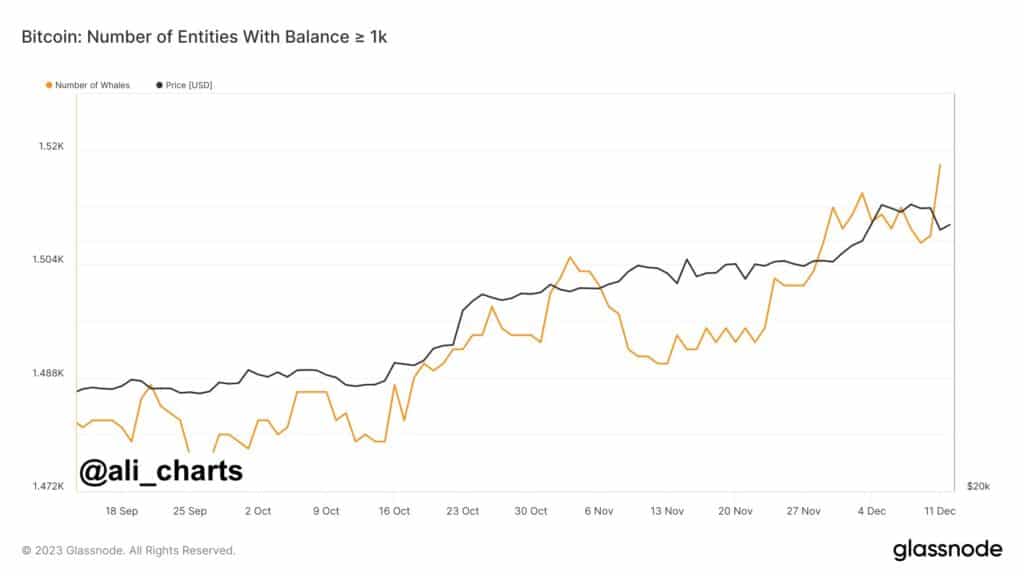

The recent price drop in Bitcoin has acted like a dramatic plot twist, igniting a fascinating chain reaction. On-chain data reveal a notable increase in the number of entities holding 1,000 BTC or more. These whales, far from panicking, seem to dive with delight into the tumultuous depths of the market.

Jon Bollinger’s alert hasn’t impacted the big fish. Indeed, Glassnode’s analysis provides insight into the behavior of these entities. These clusters of addresses controlled by a single network entity demonstrate a less reactive, more thoughtful investment strategy.

Contrary to the frenetic movements of small investors, whales adopt a long-term vision, often synonymous with substantial gains.

Their ability to influence the market is undeniable. When whales mobilize, they can not only absorb large quantities of Bitcoin, but also inject renewed confidence among investors.

The Fall of Bitcoin: A Playground for Savvy Investors

The recent fall of Bitcoin may seem alarming, but for whales, it’s a golden opportunity. These periods of decline are generally prime times for major investors, allowing them to accumulate more at a lower cost.

A look at the chart of the trend in the number of whales reveals strategic movements. An increase in their number frequently coincides with periods of price declines, suggesting active accumulation.

In these periods of consolidation, where BTC appears to stagnate, whales often lay the groundwork for the next wave of increase, strengthening their positions in anticipation of better days.

The Future of Bitcoin: Between Uncertainty and Hope

Despite attempts at recovery, Bitcoin struggles to regain stability. This raises questions about the crypto’s immediate future. The actions of whales, while promising, do not guarantee a quick turnaround.

Nonetheless, accumulation by whales remains a positive sign. Historically, these periods of accumulation have usually preceded recovery phases, offering a glimmer of hope in the surrounding chaos.

Ultimately, the movements of whales may play a crucial role in the stabilization and possibly the recovery of Bitcoin. Their ability to influence the market, sometimes subtly, sometimes blatantly, should not be underestimated.

In the realm of Bitcoin, the current panic may well be the prelude to a spectacular renaissance, orchestrated by the whales, the maestros of digital finance. In the meantime, the frisson remains intense on the market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.